June 2023 Market Update for Optometrists: Latest Economic & Financial Trends

KEY POINTS:

-

Feds pause the interest rate hike at their last meeting. Historically, when the Fed pauses its interest rate hikes, the stock market tends to go up by an average of 6% but during periods of high inflation, the stock market has fallen by an average of 6.5%.

-

May Job reports exceeded expectations, with the US economy adding 339,000 jobs, almost double the expected 180,000. The strong jobs data puts pressure on the Federal Reserve to raise interest rates, which could impact the economy and labor markets, leading to a recession.

-

Stock market rally was fueled by the hype surrounding AI, especially with the dominant Chip-maker NVDA which has skyrocketed more than 170%. Therefore making the US Growth Stock / Tech sector the best performer YTD at 24.48%. While SP 500 Index returns 8.74% YTD

-

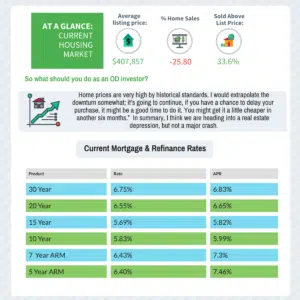

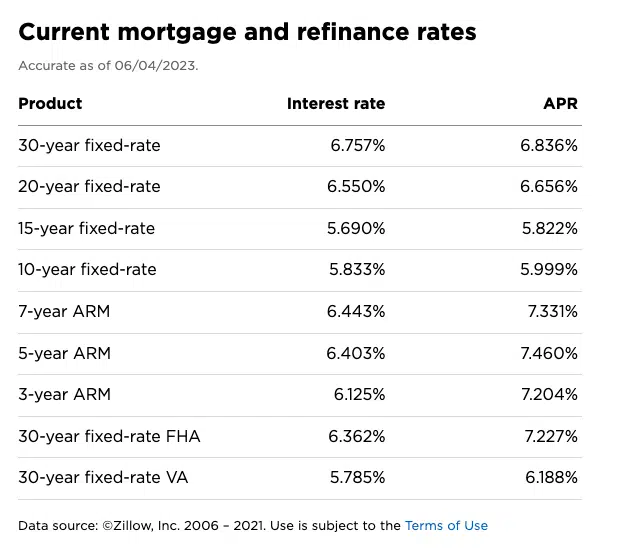

Average 30-year fixed rate is holding steady at 6.75%, with a small 4.1% reduction in home prices, far from the “predicted” housing crash.

-

As a part of his debt-ceiling compromise, all borrowers will resume their federal payments Sept 1, 2023. This will be the final deadline, as the bill includes provision that makes it illegal for Biden to further extend loan pause

-

$10,000-$20,000 Student Loan Forgiveness for eligible borrowers, The Supreme Court is expected to make a decision in late June or early July

Welcome to the June 2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans. Buckle in, this will be a long but very informative newsletter!

In recent weeks, the markets have experienced some turbulence due to the debt ceiling negotiations/ typical political drama. However, with the passage of the debt ceiling bill, we can expect a potential return to market stability.

In the latest Fed's meeting, Powell decided to pause the interest rate hike. Historically, when the Fed pauses its interest rate hikes, the stock market tends to go up by an average of 6% in the following three months. However, they also note that in certain periods of high inflation, the stock market has fallen by an average of 6.5% in the three months after a pause. We can see that the current economic landscape is characterized by high inflation, which may suggest a potential decline in the stock market.

Powell emphasizes the importance of considering the health of banks and credit flow in determining the Fed's actions. They note that tighter credit conditions from banks can have a similar effect to interest rate hikes in slowing down the economy and inflation. We can interpret this by concluding that the Fed aims to avoid triggering a deeper recession and that the decision at the upcoming FOMC meeting will depend on various factors, including credit conditions.

Now let’s head to the job report for May. The job report exceeded expectations, with the US economy adding 339,000 jobs, almost double the expected 180,000. The biggest job gains were in professional and business services, followed by government hiring, healthcare, and leisure and hospitality. However, there were some negative aspects of the report. Wage growth was low, with wages increasing by only 0.3% month over month and 3.6% annually, compared to an inflation rate of around 5%. The unemployment rate also increased from 3.4% to 3.7%, primarily due to a drop-off in self-employment. The strong jobs data puts pressure on the Federal Reserve to raise interest rates, which could impact the economy and labor markets.

The JOLTS report showed an increase in job openings and a decrease in layoffs, indicating a persistent labor shortage. While the labor market is still favorable for employees, employers are gaining more leverage. The overall situation is seen as a balancing act between economic progress and inflation.

The Federal Reserve is expected to continue raising interest rates until the numbers come down, potentially risking a recession. We are personally skeptical about the accuracy of the reports especially as elections are fast approaching, but they are acknowledged as being polished and based on calculations and surveys.

Additionally, there have been changes in housing mortgage rates, which have impacted the real estate market. This has led to both opportunities and challenges for investors and homeowners.

So we hope to provide a comprehensive overview of the latest economic trends and developments, highlighting the challenges and opportunities in today's market for optometrists.

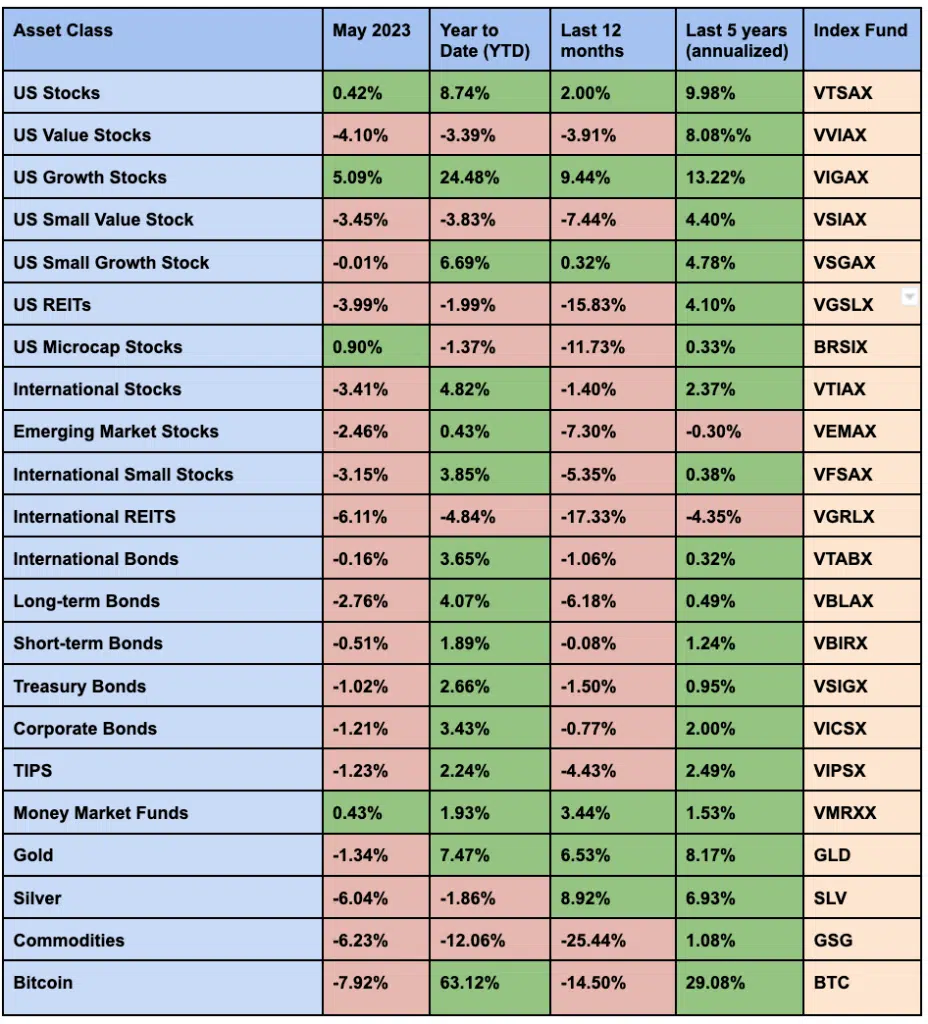

Overview of Stock Market Return

Financial Pearl

"Stock market rally was fueled by the hype surrounding AI, especially with the dominant Chip-maker NVDA which has skyrocketed more than 170%. Therefore making the US Growth Stock / Tech sector the best performer YTD at 24.48%. While SP 500 Index returns 8.74% YTD "

This month, the market rally was fueled by the hype surrounding AI (artificial intelligence , especially with the dominant Chip-maker NVDA which has skyrocketed more than 170% so far this year. Therefore making the US Growth Stock / Tech sector the best performer YTD at 24.48%.

When we reflect on the past 12 months, it paints a rather unfavorable picture for portfolios especially for the Total US Stock Index which returns a measly 2%. While savings accounts are offering high interest rates, the categories that have shown decent 12-month returns are US growth stocks and precious metals.

Notably, this month witnessed a significant gain in US growth stocks, particularly when compared to US value stocks. This trend has persisted throughout the year, underscoring the long-term importance of maintaining a diversified portfolio that encompasses both growth and value components.

Although the gains in precious metals from April were eroded in May, it's worth noting that gold and silver still exhibit positive growth over the last 12 months. They remain valuable assets in the investment landscape.

As for Bitcoin, after a period of upward movement YTD of 63.12%, May brought about a significant drop of 7.92%. The inherent volatility of cryptocurrencies continues to present challenges and requires careful consideration for investors.

So what should you do as an OD investor?

As optometrist investors, it's essential to stay informed, adapt to market dynamics, and approach investments with a discerning eye. Diversification remains crucial, incorporating both growth and value elements within your portfolio. Exercise caution when navigating the cryptocurrency market, recognizing its inherent volatility.

Dollar-cost averaging into low cost & broad-market index funds like the S&P 500 for long-term investments such as retirement is and will always be a sound strategy. It helps to reduce the impact of short-term market volatility by spreading your investments over time. The S&P 500 has historically provided an average annual return of around 10%, although it's important to note that past performance is not indicative of future results.

Your decision to take a break from individual stocks and hold cash reserves is a personal choice based on your assessment of the market. It's wise to have some cash on hand for potential buying opportunities, especially if you believe there may be favorable conditions in the market after the current cycle.

Looking back at the 2008-2009 financial crisis, it's true that there were significant opportunities for investors who had the cash reserves to take advantage of the market downturn. However, it's important to remember that timing the market perfectly is extremely challenging, and even seasoned investors often struggle to do so consistently.

If you have a long-term investment horizon and a well-diversified portfolio, staying invested in the market through ups and downs is generally recommended. Market timing can be risky, as you run the risk of missing out on potential gains if the market continues to rise.

Financial Pearl

"If you have a long-term investment horizon and a well-diversified portfolio, staying invested in the market through ups and downs is generally recommended. Market timing can be risky, as you run the risk of missing out on potential gains if the market continues to rise."

Overview of Real Estate Market

I will start by saying that every housing market is different, your local area might see a massive spike in pricing inventory while other areas like the Bay Area are seeing a decline. I know there is a lot of gloom and doom of the housing market crashing, but the actual data suggests far from that.

But overall, compared to May 2022 year over year, the median sale price is $407,857 (4.1% decrease), with a -25.8% decline in overall home sales. From its peak, the average home pricing is only down 5%, far from a “housing crash” expectations..

As you can see, the national average 30-year fixed rate is holding steady at 6.75%, but just 2 weeks ago, mortgage rates were closer to 7%. Remember that we have to take seasonality into consideration as we approach summer time, which is usually a peak traffic month.

As of now, we have to remind our members that home pricing is NOT crashing because there is a little more supply coming into the market (it has essentially been zero year after year), so the number of houses for sale is still extremely low. Most importantly, the higher interest rates are pricing out a lot of potential buyers, but there is still consistent demand in the real estate market. According to the latest statistics, 95% of homeowners have a mortgage rate of under 5%, some have as low as 3%, so they are “locked in”, which means they are not likely to sell their home, and risk trading their mortgage for the current 6-7% rate. This translates to less houses on the market.

Financial Pearl

"I know there is a lot of gloom and doom of the housing market crashing, but the actual data suggests far from that. From its peak, the average home pricing is only down 5%, far from a “housing crash” expectations...Home prices are very high by historical standards. I would extrapolate the downturn somewhat; it’s going to continue, if you have a chance to delay your purchase, it might be a good time to do it. You might get it a little cheaper in another six months.”

The good news is that only 33.6% of homes are being sold above list price, so don’t feel bad if you are trying to buy a house and you are bidding above list price. Just make sure you check your comps.

So if you are selling your house, lower your expectations and don’t expect buyers to cater to unreasonable demands.

For home buyers, the Feds predict that the recession will begin later on this year, so one can argue that higher unemployment might drive down housing prices. In addition around Q4/2023, mortgage rates are expected to “stabilize” which will allow more home buyers to purchase.

Again, as Yale economist Robert Shiller would say, “Home prices are very high by historical standards. I would extrapolate the downturn somewhat; it’s going to continue, if you have a chance to delay your purchase, it might be a good time to do it. You might get it a little cheaper in another six months.” This makes sense as the economy weakens, unemployment goes up, thus, less people will be able to afford a home purchase. Remember to ask for contingencies and negotiate for credits to lower the price!

In summary, I think we are heading into a real estate depression, but not a major crash.

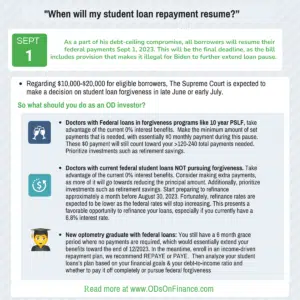

Overview of Student Loan Market

After 3 long years, it looks like the student loan forbearance is finally coming to an end as borrowers prepare to resume their federal payments Sept 1,2023.

President Biden has engaged in negotiations with the GOP Speaker of the House to address the debt ceiling issue. Their collaborative efforts have resulted in a bill that is expected to pass the Senate and be signed into law. As part of this compromise, the student loan pause will be lifted by the end of August.

This means that federal student loan interest will resume around August 31. As an optometrist with student loans, it's important to anticipate that your first loan payment will likely be due approximately one month later, around September 30, 2023.

It's worth noting that the bill being passed includes provisions that make it illegal for President Biden to further extend the loan pause, even if his plans for loan cancellation face challenges in the Supreme Court. Consequently, it is highly likely that loan payments will FINALLY resume in September, and you should be prepared for automatic debits from your bank account.

Now, you may be wondering why President Biden chose to compromise on this matter. Firstly, he sought to protect his new Income-Driven Repayment (IDR) plan. Although the final regulations for this plan have been submitted to the Budget Office, they have not been made public yet. It is crucial to closely monitor these regulations to see if Biden maintains his original plan or makes adjustments in light of potential setbacks with loan cancellation.

Furthermore, Biden has ensured that the power to pause loans in the future during emergencies is retained. This will provide a safety net in case of unforeseen circumstances. Additionally, the changes made through the IDR and Public Service Loan Forgiveness (PSLF) waivers have been safeguarded. Given the ongoing legal challenges against the loan pause, it was likely that further extensions would have been invalidated by the courts. By reaching a compromise, Biden may have sacrificed an additional 2 to 3 months of paused loans in exchange for protecting the new IDR plan and preserving the changes made through the waiver programs.

Lastly, Student loan forgiveness was proposed by President Biden in a 2022 executive action, aiming to forgive $10,000-$20,000 for eligible borrowers. However, the executive order is currently under scrutiny and awaits a significant ruling from the Supreme Court. The court is expected to make a decision on student loan forgiveness in late June or early July. If the ruling favors forgiveness, payments will resume within 60 days after that date, potentially expediting payments if the ruling occurs before June 30, 2023.

Financial Pearl

"As a part of his debt-ceiling compromise, all borrowers will resume their federal payments Sept 1, 2023. This will be the final deadline, as the bill includes provision that makes it illegal for Biden to further extend loan pause!"

As an optometrist, here's our advice for you:

- Doctors with federal loans, who are enrolled in forgiveness programs like the 10-year Public Service Loan Forgiveness (PSLF):

- Take advantage of the current 0% interest benefits. Make the minimum amount of set payments that is needed, with essentially $0 monthly payment during this pause. These $0 payment will still count toward your >120-240 total payments needed. Prioritize investments such as retirement savings.

- Take advantage of the current 0% interest benefits. Make the minimum amount of set payments that is needed, with essentially $0 monthly payment during this pause. These $0 payment will still count toward your >120-240 total payments needed. Prioritize investments such as retirement savings.

- Doctors with federal student loans but are NOT pursuing forgiveness

- Take advantage of the current 0% interest benefits. Consider making extra payments, as more of it will go towards reducing the principal amount. Additionally, prioritize investments such as retirement savings.

- Start preparing to refinance approximately a month before August 30, 2023. Fortunately, refinance rates are expected to be lower as the federal rates will stop increasing. This presents a favorable opportunity to refinance your loans, especially if you currently have a 6.8% interest rate.

- New optometry graduate with federal loans:

- You still have a 6 month grace period where no payments are required, which would essentially extend your benefits toward the end of 12/2023. In the meantime, enroll in an income-driven repayment plan, we recommend REPAYE or PAYE. Then analyze your student loans’s plan based on your financial goals & your debt-to-income ratio and whether to pay it off completely or pursue federal forgiveness

Keep in mind that after the pause on federal loans is lifted, there may be a surge in demand for refinancing, leading bank lenders will become more selective in their underwriting approval process. This could result in stricter criteria such as lower debt-to-income ratios, higher credit scores, and more work experience requirements. It may also lead to increased overall interest rates.

Summary:

In conclusion, as optometrist investors, it's important to stay informed and adapt to the ever-changing market dynamics. Diversification remains crucial, incorporating both growth and value elements within your portfolio. Exercise caution when navigating the cryptocurrency market due to its inherent volatility. Dollar-cost averaging into S&P 500 index funds for long-term investments is a sound strategy to reduce the impact of short-term market volatility. In the real estate market, while there may be some changes and challenges, it is not expected to experience a major crash.

For student loan borrowers, the student loan forbearance is coming to an end, and it's important to prepare for the resumption of loan payments. Consider taking advantage of the current 0% interest benefits and evaluate your options for refinancing or pursuing loan forgiveness based on your individual circumstances.

As always, make informed decisions based on your financial goals and risk tolerance. Cheers to financial freedom!

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get the Lowest Student Refi Rates? Compare & Shop Recommended Student Loans Refi

Facebook Comments