The Optometrist' Guide to Retirement Planning

Chapter 1: Introduction and Financial Goals: Where to Begin?

Retirement can be difficult to understand, so in 4 Sections, we will teach you how to build, grow and manage your retirement account.

You might be a new hotshot young optometrist with a brand-new job, finally getting the big doctor salary paycheck. I know you probably want to live your life after being in school for over 8+ years. I mean you feel like you deserve it right?

I know you want to travel the world and live the "YOLO" lifestyle. But just as you spend all those years planning your academic journey from college to optometry school, you need to plan your retirement. You are not going to be young forever my friend!

A lot of people have a giant misconception about retirement. The goal of retirement is NOT to sit on your butt all day and do nothing. The goal of retirement is be financially free. Free to do what you want to do, free to work part time, free to still see patients without the need for a paycheck, free to travel the world, free to donate to charities or volunteer, and free to follow a life-long passion that you put off! All while not worrying about making enough money to eat or pay your bills.

That is the True Goal of retirement

But everyone have a finite amount of cash flow each month and we all have stuff that we need or want to buy, in addition to financial milestones that we want to hit such as buying a home or saving up for a ring.

At the end of each month after meeting all of our immediate financial commitments like paying for groceries, rent/mortgage, etc, it is hard to imagine leaving any extra fund for long-term goals like retirement which are often decades away.

But before we dive into retirement planning, there are 4 Important financial goals that we need to prioritize prior to saving for retirement:

Goal 1: Know your Expenses and How to Budget

I know I know; budgets are boring and lame. But establishing a budget is the significant core of any personal finance game plan. I have met so many so-called “rich doctors” who drive into their office with their fancy Tesla, but confess to me that they are living paycheck to paycheck!

Why? Because they don’t know how much they spend each month.

The truth is simple, you cannot know how much to invest for retirement, pay off your student loans or save for other financial goals if you do not know how much you have left at the end of month.

Here are the 5 Steps for Starting a Budget:

- (1) List ALL monthly Income (W2, 1099 fill-in, side business income) at the beginning of each month

- Note: If your income is irregular and varies monthly (for example, During the holiday season, ODs usually bring in more income), just take the average monthly from this - you can make an estimate.

- Note: If your income is irregular and varies monthly (for example, During the holiday season, ODs usually bring in more income), just take the average monthly from this - you can make an estimate.

- (2) List ALL your monthly FIXED Expenses

- Example: Rent, house mortgage/property tax, utilities, car insurance, student loan + other consumer debt (credit card, car lease) minimum payments, health/disability insurance, and minimum retirement contribution.

- Note: Retirement IRA/401K contribution should ideally be a minimum of 10% of the total gross salary while paying off student debt and ideally 20% once all debt is paid off.

- Example: Rent, house mortgage/property tax, utilities, car insurance, student loan + other consumer debt (credit card, car lease) minimum payments, health/disability insurance, and minimum retirement contribution.

- (3) List your monthly NEEDS Expenses

- Example: Groceries, car (gas, parking and/or public transportation), basic home supplies.

- Example: Groceries, car (gas, parking and/or public transportation), basic home supplies.

- (4) List your monthly WANTS Expenses:

- Example: Restaurants, fast food, entertainment (Netflix, concerts, Spotify), coffee, alcohol & bars, mobile phone, haircut/hygiene.

- Example: Restaurants, fast food, entertainment (Netflix, concerts, Spotify), coffee, alcohol & bars, mobile phone, haircut/hygiene.

- (5) Total your monthly INCOME and monthly EXPENSES

- If your end result shows more income than expenses, then you are off to a good start. Use any extra to fund other financial goals

Sounds pretty simple right?

So why do so many people fail to stick to their budget? The reason is that our society often confuses NEEDS with WANTS. Like “I need to have my Netflix account” or “I need that $5 Starbuck Frappuccino every morning to survive,” rather than focusing on what I need for basic modern human survival.

This little budgeting exercise will help gauge what really matters. For the first month, try to be more flexible with each item section because you can always increase/decrease the allocated fund for the following month. Usually, it takes 2-3 months to get a fairly accurate budget, so don’t be too discouraged!

Review your budget monthly by looking at the previous month and which area you stay within range or which area you exceed in. Plan and adjust as needed (don’t be a dummy and increase your entertainment budget by $500 because Coachella is coming up).

Here are three mobile applications that we highly recommend. All of which can link all your bank/credit card transactions

- Mint. com (Free)

- YNAB.com “You need a Budget” (Free Trial but paid upgrade)

- EveryDollar.com (Free Trial but paid upgrade)

Financial Pearl

"Want to spend your money guilt-free and hate tracking your money? Consider developing a strategy called a REVERSE-BUDGET.

Once a month when you get all income, immediately send it to your 401K/Roth IRA, monthly FIXED Expenses such as rent and student loan payment, in addition to other short-term investment vehicles. Then whatever is left over, that is all yours to spend GUILT-FREE on whatever you desire, even if it is for that Coachella Tickets. But a word of caution, if it is running low toward the end of the month - it's time to start packing those sandwiches for work!"

Goal 2: Establishing an Emergency Fund (3-6 month Expenses)

Have you ever wondered to yourself, “What if my car transmission breaks down? What if I break my arm and I am forced to do one-handed eye exams? What if I lose my job and cannot find a new one?”

All of these “What if” situations can happen at any time and cause devastating results to our livelihood, usually forcing many Americans to get into further debt or even worse, bankruptcy.

This is where the importance of having a solid emergency fund comes in. It is basically an “Oh CRAP” fund that helps you sleep better at night. It is a way for you to financially prepare for all the worst things that can or will happen in life. We as doctors are so calculative in our thinking, that we expect everything to go perfectly as planned, but life is filled with unexpected surprises that can cause us to be financially ruined.

On a positive note, optometrists overall have a fairly high job security because we can always pick up fill-in shifts at random offices to cover some of our expenses, or if needed, move to the middle of nowhere where our salary is likely to double.

But ideally, many people need a minimum of 3 months of expenses coverage (not 3 months of income), but some can go a little bit lower if they have families close by (like their parents) to help them with financial trouble.

You are probably asking right now - Can I use a Credit Card for my emergencies?

NO! A credit card is NOT an emergency fund. This is how many people get into gigantic consumer debt. Don’t be like the rest.

What is Considered an Actual emergency?

This is where a lot of people get into trouble. A 50% off sale at Nordstrom is NOT an emergency! Wanting to buy the new iPhone is NOT an emergency! Buying a new car is NOT an emergency! A financial emergency will usually devastate your financial situation if you are not adequately prepared.

As you become more financially suave and have a good budget in place, then you tend to have significantly less emergencies

Where should you Keep your Emergency Fund?

This should be stored someplace safe (FDIC insured), liquid (easily accessible via withdrawal), and where it might earn a bit of interest. Usually an online high-yield saving account is the best place to meet all these criteria. Check out these high-yield savings accounts.

Financial Pearl

"Many people need a minimum emergency fund of 3 months of expenses coverage (not 3 months of income), but some can go a little bit lower if they have families close by (like their parents) to help them with financial trouble.

On a positive note, optometrists overall have a fairly high job security since we can always pick up fill-in shifts at random offices to cover some of our expenses, or if needed, move to the middle of nowhere where our salary is likely to double"

Goal 3: Contribute to any Main Retirement (401K, SEP/SIMPLE IRA) fund up to Employer’s Match

If you have any employer-sponsored retirement such as 401K, and your company matches any portion of your contribution (usually up to 6%), then make sure you contribute up to that match! This is free money and a significant part of your salary, so make sure you are taking full advantage of it.

The most common employer match can be 50% of your contribution up to 6% of your salary. Sounds complicated, but that’s essentially free money worth 3% of your salary per year.

Goal 4: Pay off any High-Interest debt (Greater than 8%) such as Credit Card debt and Car Lease Loan

This is vital because it is simple math. If you have high-interest debt such as a 8-12% credit card, the best financial move is to pay off debt off immediately! You will save more in interest by paying that off, than earning 10% in stock investing, then having to pay tax on those gains. In addition, there is no risk involved (unlike investing) since paying off those high interest debts is a guaranteed return on your money.

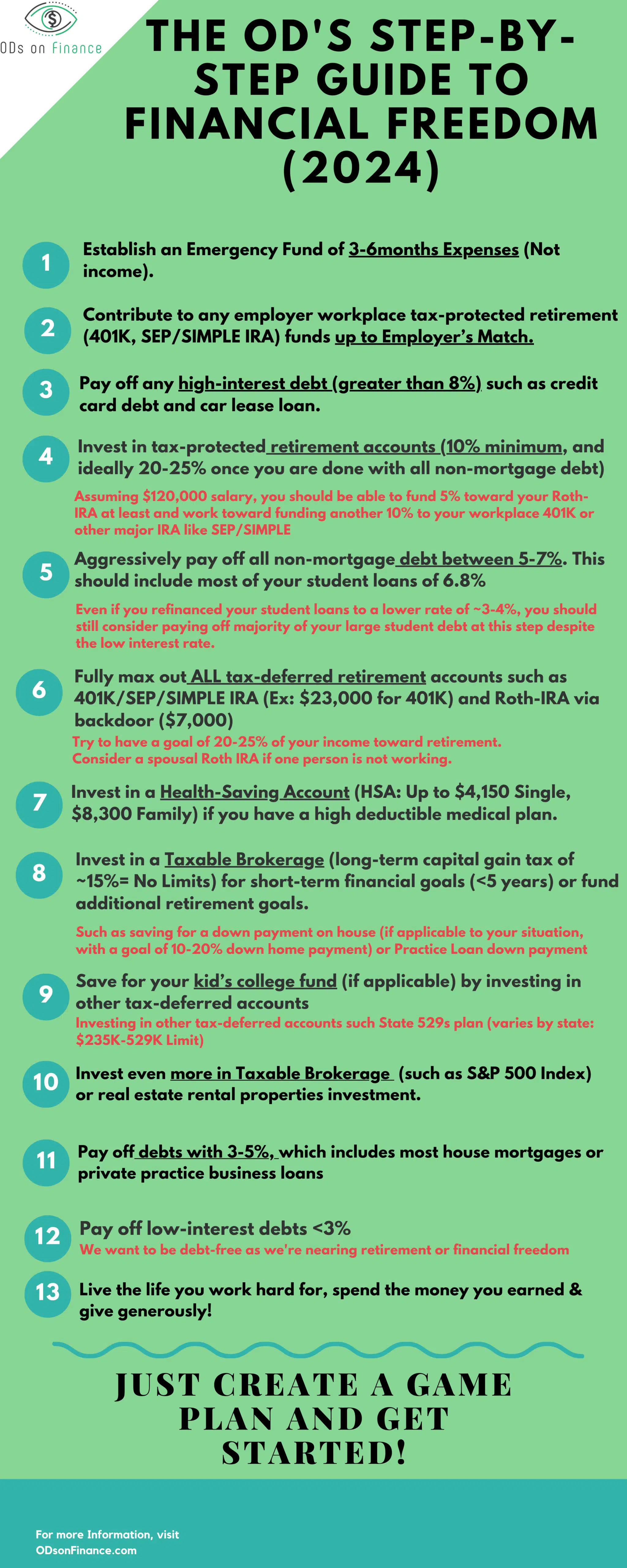

How to Prioritize Financial Goals?

Now that you have these basic financial goals out of the way, it is time to do some serious financial retirement planning. We are going to focus on retirement planning in this guide but here is a great Step-by-step guide that you can use for your own situation and adjust to your own personal financial situation!

This will help you gauge where your cash flow should go when you got multiple financial goals and priorities