The Optometrist’s Guide To Student Loan Refinancing

Introduction

Let’s dive into the approach that applies to at least 85 percent of optometrists: paying off student loans the traditional way.

Optometrists often accrue debt from both federal and private lenders to finance their education, leading to an average debt load of $220,000. Most of these loans are federal and come with average interest rates ranging from 5.5 percent to 6.8 percent.

Assuming that an optometrist is NOT going for federal forgiveness such as:

- 10 years Public Service Loan Forgiveness (PSLF) - if they work for a non-profit organization like VA

- 20-25 total loan forgiveness if their debt to income is too higher

The majority of optometrists end up refinancing their student loans to save thousands of dollars in interest. So, here’s what you need to know about the student loan refinancing process, including an understanding of how underwriting works.

What Is Student Loan Refinancing?

Student loan refinancing involves securing a new loan from a private lender to replace your existing loans. This new loan comes with different interest rates and repayment terms. By refinancing with a private lender, you alter the existing conditions of your loan, especially concerning the interest rate and the repayment timeline.

Refinancing is free, can be repeated multiple times, and often results in significant savings through lower interest rates. Many lenders also offer sign-up cash bonuses for new clients.

It’s important to differentiate this from federal direct consolidation. The latter essentially combines multiple loans into a single loan with an average, weighted interest rate. This can simplify the repayment process by making it easier to keep track of your debt. Federal Loan programs usually offer this consolidation option.

In summary, when you refinance your student loans, you’re essentially consolidating multiple federal loans into a single loan, but you’re doing so at a more favorable interest rate.

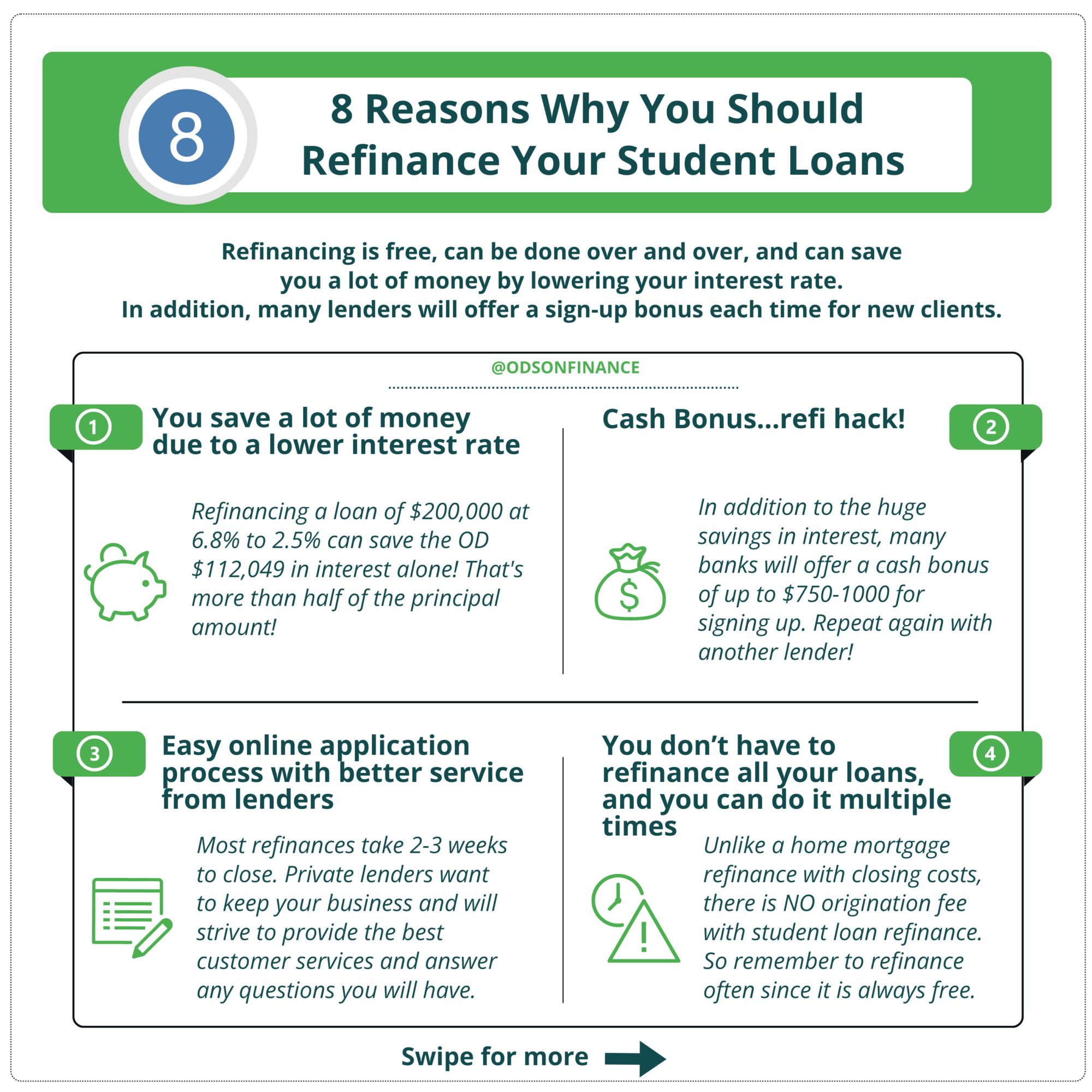

8 Reasons Why You Should Consider Refinancing Your Student Loans

(1) Significant Savings Due to Lower Interest Rates

- Interest rates can range from 2.5 percent to 4.9 percent, depending on various factors, such as the lender, term duration, and whether the interest rate is variable or fixed.

- Example: A typical optometrist might have a $200,000 loan at a 6.8 percent interest rate. By refinancing to a rate of 2.5 percent, they could save $8,600 in interest during the first year alone. Over a twenty-year term, the total interest savings could amount to $112,049—that’s more than half the principal!

(2) Cash Bonuses

- Many banks offer a cash bonus of up to $1,200 for signing up for refinancing, adding to your savings.

(3) Simple Online Application and Superior Customer Service

- Most applications can be easily submitted online, provided you have all the necessary financial documents. The entire process usually takes between 2-3 weeks. Additionally, private lenders generally offer better customer service than federal lenders, as they’re keen to retain your business.

(4) Selective Refinancing and Repeated Applications

- You don’t have to refinance all your loans; you can choose which ones to refinance based on their interest rates. Furthermore, if your credit score improves or interest rates drop, you can refinance again to get even better rates. Unlike home mortgage refinancing, student loan refinancing doesn’t come with origination fees, making it a cost-free endeavor.

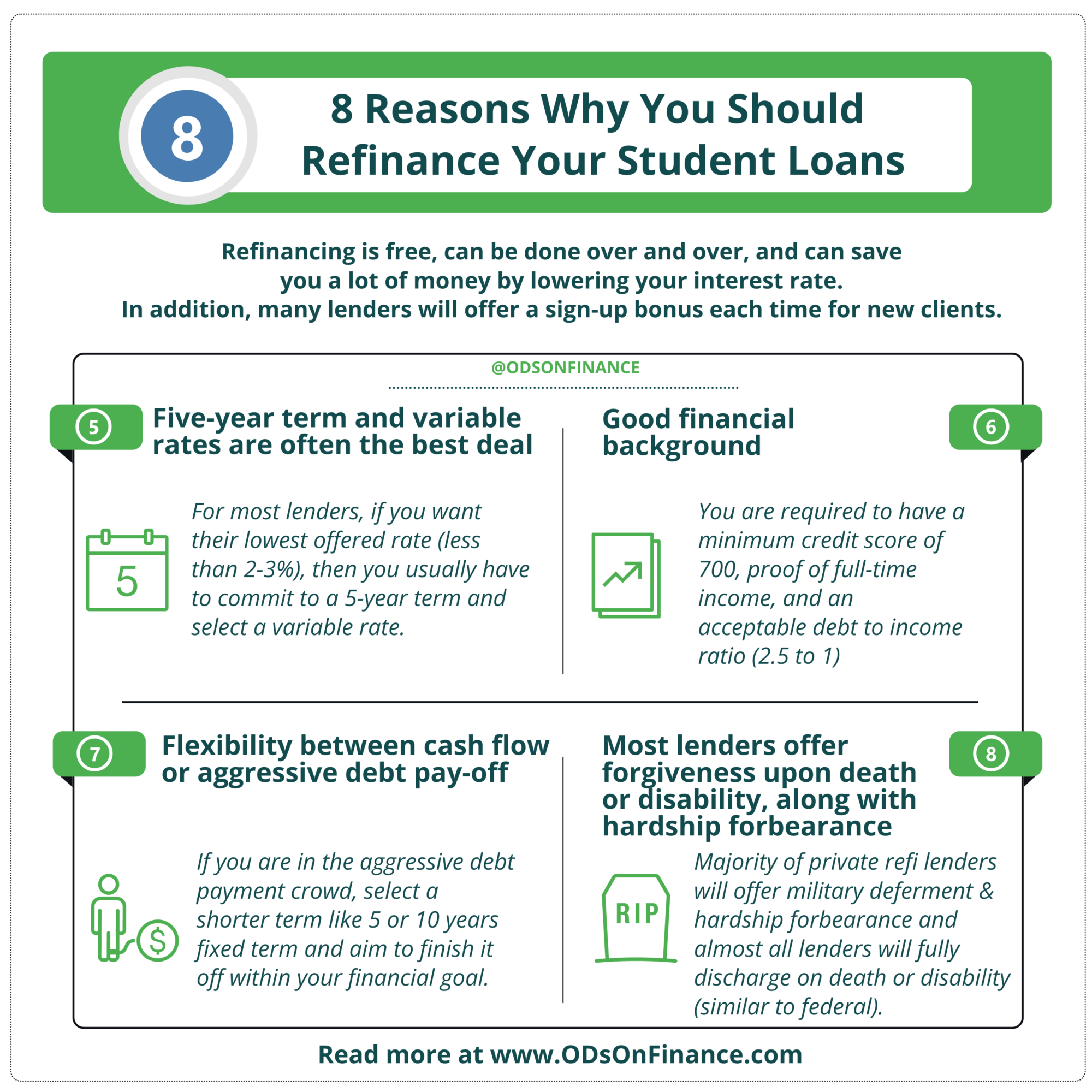

(5) Best Deals Often Involve Short Terms and Variable Rates

- For the lowest interest rates (typically between 2-3 percent), you’ll likely need to commit to a 5-year term and choose a variable rate. However, be cautious: if federal rates spike, so could your monthly payments. Most optometrists end up opting for a 10-year fixed term with a slightly higher interest rate but better monthly cash flow.

Financial Pearl

Because refinancing is free, many optometrists are “refi-hacking” multiple times by switching between lenders to capitalize on sign-up bonuses. Just remember to meet the minimum loan requirement for the cash bonus and to wait 90 days for it to be paid out.

(6) Eligibility Requirements

Private lenders usually require a minimum credit score of 700, proof of full-time income, and a reasonable debt-to-income ratio (often 2.5 to 1). These requirements can vary but will affect your eligibility and the rate you’re offered.

(7) Flexibility in Financial Planning

Refinancing offers flexibility, whether you’re looking to aggressively pay off debt or manage cash flow. Those focused on rapid debt payoff can select shorter terms, like 5 or 10 years, and aim to meet their financial goals within that time frame.

If you’re juggling multiple financial goals, such as buying a home or starting a practice, longer terms like 15 or 20 years might be more suitable. Either way, extra payments can be made without penalties.

(8) Additional Perks: Forbearance and Loan Discharge

Given the competitive market, most private refinance lenders offer military deferment, hardship forbearance, and even full loan discharge in the event of death or disability—features that bring them closer in line with federal loan offerings.

As always, it’s advisable to consult directly with potential lenders to confirm these benefits.

Click here to see a full list of Private Refi Lenders offering forgiveness | forbearance | Cosigner Release

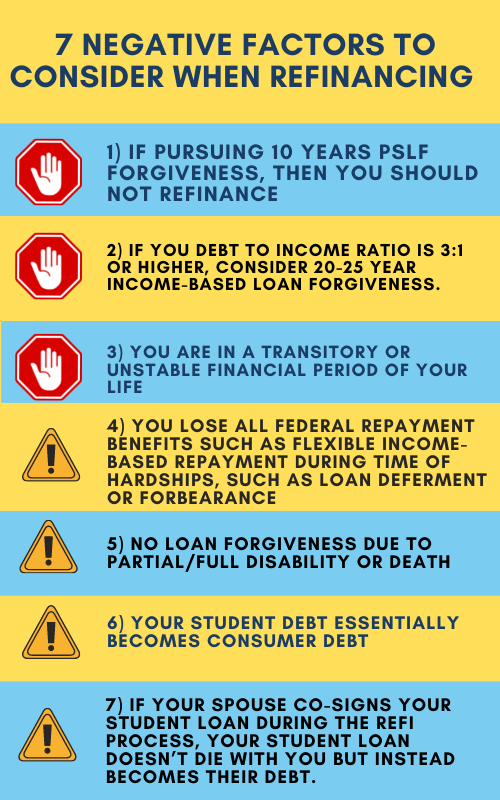

7 Negative Factors To Consider When Refinancing Your Student Loans

While we’re big advocates for using lower interest rates to aggressively pay down your student loans, we also want to make you aware of certain situations where refinancing may NOT be the best idea.

(1) Eligibility for the Ten-Year PSLF Program

If you’re an optometrist employed by a VA or non-profit and intend to stay there for ten years, you should already be in a ten-year PSLF (Public Service Loan Forgiveness) program. In that case, stick to your original plan and avoid changing course midway.

(2) High Debt-to-Income Ratio, Typically 2.5:1 or Higher

If your debt-to-income ratio is this high, think about enrolling in a twenty- to twenty-five-year income-driven federal loan forgiveness program and making income-driven payments for the time being. This is particularly important when, for example, you’re earning a salary of $100,000 but facing a debt of $300,000. In such situations, it’s tough to aggressively pay off the debt without compromising retirement investments or other financial goals. However, remember that your financial landscape may shift. As you progress in your career, your income is likely to increase and your debt to decrease.

Example: Let’s say your salary jumps to $130,000 and your debt shrinks to $270,000 after a year of payments.

This improves your debt-to-income ratio to 2:1, making it a good time to consider refinancing at a lower rate.

(3) Transitory or Unstable Financial Periods

Only consider refinancing if you have a stable, full-time job or at least five consistent days of part-time work per week. For new graduates, it’s wise to wait at least three to six months before seeking refinancing options. If you’re a current resident, your income may be too low to secure a favorable rate. For all other significant life events—such as an expected pregnancy, job loss, or transition to a new job—we highly recommend waiting until your situation stabilizes.

(4) Loss of Federal Repayment Benefits

Refinancing to a private loan means forfeiting federal benefits like hardship forbearance and loan deferment. Missing even one payment on a private loan can result in automatic default and a significant credit score drop, which is crucial to consider if you’re planning to apply for a home mortgage or business loan. However, some private lenders like SoFi and Laurel Road do offer deferment and temporary forbearance options.

(5) No Federal Forgiveness for Partial or Full Disability or Death

If you’re at high risk for disability or have a life-threatening condition, we 100 percent recommend sticking with federal loans. This is because obtaining adequate life or disability insurance may not be possible.

However, many private lenders now offer forgiveness upon death or disability. If yours doesn’t, ensure you have adequate disability and life insurance before proceeding with refinancing.

(6) Student Debt Becomes Consumer Debt

Refinanced student loans, much like credit card debt, can be fully discharged in a Chapter 7 bankruptcy. However, the downside is that lenders can claim any remaining debt from your estate value—like 401(k), IRA, or rental investments—if you pass away, potentially leaving less for your heirs.

(7) Spousal Co-Signing Risks

If your spouse co-signs during the refinancing process, the loan won’t disappear if you die; it becomes their debt. We typically don’t recommend co-signing unless both parties are fully aware of the associated risks or the financial situation is exceptionally dire. However, many private lenders do offer a co-signer release upon death, so it’s worth checking your lender’s policies. There you have it, seven potential downsides to consider when thinking about refinancing your student loans.

Financial Pearl

Considering forgiveness program? Check out our online Student Loan Payments | Forgiveness Calculators to see all your options.

For a more professional one-on-one consult, we highly recommend hiring Student Loan Expert CFP or a 90-minute consultation to do a full student loan analysis.

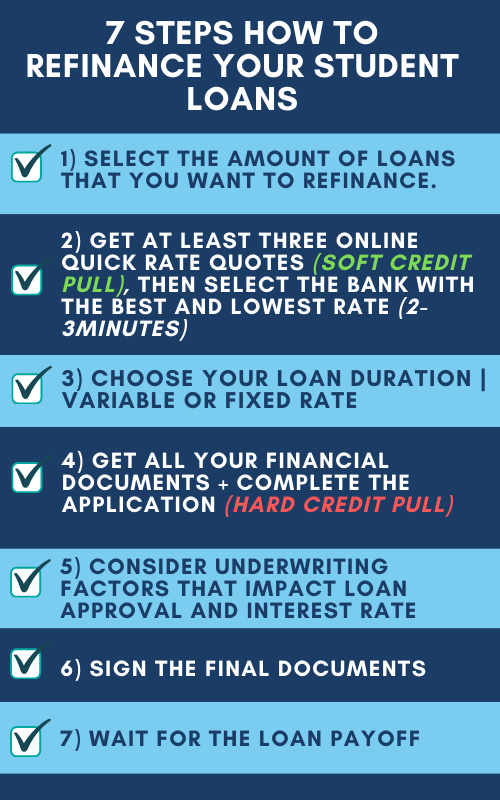

7 Steps: How to Refinance Your Loans

So you’re considering refinancing your student loans. In simple terms, you’ll need to find lenders offering lower interest rates, compare them, and then apply. Once approved, your new lender will pay off your existing loans, and you’ll begin making monthly payments to them. But let’s delve deeper into the seven steps involved in this process.

Step 1: Determine the Loan Amount to Refinance

Most doctors prefer to refinance the entire loan amount for simplicity and to consolidate payments. Plus, doing so usually comes with a bonus—around $1,000 if the loan amount exceeds $150,000.

Step 2: Obtain Quick Online Rate Quotes from Multiple Lenders (Soft Credit Pull)

At first glance, many student loan refinance lenders seem very similar. However, each has its own underwriting requirements and restrictions, which could affect your personal situation differently.

For instance, if you’re on a student visa or green card, only specific lenders like SoFi might approve you, but they’ll likely charge a higher interest rate. If your credit score is subpar (below 740), certain banks will penalize you with higher rates.

Therefore, it’s essential to get rate estimates from at least two to three lenders. This is generally a quick process, taking about two to three minutes for an online pre-approval. These estimates will give you a sense of the market rate you might qualify for from different lenders.

While you’re shopping around, some lenders might ask you to pre-qualify by providing basic information to estimate the rate you could get. Others may only show you a rate after you submit a full application, which then becomes an actual offer.

Note that a soft credit pull for pre-qualification typically doesn’t affect your credit score. However, submitting an actual application will require a hard credit check, which could temporarily lower your credit score.

Financial Pearl

We recommend starting your search with Splash and Credible, as their platforms cover about 90 percent of all refinance banks out there. After that, get at least one to two more quotes from lenders like Earnest, SoFi, or Laurel Road. This approach will give you a comprehensive view of your personal market rate across all lenders, based on your unique financial background, including credit score, debt-to-income ratio, and work history. Every month or so, we share an OD on Finance promo with our community, highlighting which lenders are currently offering the lowest rates.

Step 3: Choose Your Loan Duration and Interest Rate Type

Selecting a shorter loan duration, like five years instead of ten years, will net you a better interest rate, but your monthly payment will be much higher.

Example: On a $200,000 student loan, a five-year loan at 1.95 percent would require a monthly payment of $3,501, versus $1,894 for a ten-year loan at 2.6 percent—a significant difference.

While the allure of a lower interest rate is strong, it’s crucial to ensure that the required monthly payment fits your budget. We typically recommend starting with a safer ten-year term. You can always make extra payments with no penalty or refinance to a shorter term later if your situation changes.

A fixed rate remains constant over the life of the loan, which is ideal if you anticipate interest rates rising. A variable rate may start lower but can fluctuate based on federal rate changes. If you’re planning to pay off your loans quickly—in three to five years—a variable rate might be acceptable.

Just think of a fixed rate, as “insurance against increasing rates” and your “premium” is the higher interest rate.

Financial Pearl

If you aim for aggressive loan payoff, consider a shorter five-year fixed term to get the lowest rate and higher monthly payments. This strategy is effective if you’re willing to live frugally, like a student, for five years. On the other hand, if you have other financial goals, such as buying a home or starting a practice, a longer ten-year or fifteen-year fixed term could offer better cash flow and savings options.

For most doctors, we recommend a ten-year fixed rate as a balanced approach.

Step 4: Complete the Full Application and Gather Required Documents (Hard Credit Pull)

Even if you’re pre-qualified, you’ll still need to submit a full application to proceed. You’ll be asked for more in-depth information and supporting documents. The list often includes the following (See Right)

Finally, you’ll have to consent to a hard credit pull to confirm your interest rate. You also have the option to refinance with a co-signer, which might help you qualify for a lower rate.

Note: After you submit your application and start the underwriting process, you can lock in your new low rate for up to twenty-eight days before finalizing the loan.

Financial Documents Required

✅ Loan or payoff verification statements (can link online accounts)

✅ Bank statements (can link online accounts)

✅ Proof of employment (W-2, recent pay stubs, or two years of 1099 tax returns)

✅ Proof of residency

✅ Proof of graduation

✅ Government-issued ID

Financial Pearl

Once you submit the application (hard credit pull) and start the underwriting process, you are able to lock the new low rate for up to 28 days before signing the final loan papers.

Step 5: Consider Underwriting Factors That Impact Loan Approval and Interest Rate

Many factors can contribute to loan approval, and each bank has its own criteria. In general, your debt-to-income ratio (DTI) will decide if you get approved, while your credit score and work history will determine your interest rate.

Underwriting Factors

(1) Total student loan amount:

- Most banks prefer a lower DTI, usually 2.5 to 1 or lower. So if you’ve got $250,000 in student debt, you’ll ideally want a yearly income of $100,000 or more.

(2) Total annual income salary (including any fill-in 1099 income)

- W-2 income: A job offer letter might work if you’re a new OD graduate, but usually, a three to six month work history is preferred.

- 1099 income: If you’re self-employed, you’ll typically need a minimum of one year’s worth of 1099 tax forms, but often two years.

(3) Total Monthly Expenses + Rent.

- Living at home or renting a cheap room could boost your chances of getting approved. The fewer expenses and more income you have, the better your rate will be.

(4) Credit Score (min 700+ but ideally > 770+)

- To qualify for decent rates, aim for a credit score of 740 or higher. Lower scores will work with some lenders, but expect a significantly higher rate. A score above 775 will likely snag the best rates. You can check your score for free at CreditSesame.com or CreditKarma.com.

(5) Cash reserve

- Some lenders want to see that you have 10–20 percent of your student loan amount in your checking or retirement accounts. This requirement varies among lenders; the idea is they want to ensure you have sufficient cash flow for emergencies and can make your monthly payments. Note that this can be difficult for new graduates, so you might need to save or borrow from family to meet this requirement.

- Note: This is difficult for most new graduates, so you might need to save up for a year or borrow money from family prior to applying to get approved.

(6) Other Restrictions like location

- Certain lenders operate only in specific states, like Texas.

(7) Cosigner Option:

- If approval is challenging, a spouse or family member can co-sign your loan to improve your chances. We generally don’t recommend using a co-signer, but if you do, look for a lender that offers co-signer release.

- Most banks prefer a lower DTI, usually 2.5 to 1 or lower. So if you’ve got $250,000 in student debt, you’ll ideally want a yearly income of $100,000 or more.

Step 6: Sign the Final Documents

Once approved, you’ll need to sign the final documents to accept your loan. A three-day rescission period starts when you sign the loan’s final disclosure. You can cancel the refinance loan during this period if you change your mind.

Step 7: Wait for Loan Payoff

After the three-day rescission period, your new lender will pay off your existing loan or servicer. From then on, your payments will go to the new refinance lender. Keep paying your existing lender until you get confirmation that the process is complete. If you overpay, you’ll be refunded.

For any cash bonuses, expect them to be paid out to your account 90–120 days after your loan closes.

Summary

For the majority of ODs, refinancing to a lower rate is often the recommended path. This forces you to devise a game plan for your student loan payoff, whether that’s wiping it out within five years through aggressive payments or channeling extra cash flow toward other financial goals, like practice ownership, by securing a low-interest rate with a longer fifteen-year fixed term.

Whatever you decide to do, you have officially taken your first step toward financial freedom. Congratulations!

Want to Get the Lowest Rate? Check Out Recommended Student Refi Lenders

Want to Learn How To Manage Your Student Loan? Check out The Optometrist's Guide to Student Loan

Facebook Comments