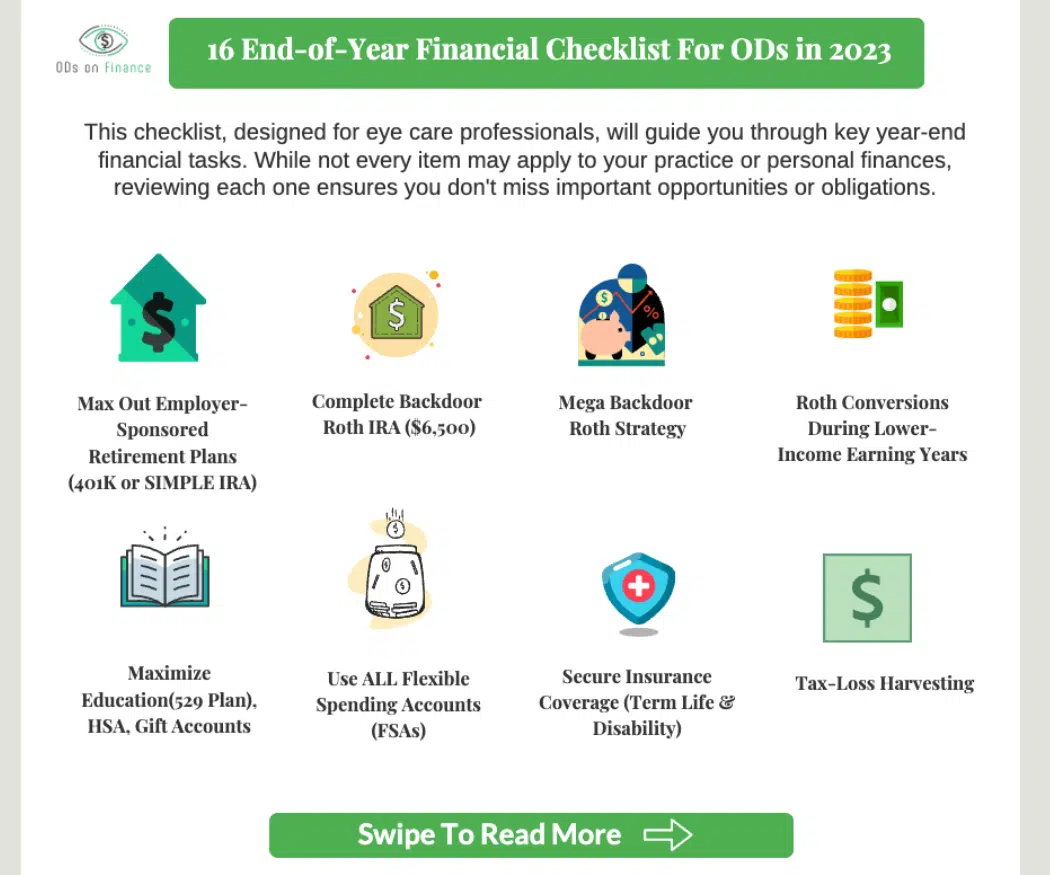

16 End-of-Year Financial Checklist For Optometrists in 2023

KEY POINTS:

-

(1) Max Out Employer-Sponsored Retirement Plans (401K or SIMPLE IRA)

-

(2) Complete Backdoor Roth IRA ($6,500)

-

(3) Mega Backdoor Roth Strategy

-

(4) Roth Conversions During Lower-income Earning Years

-

(5) Maximize Education(529 Plan), HSA, Gift Accounts

-

(6) Use ALL Flexible Spending Accounts (FSAs)

-

(7) Secure Insurance Coverage (Term Life & Disability)

-

(8) Tax-Loss Harvesting

-

(9) Tax Planning & Maximizing Deductions

-

(10) Prepare for Estimated Tax Payments

-

(11) Look at Your Charitable Contributions

-

(12) Review Your Cash Flow & Budget

-

(13) Front-Load Your Account for 2024

-

(14) Establish or Revise Your Estate Plan

-

(15) Review Your Investment Portfolio

-

(16) Check If Your Financial Goals Are On Track

As 2023 draws to a close, it's vital for optometrists to focus on financial planning for a stable and prosperous future. This checklist, designed for eye care professionals, will guide you through key year-end financial tasks. While not every item may apply to your practice or personal finances, reviewing each one ensures you don't miss important opportunities or obligations.

(1) Max Out Employer-Sponsored Retirement Plans (401K or SIMPLE IRA)

For optometrists with access to a 401(k) or SIMPLE IRA, strive to contribute the maximum allowable amount for 2023:

- 401K/Solo 401K: $22,500 Limit (increasing to $23,000 in 2024). Catch-up contributions are $7,500 for those over 50.

- SIMPLE IRA: $15,500 Limit (increasing to $16,000 in 2024). Catch-up contributions are $3,500 for those over 50.

- SEP IRA: Up to 25% of Net, with a $66,000 limit (increasing to $68,000 in 2024).

In the past, you would need to have all these contributions done before the end of the year, but the SECURE Act 2.0 allows both employer and employee contributions into the next year, but earlier contributions are advisable.

If you are an associate stuck in SIMPLE IRA, unfortunately your retirement savings is quite limited until you have a fill-in 1099, in which you can open a Solo 401K for that 1099 income.

Resources:

Financial Pearl

If you own a practice with an old-school SIMPLE IRA, consider switching to a 401K like Ubiquity for benefits like lower taxable income and the ability to do BackDoor Roth IRAs, lower your taxable income, with higher $23,000 Limit (compared to lower SIMPLE IRA $16,000), allow you to do BackDoor Roth IRA ($7,000) now that you don’t have any SIMPLE IRA, tend to be more affordable with flat-fee plans starting at $97 /month with low-cost index funds choices.

Most importantly, can receive up to $16,500 in tax credits over three years when you open a 401(k), which is up to $5,000 per year, plus an additional $500 per year for automatic enrollment for the first 3 years

(2) Complete Backdoor Roth IRA ($6,500)

For optometrists considering tax-advantaged retirement savings, completing the contribution and conversion steps of the Backdoor Roth IRA within the calendar year is advised, even though you have until April 15, 2024 before the tax deadline. If you've delayed this process, prioritize completing it before the year's end.

- Roth IRA contribution is $6,500, but increase to $7,000 for 2024, with a catch up $1,000 for people over 50 years old

- Remember to watch out for the pro rata rule with existing IRAs like a SIMPLE, and if you are on the fence for your AGI phase out income of $138,000-$136,000 for a direct Roth IRA contribution, just do a backdoor Roth IRA to be safe!

- If you are married to a stay-at home spouse, max out a spousal Roth IRA ($6,500) for them as well

Resources:

(3) Mega Backdoor Roth Strategy

If you're incorporating after-tax contributions to a solo 401(k) with subsequent conversions to a Roth 401(k) or Roth IRA, ensure this is completed within the year. This strategy can be particularly advantageous for optometrists with higher incomes that has access to this, which allows them to contribute up to $66,000 Roth Contribution in 2023, and will increase to $69,000 in 2024. This can get pretty confusing and not all plan qualify, so consult with your 401 K Plan administrator and CPA.

Resources:

(4) Roth Conversions During Lower-income Earning Years

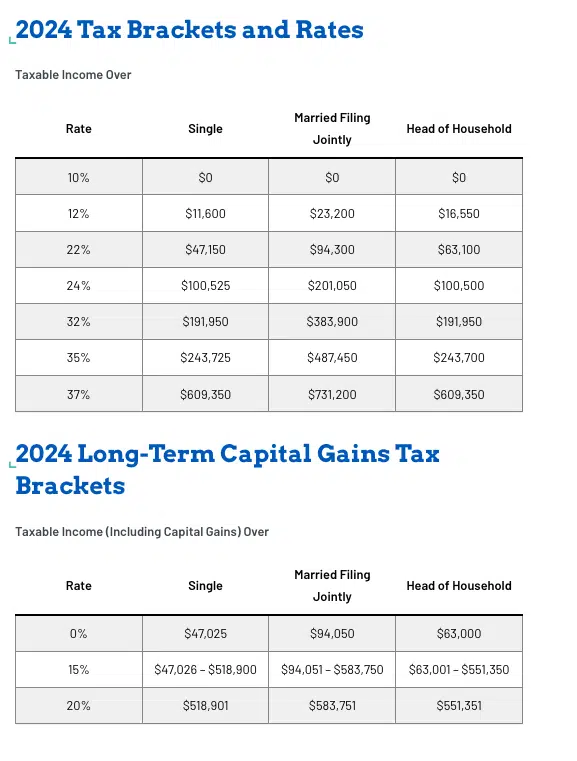

Consider converting pre-tax retirement savings, such as Traditional 401K, Traditional IRA, or SIMPLE IRA, to a Roth IRA, especially if it aligns with your long-term tax planning strategy. While this will trigger a tax event, this move can be particularly beneficial for optometrists who find themselves in a lower income bracket for the year.

This situation often applies to those in residency or optometrists who are cold-start practice owners, as they typically experience lower salaries in the initial years.

(5) Maximize Education(529 Plan), HSA, Gift Accounts

When managing your financial portfolio, remember that most investment vehicles, apart from retirement accounts and Health Savings Accounts (HSAs), require contributions within the calendar year. Therefore, if you plan to increase your contributions this year, it's wise to act quickly. This is especially important for education savings plans like 529s and Coverdell Education Savings Accounts (ESAs), as well as ABLE accounts for children with disabilities, and Uniform Transfers to Minors (UTMA) accounts.

These accounts are instrumental in building a financial foundation for your children, particularly useful when they reach their 20s. While HSAs allow contributions until Tax Day, it's usually more advantageous to contribute earlier.

Resources:

(6) Use ALL Flexible Spending Accounts (FSAs)

Unlike HSAs, FSAs do not carry over. Make sure to expend these funds before year-end to avoid losing them. This is crucial for optometrists who have opted for FSAs as part of their healthcare planning.

- Single/Family FSA limit are $3,050 but will increase to $3,200 in 2024

(7) Secure Insurance Coverage (Term Life & Disability)

It's crucial to assess and obtain the necessary disability and term life insurance coverage. This is particularly vital for optometrists, especially those with dependents, as a key aspect of financial security.

Typically, most long-term disability insurance policies cover about 60% of your income. For doctors, it is recommended to have life insurance coverage around $2 million, which can be estimated as Gross Salary multiplied by 17 (Gross Salary x 17 = Term Life Amount).

Resources:

- The Optometrist's Guide to Disability Insurance

- The Optometrist's Guide to Life Insurance

- Recommended Insurance Agents

(8) Tax-Loss Harvesting

Consider evaluating your investment accounts for tax-loss harvesting opportunities. This strategy can effectively offset capital gains, making it a practical choice for optometrists with taxable investment accounts. In a declining market, tax-loss harvesting allows you to share your investment losses with Uncle Sam. You can deduct up to $3,000 annually ($1,500 if married filing separately) from your regular income in net investment losses. For an optometrist in a typical tax bracket, this could mean about $1,000 in actual savings. If your losses exceed $3,000, the surplus can be carried forward to reduce future tax liabilities.

Be aware of the three critical rules of tax-harvesting:

- The Substantially Identical Rule.

- The Wash Sale Rule.

- The 60-Day Dividend Rule.

This process can be complex, so it's advisable to consult with your CPA and follow the guidelines carefully.

Resource:

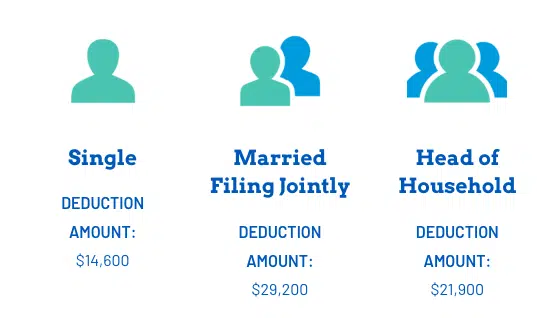

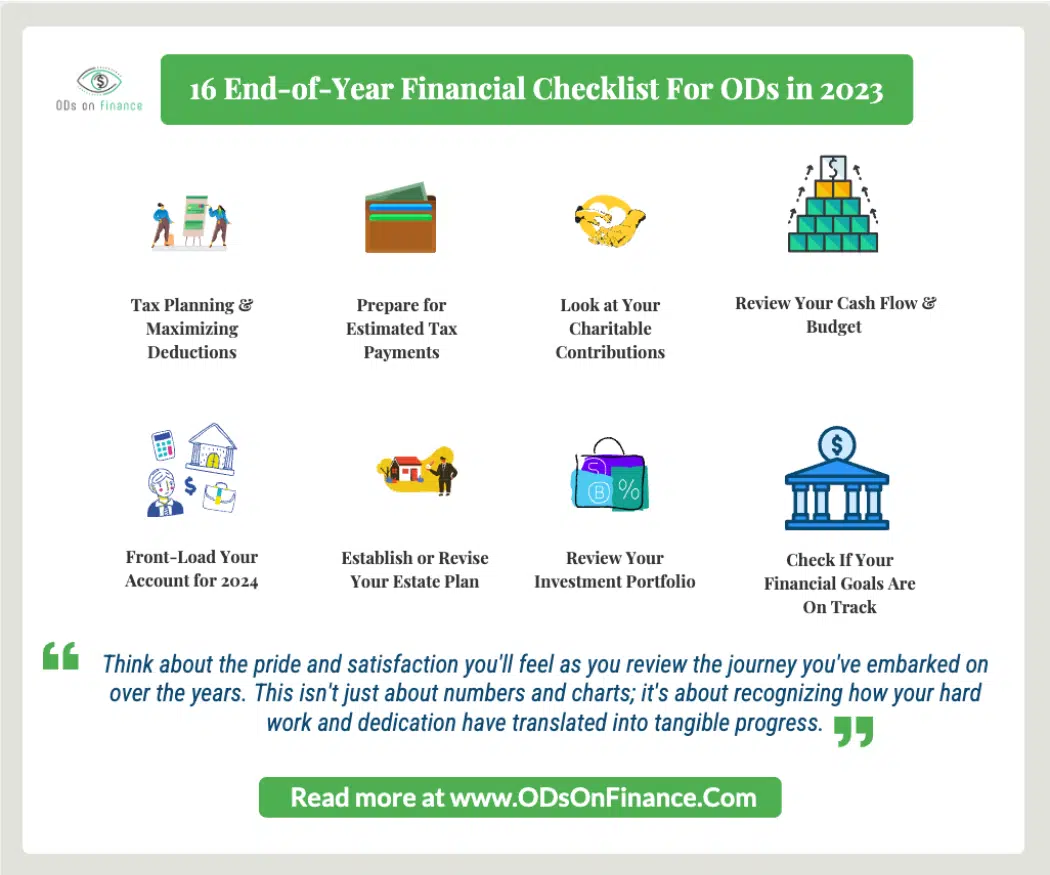

(9) Tax Planning & Maximizing Deductions

Employing strategies such as accelerating expenses and delaying income, particularly if these methods are in line with your current tax bracket. This approach is especially pertinent for optometrists who manage their own practices or have other business ventures, like real estate. Options include the Qualified Business Income (QBI) deduction, State and Local Tax (SALT) Deduction Limitation Workaround, Bonus Depreciation, Cost Segregation Benefits, and ADA Tax Credit, among others.

Given the variety of options, it's crucial for optometrists to consult with their CPA to determine the strategies best suited to their specific tax situation.

Resource:

Financial Pearl

You can Get Up to $5K Back on Your Tax Return by Making Your Optometric Practice ADA-Friendly by purchasing devices such as iCare Tonometer, Rabin Color Test, Virtual Field or Virtual Vision (Purchase only) and other accessibility-related equipment. The credit covers 50% of eligible access expenses over $250 for a maximum credit of $5,000.

(10) Prepare for Estimated Tax Payments

If you're working full-time as an independent contractor (1099), it's important to ensure that you have set aside sufficient funds for the fourth-quarter estimated tax payment due on January 17, 2024. However, it's always best to stay on top of these deadlines to avoid any penalties and ensure financial compliance.

If you're working full-time as an independent contractor (1099), it's important to ensure that you have set aside sufficient funds for the fourth-quarter estimated tax payment due on January 17, 2024. However, it's always best to stay on top of these deadlines to avoid any penalties and ensure financial compliance.

Financial Pearl

For those receiving 1099 income as a causal fill-in, be aware that the IRS may impose a penalty for missing a quarterly tax payment deadline. This penalty amounts to 0.5% of the unpaid tax for each month, or part of a month, that the tax remains unpaid. For optometrists earning less than $25,000 annually, this penalty might be less than $100, so the financial impact of not making quarterly payments may not be substantial.

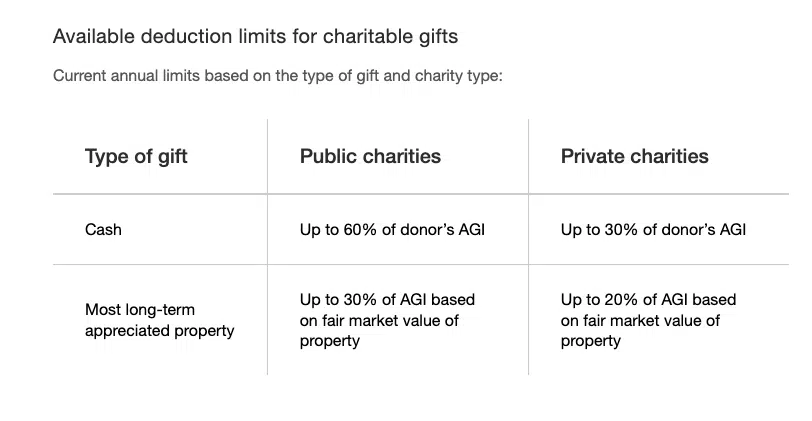

(11) Look at Your Charitable Contributions

Charitable contributions offer more than just a sense of fulfillment; they can also yield tax benefits. As an optometrist, reflect on your charitable activities over the past year and make sure to optimize your donations or contribute non-cash assets to your preferred causes and charities

Charitable Giving Tips:

- Bunch Your Donations: If your annual donation amount is consistent, consider consolidating donations into a single year. This strategy can amplify your potential itemized deductions for that year. Using a donor-advised fund allows for spread-out giving while benefiting from "bunching."

- Donate Appreciated Assets: In case of significant long-term capital gains, donating appreciated assets is a wise choice. This avoids capital gains tax, and if you itemize, you can deduct the entire value of these assets.

Financial Pearl

A simpler alternative to a private foundation is a donor-advised fund such Vanguard Charitable but almost all of your brokerage will have one. Here, you make an irrevocable contribution to a 501(c)(3) organization. The funds are held and invested, and you can recommend which charities should receive support. A tax deduction is available in the year you make the contribution, based on public charity rules (see the accompanying chart for details). These assets can then be distributed to charities over several years.

Financial Pearl

When claiming a deduction for a charitable donation without a receipt, you're limited to cash donations under $250. You must provide a bank record or payroll deduction record for tax deduction claims. Receipts and additional proof are necessary for: (1) Cash donations of $250 or more (2) All non-cash donations 93) The IRS evaluates each donation individually, regardless of whether total donations to one organization exceed $250.

(12) Review Your Cash Flow & Budget

Understanding your cash flow is crucial to effectively manage your finances as an optometrist. It involves tracking the money coming in and going out, and planning for future large expenses. Here’s a tailored approach for optometrists:

- Identify All Income Sources: Document all your income, including earnings from your optometry practice and any side ventures or investments.

- Track and Organize Expenses: Maintain detailed records of both personal and practice-related expenses on a monthly and annual basis.

- Optimize Savings: Explore ways to boost your savings. This could involve cutting unnecessary expenses such as cable TV, streaming services (Netflix, Hulu, Spotify, etc.), or switching to a more cost-effective mobile plan.

- Assess Income and Expense Trends: Be aware of potential changes in your income and expenses. This might include factors specific to your practice, ongoing professional development, or personal situations like a child’s education or elder care.

- Plan for Major Upcoming Expenses: Identify any significant expenses you anticipate in the next year, both personally and for your practice.

- Emergency Fund: Ensure you have an adequate emergency fund set aside. This is particularly important in healthcare professions like optometry, where unexpected events can impact practice operations, especially as we might head into a possible recession in 2024

(13) Front-Load Your Account for 2024

Many of us ODoF investors practice front-loading our investment accounts, such as Health Savings Accounts (HSAs), Backdoor Roth IRAs, 529 college savings plans, and 401(k)s, by fully funding them in the first week of the new year. If you're among this group, it's crucial to strategize your cash flow accordingly. Remember, the funds you plan to invest in a taxable account on December 20th cannot simultaneously be allocated for these early contributions.

Personally, funding my 2024 Roth IRA via backdoor is the first thing I do in January to get my financial year started!

(14) Establish or Revise Your Estate Plan

As an optometrist, it's important to have a comprehensive estate plan. This plan typically encompasses a will, a living trust, a living will, healthcare or financial powers of attorney, and funeral arrangements. Ensure that your plan accurately lists your designated beneficiaries and that all documents are securely stored. If there have been significant changes in your life since your last estate plan, such as family dynamics or asset fluctuations, it's essential to update your plan to reflect these changes.

If you haven't yet created an estate plan, now is the time to do so. For those with straightforward needs, online resources like Nolo, LegalZoom, or RocketLawyer offer tools for self-preparation of legal documents. However, if your family situation is complex or if you possess substantial assets, it's advisable to seek the expertise of an estate planning attorney to ensure all aspects are properly addressed.

Resource:

(15) Review Your Investment Portfolio

Analyze your investment portfolio. Consider its performance, asset allocation, and how it aligns with your risk tolerance and investment goals. Rebalance if necessary.

Many individual investments have underperformed the overall market this year. However, despite the S&P 500 showing a significant increase (+22% YTD), this growth is primarily driven by just a handful of large technology stocks.

It's advisable to consider rebalancing your portfolio. In light of these uneven returns across different asset classes, now could be an opportune time for many investors to reassess and realign their portfolio. This ensures that their investment allocation aligns with their desired level of risk tolerance.

Additionally, it's crucial to avoid chasing past performance. Steer clear of the latest 'hot' investment trend. . Each year, there's invariably some investment or portfolio manager who achieves exceptional results.

Resources:

(16) Check If Your Financial Goals Are On Track

As a final step, assess whether you are on track to meet your financial objectives. This could include paying off student loans, saving for retirement, or accumulating funds for short-term needs like purchasing a house or securing a practice loan.

Financial Tip: For optometrists, we suggest using PERSONAL CAPITAL Free Dashboard (Empower) as a tool to monitor your net worth, savings rate, and investment returns. Update this information annually to maintain a clear financial picture. I personally review these metrics once a year as part of my end-of-year financial routine.

Additionally, it's prudent to ensure your investment strategy is aligned with your financial and personal goals. Regularly check your progress and consider if your portfolio requires rebalancing. This approach helps in keeping your long-term financial plan on course and responsive to any changes in your personal or professional life.

Resource:

Summary

Taking the time to assess your financial progress at the end of the year doesn't have to be a chore; it can actually be a rewarding and even enjoyable experience, especially when shared with your family. Imagine turning this into a moment of celebration, where you and your loved ones gather to reflect on the strides you've made in your optometry career and the ways in which these efforts have enhanced your lives.

Think about the pride and satisfaction you'll feel as you review the journey you've embarked on over the years. Each small step you've taken has contributed to a larger picture, one that's gradually leading you towards achieving your retirement and investment goals. This isn't just about numbers and charts; it's about recognizing how your hard work and dedication have translated into tangible progress.

Involve your family in this process. Share your successes and discuss your future plans. This can be a wonderful opportunity to teach your children about financial responsibility and planning, or to dream together about future goals like vacations, home improvements, or community projects.

Set aside an hour or two at the end of the year for this purpose. Make it a special occasion. Perhaps you can follow it with a family dinner or a favorite activity, turning it into a tradition that everyone looks forward to. This is not just a financial review; it's a celebration of your journey, a chance to appreciate how far you've come, and an opportunity to plan for even greater achievements in the year ahead.

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get a full blueprint on How to start? Check out What Should I do First? A Complete Guideline Step-by-Step

Facebook Comments