What Should I Do First? A Complete Step-By-Step Guide For Optometrists

Personal finance is called personal for a reason; it is just as much a science as it is an art (similar to prescribing glasses). But seriously, this is probably one of the most difficult decisions that a lot of doctor investors will face and has starved me of sleep a lot - simply deciding which financial goal to attack first.

There are a lot of financial gurus that have come up with generic and quite frankly strict lists of “baby steps” that are supposed to cater to everyone. This is virtually impossible to do because everyone’s situation is completely different and varies in complication.

A new graduate with massive student loans and high-interest credit card debt will have different priorities from a seasoned OD who is nearing retirement. We hope this chapter offers a guideline to help you analyze each of your financial goals and help you prioritize them in ways that cater to your own situation; most importantly, your own attitude toward debt and goals.

(1) Think in Terms of Goals

First thing to think about: think in terms of goals. List out what your personal goals related to finance are.

Do you want to pay off your student debt in 1-5 years or are you okay to have it for 10 years? Do you want to buy a home in a few years or are you okay to rent for a while? Do you want to open a private practice soon? Do you want to start a family sooner than later? Do you want to retire much earlier than the standard 65-year-old? Do you want to help take care of your elderly parents?

Everyone’s goals are different, but many doctors should have these 8 general financials goals:

Your financial goals should be motivating and emotional; They should be why you get up each morning to drive that one-hour commute to work or professionally deal with that ridiculous rude patient yelling at your front desk staff. This is why you can do the same “One or two, which is clearer” question day after day, year after year. No millionaire’s goal is to simply have a million dollars in their bank account; it is what they plan to do with it that sparks joy in their lives.

(2) Multi-task Different Priorities

We do realize the power of intense focus and the behavioral aspect in putting all your concentration into one financial goal, such as aggressively paying off your student loans or saving up for a down payment on a house. But just as you were able to balance studying for both your binocular vision and ocular disease finals back in school, you should be able to multitask your financial goals.

The idea of an optometrist deferring his retirement fund by 5 or even 10 years while paying off student loans is RIDICULOUS when it comes to the power of compounding. Also, if your employer offers a 6% match to your 401k or IRA, contribute at least to that amount. That is free money that you are leaving on the table. Any company match is considered a part of your salary.

(3) Assess your Own Risk Tolerance and Attitude toward Debt.

If you are not a risk-taker, then focus more on paying off debt vs. investing for retirement. If you do not mind leveraging on some debt, then focus more on investing for retirement.

If you look at the math, a typical student loan costing 6.8% interest (or even 2.9% if refinanced) might not seem as exciting as your S&P 500 index mutual fund stock portfolio gaining 11% yearly. But investing in your stock portfolio carries significant risk compared to a guaranteed “return” of 6.8% if you pay off your student loans. Your ability to assess your own risk attitude is an important part of your personality as an investor.

“Dat and Aaron! Argh, Can You Just Tell Me Where to Start?”

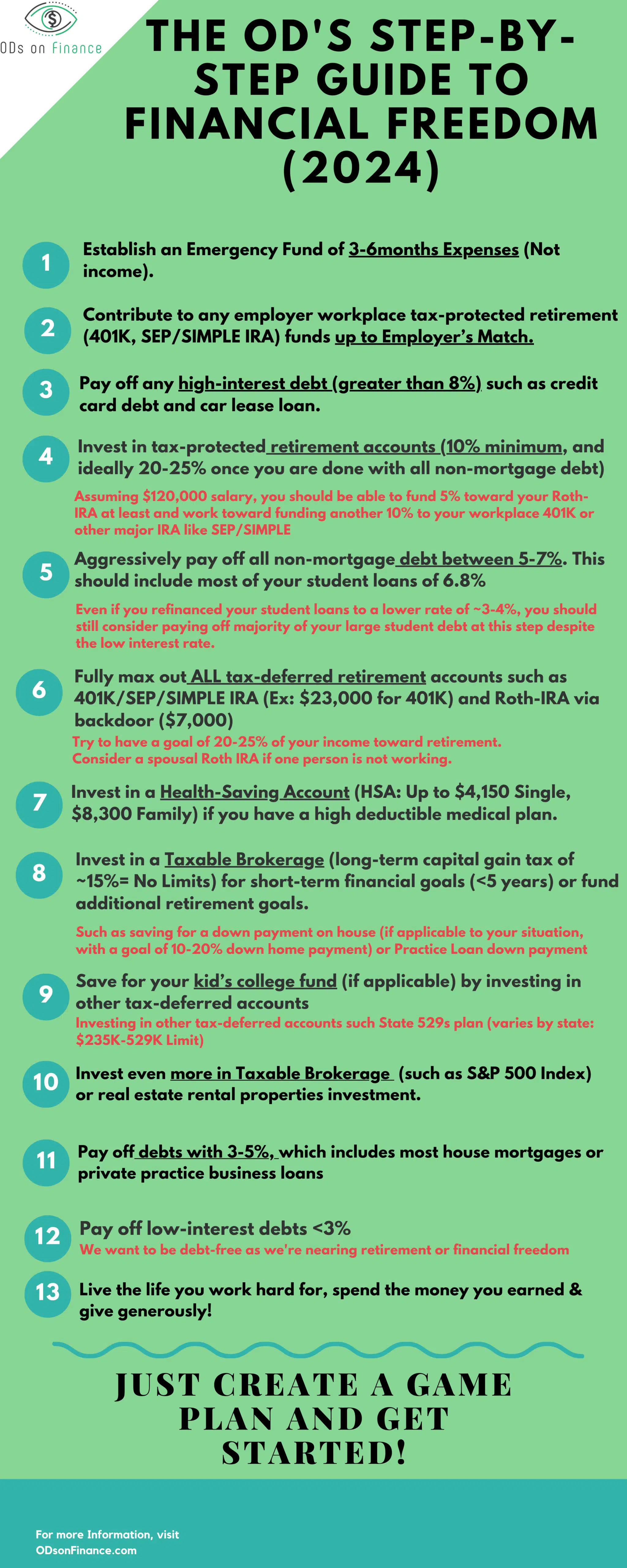

Step-by-Step Guideline

Here is a "Guideline" list of financial steps (as of 2024) that we hope will get you started, but should be adjusted to your own personal situation:

(1) Establish an Emergency Fund of 3-6months Expenses (Not income).

(2) Contribute to any main workplace tax-protected retirement up to the Employer's Match

- Ex: 401K, SEP/SIMPLE IRA funds up to employer’s match.

- Click here to Learn how to Set up your Retirement Accounts

(3) Pay off any high-interest debt (greater than 8%)

- Such as credit card debt and car lease loan

(4) Invest in tax-protected retirement accounts (10% minimum) and then ideally 20-25% once you are done with all non-mortgage debt

- Assuming $120,000 salary, you should be able to fund 5% toward your Roth-IRA at least and work toward funding another 10% to your workplace 401K or other major IRA like SEP/SIMPLE. This is while paying off your student loans.

(5) Aggressively pay off all non-mortgage debt between 5-7%. This should include most of your student loans of 6.8%

- This should include most of your student loans of 6.8%. Even if you refinanced your student loans to a lower rate of ~3%, you should still consider paying off your large student debt at this step despite the low interest rate.

- Click here to Learn how Refinance Your Student Loans

(6) Fully max out ALL tax-deferred retirement accounts such as 401K/SEP/SIMPLE IRA (Ex: $23,000 for 401K) and Roth-IRA via backdoor ($7,000)

- Try to have a goal of 20-25% of your income toward retirement. Consider a spousal Roth IRA if one person is not working.

(7) Invest in a Health-Saving Account (HSA: Up to $4,150 Single, $8,300 Family) if you have a high deductible medical plan.

(8) Invest in a Taxable Brokerage (long-term capital gain tax of ~15%= No Limits) for short-term financial goals (<5 years) or fund additional retirement goals.

- Select index funds or Bonds for other short-term financial goals (<5 years)

- Example: Saving for a down payment on house (if applicable to your situation, with a goal of 10-20% down home payment)

(9) Save for your kid’s college fund (if applicable) by investing in other tax-deferred accounts

- Investing in other tax-deferred accounts such State 529s plan (Varies by State: $235K-529K Limit)

(10) Invest even more in Taxable Brokerage (such as S&P 500 Index) or real estate rental properties investment.

(11) Pay off loans with 3-5%, which includes most house mortgages or private practice business loans.

(12) Pay off low-interest loans <3%,

- We want to debt-free as we near retirement or financial freedom

(13) Live the life you work hard for, spend the money you earned and give generously.

Summary

We do advise a lot of our doctor investors to NOT carry any debt (including the house mortgage) into retirement since losing the safety net of your job will cause significant financial risk.

But again, remember this is just a guideline! So, it is okay if you decide to place all your focus on aggressively paying off your student loans because you simply hate debt. Sometimes, it is okay to focus more on retirement or saving for a house down payment. Some years later, your goals might change and you want to aggressively attack your student debt. While other years, you want to invest more for retirement.

Just create a game plan and get started!

Thanks John!! Glad you are enjoying the Site!

Wonderful summary. Thanks for sharing.