Tax CPA | Bookkeeping Experts

Need a trusted CPA agent or Bookkeeper to handle all your complicity of your optometry business? We are excited to partner with these recommended and reliable Tax Agents! We often get asked who we recommend for Tax preparation (preparing your tax form) to tax strategizing (helping the OD in planning way to lower his or her tax bill)! So after extensive research and interviews, these firms are excellent in planning and helping your optometric business. Fees are typically per project/return or at an hourly rate.

Associate Doctor (W2, 1099) | Sublease Owner | Practice Owner

Experience a clear, professional, and affordable approach to taxes. Our Tax Advisory & Filing plans start at $50/month. Enjoy year-round, unlimited tax advisory and support without hidden fees or unexpected end-of-year costs. Rely on our licensed CPAs for a worry-free tax season.

Start by scheduling a 15-minute call between May and December, as we only onboard new tax clients during this period to guarantee a customized and exceptional tax season experience. Then, when tax season arrives, we'll provide a tailored list of tax documents for submission, ensuring nothing is overlooked. As a result, submitting your tax documents to us will be a seamless and hassle-free process.

Refractional CFO, founded by Jackson Pace, a Certified Public Accountant (CPA) with experience in public accounting, specializes in providing tailored tax, bookkeeping, and fractional CFO services for optometrists. With his full-time experience as CFO for an extensive OD/MD practice operating across multiple states with retail optical branches, he carries a wealth of industry expertise. He looks forward to being your advisor and empowering you with the help you need to thrive!

-

✅ Tax advisory & filing: Affordable pricing (W2, 1099, business), Unlimited tax support

-

✅ Bookkeeping with unlimited support

- ✅ Monthly insights: Practice Ratio Analysis, Profit-first Budgeting, Key Metric Tracking

📧 Jackson Pace, CPA | jackson@refractionalcfo.com | Call/Text (435) 200-1951

Associate Doctor (W2, 1099) | Sublease Owner | Practice Owner

For Eyes Bookkeeping, LLC offers professional bookkeeping services for professional optometrists. Founded and operated by Wade Weisz, OD, the team at For Eyes Bookkeeping brings more than 25+ years of experience in private practice ownership.

We are on a mission to help optometrists maintain financial compliance, save hours of time each month, and boost profits by being a trusted financial partner.

Our bookkeeping packages are 100% tax deductible and cover all the essential bookkeeping services needed to run your practice. We also offer add-on services, like bill pay, budgeting, clean up and catch up, team member productivity tracking, and more to help your practice succeed to the fullest extent!

- ✅ Classify & Record Transactions

👉 Book a FREE consultation with us today to get your financial future off the ground.

📧 Contact: Wade Weisz, OD at info@foreyesbookkeeping.com | (408) 214-1222

Related Articles

2024 Optometrist Income Report

With increasing student loan debts, an ever changing economy, and a profession that continues to withstand disruption – many optometrists begin to question their associated worth as practitioners. While the old phrase “comparison is the thief of joy” rings true in certain facets, comparison to get a true sense of trends in salary, debt load…

16 End-of-Year Financial Checklist For Optometrists in 2023

As 2023 draws to a close, it’s vital for optometrists to focus on financial planning for a stable and prosperous future. This checklist, designed for eye care professionals, will guide you through key year-end financial tasks. While not every item may apply to your practice or personal finances, reviewing each one ensures you don’t miss important opportunities or obligations.

October 2023 Market Update for Optometrists: Latest Economic & Financial Trends

The economic landscape is characterized by a steady 3.7% inflation and cautious actions from the Federal Reserve, particularly in managing interest rates to avoid potential economic downturns. While some economic indicators like GDP growth appear robust, there’s a visible undercurrent of economic stress and mixed expert predictions regarding a potential recession in 2024.

Good vs. Bad Optometry Debt – 4 Ways to Use Good Debt to Your Advantage

That being said, debt can be a useful tool for achieving financial goals, but not all debt is created equal. Some debt can be beneficial, while others can be detrimental to your financial well-being. Let’s explore the difference between good debt and bad debt and how you can use debt to your advantage.

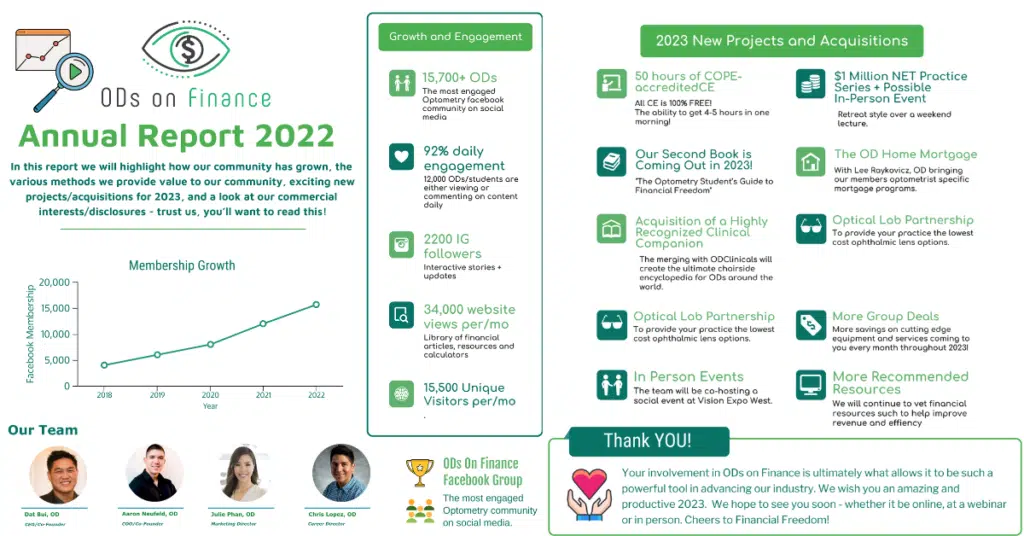

State of ODs on Finance: 2022 in Review, and a Look at 2023!

It’s hard to believe, but the year 2022 has vanished in the blink of an eye. This past year, we’ve had the pleasure of seeing ODs on Finance continue to grow and help ODs on their financial journey, whether they be new grads or seasoned veterans. We are thankful for your attention, your questions and your contributions. Two tenets that hold paramount value to us at ODs on Finance are transparency and productive growth. In this letter, we will highlight how our community has grown, the various methods we provide value to our community, exciting new projects/acquisitions for 2023, and a look at our commercial interests/disclosures – trust us, you’ll want to read this! Here is a quick recap of 2022!

6 Common Tax Mistakes That Optometrists Make

Optometrists are not trained in maximizing their tax benefits. Consequently, doctors who prepare their taxes themselves may miss many deductions they are entitled to take. I don’t know about you, but I want to take advantage of all the tax benefits I am entitled to. Following are six mistakes I see optometrists make that are costing them a lot of money in overpaid tax bills.

Three Important Tax Facts for Optometrists Investing in Cryptocurrency

For the past two years, as we have been in the middle of a global pandemic, many Optometrists have become interested in cryptocurrencies. This article will explain some of the basic questions you may have about cryptocurrency from a tax point of view.

5 Tips for Avoiding an IRS Audit For Optometrists

While an IRS audit can happen via random selection, in many cases, it’s the actions of the taxpayer that trigger the audit process. And that’s why we put together this helpful guide—outlining five common red flags. Understanding these triggers can save you a lot of potential trouble and anxiety.

Annual Report: 2020

Well 2020 has surely been a year! Let’s be honest, we all went into the year 2020 with big expectations – but the so-called Year of the Optometrist had some nasty surprises up its sleeve. Despite the trials and tribulations that 2020 brought, it also brought important lessons, and the looming importance of financial education…