Posts by Dr. Aaron Neufeld

2024 Optometrist Income Report

With increasing student loan debts, an ever changing economy, and a profession that continues to withstand disruption – many optometrists begin to question their associated worth as practitioners. While the old phrase “comparison is the thief of joy” rings true in certain facets, comparison to get a true sense of trends in salary, debt load…

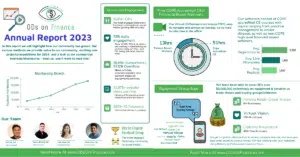

Read MoreAnnual Report 2023: In Review, and a Look at 2024!

In the next reading, you’ll discover metrics that mirror our community’s overall progress, along with the resources and offerings this growth has enabled us to continue providing. Next, we’ll transparently outline the methods ODs on Finance employs to generate revenue. Lastly, we’ll offer you a sneak peek at some major projects we’re embarking on for 2024, aiming to further our profession and assist every OD in achieving financial freedom.

Read MoreNavigating the Path to Cold-Starting an Optometry Practice: A Journey of Passion and Persistence with Dr. Ashley Szalkowski

Driven by the desire for change and a fresh approach to eye care, Dr. Ashley Szalkowski shares insights into the process of establishing a thriving practice from the ground up.

Read MoreGood vs. Bad Optometry Debt – 4 Ways to Use Good Debt to Your Advantage

That being said, debt can be a useful tool for achieving financial goals, but not all debt is created equal. Some debt can be beneficial, while others can be detrimental to your financial well-being. Let’s explore the difference between good debt and bad debt and how you can use debt to your advantage.

Read MoreState of ODs on Finance: 2022 in Review, and a Look at 2023!

It’s hard to believe, but the year 2022 has vanished in the blink of an eye. This past year, we’ve had the pleasure of seeing ODs on Finance continue to grow and help ODs on their financial journey, whether they be new grads or seasoned veterans. We are thankful for your attention, your questions and your contributions. Two tenets that hold paramount value to us at ODs on Finance are transparency and productive growth. In this letter, we will highlight how our community has grown, the various methods we provide value to our community, exciting new projects/acquisitions for 2023, and a look at our commercial interests/disclosures – trust us, you’ll want to read this! Here is a quick recap of 2022!

Read More6 Tips for Utilizing Cost Benefit Analysis on a New Piece of Equipment

New equipment is always a temptation for practice owners, and for good reason. A cost-benefit analysis (or CBA for short) is a term derived from Lean theory and is an analysis of the expected balance of benefits and costs, including an account of any alternatives and the status quo. CBA takes into account your overall return on investment (ROI), however the approach is a little less black and white than might be expected. Let’s go through 6 important tips on utilizing CBA to its full extent in order to find whether that new piece of equipment should find its way through your practice doors.

Read MoreHow Dr. Kala Brown Eliminated $180K While Dealing with Husband’s Leukemia in 7 years #InspirationalStudentLoansSuccess

When it comes to loan debt elimination, Dr. Kala Brown Brewer’s story of eliminating $180,000 in student loan debt over 8 years is especially inspiring and heart wrenching. As a newly minted SCO grad in 2013, Kala first did a residency and then embarked on a career at an ophthalmology practice in North Carolina. Upon arriving at her new job, Kala found out that her husband had a relapse of leukemia.

Read More3 Important Steps to Do Due Diligence For a Successful OD Practice Purchase

Purchasing a practice is an exciting yet daunting process for both new grad and seasoned optometrists alike. One of the reasons purchasing a practice is so daunting is due to the uncertainty that comes with becoming the new owner of an existing business….Due diligence methodology for purchasing an optometric practice has been nearly universally defined by prominent valuation experts in the field. This is the 3 methodology that we will be discussing.

Read More8 Dos and Don’ts When Purchasing an Optometry Practice

Practice ownership is often heralded as one of the pinnacles of an optometric career. Having ownership of a practice often allows for higher income, and more importantly: freedom and autonomy to practice as one sees fit. In my career, I have had the privilege of buying my own practice as well as helping others through the buying process… So whether you are a newly minted graduate looking to begin your legacy, or you are a seasoned veteran looking to acquire another piece of your empire – use these points to help guide you towards your next big purchase.

Read MoreBoosting In-Office Revenue (Virtual Webinar)

Click here to watch on YouTube Growing a practice and keeping it profitable requires an ever evolving mindset that embraces both technology and creativity. In this panel discussion with industry experts Dr. Ryan Gustus, Perry Brill and Steve Alexander; we discuss implementation and execution of strategies ranging from materials sales to insurance. The following key…

Read More