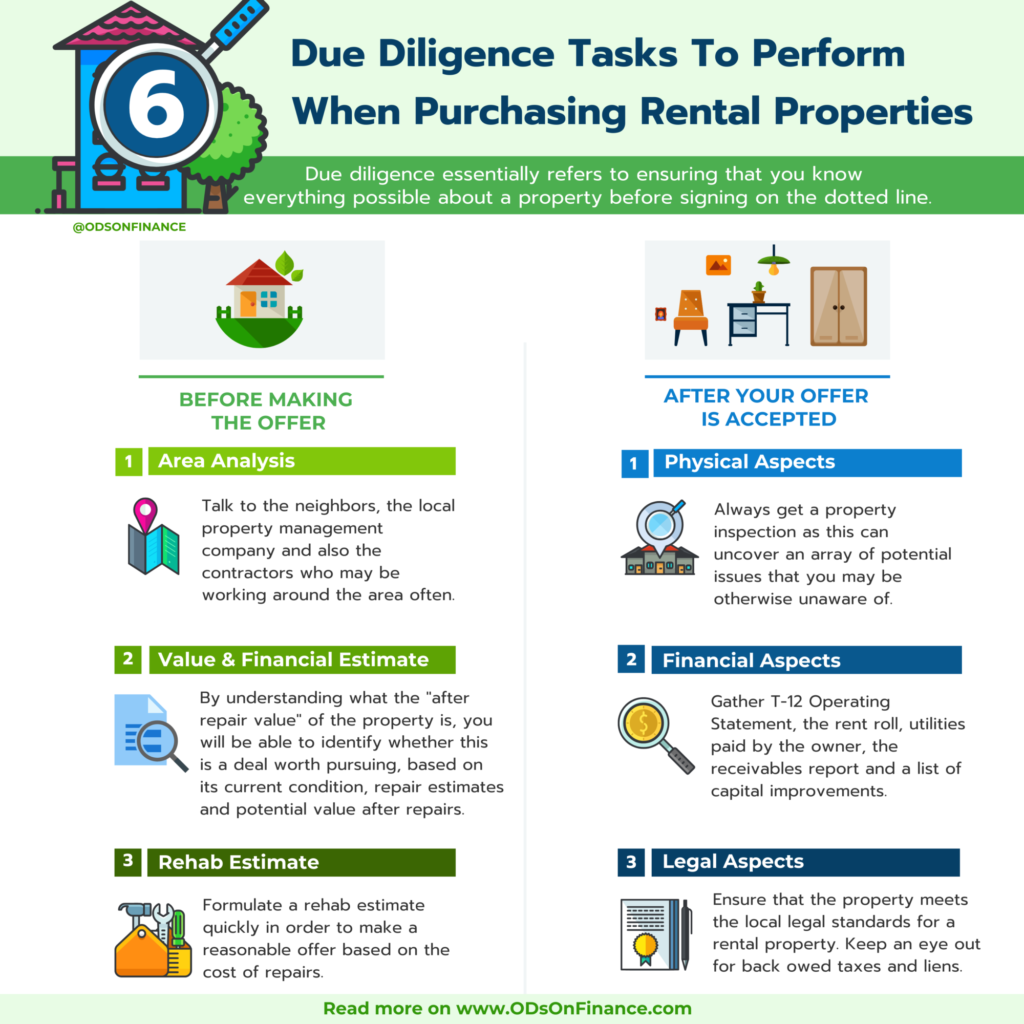

6 Due Diligence Tasks to Perform when Purchasing Rental Properties

KEY POINTS:

-

(1) BEFORE: Area Analysis: Talk to the neighbors, the local property management company and also the contractors who may be working around the area often.

-

(2) BEFORE: Value & Financial Estimate: By understanding what the "after repair value" of the property is, you will be able to identify whether this is a deal worth pursuing, based on its current condition, repair estimates and potential value after repairs.

-

(3) BEFORE Rehab Estimate: Formulate a rehab estimate quickly in order to make a reasonable offer based on the cost of repairs.

-

(4) AFTER Physical Aspects: Always get a property inspection as this can uncover an array of potential issues that you may be otherwise unaware of

-

(5) AFTER Financial Aspects: Gather T-12 Operating Statement, the rent roll, utilities paid by the owner, the receivables report and a list of capital improvements.

-

(6) AFTER Legal Aspects: Ensure that the property meets the local legal standards for a rental property. Keep an eye out for back owed taxes and liens.

Investing in rental properties can have a lot of exciting moments; however, one thing that people will never claim to be enthralling is performing their due diligence. Despite this, I cannot emphasize enough the importance of doing proper due diligence when investing.

Due diligence essentially refers to ensuring that you know everything possible about a property before signing on the dotted line. In this article, I will discuss due diligence, breaking it into tasks prior to making an offer and those done after your offer is accepted.

Before the Offer: Due diligence begins when you first consider looking at a potential rental property. Prior to making the offer, there are three major things that need to be done. These include conducting an area analysis, doing a value & financial estimate, and completing a rehab estimate.

(1) BEFORE THE OFFER: Area Analysis

An area analysis involves gaining insight into the different aspects of the area you are looking at. This will help you get a sense of the desirability of any property you are considering purchasing. There are a number of aspects in conducting a successful area analysis. You’ll definitely want to look at median home values over time, as this will help you determine the potential appreciation of your property. This in turn can be a good benchmark for if rental prices will rise, as well as if you can expect to gain value if you sell down the road.

You will also want to pay attention to aspects such as population growth and current occupancy rates. These factors will help determine if the property will be relatively easy to rent or if you may struggle to find occupants when experiencing turnover. Also, school rankings and crime rate, are both important factors that can greatly influence the desirability of an area, particularly for families.

A quick and free resource to find out about a particular area is to talk to your property management team. Since they will be the one sourcing quality tenants, they will be in the know if the area will be attracting higher quality tenants or the opposite. Other tools include websites such as www.city-data.com and www.trulia.com .

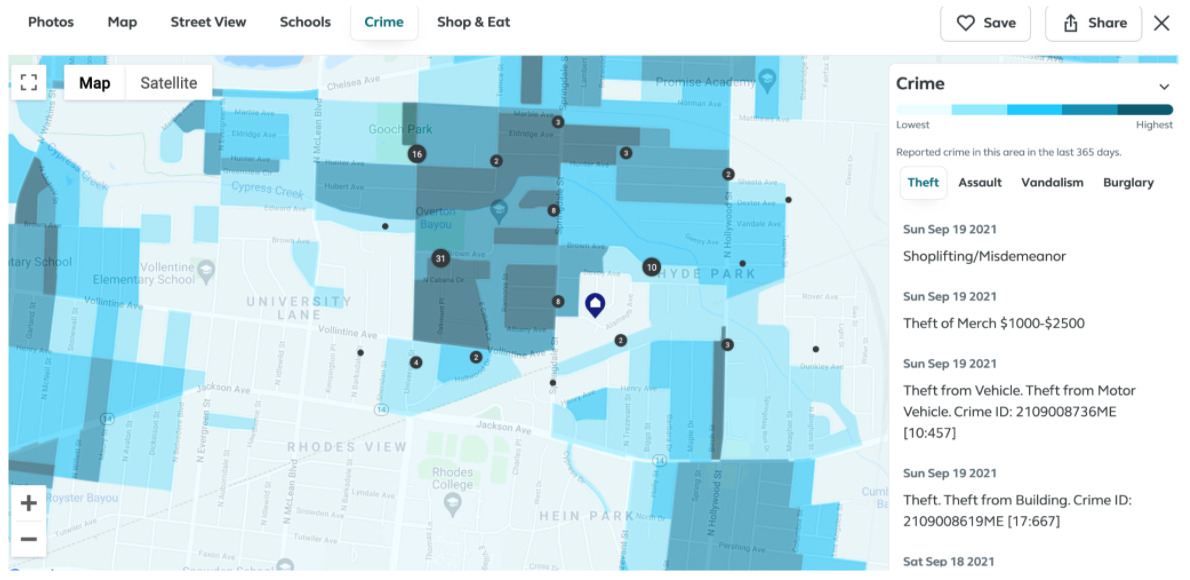

Trulia has an easy to understand crime rate map. A good analysis of the crime around your property can give you an insight of the neighborhood without you needing to visit the area itself.

Here is an example of a Trulia Crime Map

- As you can see the property is right in the middle of a heavy crime area (dark blue) and a lower crime area (light blue). While crime mapping systems are accurate in displaying raw data of reported crime incidents, they don’t always paint a true picture of a neighborhood’s safety.

- For example, the crime rate in a densely populated area may appear higher because more people equals a higher number of reported crimes and vice versa. Here’s a great tip - if you are unsure about the area, talk to the neighbors, the local property management company and also the contractors who may be working around the area often.

Financial Pearl

"A quick and free resource to find out about a particular area is to talk to your property management team. Since they will be the one sourcing quality tenants, they will be in the know if the area will be attracting higher quality tenants or the opposite. Other tools include websites such as www.city-data.com and www.trulia.com which can show your crime rates around your rental"

(2) BEFORE THE OFFER: Value & Financial Estimate:

When it comes to investing in real estate, not only is it important to know the value of the property in its current state, but the potential of the property’s value after it has been updated. This is called the “After Repair Value'' also known as “ARV”.

Example: If you’ve seen a distressed property that is selling for $100,000, and needs about $50,000 in repairs, but neighboring houses are selling at $125,000 for a fully rehabbed property, then indeed this house is considered “over-valued”. By understanding what the ARV of the property is, you will be able to identify whether this is a deal worth pursuing, based on its current condition, repair estimates and potential value after repairs.

The best way to calculate the ARV of a potential property is to partner with your real estate agent and run an analysis of comparables of homes sold within the area. Make sure that your realtor “compares” apples to apples - meaning, providing you with homes that closely match your subject property (i.e. number of bedrooms, bathrooms, garages, basements, etc). I also recommend to filter the search to include:

- Homes sold within the last 90 to 120 days

- Homes similar in age, size, square footage and room count

- Homes in a similar neighborhood

- Homes within one mile of the investment property

Remember to also consider current market conditions and trends, as well as seasonal price changes as those items can affect the value of your house.

The next aspect of research you’ll want to engage in is a financial estimate of the property. This should be divided into income and expense categories. Income categories include things such gross rental income, pet fees, late fees, laundry fees or utility chargebacks.

A great tool to look for market rents is www.rentometer.com. I recommend searching a .5 mile radius with the same property type. It is a quick way to gauge the competitiveness of your rents to give a clear indication of whether or not your rents rates are fair for the surrounding area. If you are using a property management company, they will be a great resource to provide a market rent in the area as well as what specific amenities that tenants in the area are looking for (i.e. dishwasher, yards for pets, garages etc).

Next, calculate expenses including property taxes, owner paid utilities, property insurance, maintenance, marketing, management fees, and other aspects that may affect net cash flow. Subtracting your expenses from your income will estimate your net operating income for the property.

Many investors use the 1% rule to quickly gage to see if their investment will “positively cash flow” after all expenses and reserves have been accounted for.

Financial Pearl

"The best way to calculate the ARV of a potential property is to partner with your real estate agent and run an analysis of comparables of homes sold within the area. Make sure that your realtor “compares” apples to apples - meaning, providing you with homes that closely match your subject property (i.e. number of bedrooms, bathrooms, garages, basements, etc). I also recommend to filter the search to include: Homes sold within the last 90 to 120 days, similar in age, size, square footage and room count, Homes in a similar neighborhood, Homes within one mile of the investment property"

Want to learn how to analyze the potential profit of your investment property? Check out this How Much Profit Should Rental Properties Generate?

(3) BEFORE THE OFFER: Rehab Estimate

Finally, you’ll want to complete a rehab estimate for the property. This is sometimes the most difficult part - especially if you live thousands of miles away or if it is your first rehab project. You will need to rely on the expertise of your realtor and contractors to help you determine a quick rehab scope/estimate based on their walk through before making an offer. Once you’ve done a few rehab projects, you can quickly estimate the rehab cost based on your past experiences.

When evaluating a rehab estimate, a quick and dirty scope should always include the major mechanicals (if they need to be replaced, repaired or deferred), this includes:

This specifically notes the different repairs that you feel are necessary in order to make the property rentable and safe, as well as concrete estimates of their cost. Remember that not all items need to be replaced. As long as they are in good and serviceable condition, they can be used for many years to come. Just remember to set aside a “reserve” for when that time does come.

Having a good idea of the cost to renovate/repair the property will be particularly useful when negotiating your offers. In a competitive market, you will want to formulate a rehab estimate quickly in order to make a reasonable offer based on the cost of repairs.

Once you’ve determined the ARV (after repair value of the house) and then the estimated repair cost, now you will have strong data points to generate a fair offer.

ARV X 70% - Estimated Repairs = Purchase Price

Example with numbers:

- Property ARV $100k.

- $10k are needed in repairs to to bring it up to retail condition

- ARV=100K x 70%= 70K-10k(repairs)= $60K this is a good purchase price (don’t be afraid to offer lower)

(4) AFTER THE OFFER: Physical Aspects

Once the offer is accepted, your due diligence journey is not yet over. In fact, you’ll want to complete a number of other things. These can be broken down into physical, financial, and legal categories.

In terms of the physical aspects, you (or your trusty boots on the ground) will need to walk the entire property … every room and every area of every unit! More importantly, you will always want to get a property inspection as this can uncover an array of potential issues that you may be otherwise unaware of. If it is a new area, ask for recommendations for a professional home inspector. The inspector will comb through the property and note any problems with the property that need to be remedied, along with accompanying photos and recommendations.

Once you have received the inspection report back you can use this as a guide for your rehab “punch list” and send that to your contractor to create a bid for the repairs. Remember that “quick and dirty” rehab estimate that you created prior to the offer being accepted? This is the time to go through each item and determine the extent of damage, and if the item needs to be repaired, replaced or deferred.

Secondly, if the property is occupied, be sure to try to get a feel for the current tenants as well. Do the units look organized and relatively clean, or in a state of utter chaos?

(5) AFTER THE OFFER: Financial Aspects

When it comes to the financial aspect, you will want to complete a thorough review of the various financial elements of the property.

The most important documents to request are the T-12 Operating Statement for the past three years, the rent roll, utilities paid by the owner, the receivables report to show who owes rent, and a list of capital improvements.

Make sure to get a signed estoppel agreement from the tenants and seller. This agreement will outline the lease terms, amount of rent/security deposit, outstanding balances and if the current landlord has met all his/her obligations.

(6) AFTER THE OFFER: Legal Aspects

Legal aspects include a variety of things as well. If the property has a homeowner’s association, you’ll want to ensure that the HOA has sufficient money in reserve and confirm the cost of the annual HOA fees. You also want to ensure that the property meets the local legal standards for a rental property. In addition, the major things that you will want to keep an eye out for are back owed taxes and liens on the property. Having a good title company will uncover these details for you.

Once you’ve done a thorough post-offer inspection and have determined the extent of damages as well as analyzed the financial & legal aspects of the property, you will need to determine if the offer price you made is still suitable for the condition of the property. As long as the offer is not an “as is” offer, all negotiation is fair game. I highly advise to have an inspection contingency of at least 10 days for a single family home and longer for multifamily units, or longer if during busy seasons or poor weather - as these things can delay scheduling inspections. After the inspection period, your earnest money will be forfeited, unless you extend the inspection period or further negotiate the contract.

Finally, Completing the Process

Your due diligence will help you determine whether to invest in the property or back out and retrieve your earnest money. Following these recommendations for due diligence after your offer is accepted also gives you an ability to renegotiate if there are major issues that come up that may affect the success of the property. Ultimately, you must make the decision whether to purchase the property or walk away based on the data points in front of you. Many new investors struggle with landing their first deal because of something called “analysis paralysis”. However, if you take the time and proper steps to do proper “due diligence”, this can ensure that you make good decisions based on good data.

Remember, walking away from a bad deal is much less costly than sinking your money into a property that you’ve didn’t do your homework on!

Financial Pearl

"The most important financial documents to request are the T-12 Operating Statement for the past three years, the rent roll, utilities paid by the owner, the receivables report to show who owes rent, and a list of capital improvements. Make sure to get a signed estoppel agreement from the tenants and seller. This agreement will outline the lease terms, amount of rent/security deposit, outstanding balances and if the current landlord has met all his/her obligations"

Want to learn how to build your own RE Portfolio? Check out The Five Step to Begin Your Real Estate Journey

Need Mortgage Lender? Check out Recommended Home Loans

Facebook Comments