What Happens to My Optometry Student Loans if I Die, Become Permanently Disabled, or Become Bankrupt?

KEY POINTS:

-

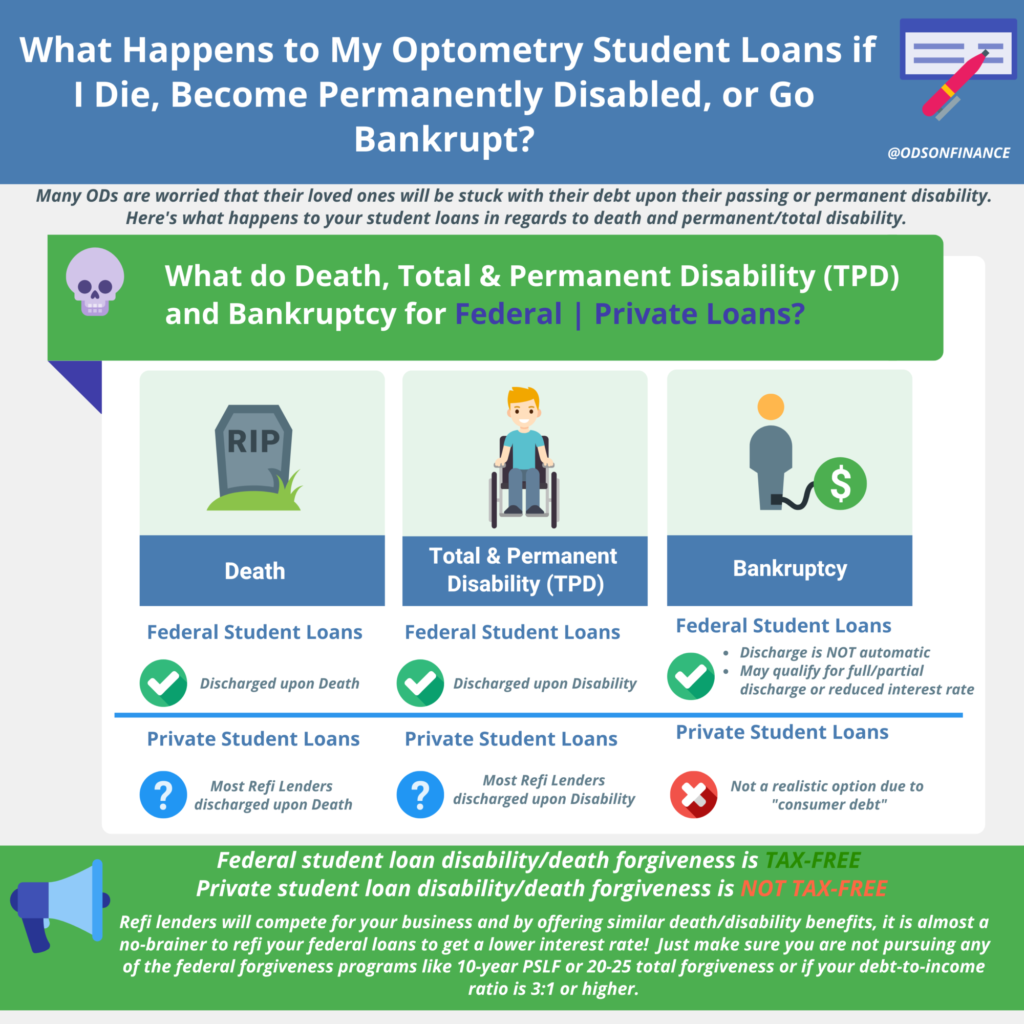

(1) Differences between death, total & permanent disability (TPD) & bankruptcy and how it impacts your student loans

-

(2) Majority of private refi lenders will offer military deferment & forbearance during times of hardship, and almost all will fully discharge Loans on death or disability (similar to federal)

-

(3) Federal student loans disability/death forgiveness are TAX-FREE, but private student loans disability/death forgiveness are NOT TAX-FREE. So plan accordingly with the enough term life + disability coverage

-

(4) Unless ODs are pursuing a federal forgiveness program or have a high 3:1 debt to income ratio, it is almost a no-brainer to refinance to get a lower interest rate with all these “federal-like” perks that private lenders offer.

Optometrists graduate with an average of $200,000+ in student loan debt, usually at a federal interest rate of 6.8%. The majority of ODs will eventually refinance their student loans with a private lender to get a significantly lower interest rate of around 2.5-3%, essentially accelerating their debt payoff timeline.

According to the CDC, "26% of people will have a period of disability before reaching age 65”, so it is no wonder why many optometrists are worried about not being able to pay off their massive debt if they are unable to take home a large doctor’s salary. Even more fearful, a lot of ODs are worried that their loved ones will be stuck with their debt upon their passing or permanent disability.

In this article, we will clear up some misconceptions around student loans (both federal & private) in regards to death and permanent/total disability.

Financial Pearl

"According to the CDC, "26% of people will have a period of disability before reaching age 65”, so it is no wonder why many optometrists are worried about not being able to pay off their massive debt if they are unable to take home a large doctor’s salary. Even more fearful, a lot of ODs are worried that their loved ones will be stuck with their debt upon their passing or permanent disability"

What do Death, Total & Permanent Disability (TPD), and Bankruptcy Mean?

First of all, let’s define what death, permanent/total disability or bankruptcy is:

Death

This is pretty straight forward, once you are medically pronounced dead, you would need to submit a death certificate.

Total & Permanent Disability (TPD)

According to the Social Security Act Guidelines, TPD defined disability as:

- (A) Inability to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months, or

- (B) In the case of an individual who has attained the age of 55 and is blind (within the meaning of blindness as defined in section 216(i)(1)), inability by reason of such blindness to engage in substantial gainful activity requiring skills or abilities comparable to those of any gainful activity in which the individual has previously engaged with some regularity and over a substantial period of time

To qualify for TPD discharge, you need to provide documentation from one of three sources:

- (1) U.S. Department of Veterans Affairs (VA)

- (2) Social Security Administration (SSA)

- (3) Medical Physician

Bankruptcy

You must declare Chapter 7 or Chapter 13 bankruptcy and demonstrate that repayment would impose undue hardship on you and your dependents. This must be decided upon an adversary proceeding in bankruptcy court. Your creditors may be present to challenge the request.

Bankruptcy courts: Determine your undue hardship by the following factors to determine whether requiring you to repay your loans would cause an undue hardship:

- (1) If you are forced to repay the loan, you would not be able to maintain a minimal standard of living.

- (2) There is evidence that this hardship will continue for a significant portion of the loan repayment period.

- (3) You made good faith efforts to repay the loan before filing bankruptcy.

FEDERAL | Student Loans

Since federal student loans are backed by the U.S. Department of Education and offer unique perks that you won’t find with private student loans. Some of the benefits of federal student loans include low interest rates, income-driven repayment options, and access to student loan forgiveness programs.

Death

- If you die, then your federal student loans will be DISCHARGED after the required proof of death is submitted.

- Parent Plus Loan: Your parent's PLUS loan will be discharged if your parent dies or if you (the student on whose behalf your parent obtained the loan) die

- Need to submit acceptable documentation of the borrower's death

- Available for Direct Loans, FFEL Program loans, and Perkins Loans.

Total & Permanent Disability (TPD)

- If you’re totally and permanently disabled, you may qualify for a discharge of your federal student loans

- Tax-free disability forgiveness (2018 Tax Cut & Job Act)

- Available for Direct Loans, FFEL Program loans, and Perkins Loans

Bankruptcy

In some cases, you can have your federal student loan discharged after declaring bankruptcy. However, discharge in bankruptcy is NOT an automatic process.

After a bankruptcy court determines your “undue hardship” via 3 Factors (see above), then 3 possible terms might be available for you:

- (1) Fully Discharged: You will not have to repay any portion of your loan + all collection activity will stop.

- (2) Partial Discharged: Required to repay some portion of your loan.

- (3) You may be required to repay your loan, but with different terms, such as a lower interest rate.

PRIVATE REFI | Student Loans

When I was a new OD graduate back in 2015, there were not too many private refi lenders out there, especially not for optometrists. Nowadays, due to competition in the space, rates are historically low and many private lenders (not all) are offering similar federal benefits such as forbearance, forgiveness for death or total disability (TPD), and even a cosigner’s release.

Let's talk about bankruptcy with private refinance loans. Refinanced student loans are essentially new loans taken out with a private lender – so when talking about whether refinanced student loans are dischargeable upon bankruptcy, you should look at them like consumer debt.

There might be some situations in which private student loans may be dischargeable due to personal bankruptcy, but keep in mind that private student loans are very rarely discharged in bankruptcy (similar to federal student loans) and that OD shouldn’t be considered a realistic option.

Now let’s go through all the popular private Refi Lenders and what perks they can offer in term of forgiveness:

Credible has the largest list of banks that they work with, so forbearance and discharge on death/disability is dependent on individual lenders | List of Credible Lenders:

Advantage Education Loan:

- Forbearance

- Loans discharged upon death or disability of borrower

- Cosigner release: After 36 months

Brazos Student Loans (Texas only)

- Military deferment, forbearance

- Loans are discharged on death or disability

- Cosigner release: None

Citizens Bank:

- Academic deferment, military deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: After 24 to 36 months

College Ave Student Loans:

- Military deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: After 24 to 36 months

Commonbond:

- Academic deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: Yes

EDvest in U

- Academic deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: After 36 months

Education Loan Finance

- Forbearance

- Loans NOT discharged upon death or disability

- Cosigner release: No

INvestEd

- Academic deferment, military deferment, forbearance

- Loans NOT discharged upon death or disability

- Cosigner release: Yes

ISL Education Lending

- Academic deferral, military deferral, forbearance

- Loans discharged upon death or disability

- Cosigner release: After 24 months

Mefa

- Military deferment

- Loans discharged upon death or disability

- Cosigner release: No

PenFed Credit Union

- No forbearance but PenFed will work case-by-case

- Loans NOT discharged upon death or disability

- Cosigner release: After 12 months

RISLA (Rhode Island Student Loan Authority)

- Academic deferment, military deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: No

Texas Only

- Military deferment, forbearance

- Loans are discharged on death or disability

- Cosigner release: No

- Academic deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: Yes

Similar to Credible, the 5 banks that they partner with will have forbearance and discharge on death/disability dependent on individual lenders themselves.

First Tech

- No forbearance/military deferment or academic deferment

- Loans NOT discharged upon death or disability

- Cosigner release: No

Laurel Road

- Academic deferment, military deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: After 36 Months

PenFed Credit Union

- No forbearance but PenFed will work case-by-case

- Loans NOT discharged upon death or disability

- Cosigner release: After 12 months

Earnest

- Academic deferment, military deferment, forbearance

- Loans are discharged on death or disability

- Cosigner release: No

Education Loan Finance (ELF)

- Financial hardship or medical forbearance up to 12 months

- Loans NOT discharged on death or disability but open to review by credit manager

Sofi:

- Academic deferment, military deferment, forbearance

- Loans are discharged on death or disability

- Cosigner release: No

U-Fi (Nelnet)

- Academic deferment, military deferment, forbearance

- Loans discharged upon death or disability

- Cosigner release: After 24 Months

Since Lendkey work with a wide variety of smaller credit unions and banks, Forbearance and discharge on death/disability is dependent on individual lenders but overall, they strive to offer these similar benefits across the platform

- Academic deferment, military deferment, Forbearance

- Loans are discharged on death or disability or bankruptcy of borrower

- Cosigner release: Yes

Lendkey: “It is certainly not a frequent occurrence given the relatively young age of the borrower demographic; but if it happens, we immediately notify the lender and the lender determines how it wants to handle the situation if it does not fall into one of the two scenarios above. These lenders are often not-for-profit credit unions and community banks who do everything they can to support their members and customers, but there is no guarantee of forgiveness in death or disability”

- Academic deferment, military deferment, forbearance

- Loans are discharged on death or disability

- Cosigner release: No

- Academic deferment, military deferment, forbearance

- Loans are discharged on death or disability

- Cosigner release: No

Although First Republic Bank has offered direct student loan refinancing in the past, it no longer does. Instead, it has replaced traditional student refinancing by allowing ODs to refi student loans into a personal line of credit. This does prevent an OD from refinancing with another student loan lender in the future

- No forbearance but hardship deferment (up to 1 month)

- Loans are NOT discharged upon death or disability

- Cosigner release: No

Two Important Facts about Student Loans:

- (1) Federal student loan disability/death forgiveness is TAX-FREE, but private student loan disability/death forgiveness is NOT TAX-FREE

-

- Starting in 2018 via Tax Cut & Job Acts, federal student loan forgiveness due to death or permanent disability is tax-free. But your private lenders might send you (or your estate upon death) a 1099 form for the IRS to collect taxes on the amount forgiven. So make sure you are taking out an appropriate term life insurance or disability policy to help with this tax bill

- Starting in 2018 via Tax Cut & Job Acts, federal student loan forgiveness due to death or permanent disability is tax-free. But your private lenders might send you (or your estate upon death) a 1099 form for the IRS to collect taxes on the amount forgiven. So make sure you are taking out an appropriate term life insurance or disability policy to help with this tax bill

- (2) Should I use a Cosigner on my refi student loan?

-

- While we do not recommend adding a cosigner to your private loan (since their debt becomes your debt), some ODs are not able to qualify alone on their income without a cosigner such as a spouse or parent. The downside is that the co-signer may still be responsible for the loan if you die.

- While the majority of private lenders offering a cosigner release due to unfortunate events, if your particular lender doesn’t, just make sure you have a little extra life and disability insurance if you use a co-signer.

- While we do not recommend adding a cosigner to your private loan (since their debt becomes your debt), some ODs are not able to qualify alone on their income without a cosigner such as a spouse or parent. The downside is that the co-signer may still be responsible for the loan if you die.

Summary:

In the past, refinancing your federal student loans meant you lost all the vital federal benefits that protect you from financial catastrophes, but that is NOT true anymore. With the competitive market of private lenders, trying to get your student loan business and offering similar benefits, it is almost a no-brainer to refinance your federal loans to get a lower interest rate! Just make sure you are not pursuing any of the federal forgiveness programs like 10-year PSLF or 20-25 total forgiveness or if your debt-to-income ratio is 3:1 or higher.

As always, Dat and Aaron are here to help you out during your student loan journey. Here are some amazing refi student partners that we partner with to get you the lowest rate + best benefits!

Want to learn how to learn how to manage your Student Loans? Check out The Optometrist's Guide to Student Loans

Want get the lowest ReFi Student Rates + $1000? Compare Recommended Student Refi Lenders

Chapter 7 allows most people to discharge their debts in a short period of time (usually about four months) and get a fresh financial start. From a bankruptcy lawyer’s perspective, preparing a Chapter 13 case is very similar to a Chapter 7 case.