Prescription for Financial Health: 5 Steps for Achieving Budgeting Success

KEY POINTS:

-

Embrace the Power of Budgeting: Track everything—every cup of coffee, every gym class, and even those mid-week DoorDash orders. Follow the 50/30/20 rule!

-

Define Short-Term Savings Goals: Do you want to boost your savings account, build up an emergency fund, plan a vacation for next year, or pay off some debt?

-

Trim Expenses and Optimize Debt Management: With your goals in mind, outline actionable and realistic steps to cut back on expenses. For instance, if your monthly restaurant bill totals $500, aim to trim it by 10%.

-

Take Action and Maintain Consistency: Now comes the challenging part—taking action and making a change! Choose specific expenses and make changes that you will stick to.

-

Regularly Reevaluate and Adjust: See if there's room to cut costs even further and accelerate your road to financial freedom. It's all about staying flexible and fine-tuning your approach along the way.

My name is Julie Phan, and I have a confession to make. As the admin of a finance group, I've got a little secret—I’ve never tracked my expenses. Yep, you heard it right! I have a general idea of my expenses, but I haven't been actively tracking them like we recommend to our members on their journey towards financial independence. But recently, a hot post caught my attention. It was about living comfortably on a household income of $100,000. That got people talking, including my husband Toan Nguyen, who made a remark about how making $100K in So-Cal would probably only last us three months.

Well, that got me curious. I decided to take a deep dive into our actual expenses for our family of four in Southern California and see if his statement held any truth. And now, I'm here to spill the beans and share what I’ve discovered!

Our Simple Life and Surprising Expenses:

My husband and I like to think of ourselves as simple people. We're not into fancy designer things; instead, we value experiences and spending quality time with our two boys around beautiful SoCal. Family outings are a must for us. However, when I analyzed our bank accounts, I was genuinely taken aback by the amount of money leaving them each month. It's time for us to sit down and figure out where we can trim some fat, so to speak. Who knew those seemingly insignificant expenses could add up so quickly?

A Challenge for the Non-Trackers:

Now, for those of you who are like me and don't track every penny, here's a little challenge. Take a deep dive into your last month's expenses and see if there's potential to save a few bucks. Trust me, you might be surprised by what you find! If you're comfortable enough, feel free to share your findings in the comments below. Let's learn from each other and support one another on this financial adventure!

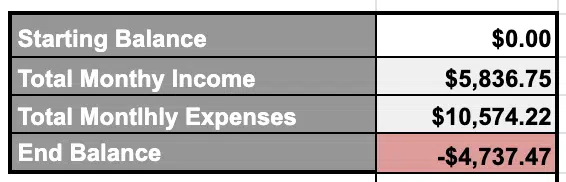

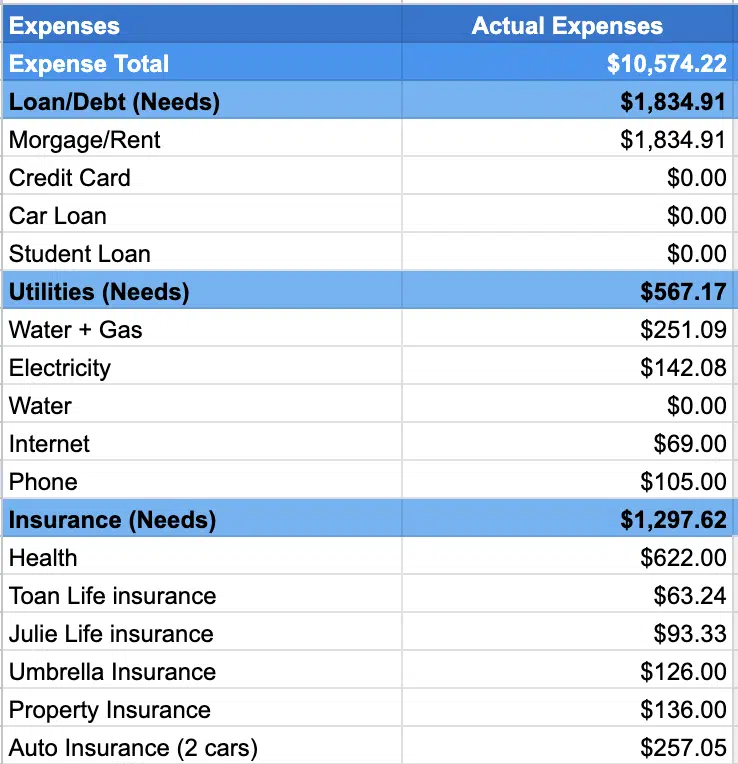

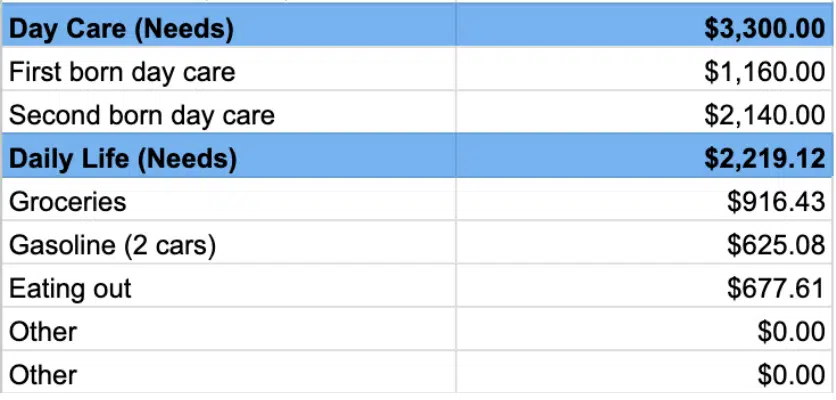

To kick things off, I'll lead by example. Here's a breakdown of all my expenses for the month of June. Note that I did not include any savings for simplicity. Take a look and let's find those areas where we can trim some fat.

Before we dive into some steps for budgeting success, I want to take a moment to share some noteworthy expenses I've come across in my own financial discovery.

- Brace yourself, because as you may already know, children can be quite expensive. In fact, childcare makes up a significant portion, accounting for over 31% of our expenses. We adore our kids, and while this expense will continue until they start public school (which is just around the corner, one year for our older child and three years for our younger one), the good news is that it will free up an extra $3,300 in our pockets every month!

- Now, let's talk about dining out. While we don't eat out often, we do occasionally indulge in takeout, especially when there's a tempting coupon code on DoorDash or Uber Eats. Who can resist a $25 off $25 coupon? It's the perfect opportunity to order some Chinese or sushi at a slight discount. Admittedly, we find ourselves giving in to this temptation once or twice a week, but we recognize that there's definitely room to cut back.

- Ah, the gym membership. $50 a month doesn’t seem like a lot, but the $10 a month at Planet Fitness yields the same result right?

As we carefully analyze our yearly expenses, amounting to just over $125,000, it becomes clear that sustaining a family of four solely on a $100,000 salary is simply not enough, especially in the high-cost landscape of California. In fact, when we consider the hypothetical take-home pay of $70,000, it leaves no room for saving or establishing emergency funds. This stark reality emphasizes the need for ODs, especially those residing in high-cost areas and with young children, to explore strategies for increasing their household income.

While this article focuses on expenses and budgeting, we will delve into income growth strategies in a separate piece to provide a comprehensive financial roadmap for our fellow ODs.

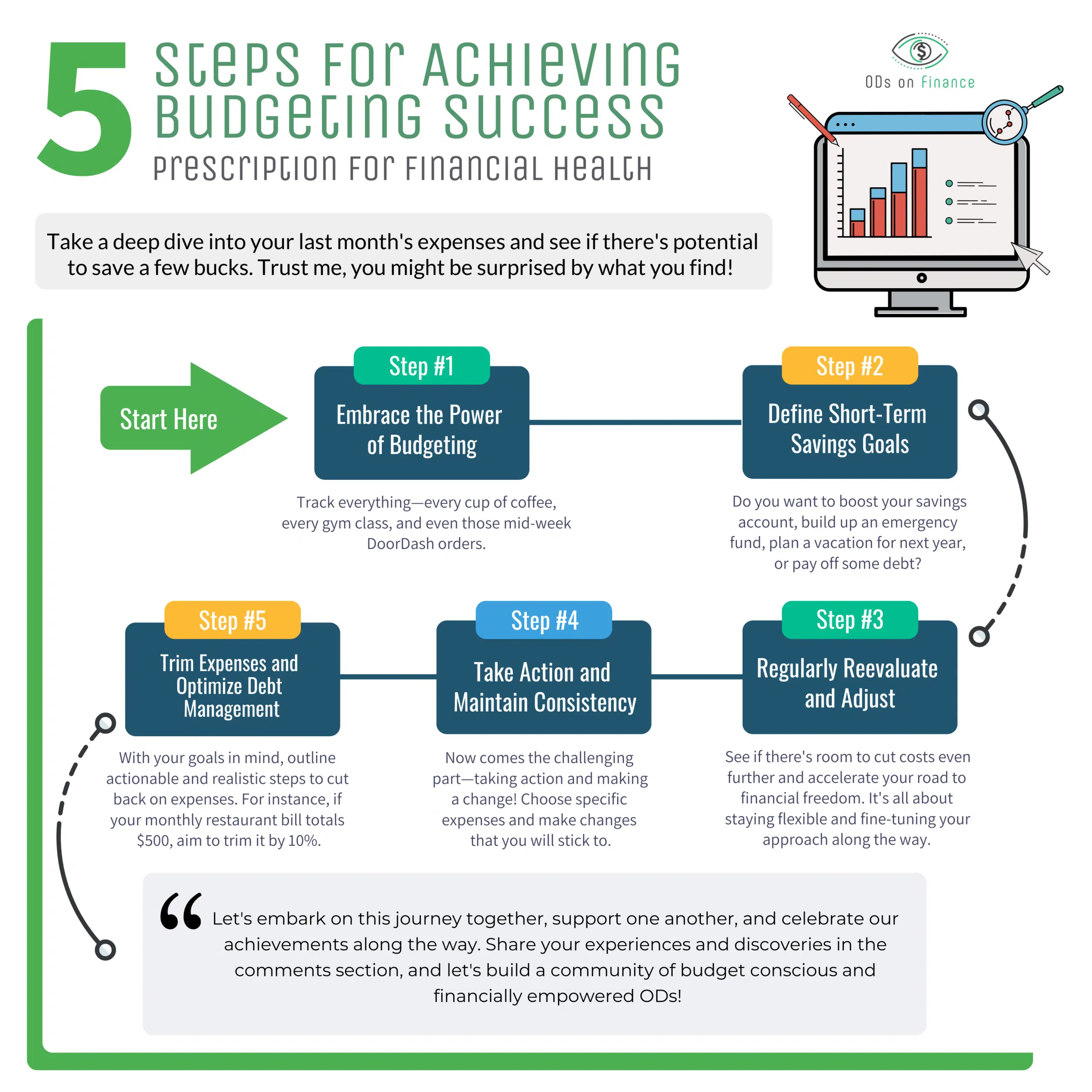

With these insights in mind, let's move forward and explore the 5 steps for achieving budgeting success!

Financial Pearl

"You cannot know how much to invest or pay off debt, unless you know what your monthly expenses are and what your budget is. Be conscious with your spending and only spend on things (or people) that really matter to you. If you hate budgeting, do a reverse-budget where you allocate all funds FIRST into your required bills such as rent, student loan debt, retirement and/or short term investing goals, then spend whatever is left over, GUILT-FREE"

Step 1: Embrace the Power of Budgeting

If you're uncertain about where your money is really going, it's time to buckle up and get detailed. Track everything—every cup of coffee, every gym class, and even those mid-week DoorDash orders. Add it all up! I was completely blown away by the final amount, but it was a necessary first step towards taking control of my finances. Many financial advisors recommend spending no more than 10%-15% of your take home pay on food alone! A simple rule to follow is allow 50% of your take home pay for needs, 30% for wants and 20% for savings and debt repayment.

Step 2: Define Short-Term Savings Goals

Now that you have a clearer understanding of your financial situation, it's time to set some goals. What changes would you like to make? Do you want to boost your savings account, build up an emergency fund, plan a vacation for next year, or pay off some debt? Choose one or two short-term goals to give purpose to your financial changes.

Step 3: Trim Expenses and Optimize Debt Management

With your goals in mind, outline actionable and realistic steps to cut back on expenses. For instance, if your monthly restaurant bill totals $500, aim to trim it by 10%. In my case, my family will focus on reducing our bi-weekly DoorDash orders and eating out a little less frequently. Remember, it's all about making sustainable changes rather than drastic ones.

Step 4: Take Action and Maintain Consistency

Now comes the challenging part—taking action and making a change! Personally, I love treating myself to boba a few times a month and enjoying spontaneous weekend getaways to Palm Springs by the pool. But to trim my expenses, I have to get creative and be disciplined. I might try making a healthy homemade protein shake (just ordered in my taro flavor protein powder!) and taking the kids to the beach instead (we live in SoCal—time to hit the ocean!).

Step 5: Regularly Reevaluate and Adjust

After a month of implementing changes, take the time to evaluate the progress you've made. See if there's room to cut costs even further or put away more for savings and accelerate your road to financial freedom. It's all about staying flexible and fine-tuning your approach along the way.

Financial Pearl

" A simple rule to follow is allow 50% of your take home pay for needs, 30% for wants and 20% for savings and debt repayment."

Summary

Through this eye-opening journey, I have come to realize that my husband's remark about living (un)comfortably on a $100k income in SoCal holds quite a bit of truth for our family. Contrary to the perception that a six-figure income guarantees an easy life, we have discovered that our current living expenses require a bit more thoughtful planning. However, this realization has motivated us to take proactive steps in managing and tracking our expenses to embrace a more intentional approach to our finances. By doing so, we are confident that we can create a more secure future for our family.

Need a budgeting tool? Here is a simple editable excel sheet for you to plug in your monthly income and expenses and to help you kickstart your budgeting journey! (Don’t forget about the 50/30/20 rule!) Remember that the first step is to track everything! Secondly, join us for this weekend’s first ever Financial Summit for ODs. It's an incredible opportunity to learn about other important financial tools that will set you up for success. Lastly, let's embark on this journey together, support one another, and celebrate our achievements along the way.

Share your experiences and discoveries in the comments section, and let's build a community of budget conscious and financially empowered ODs!

Want to learn to how to pay off your student loans in 5 years? Check out 10 Practice Tips On How To Pay Off $221K Student Loans

Want to get the LOWEST RATES/BEST PROMO? Check out Recommended Student Refi Lenders

Facebook Comments