Editor’s Picks

What Should I Do First? A Complete Step-By-Step Guide For Optometrists

Here is a “Guideline” list of financial steps that we hope will get you started, but should be adjusted to your own personal situation as an optometrist.

Read More2024 Optometrist Income Report

With increasing student loan debts, an ever changing economy, and a profession that continues to withstand disruption – many optometrists begin to question their associated worth as practitioners. While the old phrase “comparison is the thief of joy” rings true in certain facets, comparison to get a true sense of trends in salary, debt load…

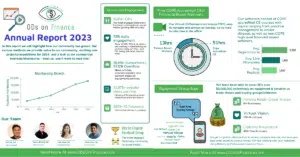

Read MoreAnnual Report 2023: In Review, and a Look at 2024!

In the next reading, you’ll discover metrics that mirror our community’s overall progress, along with the resources and offerings this growth has enabled us to continue providing. Next, we’ll transparently outline the methods ODs on Finance employs to generate revenue. Lastly, we’ll offer you a sneak peek at some major projects we’re embarking on for 2024, aiming to further our profession and assist every OD in achieving financial freedom.

Read MoreThe Optometrist’s Guide To Student Loan Refinancing

Optometrists often accumulate multiple loans from federal and private lenders to fund their doctor education, which results in an average debt load of $220,000. The majority of these loans are federal loans which have an average interest rate of 5.5-6.8%.Then the majority of doctors will end up refinancing their student loans to save thousands of dollars in interest. Here is your comprehensive guide to the student loan refinancing process and understanding how underwriting works.

Read More16 End-of-Year Financial Checklist For Optometrists in 2023

As 2023 draws to a close, it’s vital for optometrists to focus on financial planning for a stable and prosperous future. This checklist, designed for eye care professionals, will guide you through key year-end financial tasks. While not every item may apply to your practice or personal finances, reviewing each one ensures you don’t miss important opportunities or obligations.

Read More2023-2024 IRS limitations for Optometrists

With inflation rising at all time highs, it definitely seem that the IRS is adjusting quite drastically for most of these accounts for 2023! While all of these limits might seem higher, remember that it is mainly keeping up with inflation, which the consumer index is estimated at 8%. in 2022. Please use these important limit to adjust your financial planning for 2023 especially for any retirement plans!

Read MoreNavigating the Path to Cold-Starting an Optometry Practice: A Journey of Passion and Persistence with Dr. Ashley Szalkowski

Driven by the desire for change and a fresh approach to eye care, Dr. Ashley Szalkowski shares insights into the process of establishing a thriving practice from the ground up.

Read MoreOctober 2023 Market Update for Optometrists: Latest Economic & Financial Trends

The economic landscape is characterized by a steady 3.7% inflation and cautious actions from the Federal Reserve, particularly in managing interest rates to avoid potential economic downturns. While some economic indicators like GDP growth appear robust, there’s a visible undercurrent of economic stress and mixed expert predictions regarding a potential recession in 2024.

Read MoreCold Start Accelerator Checklist

Click Here To Download CheckList This comprehensive checklist is a fantastic resource for optometrists looking to start their practice from scratch. It covers a wide range of topics, from location and financing to equipment and marketing. By following this guide, optometrists can ensure they have all the necessary tools and resources to launch a…

Read MoreThe Holland’s Journey: Paying off $660,000 Student Debt in 5 1/2 Years

We want to share our stories to help other young optometrists who are struggling with their student loans. We are both practicing optometrists and managed to overcome a massive obstacle together: paying off $660,000+ in student loans in just 5 1/2 years. Sounds impossible right? But let’s start from the beginning.

Read More