Real Estate Investing

“The best investment on Earth is Earth.” -Louis Glickman

Through leveraging a talented team of realtors, contractors, and property managers spanning five states, Dr. Julie Phan has steadily built a real estate business that generates consistent passive income. She plans to continue investing in small multifamily structures and eventually larger apartment buildings with the ultimate goal of achieving financial independence before the age of 40 so she can fully dedicate her time to raising her children while overseeing her two optometry practices.

Along the way, she hopes to inspire friends, family, and colleagues about the value of real estate investment so they can work towards their own financial independence.

Let's get started on your journey toward financial freedom with your real estate!

Related Articles

October 2023 Market Update for Optometrists: Latest Economic & Financial Trends

The economic landscape is characterized by a steady 3.7% inflation and cautious actions from the Federal Reserve, particularly in managing interest rates to avoid potential economic downturns. While some economic indicators like GDP growth appear robust, there’s a visible undercurrent of economic stress and mixed expert predictions regarding a potential recession in 2024.

Good vs. Bad Optometry Debt – 4 Ways to Use Good Debt to Your Advantage

That being said, debt can be a useful tool for achieving financial goals, but not all debt is created equal. Some debt can be beneficial, while others can be detrimental to your financial well-being. Let’s explore the difference between good debt and bad debt and how you can use debt to your advantage.

Q1/2023 Market Update for Optometrists: Latest Economic Trends And How To Adjust Your Financial Plan

Welcome to the Q1/2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans… So we hope to provide a comprehensive overview of the latest economic trends and developments, highlighting the challenges and opportunities in today’s market for optometrists.

State of ODs on Finance: 2022 in Review, and a Look at 2023!

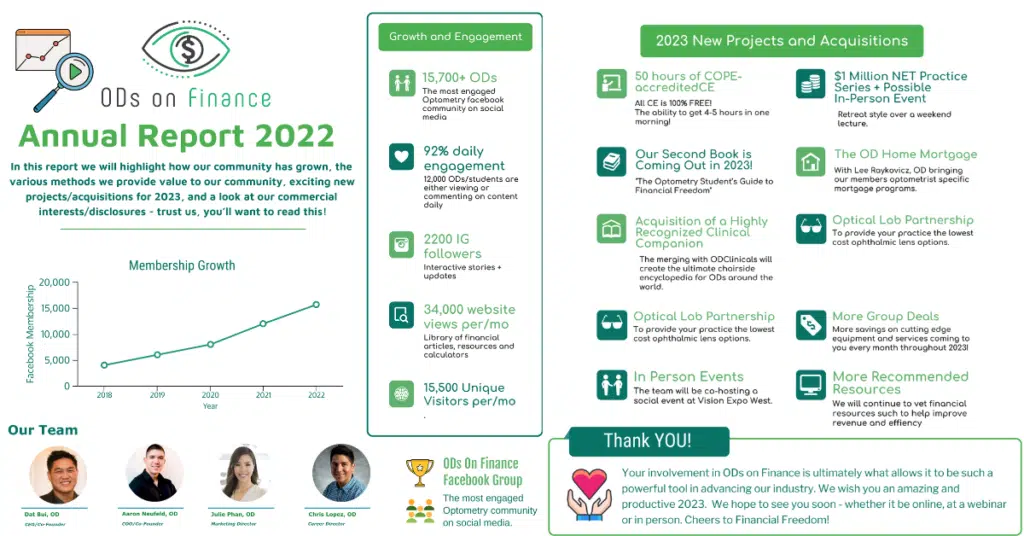

It’s hard to believe, but the year 2022 has vanished in the blink of an eye. This past year, we’ve had the pleasure of seeing ODs on Finance continue to grow and help ODs on their financial journey, whether they be new grads or seasoned veterans. We are thankful for your attention, your questions and your contributions. Two tenets that hold paramount value to us at ODs on Finance are transparency and productive growth. In this letter, we will highlight how our community has grown, the various methods we provide value to our community, exciting new projects/acquisitions for 2023, and a look at our commercial interests/disclosures – trust us, you’ll want to read this! Here is a quick recap of 2022!

The OD’s Quick Guide into Active & Passive Real Estate Investment

You’ve heard it again and again that real estate is an excellent pathway to accumulate significant wealth. However, you should also know that most real estate investors do not get rich overnight, as it can take years for investment properties to accumulate enough equity and generate significant wealth. The nice thing about real estate is that there are many approaches to make money and to do so either requires a lot of your time, or very little of it. Simply put, real estate investing can typically be classified as either active or passive investing. Let’s take a look at these categories to learn which may be the best fit for you!

5 Big Challenges of Out of State Rentals & How To Overcome Them

If you are reading this, chances are that you have realized how lucrative the rental property market can be. Rentals can serve as a great source of passive income, but they certainly are not without risk. One strategy for decreasing your risk is to diversify your rental portfolio by investing in out of state properties. However, out of state investing is not without its own challenges. Let’s look at the 5 biggest challenges for out of state investing and how to address them.

Four Major Benefits of Investing in Out of State Rentals

If you’re reading this article, you most likely live in a state that has a high cost of living and home prices are skyrocketing at a pace that makes little sense in investing for cash flow. You’ve wondered how you can also own rental properties and enjoy the sweet success of passive positive cash flow that isn’t possible where you’re at. We’ll talk more about the disadvantages in a follow up article, but for now, we will dive into four major benefits of investing in rental properties out of state.

10 Reasons For Optometrists to Invest in Apartment Syndications & 2 Reasons to Not Invest in Apartment Syndications

When we started New Sight Capital, we set out on a mission to share the unique opportunity of apartment investing with our fellow optometrists. The challenge: not many ODs have ever heard of apartment syndications. In short, an apartment syndication is the pooling of collective capital from investors in order to acquire an apartment complex that would normally be reserved to larger, institutional investors. Although syndications have been around for years, they’ve typically been an instrument of very wealthy or well-connected accredited investors. We are setting out to change that by bringing syndications directly to the optometric community.

6 Due Diligence Tasks to Perform when Purchasing Rental Properties

Investing in rental properties can have a lot of exciting moments; however, one thing that people will never claim to be enthralling is performing their due diligence…Due diligence essentially refers to ensuring that you know everything possible about a property before signing on the dotted line. In this article, I will discuss due diligence, breaking it into tasks prior to making an offer and those done after your offer is accepted.