The Optometrist's Guide to Student Loans

Chapter 2: (II) Standard Federal Payment Plan

If you're not eligible for tuition reimbursement or loan forgiveness programs, then your primary option is to pay off your student loans outright. You can either do this through a federal repayment program or take the arguably smarter route of refinancing into private loans for a lower interest rate

Unlike some other repayment options, there's no prescribed timeline for paying off these loans. You could technically pay them off immediately (though this is unlikely unless you have wealthy parents or win the lottery), or you can stretch the payments out for as long as you'd like—up to a maximum of 30 years. The length of time you choose will influence your monthly payments, which are also determined by the type of repayment plan you select.

If you're like most optometrists, you likely financed your optometry education (or perhaps even your undergraduate education) through federal loans, serviced by organizations like Nelnet, Great Lakes Education Loan Services Inc., Navient, or FedLoan Servicing, to name a few. While you can manage multiple monthly payments to different servicers, a more efficient first step would be to consolidate these loans through a Direct Consolidation Loan.

Understanding the Difference: Consolidation vs. Refinancing

Consolidation enables you to combine all your federal student loans into a single loan under a federal lender, simplifying the repayment process with just one monthly payment. The interest rate for the consolidated loan is an average of the rates on the loans you are bringing together, meaning your final rate could be a bit higher or lower than your current rates. The key benefit of consolidation is the convenience of having a single monthly payment to manage.

Refinancing: It's important to distinguish this from refinancing your student loans. Refinancing typically involves consolidating all your federal loans into a single private loan payment, usually at a lower interest rate. However, once you refinance, you are effectively exiting the federal loan program, and you'll lose any federal benefits that come with it. Refinancing is a definitive decision that should be made carefully, considering the trade-offs involved.

Types of Federal Loan Payment Programs Explained

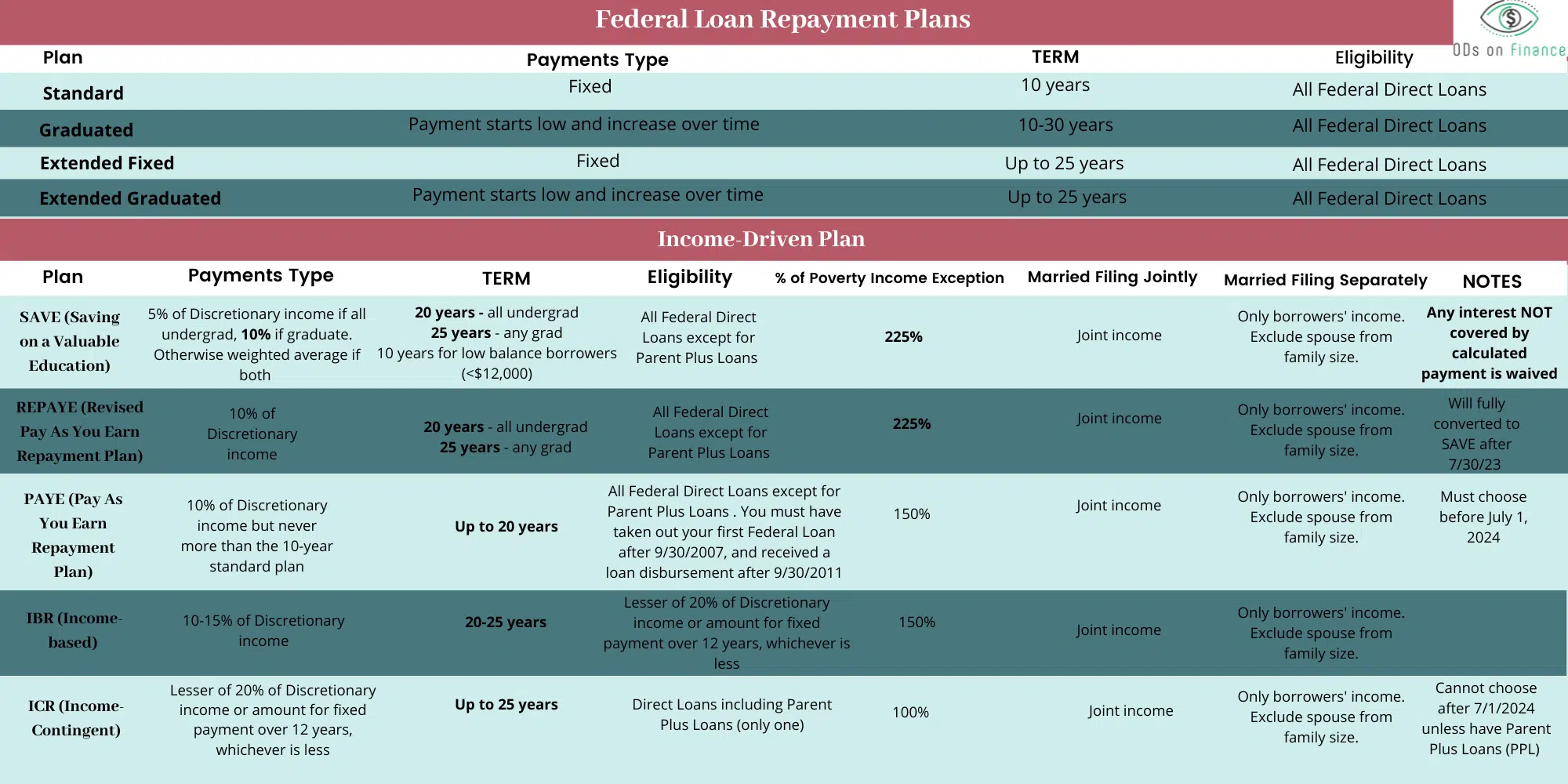

Standard Repayment Plan: This plan is generally set to a default term of 10 years but can be extended up to 25 years (known as the Extended Repayment Plan). It involves consistent monthly payments and usually accrues the least amount of interest over a 10-year repayment period.

Graduated Repayment Plan: In this plan, your payments start out low and gradually increase over the life of the loan. That means you'll be making the highest payments toward the end of the repayment term.

Income-Contingent Repayment Plan (ICR): Similar to IBR, this plan offers a monthly payment that's either 20% of your discretionary income or a fixed amount based on a 12-year repayment plan, whichever is lower.

Income-Based Repayment Plan (IBR): Here, your monthly payments will be between 10% and 15% of your discretionary income and will be recalibrated each year based on your income and family size. Note that if you're married, your spouse’s income will be included in the calculation.

Pay As You Earn Repayment Plan (PAYE): Like REPAYE, this plan caps your maximum monthly payment at 10% of your discretionary income. Your payments will actually be lower if you have a high debt-to-income ratio, but they won't exceed what you'd pay on the standard repayment plan.

Revised Pay As You Earn Repayment Plan (REPAYE): This plan sets your monthly payments at 10% of your discretionary income but will be phased out and replaced by SAVE after July 30, 2023.

SAVE (Saving on a Valuable Education): This is the newest Income-Driven Repayment (IDR) plan, and all REPAYE borrowers will automatically transition to it. SAVE has several significant benefits for optometrists:

- It offers a 100% interest subsidy on any accruing interest, meaning if your payments don't cover the interest, you won't be responsible for the interest that accrues. This is particularly beneficial for lower-income borrowers.

- If married, you can exclude your spouse's income by filing taxes separately.

- The income exclusion for payment calculation increases from 150% to 225% of the poverty income level.

- Note: Discretionary income is what you earn above 150% of the federal poverty level for your family size. If you're married, your spouse’s income will be counted, which will increase your monthly payment.

- In essence, SAVE only charges 5% of your discretionary income for undergraduate loans and 10% for graduate loans. If you have both, a weighted average will apply.

Financial Pearl

Confused by all these income-driven plans? Don't worry. Usually during your school exit interview, choosing SAVE or PAYE is the recommended route. If you're aiming for total federal loan forgiveness, SAVE generally results in the lowest total payments over 25 years, whereas PAYE offers a shorter forgiveness term of 20 years. However, if you plan to refinance your student loans or are considering the 10-year Public Service Loan Forgiveness (PSLF) program, then SAVE is the way to go.

Check out the Student Loan Payment | Forgiveness CALC to see the different payment options.

3 Notable Benefits of Federal Programs:

I'd like to spotlight some significant perks associated with federal loan programs:

- Flexible Repayment Plans: These plans can be easily modified during financial hardships, a feature that's particularly helpful for doctors who may experience fluctuations in income.

- Total Forgiveness: If a borrower, who has no cosigner, either passes away or becomes fully or partially disabled, all federal loans will be entirely forgiven. However, it's important to note that declaring bankruptcy won't lead to loan dismissal. In such cases, the government retains the authority to garnish future earnings.

- No Need for Good Credit to Consolidate: Unlike private refinancing, where your credit score could substantially impact your interest rate, the federal government offers consolidation at the same rate for everyone. This can be beneficial for doctors with poor credit scores, although it might feel frustrating for those who have maintained excellent credit.