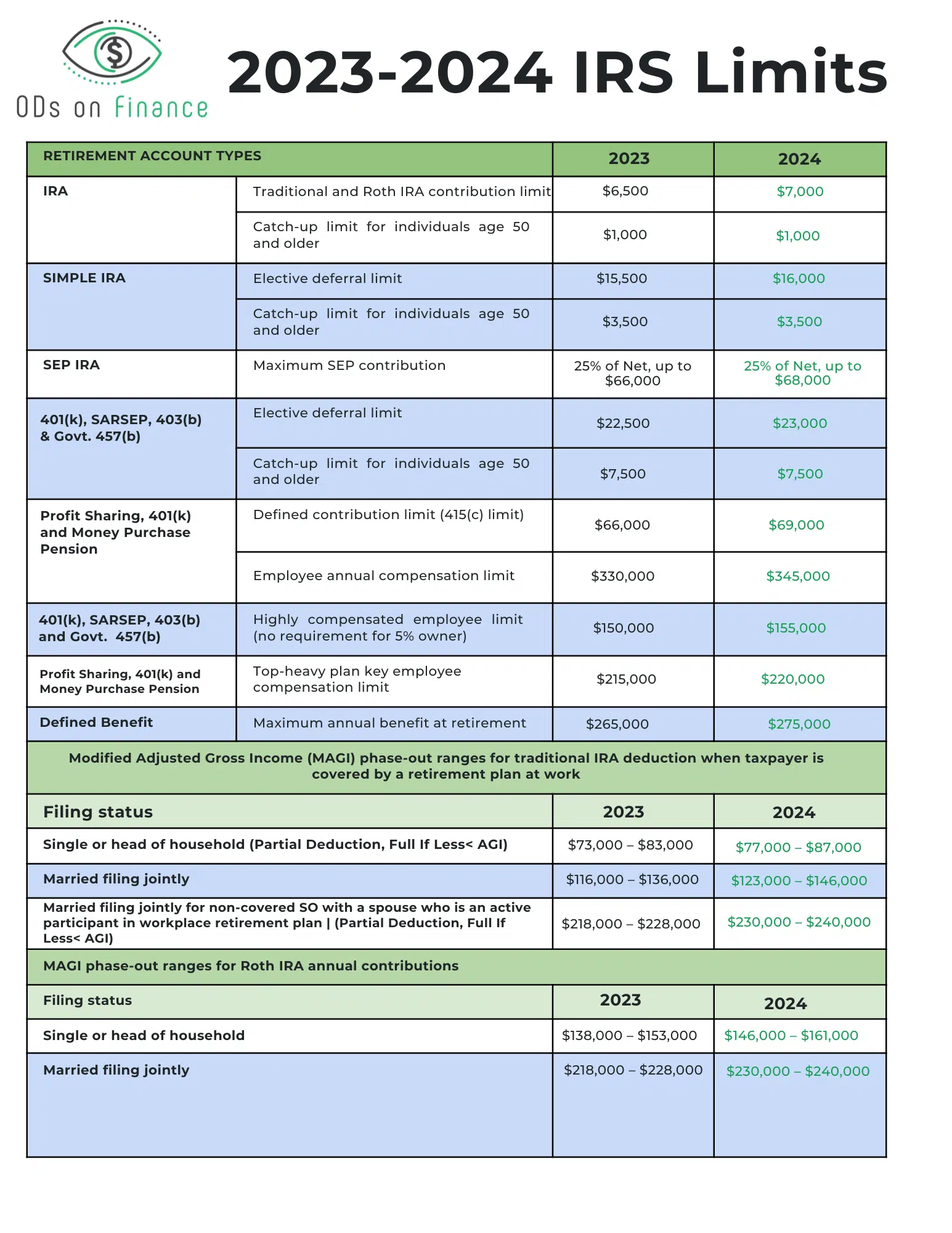

2023-2024 IRS limitations for Optometrists

KEY POINTS:

-

(1) The contribution limits for 401(k) and 403(b) plans have increased to $23,000, with the catch-up contribution remaining at $7,500 for those aged 50 and older.

-

(2) The total defined contribution limit for the Mega Roth 401K, aimed at super savers, has risen to $69,000.

-

(3) Traditional and Roth IRA contribution limits have been raised to $7,000, with the catch-up contribution remaining unchanged at $1,000 for individuals 50 years old and older.

-

(4) The maximum income limits for Roth IRAs have increased to $161,000 for single filers and $240,000 for married couples. For those near these limits, consider utilizing a BackDoor Roth IRA.

-

(5) The SEP IRA contribution limit has increased to $68,000, up from $66,000, but is still capped at 25% of NET income.

-

(6) SIMPLE IRA contribution limits have increased to $16,000, with the catch-up contribution remaining at $3,500 for those aged 50 and older.

-

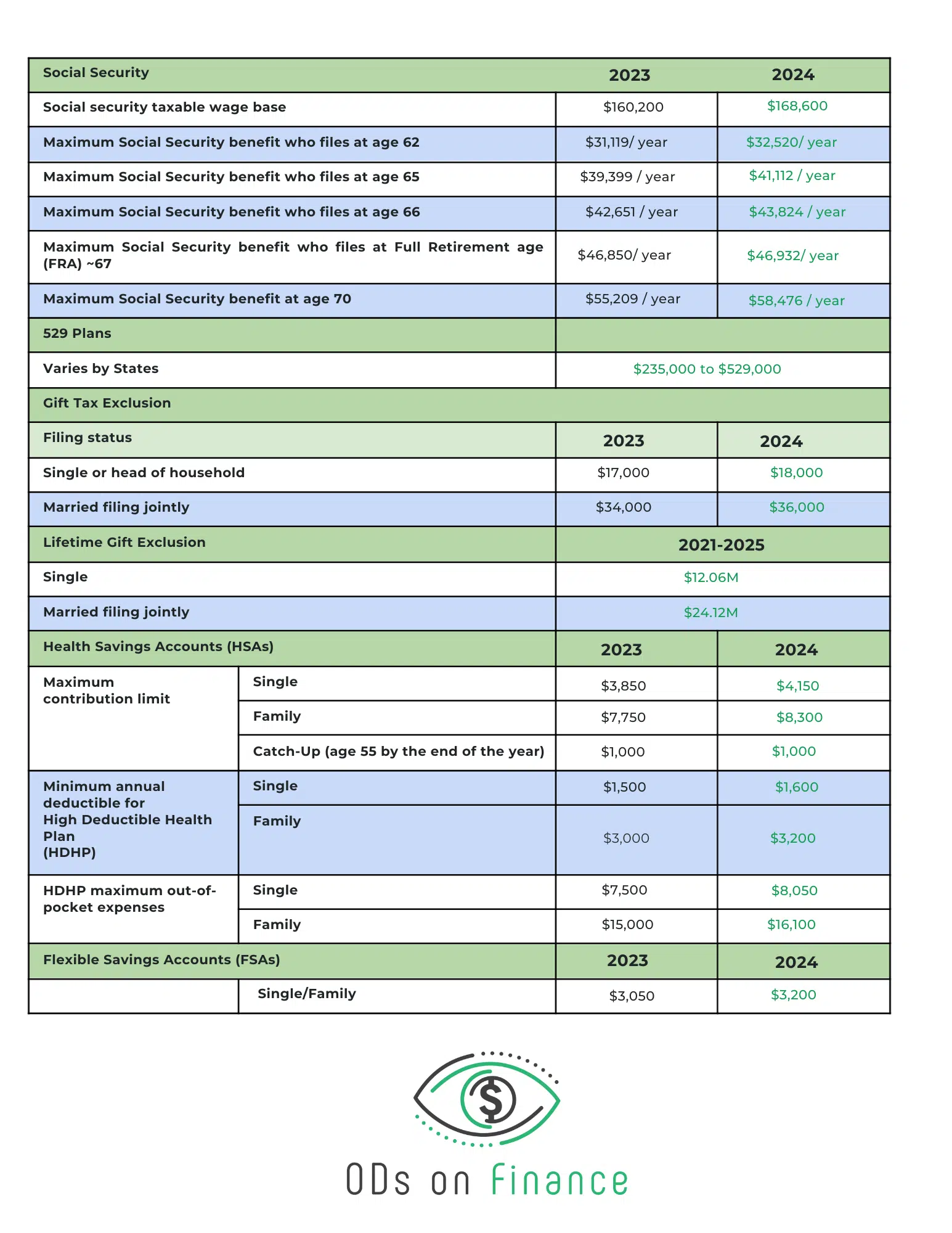

(7) Health Savings Account (HSA) limits have increased to $4,150 for single coverage and $8,300 for family coverage, alongside a rise in Flexible Spending Account (FSA) limits to $3,200 for both single and family coverage.

-

(8) The maximum Social Security benefit for individuals filing at their Full Retirement Age (around 67 years old) has increased to $46,932 per year.

As we step into 2024, amidst the backdrop of soaring inflation rates and a possible recession, it's evident that the IRS is making significant adjustments to various account limits.

Although these updated limits might appear substantially higher, it's important to recognize that they are primarily aligned with the pace of inflation, which was estimated to average 4.40% in 2023. These modifications are crucial for your financial planning in 2024, particularly when it comes to retirement strategies. Ensure to incorporate these new limits into your plans to make the most of your financial opportunities in the coming year.

If you have any questions about your retirement plan or IRS limits, please contact your tax professional.

Want to learn how to plan for Retirement? Check Out The Optometrist's Guide to Retirement

Need help with your Tax? Check out our Recommended Tax Experts

1