Posts by DatBuiOD

What Should I Do First? A Complete Step-By-Step Guide For Optometrists

Here is a “Guideline” list of financial steps that we hope will get you started, but should be adjusted to your own personal situation as an optometrist.

Read MoreThe Optometrist’s Guide To Student Loan Refinancing

Optometrists often accumulate multiple loans from federal and private lenders to fund their doctor education, which results in an average debt load of $220,000. The majority of these loans are federal loans which have an average interest rate of 5.5-6.8%.Then the majority of doctors will end up refinancing their student loans to save thousands of dollars in interest. Here is your comprehensive guide to the student loan refinancing process and understanding how underwriting works.

Read More16 End-of-Year Financial Checklist For Optometrists in 2023

As 2023 draws to a close, it’s vital for optometrists to focus on financial planning for a stable and prosperous future. This checklist, designed for eye care professionals, will guide you through key year-end financial tasks. While not every item may apply to your practice or personal finances, reviewing each one ensures you don’t miss important opportunities or obligations.

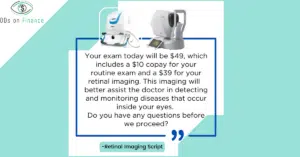

Read MoreHow To Achieve Over 90% Capture Rate With Optos/Eidon Widefield Script

As practitioners, we understand the importance of retinal imaging, and we need to be able to clearly explain that value to our patients. I’ve found that communication is key with patients — before, during, and after their appointments. This helps to eliminate any questions, and it ensures that they’re not only on board with the…

Read More2023-2024 IRS limitations for Optometrists

With inflation rising at all time highs, it definitely seem that the IRS is adjusting quite drastically for most of these accounts for 2023! While all of these limits might seem higher, remember that it is mainly keeping up with inflation, which the consumer index is estimated at 8%. in 2022. Please use these important limit to adjust your financial planning for 2023 especially for any retirement plans!

Read MoreOvercoming $153,242 Student Loan Debt in Four Years Working in Corporate Optometry

Hello, I’m Dr. Ayana Pierre O.D, and I graduated from NSU in May 2019. I chose the path of corporate optometry and currently practice in Central Florida. Working about 4.5 days a week, I’ve been fortunate to earn a gross income of approximately $250,000 last year. This achievement has been a blessing, providing me with not just financial stability but also the flexibility to manage my schedule effectively.

Read MoreOctober 2023 Market Update for Optometrists: Latest Economic & Financial Trends

The economic landscape is characterized by a steady 3.7% inflation and cautious actions from the Federal Reserve, particularly in managing interest rates to avoid potential economic downturns. While some economic indicators like GDP growth appear robust, there’s a visible undercurrent of economic stress and mixed expert predictions regarding a potential recession in 2024.

Read MoreThe Holland’s Journey: Paying off $660,000 Student Debt in 5 1/2 Years

We want to share our stories to help other young optometrists who are struggling with their student loans. We are both practicing optometrists and managed to overcome a massive obstacle together: paying off $660,000+ in student loans in just 5 1/2 years. Sounds impossible right? But let’s start from the beginning.

Read MoreUPDATE: Must-Read Strategies to Tackle Optometry Student Debt

After an enduring three-year period, the final COVID-19 student loan forbearance is drawing to a close on August 30, 2023. Recognizing the natural apprehension that some optometrists might be feeling as this date nears, our team has been working tirelessly to develop strategies to support all our borrowers, especially new graduates stepping into the workforce!

Read MoreConquering a Mountain of Debt: Paying off $242K in 7.5 Years on an Starting Salary of $85K as an Optometrist

Over 7.5 years, Ada Noh cleared her substantial student loan of $242K on a beginning salary of $85K by adopting a frugal lifestyle and engaging in optometry-related side gigs.

Read More