STUDENT LOAN REFI

Get Up to $1200 & Lowest Rates

FREE CE EVENTS

50hrs Free CE & Financial Events

FINANCIAL RESOURCES

Looking for Insurance, CPA, CFP, Home Mortgage?

JOB | PRACTICE LISTING

Connect With Best Candidates To Your Practice

EYEDOCK

#1 Online Clinical Resource

NEWSLETTER

Get Weekly Financial Updates

FACEBOOK GROUP

Connect With Your ODs Peers

THE BOOK

OD's Guide To Financial Freedom

Latest Announcement | Events

Sunday, May 19, 2024 | 8am PST/11:00am EST (4hrs FREE CEs)

Navigate the intricate world of glaucoma care with a fresh perspective. This unique event bridges the gap between advanced glaucoma management and the financial nuances that drive a successful practice.

✅ AI-enabled glaucoma management (89436-GL) Jessica Steen OD, FAAO | CE Hour 1

✅ Optimizing the Ocular Surface in Glaucoma (85638-GL) Justin Schweitzer, OD, FAAO | CE Hour 2

✅ Billing & Coding Documentation for Glaucoma Evaluations (88896-PM) Kyle D Klute O.D l | CE Hour 3

✅ The Role of Laser in the Treatment of Glaucoma (89296-LP) Nathan Lighthizer, OD, FAAO | CE Hour 4

👉 ODs on Finance Member Rate: FREE | 🎥 Recording AVAL TO REGISTERS ONLY x 4 weeks

Sunday, June 9, 2024 | 8am PST/11:00am EST (4hrs FREE CEs)

Step into the evolving landscape of myopia management. This exclusive event is designed for professionals eager to understand the rising prevalence of myopia and how to harness its potential as a significant revenue stream for their practice.

✅ Upgrading your Myopia Management Practice: Soft Contact Lens Modalities & Fee Structures (82626-CL) Andrew Neukirch, O.D | CE Hour 1

✅ Making a CASE for Advanced Ortho-K (89902-CL ) Anith Pillai, OD, FSLS | CE Hour 2

✅ Breaking Barriers in Myopia Management: Marketing, Pricing, and Parental Involvement (89057-PM) Ariel Cerenzie, OD, FAAO, FSLS l | CE Hour 3

✅ Utilizing Technology for Improved Outcomes: Designing Myopia Management Contact Lenses with Corneal Topography and Tomography (PENDING) Melanie Frogozo, OD | CE Hour 4

👉 ODs on Finance Member Rate: FREE | 🎥 Recording AVAL TO REGISTERS ONLY x 4 weeks

Join the Conversation on Optometry's Largest Finance Focused Forum:

LATEST ARTICLES

What Should I Do First? A Complete Step-By-Step Guide For Optometrists

Here is a “Guideline” list of financial steps that we hope will get you started, but should be adjusted to your own personal situation as an optometrist.

2024 Optometrist Income Report

With increasing student loan debts, an ever changing economy, and a profession that continues to withstand disruption – many optometrists begin to question their associated worth as practitioners. While the old phrase “comparison is the thief of joy” rings true in certain facets, comparison to get a true sense of trends in salary, debt load…

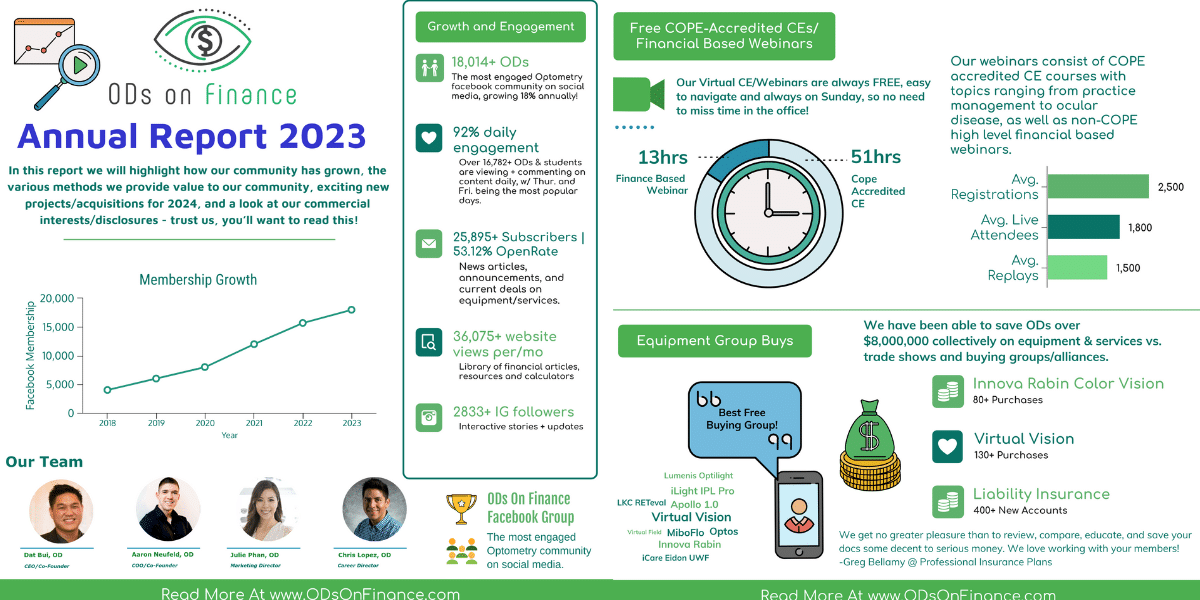

Annual Report 2023: In Review, and a Look at 2024!

In the next reading, you’ll discover metrics that mirror our community’s overall progress, along with the resources and offerings this growth has enabled us to continue providing. Next, we’ll transparently outline the methods ODs on Finance employs to generate revenue. Lastly, we’ll offer you a sneak peek at some major projects we’re embarking on for 2024, aiming to further our profession and assist every OD in achieving financial freedom.

The Optometrist’s Guide To Student Loan Refinancing

Optometrists often accumulate multiple loans from federal and private lenders to fund their doctor education, which results in an average debt load of $220,000. The majority of these loans are federal loans which have an average interest rate of 5.5-6.8%.Then the majority of doctors will end up refinancing their student loans to save thousands of dollars in interest. Here is your comprehensive guide to the student loan refinancing process and understanding how underwriting works.

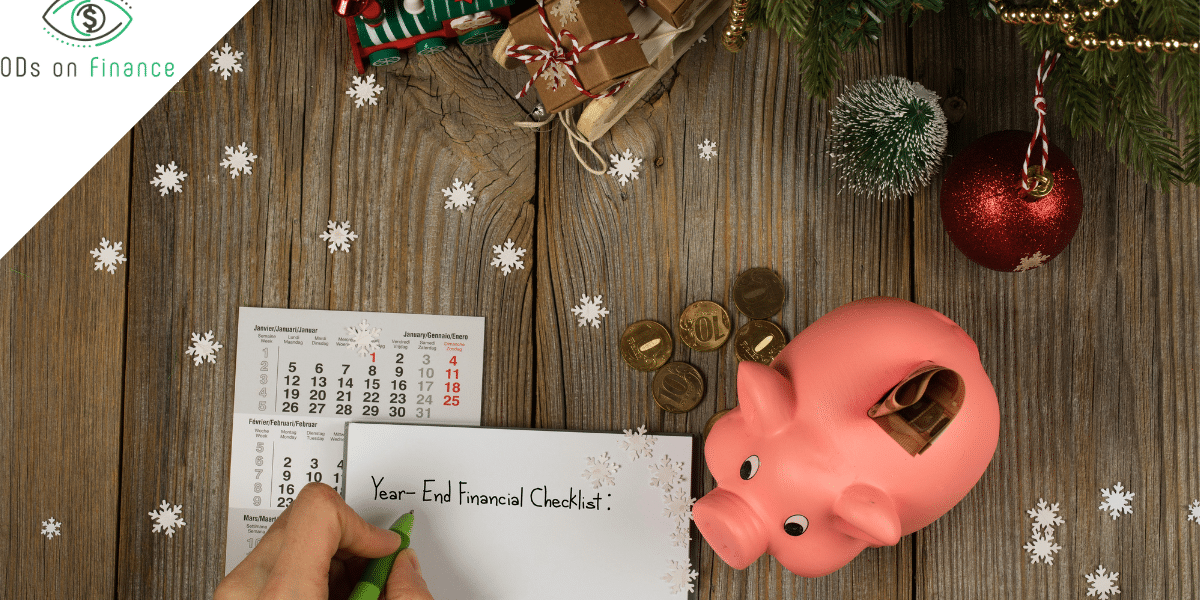

16 End-of-Year Financial Checklist For Optometrists in 2023

As 2023 draws to a close, it’s vital for optometrists to focus on financial planning for a stable and prosperous future. This checklist, designed for eye care professionals, will guide you through key year-end financial tasks. While not every item may apply to your practice or personal finances, reviewing each one ensures you don’t miss important opportunities or obligations.

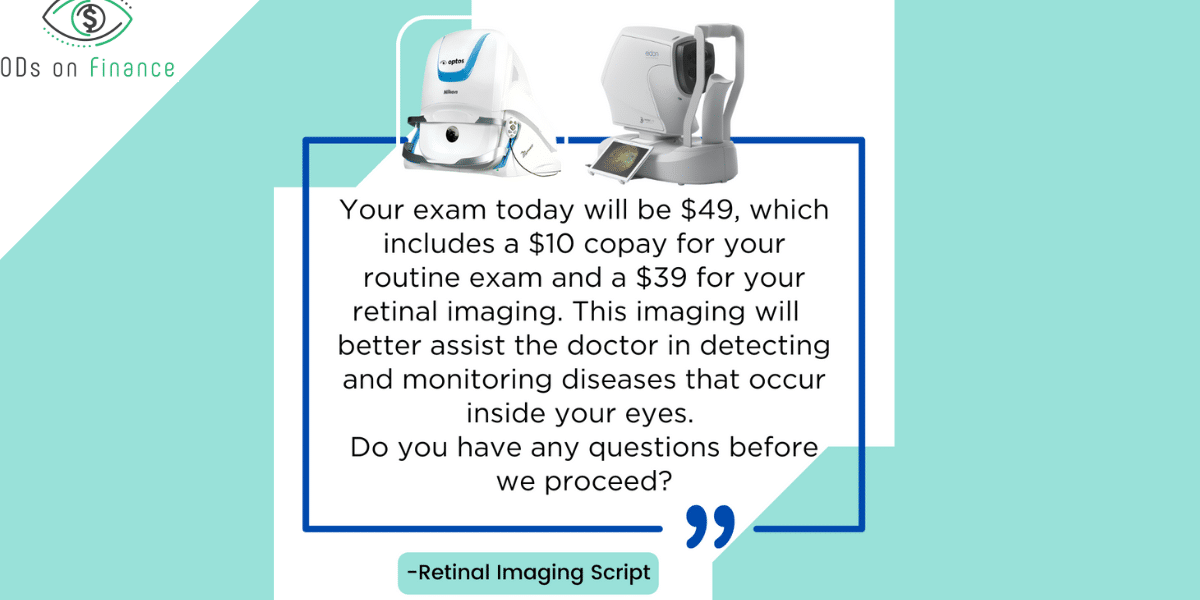

How To Achieve Over 90% Capture Rate With Optos/Eidon Widefield Script

As practitioners, we understand the importance of retinal imaging, and we need to be able to clearly explain that value to our patients. I’ve found that communication is key with patients – before, during, and after their appointments. This helps to eliminate any questions, and it ensures that they’re not only on board with the…

2023-2024 IRS limitations for Optometrists

With inflation rising at all time highs, it definitely seem that the IRS is adjusting quite drastically for most of these accounts for 2023! While all of these limits might seem higher, remember that it is mainly keeping up with inflation, which the consumer index is estimated at 8%. in 2022. Please use these important limit to adjust your financial planning for 2023 especially for any retirement plans!

Creative Approaches To Acquire An Optometric Practice

Approaching the acquisition of your first practice with a little creativity may open up additional opportunities for acquisition at a more reasonable cost of investment. We are all used to the approach of identifying a practice for sale and buying it. Gone are the days when banks easily lent money, that borrowed cash was affordable, and the price of practices for sale was attainable to a new solo practice optometrist

Overcoming $153,242 Student Loan Debt in Four Years Working in Corporate Optometry

Hello, I’m Dr. Ayana Pierre O.D, and I graduated from NSU in May 2019. I chose the path of corporate optometry and currently practice in Central Florida. Working about 4.5 days a week, I’ve been fortunate to earn a gross income of approximately $250,000 last year. This achievement has been a blessing, providing me with not just financial stability but also the flexibility to manage my schedule effectively.

Navigating the Path to Cold-Starting an Optometry Practice: A Journey of Passion and Persistence with Dr. Ashley Szalkowski

Driven by the desire for change and a fresh approach to eye care, Dr. Ashley Szalkowski shares insights into the process of establishing a thriving practice from the ground up.

October 2023 Market Update for Optometrists: Latest Economic & Financial Trends

The economic landscape is characterized by a steady 3.7% inflation and cautious actions from the Federal Reserve, particularly in managing interest rates to avoid potential economic downturns. While some economic indicators like GDP growth appear robust, there’s a visible undercurrent of economic stress and mixed expert predictions regarding a potential recession in 2024.

The Holland’s Journey: Paying off $660,000 Student Debt in 5 1/2 Years

We want to share our stories to help other young optometrists who are struggling with their student loans. We are both practicing optometrists and managed to overcome a massive obstacle together: paying off $660,000+ in student loans in just 5 1/2 years. Sounds impossible right? But let’s start from the beginning.

UPDATE: Must-Read Strategies to Tackle Optometry Student Debt

After an enduring three-year period, the final COVID-19 student loan forbearance is drawing to a close on August 30, 2023. Recognizing the natural apprehension that some optometrists might be feeling as this date nears, our team has been working tirelessly to develop strategies to support all our borrowers, especially new graduates stepping into the workforce!

Conquering a Mountain of Debt: Paying off $242K in 7.5 Years on an Starting Salary of $85K as an Optometrist

Over 7.5 years, Ada Noh cleared her substantial student loan of $242K on a beginning salary of $85K by adopting a frugal lifestyle and engaging in optometry-related side gigs.

Prescription for Financial Health: 5 Steps for Achieving Budgeting Success

My name is Julie Phan, and I have a confession to make. As the admin of a finance group, I’ve got a little secret—I’ve never tracked my expenses. Yep, you heard it right! I have a general idea of my expenses, but I haven’t been actively tracking them like we recommend to our members on their journey towards financial independence.