The Holland’s Journey: Paying off $660,000 Student Debt in 5 1/2 Years

Editor’s Note: This is a guest post written by Drs Zac & Joelle Holland who is able to pay off a massive amount of loans while achieving their dream of practice ownership. Zac owns the Cornea and Contact Lens Institute of Minnesota, specializing in dry eye, keratoconus, and irregular scleral contact lens fittings. He precepts optometry students, participates in FDA trials, and is the sole OD owner of a certified iLink center for corneal crosslinking in the US. Dr. Joelle Holland, OD, works at Complete Eye Care of Medina, focusing on Myopia Control and Dry Eye Disease, managing orthokeratology and Lipiflow treatments. Outside work, they both enjoy time with their three children.

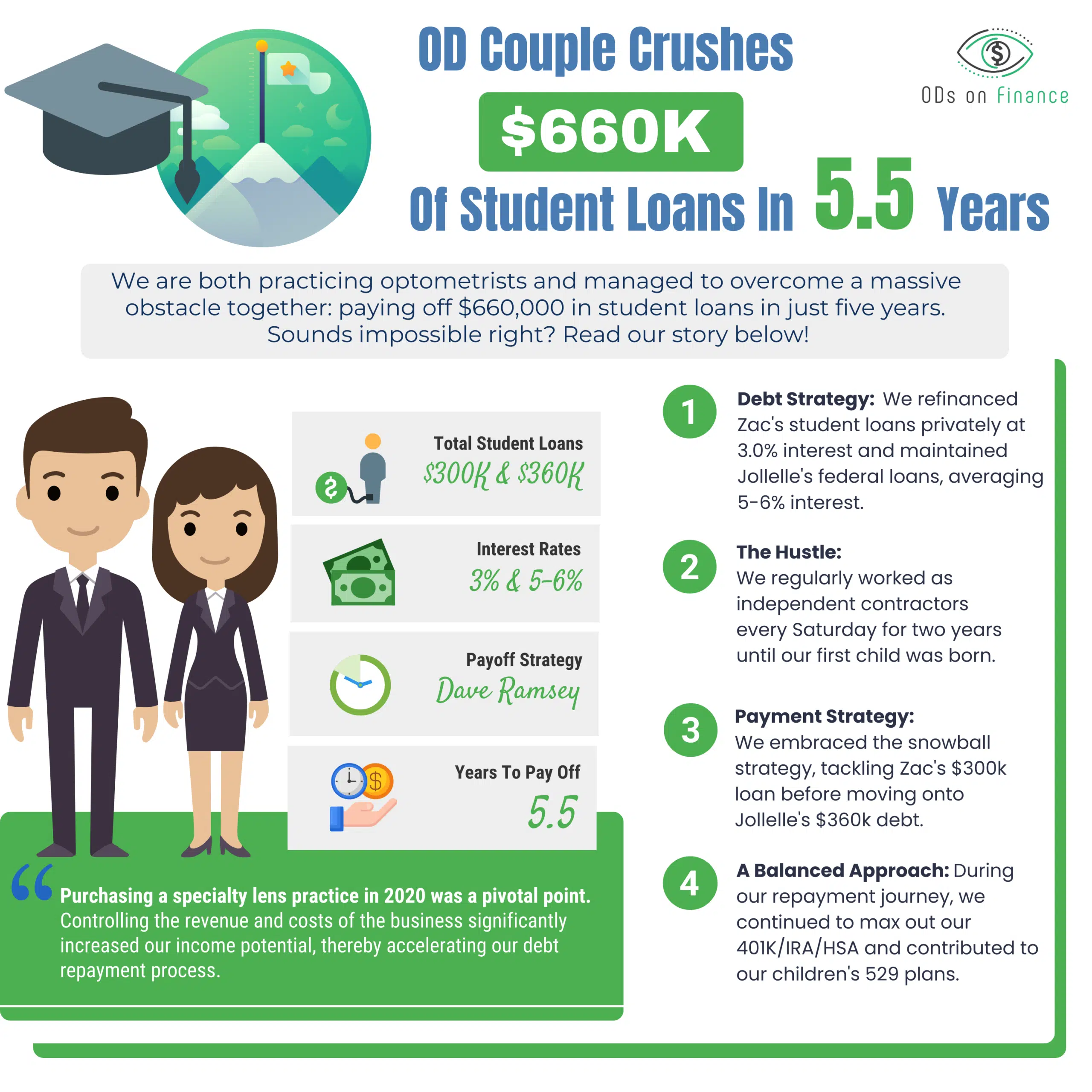

KEY POINTS:

-

Debt Strategy: We refinanced Zac's student loans privately at 3.0% interest and maintained Jollelle's federal loans, averaging 5-6% interest.

-

The Hustle: We regularly worked as independent contractors every Saturday for two years until our first child was born

-

Payment Strategy: We embraced the snowball strategy, tackling Zac's $300k loan before moving onto Jollelle's $360k debt.

-

A Balanced Approach: During our repayment journey, we continued to max out our 401K/IRA/HSA and contributed to our children's 529 plans.

Our Background: Setting the Stage

Hey ODoF community, our names are Drs. Zac and Joelle Holland and we want to share our stories to help other young optometrists who are struggling with their student loans.

We are both practicing optometrists and managed to overcome a massive obstacle together: paying off $660,000+ in student loans in just 5 1/2 years. Sounds impossible right? But let’s start from the beginning.

We're alumni of the Illinois College of Optometry (ICO), with Zac graduating in 2015 and Joelle in 2016. Following graduation, we moved to Minnesota (MN), and Zac started working in specialty contact lenses while also working part-time in a primary care practice. Joelle found several full-time positions after moving to MN in 2016. As our careers developed, our income varied. On the lower end, we collectively earned around $275k in 2017, while our peak income exceeds $750k currently.

Drowning in Debt: The Mountain We Conquered

In February 2017, our combined student loan balance was a staggering $660k, all federal loans. We refinanced Zac's student loans privately at 3.0% interest and maintained Joelle's federal loans, averaging 5-6% interest. We embraced the snowball strategy, tackling Zac's $300k loan before moving onto Joelle's $360k debt. Zac's loans were completely paid off by May 2020 and Joelle's by October 2022.

The Motivation: How We Were Driven

A catalyst for our aggressive debt repayment approach was Dave Ramsey's Financial Peace University, a gift from Zac's mother, which we began four months after our wedding in September 2017.

Our Strategy: The Roadmap We Followed

To stay on track, we adopted a modified Dave Ramsey protocol. We maintained a larger emergency fund than the recommended $1,000 and fully contributed to our IRA/401K/HSA plans to reduce our tax liability. We also relied heavily on setting mini goals and rewarding ourselves frugally when we achieved them. These tactics, along with monthly budget discussions and mutual support, were instrumental in keeping us focused.

Visualization of Success: “Chain of Shame”

We created a paper chain of our student loan debt to hang in our basement as a physical reminder of our journey. It was classically known as “The Chain of Shame” and provided motivation and a visualization of progress during our journey. Each ring symbolized $10,000. 66 rings was pretty long and wrapped around us both multiple times. There were some months where we cut 2-3 links.

Our Side Hustles: The Extra Mile

We regularly worked as independent contractors every Saturday, and even the occasional Sunday, for two years until our first child was born. We reduced this to every other Saturday following the birth of our second child. As our loan principal reduced, so did our need for weekend work.

Budgeting Tips: Cutting the Costs

Our key tip: don't try to match your classmates' or society's classification of a doctor's lifestyle. In fact, Zac still drives the oldest car among all of his employees. We tracked our expenses diligently and were frugal most of the time. Yes, we occasionally lost motivation, but we always found our way back onto our plan.

The Refinancing Process: A Key Step

Our key tip: don't try to match your classmates' or society's classification of a doctor's lifestyle. In fact, Zac still drives the oldest car among all of his employees. We tracked our expenses diligently and were frugal most of the time. Yes, we occasionally lost motivation, but we always found our way back onto our plan.

Investing Alongside Debt Repayment: A Balanced Approach

During our debt repayment journey, we continued to max out our 401K/IRA/HSA and contributed to our children's 529 plans.

The Challenges: Life and Debt

Balancing our life expenses with loan repayments required discipline and sacrifices. We cut out excessive food costs and said no to nights out, vacations, and more. We embraced a lifestyle of frugality.

Our Practice Ownership Journey: Accelerating Repayment

Purchasing a specialty lens practice in 2020 was a pivotal point. Controlling the revenue and costs of the business significantly increased our income potential, thereby accelerating our debt repayment process.

Reflections: Looking Back on the Journey

Would we do anything differently? Possibly, but overall we're content with our journey. We worked hard, remained focused, and made sacrifices without severely impacting our quality of life.

Advice for Future Optometrists: Words of Wisdom

Our top three pieces of advice are:

- ✅ Work more than you think you can.

- ✅ Don't give up. Having a plan helps. Make sure you are checking in with your accountability partner or spouse religiously

- ✅ Make your payments personally.

Looking Ahead: Our Future Goals

Our clinic is our ticket to our personal and professional goals. We aim to work fewer days per week, enjoying the fruits of our hard work and controlling how we spend our time and money.

Celebrating our Victory: The Fruit of our Labor

We celebrated our achievement with a family cruise and Joelle reduced her work hours. Our journey to financial freedom was long (~68 months), but the habits we formed along the way have become a part of our lifestyle.

Want to learn how to manage your Student Loans? Check out The Optometrist's Guide to Student Loans?

Want to get the Lowest Student Refi Rates? Compare & Shop Recommended Student Loans Refi

Facebook Comments