UPDATE: Must-Read Strategies to Tackle Optometry Student Debt

KEY POINTS:

-

6 Typical Scenarios for Optometrists: Presents common debt and income scenarios among optometrists including the typical optometrist, financially-motivated OD with large debt, mathematically challenged OD, the federal total forgiveness OD, the slacker YOLO OD, and the 10-year PSLF OD.

-

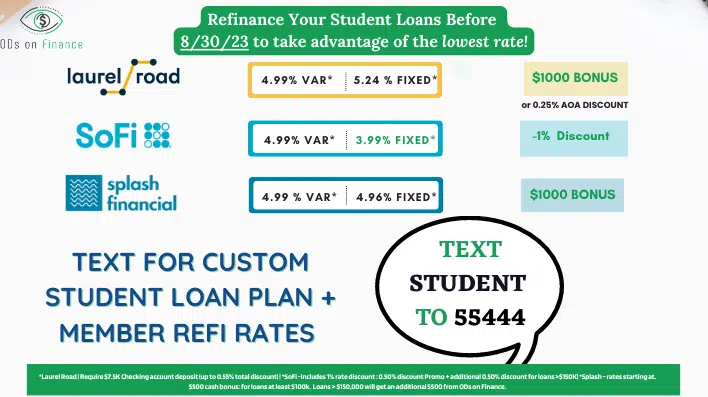

The State of Student Refinancing: Provides recommendations on loan refinancing based on the debt amount and offers a guide on securing the best rates/promotions from different lenders.

-

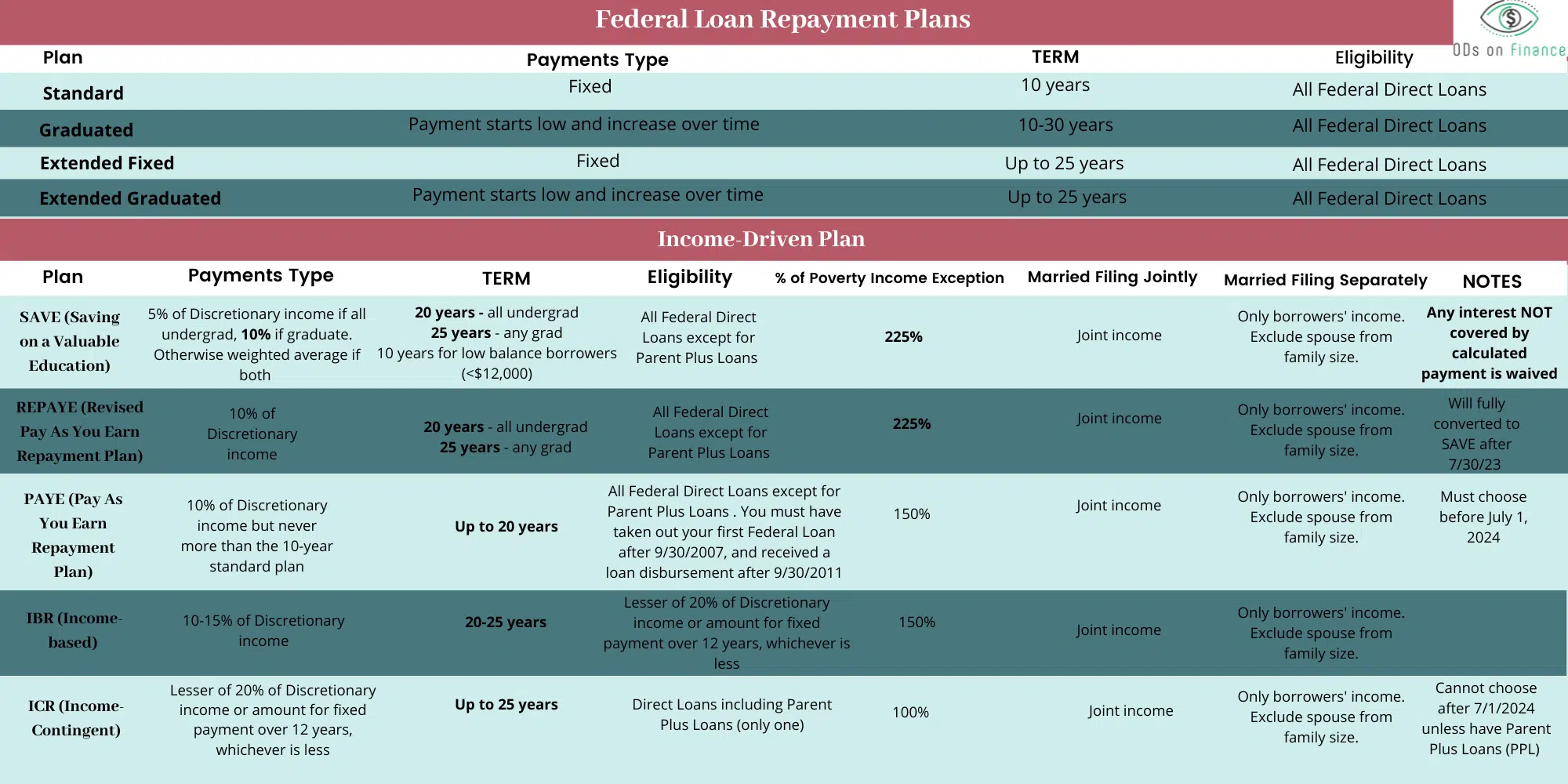

The New Federal Payment Plan (SAVE): Introduces the upcoming SAVE Plan replacing the REPAYE Plan, discussing its benefits, such as increased income exemption and the elimination of remaining interest after scheduled payments.

-

Inspirational OD Student Loan Pay-Off Stories: Shares inspiring stories of optometrists who successfully paid off their student loans, demonstrating that it's possible to conquer student debt with determination and strategic planning.

After an enduring three-year period, the final COVID-19 student loan forbearance is drawing to a close on August 30, 2023. Recognizing the natural apprehension that some optometrists might be feeling as this date nears, our team has been working tirelessly to develop strategies to support all our borrowers, especially new graduates stepping into the workforce!

From years of interacting with optometrists, I've come to understand that there are 8 critical questions that an optometrist must candidly answer. Here's the mental exercise:

✅ (1) Graduation year

Determine how far along you are on your financial journey

✅ (2) Current gross annual OD salary + earning potential over the next 5 years

For instance, raises or becoming a practice owner

✅ (3) Total federal loans amount with an interest range (e.g., 4.5% to 6.8%)

If the debt is large, then federal forgiveness should be considered

✅ (4) Total Private Loans with interest range (e.g., 5.5% to 10%)

If rate is high, consider refinancing all private loans to lower rate

✅ (5) Credit score along with any significant debts like credit cards or home loans

✅ (6) If you're working for a non-profit like VA/IHS/Academic/Kaiser to be considered for 10 years Public Service Loan Forgiveness (PSLF)

✅ (7) Any special financial circumstances such as past major bankruptcy, disability, part-time work, etc.?

✅ (8) Are you motivated to aggressively pay off your loans within 5-10 years to achieve financial freedom? Or more interested in the 20-25-year total income-based Federal Forgiveness?

These eight questions are significant because they help determine your attitude toward debt, your motivation to put in extra working days, highlight poor spending habits needing correction, and lastly, identify if your debt to income (DTI) ratio mathematically does not make sense, prompting consideration for federal forgiveness.

6 Financial Student Loan Profiles of Optometrists

Here are six typical scenarios I've seen among many optometrists:

✅ (1) The Typical Optometrist:

The majority of doctors fall into this category. They're usually new graduates earning a starting salary of $125,000 with a student loan debt of less than $250,000. This indicates a DTI ratio of around 2:1, making it mathematically feasible and safe for them to aggressively pay off their student loans within 5-7 years while saving for retirement and other financial goals. They usually add an extra workday to bring in an additional $25,000 to their annual income. Refinancing their high 6.8% federal interest rate to a fixed 5-year rate of 4% is a no-brainer for them, and with a disciplined mindset and frugal lifestyle, they typically finish paying off their loans in 3-5 years.

✅ (2) The Financially-Motivated OD with a Large Debt Loan:

With rising tuition costs, I see more new graduates in this situation. These doctors usually have a $125,000 salary with a student loan debt of around $300,000, meaning their DTI is approximately 2.5:1. At this point, a doctor must decide whether to refinance with the goal of paying off the debt within 10 years, or consider total federal forgiveness. A DTI of 2.5:1 is the tipping point where you can mathematically pay off your student loans and invest for retirement, but it requires substantial effort. Typically, these ODs refinance their high-interest federal loans to a lower 10-year fixed term (around 5%) for extra monthly cash flow while gradually decreasing the principal. These ODs are motivated to take control of their financial destiny and work extra hard for 5-7 years to eradicate their student debt.

✅ (3) The Mathematically Challenged OD:

A small number of ODs find themselves in this difficult situation. These are the ODs with a debt load of $300,000 to $350,000 who see no significant growth in their salary, typically remaining below $120,000. This means their DTI ratio is closer to 3:1, making it mathematically impossible for them to pay off their debt within 10-15 years while saving for retirement. They're living frugally, surviving on bare essentials. Unless there's a drastic change, like adding an extra workday, securing a yearly raise, moving to a rural area, or working in a high-paying corporate job, we recommend considering the 20-25-year total forgiveness via the SAVE payment plan.

Financial Pearl

"There are always exception to the rule, and I was one of the Mathematically Challenged OD. As a new grad in 2015, I was earning $85,000 with a $225,000 debt loan. Determined not to be saddled with student debt for 20+ years, I picked up as many fill-in jobs as possible, gradually increasing my annual salary from $85,000 (Year 1) to $175,000 (Year 4). By living below my means, I managed to pay off my loan within 4.5 years while saving a significant amount for retirement and a down payment on a house. I, along with many of our ODoF members, am living proof that it's possible with the right mindset and hard work."

✅ (4) The Federal 20-25 Years Total Forgiveness OD:

A few ODs find themselves in this situation where federal forgiveness is the best path. The reasons vary – perhaps their salary is stuck at $100,000, they may need to work part-time to care for their family, or they don't foresee their income rising substantially year after year (though rare). Alternatively, their debt load may be too high to meet other financial obligations like caring for children or buying a house. Or, they might have a permanent disability that could prevent them from continuing to work as an OD, making it safer to stay in the federal program. Regardless of the reason, it's crucial to be educated and mentally prepared to commit to this path because 20-25 years is a long time. The worst thing one can do is change their mind five years in. Start saving for that massive tax bill at the end of the 20-25 years in a separate brokerage account.

We recommend hiring a flat-fee student loan expert like Patrick Logue & Evon Mendrin for a financial plan to walk you through the federal forgiveness program.

✅ (5) The Slacker YOLO OD:

This is probably the most challenging category we deal with. These are the ODs that start with relatively little student debt but lack the motivation to work hard to increase their annual salary. Most work four days a week or even part-time as new graduates. They could easily pay off their student loan within five years but prefer not to work more. Worse still, they shun the wealth-building lifestyle, opting for lavish vacations and reckless spending, living paycheck to paycheck and embodying the YOLO (You Only Live Once) philosophy. If you identify with this category, that's okay, just be honest with yourself! Without the necessary work ethic, the 20-25 years total federal forgiveness path is likely the way to go. As with the previous category, start saving for that massive tax bill at the end of the 20-25 years in a separate brokerage account.

We recommend hiring a flat-fee student loan expert like Patrick Logue & Evon Mendrin for a financial plan to walk you through the federal forgiveness program.

✅ (6) The 10-Year PSLF OD:

This is the fortunate optometrist who has managed to secure a position at a VA, IHS, academic institution, non-profit, or even Kaiser! As long as they work at least 30 hours a week and are enrolled in an income-based payment plan (we recommend SAVE), their entire debt will be forgiven within 10 years, entirely tax-free.

Once you've identified which scenario applies to you, let's delve into some features and updates on student loans!

The State of Student Refinancing

If you're not planning to go for any of the federal forgiveness options, then we highly recommend that you refinance your high-interest 6.8% federal loan to a lower interest rate. Here are some insights we've negotiated for our community:

- ⚠️ If your loan debt is less than $150,000, consider a 5-year fixed term to take advantage of the lowest interest rates (3.99% to 4.5%) because you'll likely pay it off within five years.

- ⚠️ If your loan debt is between $150,000 and $200,000, consider a 7 or 10-year fixed term loan. These are usually 0.25% to 0.50% higher but allow for better monthly cash flow.

- ⚠️ If your loan debt is between $200,000 and $250,000, consider a 10-year fixed term loan to play it safe. Remember, you can always pay extra without incurring any prepayment penalties.

The Federal Reserve recently announced a 0.25% rate increase to combat growing inflation and plans to meet two more times in 2023, where they'll likely either increase or maintain the rate in preparation for a possible recession. Therefore, the rate you secure today is likely to be lower than what you could get next month.

Financial Pearl

"Here is an insider tip! you can get an instant quote (in just 2 minutes) and lock in that rate for 30 days with no obligations. It's standard practice for student refinance lenders to send us their updated monthly rates at the beginning of each month. So, make sure to get a quote before August 1!"

Here are the best rates/promotions we've negotiated exclusively for our ODoF community:

🏦 SoFi offers the lowest rates, with a 1% ODoF discount.

- This used to be reserved only for MDs and DDSs, but we've managed to include ODs in their underwriting process. Min Loan size >$150K, otherwise 0.50% discount

- If you're looking for a longer term, like 7 or 10 years, Splash will likely offer the lowest rates. This is due to their wide range of local credit unions that keep your loan in-house.

🏦 Laurel Road ($1000 Cash Promo):

- This is probably the most flexible and well-known refi lender. While their rates aren't the lowest, if you sign up for their checking account, you can get up to a 0.55% additional discount. I recommend them if you're planning to have a cosigner, as they offer cosigner release if anything happens to you.

I suggest obtaining quotes from all three lenders and comparing them to secure the lowest market rate. Feel free to screenshot the quotes and email them back to us admin@odsonfinance.com if you need assistance.

👉 Want more help? Check out OD’s Guide to Student Refinancing

👉 Want to compare all the Student Refi Lenders? Check out the Lowest Rates

The New Federal Payment Plan (SAVE) as the Recommended Federal Payment Plan

The "Saving on a Valuable Education" (SAVE) Plan will replace the existing "Revised Pay As You Earn" (REPAYE) Plan after July 30, 2023. Borrowers on the REPAYE Plan will automatically benefit from the new SAVE Plan. Here are some key points explaining why SAVE should be your primary choice if you are enrolled in a forgiveness program:

✅ The SAVE Plan increases the income exemption from 150% to 225% of the poverty line.

- Essentially, this new plan can significantly decrease your monthly payment amount compared to all other income-driven repayment plans.

✅ The plan eliminates 100% of remaining interest for both subsidized and unsubsidized loans after a scheduled payment is made under the SAVE Plan.

- Therefore, if you make your monthly payment, your loan balance won't grow due to unpaid interest. For instance, if $50 in interest accumulates each month and you make a $30 payment, the remaining $20 would not be added to your balance.

✅ The SAVE Plan excludes spousal income for borrowers who are married and file separately.

- This change eliminates the need for your spouse to cosign your IDR application.

In summary, we recommend enrolling in the SAVE payment plan as a new graduate while you figure out your financial student plan. For those pursuing the 10-year PSLF or Total Federal Forgiveness program, this is an excellent and improved payment option to reduce your overall debt payment.

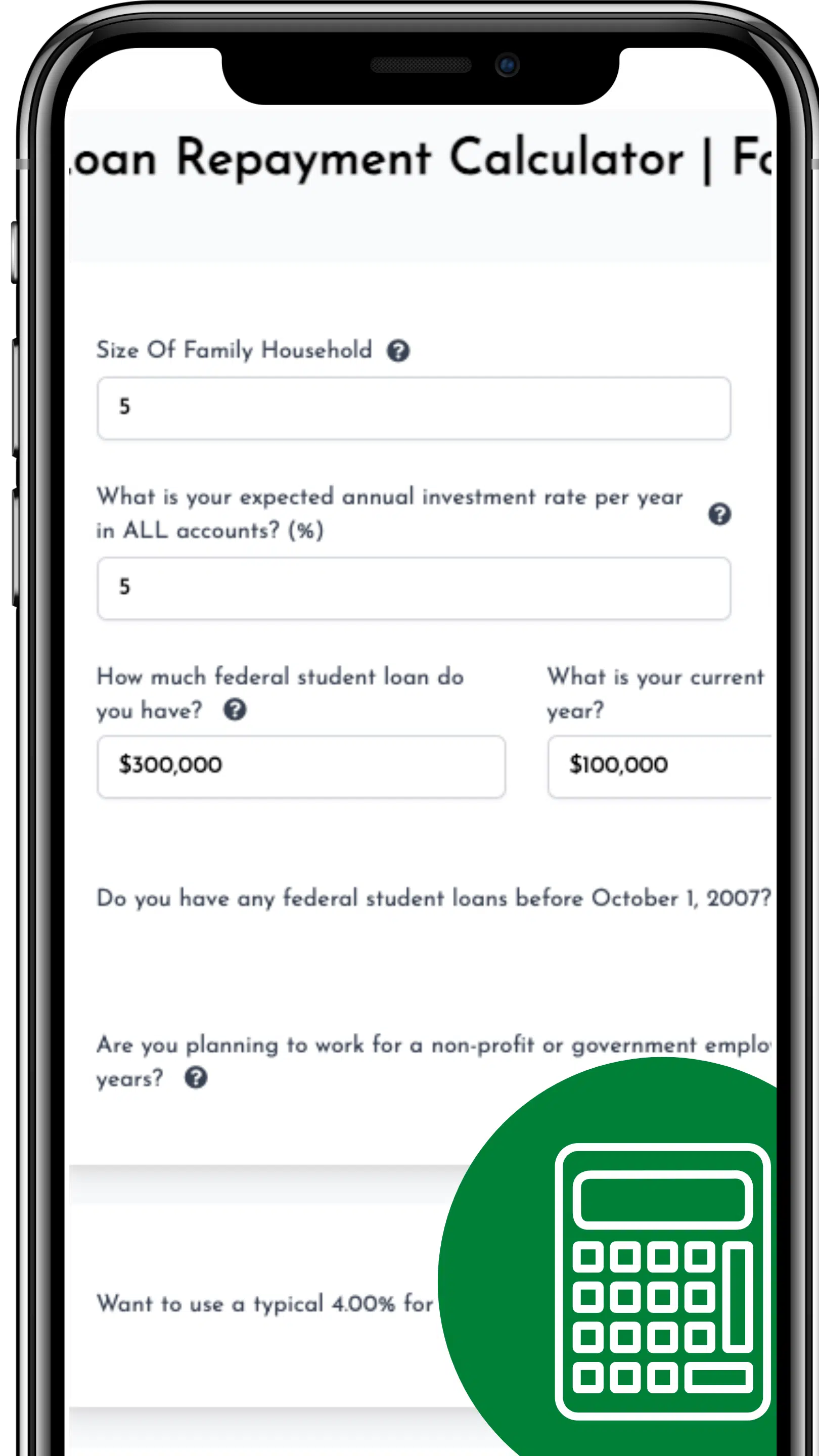

The Ultimate Student Loan Payment | Forgiveness Calculator

We spent nearly 3 months developing this comprehensive, OD-focused repayment calculator. With some personal information, the calculator can compare all federal income-based repayment options, including the newest SAVE plan, along with PAYE, REPAYE, and refinancing options. It can help you decide if pursuing federal forgiveness with a tax bill or refinancing to a lower interest rate is the right path for you.

While this tool is a great resource, if you're aiming for forgiveness, we recommend consulting with a student loan expert.

Inspirational OD Student Loan Pay-Off Stories

Since launching ODs on Finance back in 2016, I've had the honor of hearing many optometrists' student loan stories. It's quite motivational to see these inspiring stories. Less than seven years ago, many new grads felt overwhelmed by the sheer magnitude of their student loans. Now, however, more and more ODs are demonstrating that it's not impossible to pay off your student loan with the right mindset and hard work. Here are some of my favorite stories, including my ever own journey:

- 👉 Conquering a Mountain of Debt: Paying off $242K in 7.5 Years on an Starting Salary of $85K as an Optometrist (Ada Noh OD)

- 👉$182K in 2.75 years | Balancing Residency, Future Goals and Aggressive Loan Payoff (Andreas Zacharopoulos O.D)

- 👉 10 Practical Tips on How to Pay Off $221K+ Optometry Student Loans in 5 years (Dat Bui O.D)

Summary

And there you have it, all the student loan updates for the month. Remember, the journey to financial freedom isn't a sprint, it's a marathon. Each student debt story you've read today is a testament to the tenacity, hard work, and strategic planning it takes to conquer the mountain of student debt. Yes, the numbers may seem daunting initially, but remember you're not alone. We are a community, a collective force navigating the same challenges, together. Whether you're pursuing loan forgiveness, refinancing, or aggressively paying off your loan, there's a path for everyone.

Take heart in the knowledge that it's not only possible, but entirely achievable, to come out on the other side debt-free. At ODs on Finance, Aaron and myself are committed to providing resources, support, and community to help you achieve that goal. Your story could be the one inspiring others in the years to come. After all, we are optometrists, and there's nothing sharper than our focus. Keep pushing forward, and never lose sight of your financial freedom.

📱 Need more help? Text STUDENT to 55444 for a custom student loan plan with Dat!

👉 Want more help? Check out "OD’s Guide to Student Refinancing

👉 Want to compare all the Student Refi Lenders? Check out the Lowest Rates

Facebook Comments