To Get Started on Your Financial Journey, Follow These Simple Steps...

-Dat & Aaron | Co-Founders

This rapidly growing community, boasting over 18,000 optometrists, is eager to assist with your financial inquiries. We offer advice on investment strategies, student debt management, and provide support and encouragement. Additionally, Dat and Aaron are available daily for direct, additional help.

If you wish to share your financial situation anonymously, please send us a direct message on Facebook for any private member posts!

2. Subscribe To Our Financial Newsletter

Rest assured, Dat and Aaron despise spam just as much as you do! Our aim is to furnish you with fresh and valuable articles, alongside the latest updates. We're committed to delivering quality content without the clutter of unwanted emails

3. Start With This Article And Keep on Reading the Latest Posts!

Through education, discussion, and tools, ODs on Finance strives to be a comprehensive resource for all finance-related matters. We aim to empower every optometrist, whether as an employee or practice owner, to achieve their full potential in their careers. Our objective is to help our colleagues in optometry and other healthcare professions live debt-free, financially liberated lives, and build substantial net worth. Financial freedom is one of the most valuable gifts you can give to yourself. Start learning today!

What Should I Do First? A Complete Step-By-Step Guide For Optometrists

Here is a “Guideline” list of financial steps that we hope will get you started, but should be adjusted to your own personal situation as an optometrist.

2024 Optometrist Income Report

With increasing student loan debts, an ever changing economy, and a profession that continues to withstand disruption – many optometrists begin to question their associated worth as practitioners. While the old phrase “comparison is the thief of joy” rings true in certain facets, comparison to get a true sense of trends in salary, debt load…

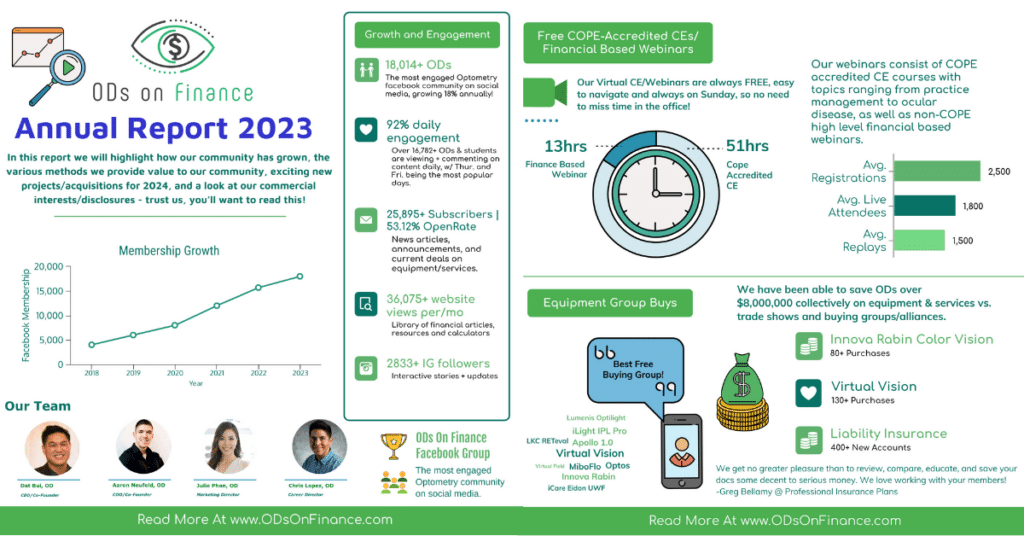

Annual Report 2023: In Review, and a Look at 2024!

In the next reading, you’ll discover metrics that mirror our community’s overall progress, along with the resources and offerings this growth has enabled us to continue providing. Next, we’ll transparently outline the methods ODs on Finance employs to generate revenue. Lastly, we’ll offer you a sneak peek at some major projects we’re embarking on for 2024, aiming to further our profession and assist every OD in achieving financial freedom.

The Optometrist’s Guide To Student Loan Refinancing

Optometrists often accumulate multiple loans from federal and private lenders to fund their doctor education, which results in an average debt load of $220,000. The majority of these loans are federal loans which have an average interest rate of 5.5-6.8%.Then the majority of doctors will end up refinancing their student loans to save thousands of dollars in interest. Here is your comprehensive guide to the student loan refinancing process and understanding how underwriting works.

16 End-of-Year Financial Checklist For Optometrists in 2023

As 2023 draws to a close, it’s vital for optometrists to focus on financial planning for a stable and prosperous future. This checklist, designed for eye care professionals, will guide you through key year-end financial tasks. While not every item may apply to your practice or personal finances, reviewing each one ensures you don’t miss important opportunities or obligations.

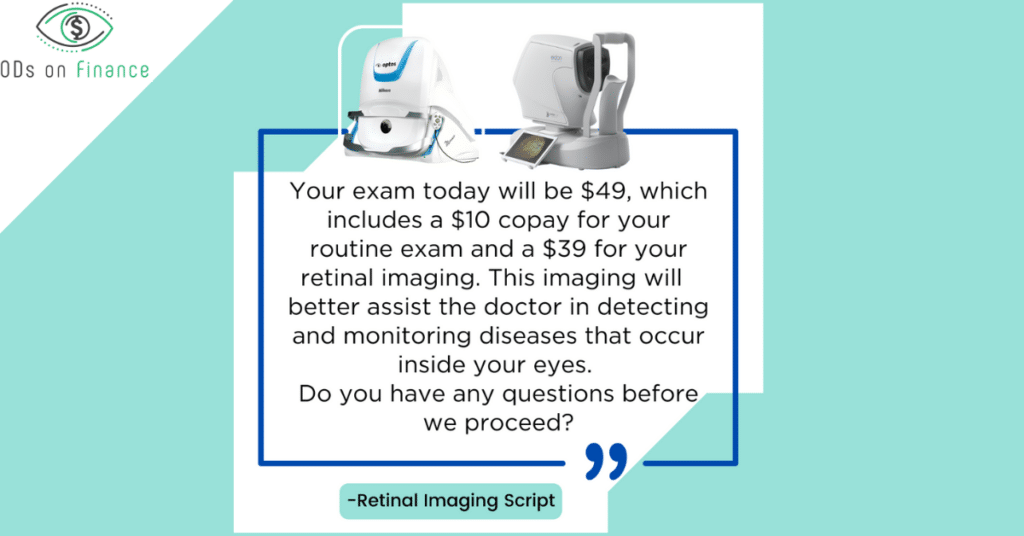

How To Achieve Over 90% Capture Rate With Optos/Eidon Widefield Script

As practitioners, we understand the importance of retinal imaging, and we need to be able to clearly explain that value to our patients. I’ve found that communication is key with patients – before, during, and after their appointments. This helps to eliminate any questions, and it ensures that they’re not only on board with the…

4. Check Out ODs on Finance Book Series

These books strives to teach student, young and experienced optometrists financial topics that were never taught in school, ranging from strategies on how to use a high-income salary to attack massive student debt, budgeting and saving for retirement, avoiding predatory advice from financial advisers, using tax strategies to save money, creating passive income, stepping into private practice ownership and how to build wealth through long-term investing in an ever-changing optometric world.

Clinical anecdotes and straightforward advice will keep students and new graduates entertained page after page while teaching important financial lessons to avoid potential pitfalls.

5. Refinance Your Student Loans Today to Save Money!

Great news! Aaron and Dat were able to negotiate and advocate for the best term rates and cash back bonuses for all ODs on Finance members/users looking to refinance their student loans.

Starts thousands worth on interest and get up to $1000 Sign-Up Bonus today!

6. Need Help with a doctor's home mortgage, disability/life insurance, or a tax CPA?

Whether you're in search of top refinancing lenders, insurance brokers, real estate assistance, tax professionals, or a book recommendation, this exceptional list of Recommended Resources is tailored for optometrists and other high-earning professionals. Aaron and Dat diligently vet each partner to ensure they uphold ethical standards and adhere to our stringent principles.

If you're seeking trusted and experienced professionals and services, you're in the right place!

Explore our upcoming virtual webinars, where we provide more than 50 hours of CE hours and financial webinars. Enjoy all of these for free and from the comfort of your own home!