The Optometrist's Guide to Student Loans

Editor's Note: By: Dat Bui | Updated Sept 3, 2023

Since federal programs and student loan policies change all the time, we try to keep this guide updated with the latest information as much as possible.

The Optometry Student Loan Crisis

As of 2023, the student debt crisis in the United States has ballooned to a staggering $1.77 trillion, posing a societal epidemic that hampers the financial growth of many young professionals. This financial burden often forces newly minted doctors to live with their parents longer, unable to afford rent or even contemplate buying a home. Consequently, these financial pressures delay life milestones like starting a family, primarily because these young professionals struggle to manage their own finances.

While we have worked with current optometry student to outline strategies for significantly reducing the amount of student loans you may need to take—such as securing scholarships and living frugally—the unfortunate truth remains: the majority of doctors will graduate with substantial student loan debt.

Optometrists face an even bleaker financial picture. The average starting salary for new optometry graduates stagnates at around $120,000, whereas the average student debt is rising, often exceeding $250,000—with some doctors accruing nearly $350,000 in debt. Therefore, it is crucial for optometry students to be acutely aware of these financial pitfalls and to formulate a robust student loan repayment plan as soon as they start drawing a doctor's salary.

So, what is the typical approach among optometrists? Many yield to societal expectations to maintain a "rich doctor lifestyle," relegating their student loans to the back burner. They make minimum payments over two decades or more, hoping for a miraculous loan forgiveness from the government after 20 to 25 years. Unfortunately, this is the norm, and the norm falls short. A "normal" approach won't lead to wealth or remarkable success.

Let's change this narrative. This guide will guide you through taking control of your financial destiny, specifically concerning your student loans after graduation.

The Harsh Reality of Optometry

When I was a young optometry student in 2015, I bought into the sad illusion that my “amazing optometrist salary“would easily enable me to pay off my student loans and was a fast-track to building wealth. Unfortunately, this wasn’t the case.

After all the graduation celebrations ended, I was slapped with my first loan payment. I quickly realized that my 6-figure salary was not enough to cover this monthly payment.

An optometrist paying off student loans in 2019 is a lot different than one who graduated 10 years ago. Simply put, the cost of attending optometry school is almost double what it was 10 years ago, while optometrist salaries have remained relatively stagnant.

Currently, optometry schools are not required to teach personal finance. Sure, there is a mandatory federal loan “exit” counseling that often leaves 4th year students more confused than anything. Often, these counseling sessions don’t educate students in choosing the best payoff strategy for their situation.

With the vast complicated multitude of student loan types, refinancing, consolidation, or whether to pursue loan forgiveness - it can be overwhelming. Therefore, it is even more vital for the optometrist to have a solid game plan and we hope this comprehensive guide will educate and allow you to have the best strategy to take down your massive student loans for your own financial situation.

"Sadly, most optometrists pay the minimum amount for 20+ years, hoping that our government will miraculously forgive their loans after 20-25 years. This is unfortunately the norm. Don’t be normal...normal sucks! Normal people don’t get rich or become wildly successful"

Step 1: Understand the Extent of Your Loan Debt

Firstly, you must be fully aware of the amount of student loan debt you have incurred—from undergraduate through optometry school. Most of your loans will likely be federal loans, accessible through the Department of Education.

You can easily review all your federal loan information using the National Student Loan Data System (NSLDS), which provides a comprehensive, national record of all your loans and grants, including balances, interest rates, servicers, and loan durations. Access this information through the Federal Student Loan Repayment website (https://studentloans.gov) using your Federal Student Aid (FSA) ID.

For any private loans, consult www.annualcreditreport.com to view all your outstanding debts.

Step 2: Identify the Type of Student Loan

Private Student Loans: These are usually more expensive, with higher interest rates that can exceed 10%. Interest accrues even while you're in school. Essentially, these loans are treated like consumer credit debt or business loans and usually require a good credit score or a co-signer if your credit score is poor.

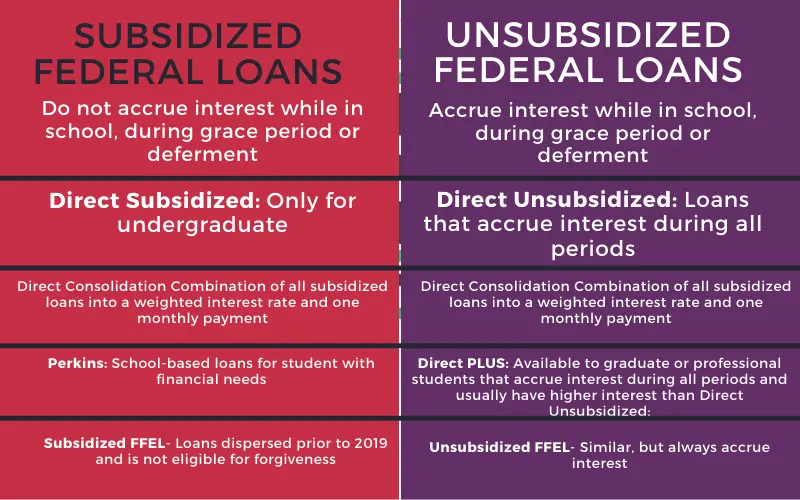

Federal Student Loans: These are generally less expensive, with average interest rates around 6.8%, and come with multiple government program benefits. Federal loans also have a grace period that allows you to defer payments while you're in school—at least as a half-time student. If your federal loans are subsidized, the government will cover the interest during your school years.

Step 3: Choose the Repayment Strategy That Best Suits You

There are five primary strategies for repaying optometry school loans, each with its own set of implications and advantages. These include:

- (I) Tuition Reimbursement Program

- (II) Standard Federal Payment Plan

- (III) Federal Loan Forgiveness Program ( 10 years Public Service Loan Forgiveness)

- (IV) Federal Loan Forgiveness Program ( 20-25 years Total Forgiveness)

- (V) Aggressive Debt Payback Through Student Loan Refinancing

Let's dive into each of these options in more detail:

I) Tuition Reimbursement Programs

Tuition Reimbursement Programs are employer benefits wherein the employer allocates a set amount of "free" money as a part of your salary benefits toward your student loans, usually in exchange for a commitment to work for a specific number of years. Some programs might require you to contribute a certain amount, which they then match or reimburse. Here's a quick review:

Military Health Professions Scholarship Programs

Though called a "scholarship," the Military's Health Professions Scholarship Program (HPSP) is more aptly described as a contract. This program covers tuition, fees, and necessary expenses while providing a taxable living stipend—about $2,200 per month as of 2023. In return, you commit to a year of active military service for each year you received this funding. Be aware that military optometrists usually earn less than their civilian peers and must adapt to military governance over various aspects of their professional and personal lives.

Indian Health Service (IHS) Programs

Similarly, the Indian Health Service (IHS) offers what is called a "scholarship," but is essentially a contract. Eligibility is limited to members of a federally recognized American Indian Tribe or Alaska Native village. The program provides a monthly living stipend (at least $1,500 as of 2023) and covers all tuition and fees. In return, you commit to one year of service for each year of scholarship support, with a minimum of two years, serving primarily Native American communities.

Corporate Employer Loan Repayment Programs

Some private employers in the optometry sector, such as Lenscrafters, National Vision (also known as America's Best), and Walmart Optometry, offer loan repayment programs. These programs partially cover tuition and generally last between 2 to 4 years. While this benefit may be taxable, some recent legislation allows a portion to be tax-free for the employee and tax-deductible for the employer. Bear in mind that these programs are often seen by employers as an alternative to a higher salary, rather than an additional benefit. However, they could serve as a negotiation point when you're seeking your first job post-graduation. Often, these programs come with specific location requirements, frequently in more rural areas.

By understanding these options, you'll be better equipped to choose a repayment route that aligns with both your career goals and financial needs.