Recommended Student Refinancing

FREQUENTLY ASKED QUESTIONS ABOUT STUDENT LOAN REFINANCING

NEED HELP WITH THE STUDENT REFI PROCESS?

Splash Financial

Benefits:

- ✅ Fast and easy rate check without affecting your credit score. No application or origination fees, with no prepayment penalties

✅ Forbearance, discharge on death/disability, cosigner release is dependent on individual lenders

- ✅ $500 cash bonus: ODs On Finance readers who refinance at least $100k through Splash are eligible. If you refinance over $150,000, ODoF will contact you for $500 additional once it closes (90-120 Day after your loan closed), but if issues arise, please email admin@odsonfinance.com

Requirements:

- ▶️ Resident okay

- ▶️ All States eligible

- ▶️ Loan amounts: $25,001 to $500,000

- ▶️ Typical credit score: 700+

- ▶️ 2 years of 1099 History required

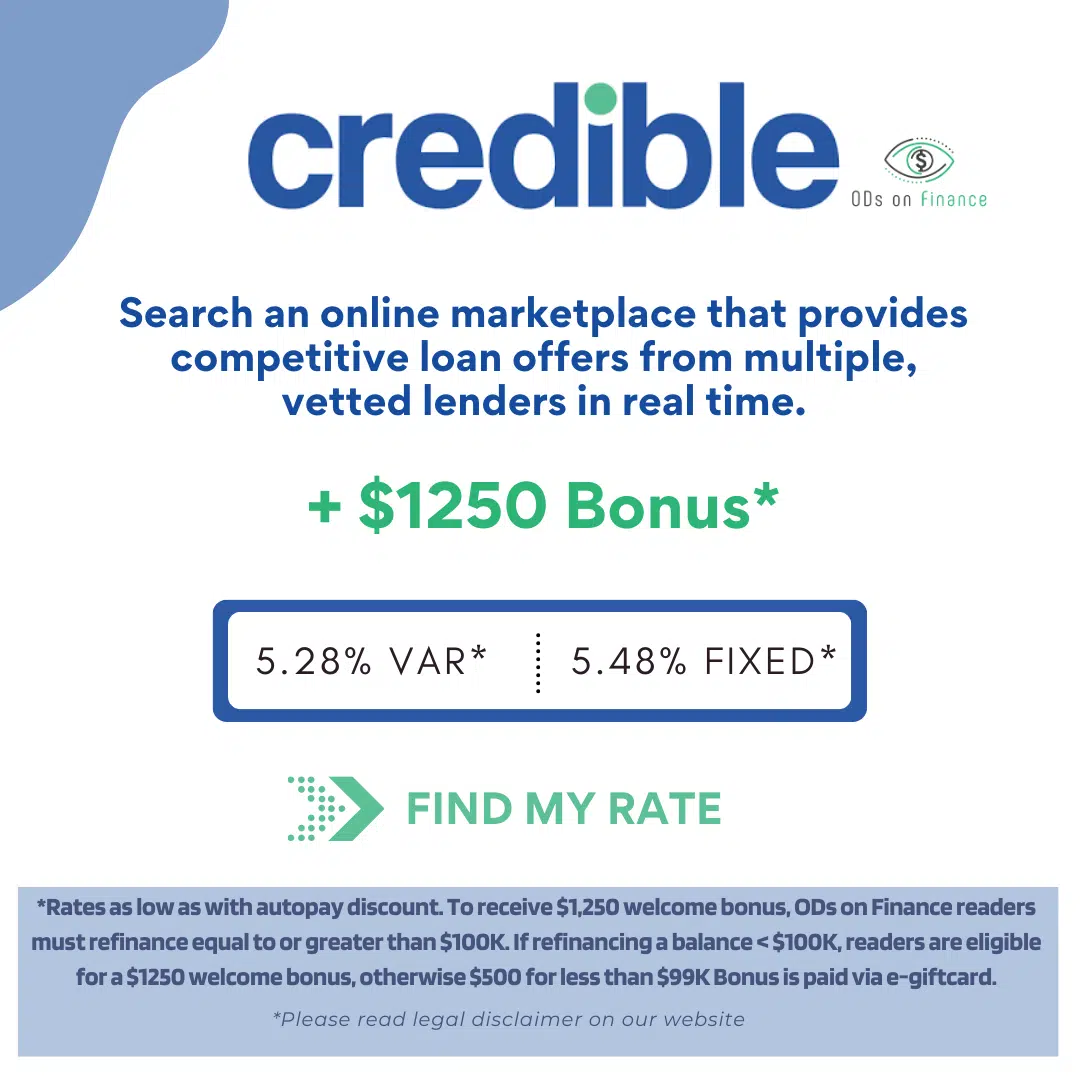

Credible

Benefits:

- ✅ Free, fast and able to compare prequalified rates from multiple lenders under 2 minutes, without affecting your credit score. Get a final offer as little as 1 business day! No prepayment penalties, loan application fees, or origination fees.

✅ Forbearance, discharge on death/disability, cosigner release is dependent on individual lenders

✅ Special Promo: Get up to $1250 bonus for loans over $100K, $1000 Bonus for $100K loan, anything less , $500 Bonus via E-giftcard

Requirements:

- ▶️ Residents Okay

- ▶️ All States eligible

- ▶️ Typical credit score of approved borrowers or co-signers: 700+

Laurel Road

Benefits:

- ✅ $300 for refinancing 50k to 100k, $1,000 for refinancing over 100k†

- ✅ Up to 12 months of forbearance is available†

✅ Academic deferment, military deferment, forbearance | Loans are discharged on death or disability | Cosigner release (36 months): YES†

- ✅ Approval: Must be a U.S. citizens or permanent resident. Permanent residents must have a valid I-551 card (green card)

- Rates as of 2/09/24. Rates subject to change. Terms and conditions apply. All products subject to credit approval.

Requirements:

- ▶️ All States eligible

- ▶️ Loan Amount: $5,000 up to your total outstanding loan balance

- ▶️ Typical credit score of approved borrowers or co-signers: 650+

- ▶️ 1099: Doctors/Optometrists are underwritten as healthcare employees and as such we do not have a 2 year self-employment requirement

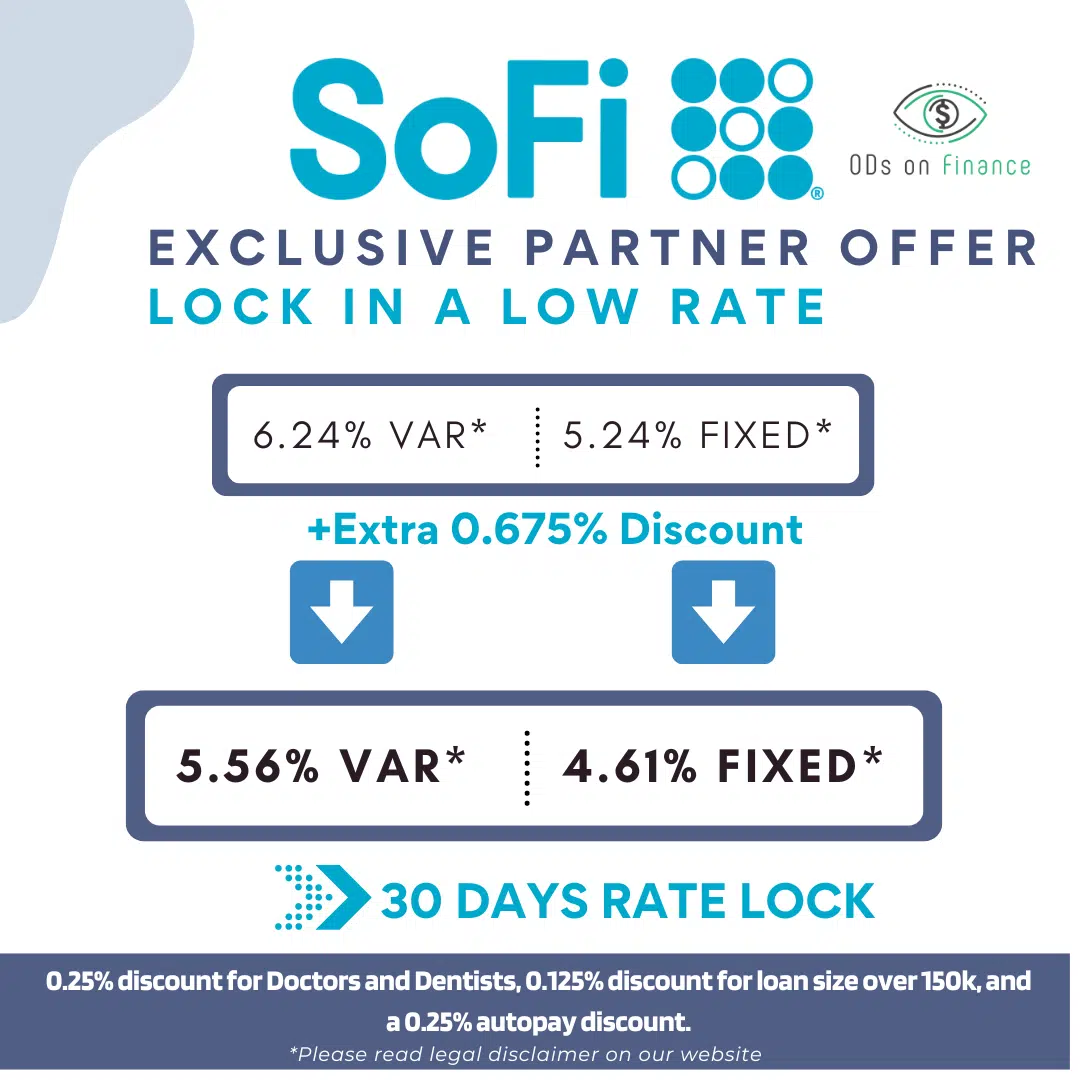

SoFi

Benefits:

- ✅ 0.25% partnership discount, 0.25% autopay discount, and 0.125% discount for ODs w/ loan balances over $150k

- ✅ No extra fees: No application fees, no origination fees, and no prepayment penalties for paying off your loan early

✅ Academic deferment, military deferment, forbearance | Loans are discharged on death or disability | ⚠️ Cosigner release: No

- ✅ Approval for visa holder (E-2, E-3, H-1B, J-1, L-1, or O-1)

- 📧 833-277-7634 | your-benefits@sofi.com

- ⚠️ *Sofi Legal Disclaimer: Please Read for more details

Requirements:

- ▶️ All States eligible

- ▶️ Loan Amount: $5,000 up to your total outstanding loan balance

- ▶️ Typical credit score of approved borrowers or co-signers: 700+

LendKey

Benefits:

- ✅ Simple, consistent and transparent which allow you to compare multiple of lenders in under 2 minutes to get the best rate

✅ Forbearance, discharge on death/disability | Cosigner release is dependent on individual lenders

- ✅ Get up to a $750 bonus for loans over $150K, $400 bonus for loans between $50k-$150K

Requirements:

- ▶️ All States eligible except for NV, ME, ND, WV, RI.

- ▶️ Loan amounts: $5,000 to $300,000, depending on the highest degree earned

- ▶️ Typical credit score of approved borrowers or co-signers: 751+

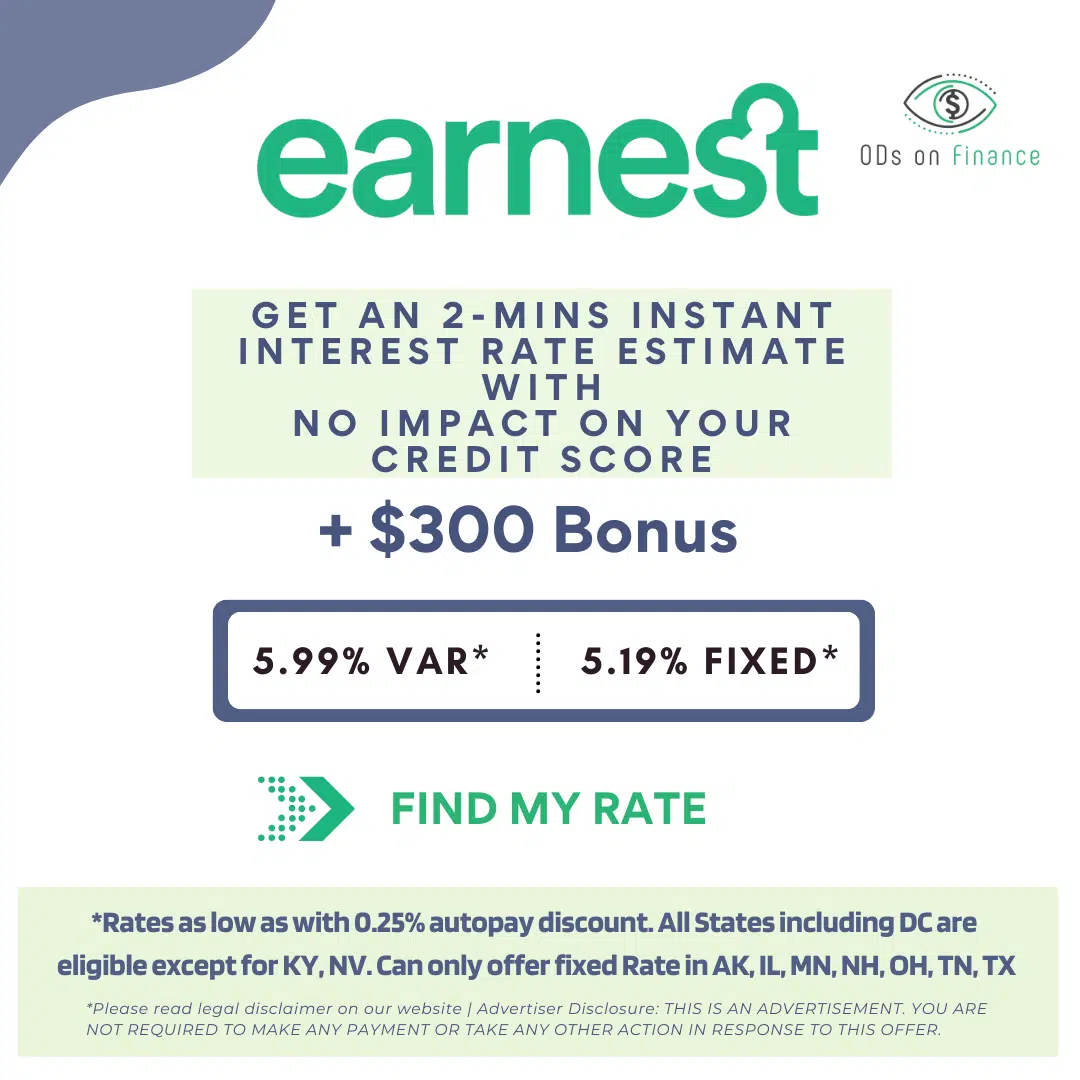

Earnest

Benefits:

- ✅ Analysis of information beyond your credit score, Earnest can provide an instant rate estimate using data other lenders don’t, such as your savings patterns, investments, and career trajectory—to give you the best possible rate

✅ Academic deferment, military deferment, forbearance | Loans are discharged on death or disability | ⚠️ Cosigner release: No

- ✅ $300 Bonus* Must refinance greater than $100K using Earnest via our link

- ✅ Client Welcome Disclosure | Advertiser Disclosure: THIS IS AN ADVERTISEMENT. YOU ARE NOT REQUIRED TO MAKE ANY PAYMENT OR TAKE ANY OTHER ACTION IN RESPONSE TO THIS OFFER.

Requirements:

- ▶️ All States eligible except for NV, ME, ND, WV, RI.

- ▶️ Loan amounts: $5,000 to $300,000, depending on the highest degree earned

- ▶️ Typical credit score of approved borrowers or co-signers: 751+, minimum is 650+

Brazos

Benefits:

- ✅ No extra fees: Transparent pricing, zero fees, and some of the best rates available due to non-profit status

- ✅ Military deferment, forbearance | Loans are discharged on death or disability | ⚠️ Cosigner release: No

- ✅ *Brazos Legal Disclaimer: Please Click here to Read

Requirements:

- ✅Texas Resident only

- ✅ Minimum loan amount: $10,000, up to $400,000 with a graduate degree

- ✅ Typical credit score of approved borrowers or co-signers: 720+

GENERAL

CASH BONUS AND DISCOUNTED RATE FOR MEMBERS

OTHER QUESTIONS FOR DAT AND AARON

Any Questions or Concerns, please read Frequently asked questions (FAQ) and as always, please don't hesitate to contact at Admin@ODsonFinance.com