The Optometrist’s Guide to Disability Insurance

Optometrists with an average salary of $120,000 will make approximately $10 million dollars over their working career when factoring in raises and inflation. It took you 8-10 years of schooling to get to where your career is, in addition you probably took over $200,000 worth of student loans to invest in your future. Therefore, with all the energy, time and financial resources you have invested into your career, you must do all that is necessary to safeguard that income. No matter how much you budget or work at your side hustles, your optometric profession is normally your highest producing income.

While you may be young and in good health, would you be able to support yourself and your family if you were suddenly unable to work because of an accident or illness? Disability insurance provides you with money to cover your bills and expenses if you are unable to work. Therefore, disability insurance is really income insurance. Long-term disability insurance protects you for a loss of income if you are unable to work for a long period of time (greater than 90 days) due to any illness or injury. Studies have showed:

"20% of people will have a period of disability before reaching age 65. But around 70% of people working in the private sector do NOT have long-term disability"

So, with those odds, it is obvious you must insure against impeding financial catastrophe.

Disability insurance is extremely convoluted and subjective to each individual’s health situation, and will vary greatly with each insurer. This guide is in no way a comprehensive summary of all the little nuances that go into each disability policy, but will strictly serves as a basic guideline, especially for new doctors.

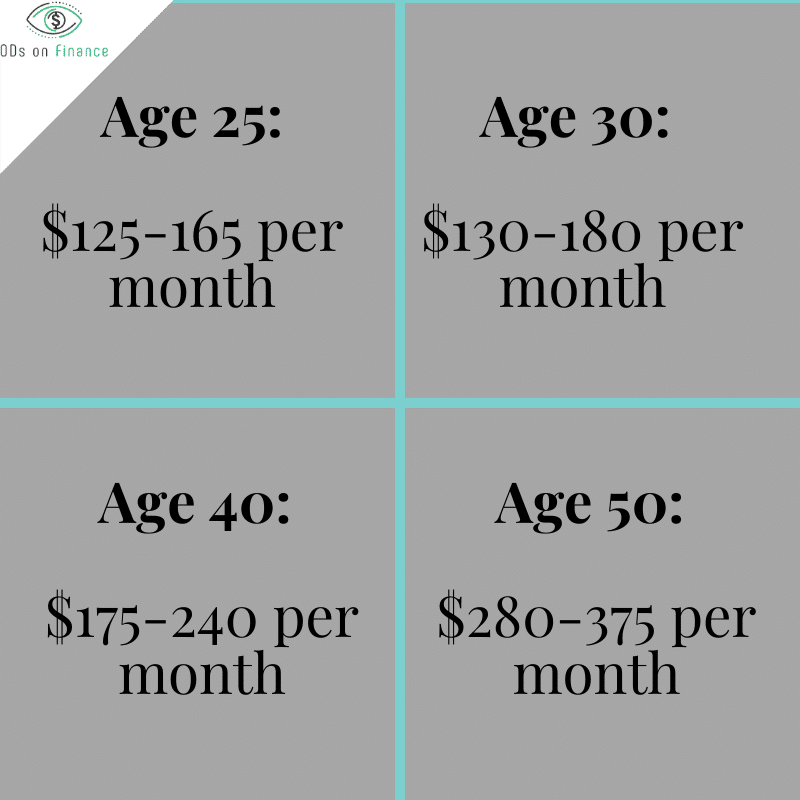

Disability insurance is sold in direct relations to a certain % of your income and will get more expensive as you get older, due to a higher chance of insurance payout. There are many factors that can increase how much you will have to pay such as having a higher risk profession like stuntman, perilous hobbies like rock climbing or sky diving and overall general health. Furthermore, there are a bunch of exclusion factors as well such as life-threatening medical health rejections that the insurance won’t cover within your policy.

For example, if you have a chronic heart condition at the time of the issuing of the disability insurance, but then later on develop a disability due to said a heart attack; the policy is NOT going to pay you anything (Crazy right?). Also, there might be other limitations on payout qualifications such as getting injured during foreign travel, pregnancy or mental disorder. The list can go on and on.

How Much Long-Term Disability (LTD) Insurance should you Purchase?

Unlike life insurance, there is a strict limit to how much disability insurance you can purchase. As a general rule, most insurance companies will only cover a maximum limit of 66% of your total salary but with an annual cost of 1-3% of your total annual salary.

We usually recommend:

Example: A doctor making a $150,000 yearly salary might have an average yearly payment of $3,000 (1-3% of salary) with an average monthly payment of $250. If he is fully disabled and unable to work, his insurance will pay him roughly $90,000 a year (or 60% of his salary), until he is 65-year-old.

There are 5 main factors that can affect your rate of the policy and can significantly increase the cost:

1) Coverage Amount: The amount of coverage you need depends on your current income and how much you need to maintain that desired lifestyle. The more you need, the higher cost your insurance rate will be. A general rule is have 60% of your pretax gross salary

2) Benefit Period: How long you want the benefits to last. This can range from a few years to 10 years, or even until retirement. The longer you want to be able to receive benefits, the more it will cost. We recommend a minimum of at least 5 years, but if you can afford more! Go for it!

3) Waiting Period: The time period between when you become disabled and when you want to start receiving disability benefits. The shorter the waiting period, the more the policy will cost. To offset this waiting period, a lot of doctors will usually have an emergency fund (3-6 months) to cover their expenses, or sign up for short-term disability insurance (discussed later). We just recommend having a larger emergency fund to reduce the waiting period cost.

4) Age and Health: The older or less healthy you are, the more expensive it will be. So, when buying disability insurance, it will never be as cheap than what it costs today.

5) Occupation: The riskier your profession is, the more expensive it will be (ex: Stuntman). Good thing, optometry is considered a fairly low-risk profession. You can’t really die from refracting.

These main five factors set up the Base Price for typical LTD coverage for a few years, resulting in only a 1% cost of your annual salary per year in premiums. But if you want additional and fuller protection with a longer benefit period, you might be paying close to 3% of your annual salary per year in premiums.

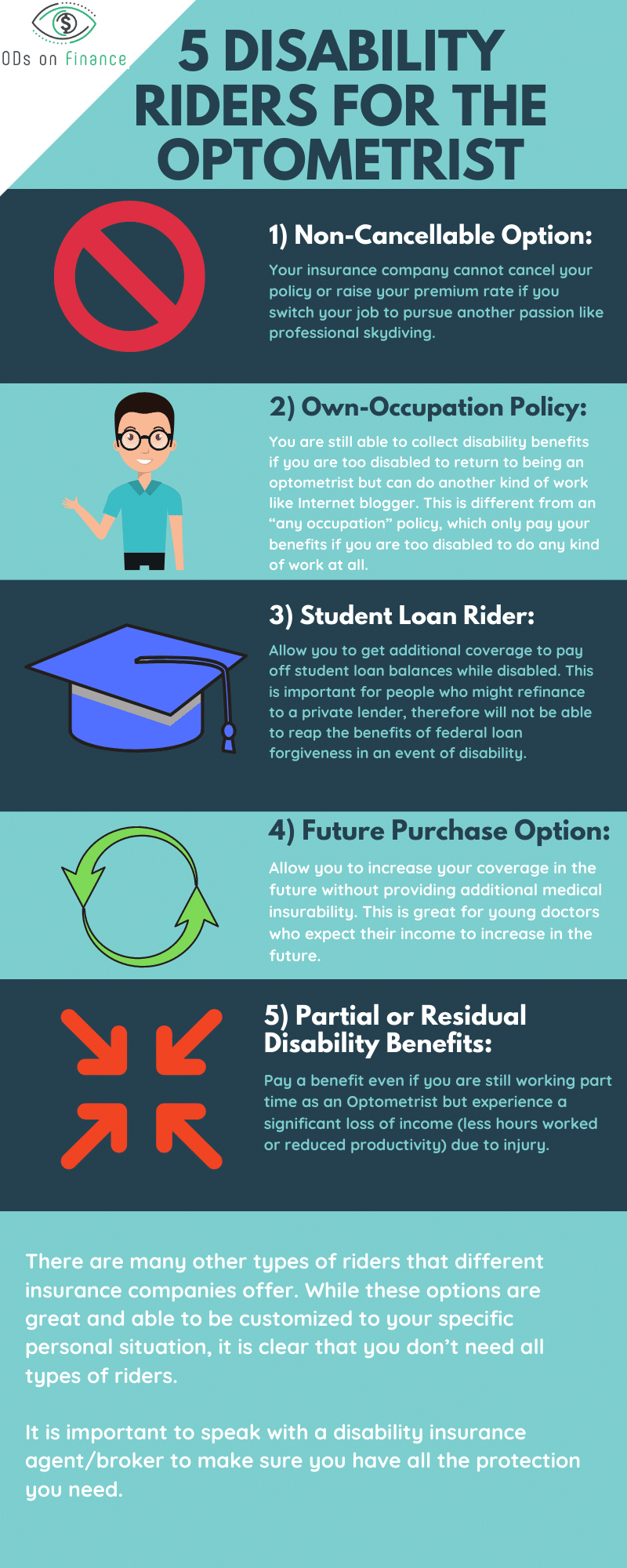

There are a lot of extra features called RIDERS that you can add to your policy, but will come at extra fees.

What are 5 Features/Riders that an Optometrist may need:

1) Non-Cancellable Option: Your insurance company cannot cancel your policy or raise your premium rate if you switch your job to pursue another passion like professional skydiving.

2) Own-Occupation Policy: You are still able to collect disability benefits if you are too disabled to return to being an optometrist but can do another kind of work like Internet blogger. This is different from an “any occupation” policy, which only pay your benefits if you are too disabled to do any kind of work at all.

3) Student Loan Rider: Allow you to get additional coverage to pay off student loan balances while disabled. This is important for people who might refinance to a private lender, therefore will not be able to reap the benefits of federal loan forgiveness in an event of disability.

4) Future Purchase Option: Allow you to increase your coverage in the future without providing additional medical insurability. This is great for young doctors who expect their income to increase in the future.

5) Partial or Residual Disability Benefits: Pay a benefit even if you are still working part time as an Optometrist but experience a significant loss of income (less hours worked or reduced productivity) due to injury.

There are many other types of riders that different insurance companies offer. While these options are great and able to be customized to your specific personal situation, it is clear that you don’t need all types of riders. It is important to speak with a disability insurance agent/broker to make sure you have all the protection you need.

What about Short-term Disability Insurance (STD)?

Short-term disability insurance (STD) basically replaces your income for a short period (3-6 months). STD can essentially cover that waiting period before your long-term disability kicks in. Some female doctors can also get a short-term disability policy that specifically covers future planned pregnancies. But for the mass majority of us, simply having a large enough emergency fund of 6 months will be enough to cover any brief time of no income.

Getting disability insurance doesn't have to be complicated!

Dat and Aaron have partnered with these vetted insurance agents that will help you quickly shop multiple companies for the coverage that's right for you.

Ready to get Started? Check out List of Recommended Insurance Agents

Facebook Comments