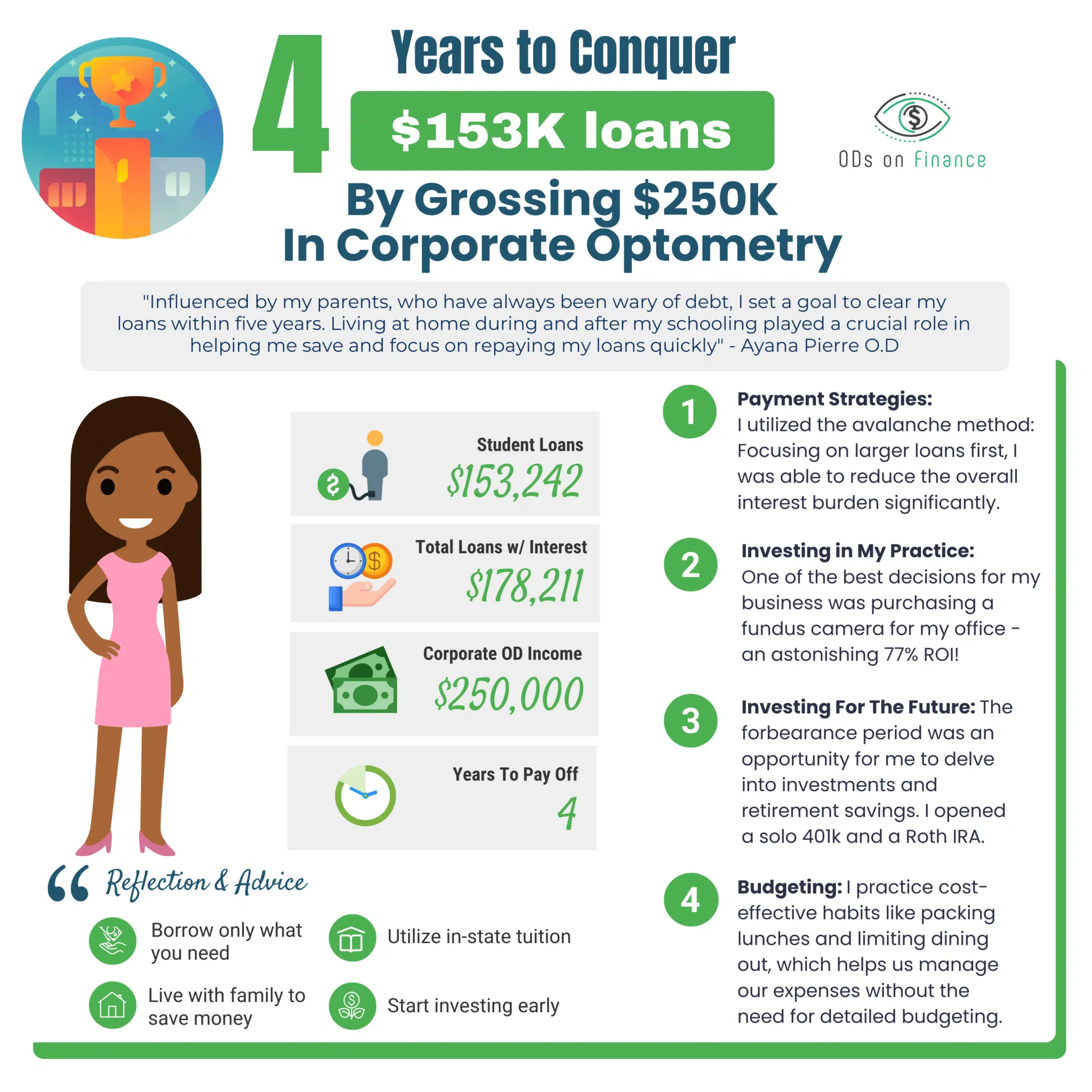

Overcoming $153,242 Student Loan Debt in Four Years Working in Corporate Optometry

Editor’s Note: This is a guest article with Ayana Pierre, a NSU 2019 graduate based in Central Florida, who shares her story on how she is able to pay off $153,242 in student debt, while commanding a whooping corporate salary of over $250,000 annually

My Educational Background and Career Choices

Hello, I'm Dr. Ayana Pierre O.D, and I graduated from NSU in May 2019. I chose the path of corporate optometry and currently practice in Central Florida. Working about 4.5 days a week, I've been fortunate to earn a gross income of approximately $250,000 last year. This achievement has been a blessing, providing me with not just financial stability but also the flexibility to manage my schedule effectively.

Tackling My Student Loan Debt

I began my professional journey with a student loan amount of $153,242. The interest during the deferment period pushed this to $178,211. Influenced by my parents, who have always been wary of debt, I set a goal to clear my loans within five years. Living at home during and after my schooling played a crucial role in helping me save and focus on repaying my loans quickly.

Editor's Financial Pearl

"Corporate Optometry, particularly in rural areas, often provides some of the highest salaries, whether you are an associate or a sublease holder. This setting not only teaches you how to be an efficient clinician, but it is also an excellent way for new graduates who are willing to dedicate a few years to quickly pay off their student loans.

Are you inclined to remain in private practice? You might want to consider a 6th or 7th day fill-in at a corporate location. Weekends there are lucrative due to high demand!"

My Approach to Debt Repayment

I found the avalanche method of loan repayment most effective. Focusing on larger loans first, I was able to reduce the overall interest burden significantly. This approach was partly inspired by the valuable insights I gained from resources like the ODs on Finance guides.

Investing in My Practice

One of the best decisions for my business was purchasing a fundus camera for my office. Not only did it offer a 77% return on investment in the first year, but it also allowed me to generate extra income, which I reinvested wisely. This strategic decision helped me in reducing my working hours while maintaining a steady income.

Editor's Financial Pearl

"Embrace new technology that will bring you an instant ROI on the purchase and charge $39 accordingly! Widefield imaging such as Optos or Eidon are essentially standard of care in majority of practice, with many offices having a capture rate of 90% or making it mandatory for their patient using this script.

Don't have the capital to purchase a wide-field? Consider a used fundus camera or an Portable Eyer Retina Camera for as little as $6,999."

Managing Finances Without a Strict Budget

Interestingly, I've never been strict about budgeting. I tried using budgeting apps but realized that my natural inclination towards frugality made a rigid budget unnecessary. My husband and I practice cost-effective habits like packing lunches and limiting dining out, which helps us manage our expenses without the need for detailed budgeting.

Loan Forgiveness and Refinancing: My Perspective

I NEVER considered loan forgiveness, as my goal was always to be debt-free as soon as possible. I started making substantial payments toward my loans but held off on refinancing when the interest rate freeze and forbearance began.

Editor's Financial Pearl

"Although we generally don’t advocate for loan forgiveness, there are few specific situations that we frequently encounter where it might be advisable for optometrists to consider this option for their own financial well-being: such as optometrists with a debt-to-income ratio of 2.0 to 1 or greater. While it’s not impossible for an optometrist earning $100,000 to pay off a staggering $300,000 in student loans, doing so would require an extremely tight budget (think beans and rice) and serious retirement savings, and would likely take much longer than five to ten years to achieve."

If you are pursuing 20-25 federal forgiveness, set aside any preconceptions about debt payoff. The objective of this program is to make the minimum required payment based on your AGI income throughout its duration. Think of it as a tax bill; aim not to pay the IRS more than what’s due. In other words, avoid leaving a tip."

Investing for the Future

The forbearance period was an opportunity for me to delve into investments and retirement savings. I opened a solo 401k and a Roth IRA, strategically using the extra funds to secure my financial future.

Balancing Life's Expenses

Living at home post-graduation allowed me to save substantially, easing the balance between life's expenses and loan repayment. This strategy was integral to my plan for financial independence.

My Personal and Professional Goals

My husband and I are united in our pursuit of financial freedom. We've made conscious decisions like having a small, cost-effective wedding and buying a modest home to work towards our goals. Our ambition is to build wealth, not just to accumulate assets but to enjoy the freedom it brings.

Reflections and Advice

Looking back, I have no regrets. My advice to new optometrists facing student loans would be:

- Borrow only what you need.

- Utilize in-state tuition and live with family to save money.

- Start investing early, even while repaying loans.

Celebrating My Achievements

To celebrate my hard work and achievements, I enjoyed a delightful dinner at my favorite restaurant in Disney and a trip to New York City. These moments of joy symbolize the balance I strive to maintain between diligent financial management and enjoying life.

Want to learn how to manager your Student? Check out The Optometrist's Guide to Student Loans

Want to get a full blueprint on How to start? Buy our Book The Optometrist Student's Guide to Financial Freedom

1

1%2527%2522