Conquering a Mountain of Debt: Paying off $242K in 7.5 Years on an Starting Salary of $85K as an Optometrist

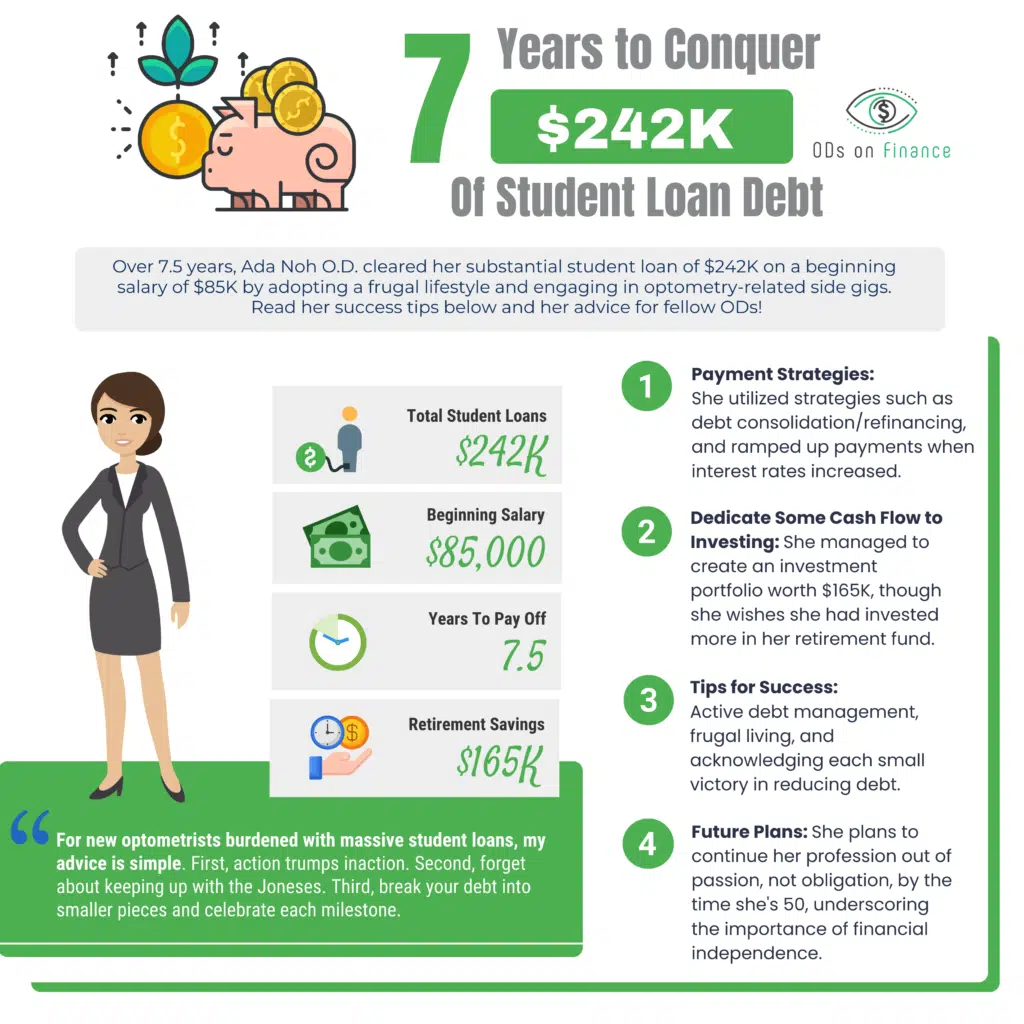

Editor’s Note: This is a guest post written by Dr. Ada Noh, a graduate of the University of Pittsburgh and Pennsylvania College of Optometry, is an active participant in the American Optometric Association and the Arkansas Optometric Society. After years in private practice, she discovered her passion for treating Dry Eye Disease, an underserved area that she is eager to assist. By sharing her story of paying off a substantial $242K student debt in 7.5 years on the ODsonFinance Community, she aims to inspire and motivate new graduates, showing them that such a feat is indeed possible. Now debt-free, she plans to pursue her profession out of love rather than obligation, demonstrating the significance of financial independence.

KEY POINTS:

-

Over 7.5 years, Ada Noh cleared her substantial student loan of $242K on a beginning salary of $85K by adopting a frugal lifestyle and engaging in optometry-related side gigs.

-

To manage her loan, she utilized strategies such as debt consolidation and refinancing, and ramped up payments when interest rates increased.

-

Simultaneously, she managed to create an investment portfolio worth $165K, though she wishes she had invested more in her retirement fund. Also opening a cold start!

-

For graduates dealing with hefty loans, her guidance includes active debt management, frugal living, and acknowledging each small victory in reducing debt.

-

Now free from student debt, she plans to continue her profession out of passion, not obligation, by the time she's 50, underscoring the importance of financial independence.

Journey to Financial Freedom

Hey ODsonFinance Community! My name is Ada Noh and I have a unique (and rather unbelievable) story to share today, revolving around my personal experience with student loans, my career journey in optometry, and how I managed to transition from a life burdened with debt to financial freedom. It's my hope that this insight will inspire and provide practical advice to those walking a similar path especially for all those new grad students with a massive debt to income ratio.

Embarking on the Optometry Adventure

I graduated in 2015 from the esteemed Pennsylvania College of Optometry at Salus University. My optometry career has been a fulfilling, diverse journey, with roles in private practice, OD/MD, solo OD, multi-OD, and even a dry-eye only specialty practice. Besides full-time work, I've taken up opportunities in retail, mobile/pop-ups, and nursing homes – basically anywhere an opportunity arose, I grabbed it. My adventure took me from Philly/South Jersey to Little Rock, AR, where I opened a cold-start optometry practice without a professional network in place. What seemed like a crazy, bold move has proven incredibly rewarding.

My starting salary was around 85k, and before starting my practice, I was approaching the 200k mark.

The Debt Mountain: $242K Student Loan

But there was a catch to all this – the $242k student loan I started with, which I managed to pay off over 7.5 years. The interest rates started at 6.8% and after refinancing, dropped to just under 5%. During the covid pandemic, I shifted to variable rates, ranging between 1-6%. Initially, I was just paying the minimum after refinancing during covid. But as the interest rate began climbing above 4%, I had to start paying more aggressively.

The Drive to Freedom: Eradicating Debt

What really pushed me to get rid of my loans so quickly? One word – freedom. The mental burden of debt was far too heavy, casting shadows over otherwise joyful occasions. I found it challenging to enjoy vacations or even small indulgences as the guilt of unaddressed debt lingered.

To stay focused, I lived like a student and set monthly payment goals. I consolidated all my debt early into one loan, eliminating the need for the avalanche or snowball method. My side hustles were all optometry-based, providing the best income for the least amount of time. I was even working Saturdays and Sundays!

Mastering Mindful Spending

The main keys to my success were frugality and mindful spending. For instance, I did not upgrade my car upon graduation – I'm still driving the 2012 Nissan Rogue base model gifted to me by my parents. I also avoided the temptation of buying lunch frequently.

Throughout this journey, I never considered loan forgiveness or other repayment plans. My objective was clear – to become debt-free as quickly as possible. As for refinancing, I used Sofi twice – once in 2015 and again in 2020.

Balancing Act: Loan Repayment and Investment

Despite aggressive loan repayment, I managed to dedicate some cash flow to investing and retirement, accumulating an investment portfolio of about 165k. In retrospect, I wish I had put more towards my retirement vs my debt.

Balancing loan payoff and life expenses was a challenging act, one that involved working extra shifts and living with roommates. But it wasn't all work and no play. I lived life fully, though mindfully, understanding that smaller expenses accumulate over time.

Reflections and Advice for New Graduates

Looking back, I don't regret my journey. I do wish, however, I had contributed more towards my retirement. Yet, I am grateful for the peace of mind I've earned and don't regret working those extra shifts.

For new optometrists burdened with massive student loans, my advice is simple. First, action trumps inaction. Second, forget about keeping up with the Joneses. Third, break your debt into smaller pieces and celebrate each milestone.

Conclusion: Towards a Debt-Free Future

As for my future, I aim to work because I love it, not because I have to, by the age of 50. My dream is to travel for 3-6 months a year! And as a celebration for this milestone, I plan to rest, enjoy sushi omakase, visit the spa, save for a new car (with no rush), and simply bask in the relief of being free from my student loan debt. Also, I am looking forward to more luxurious travels.

In closing, I would say that while the journey might be challenging, the reward of financial freedom and peace of mind is truly worth it. Keep striving, and remember, every small step counts!

Want to learn how to manage your Student Loans? Check out The Optometrist's Guide to Student Loans?

Want to get the Lowest Student Refi Rates? Compare & Shop Recommended Student Loans Refi

Facebook Comments