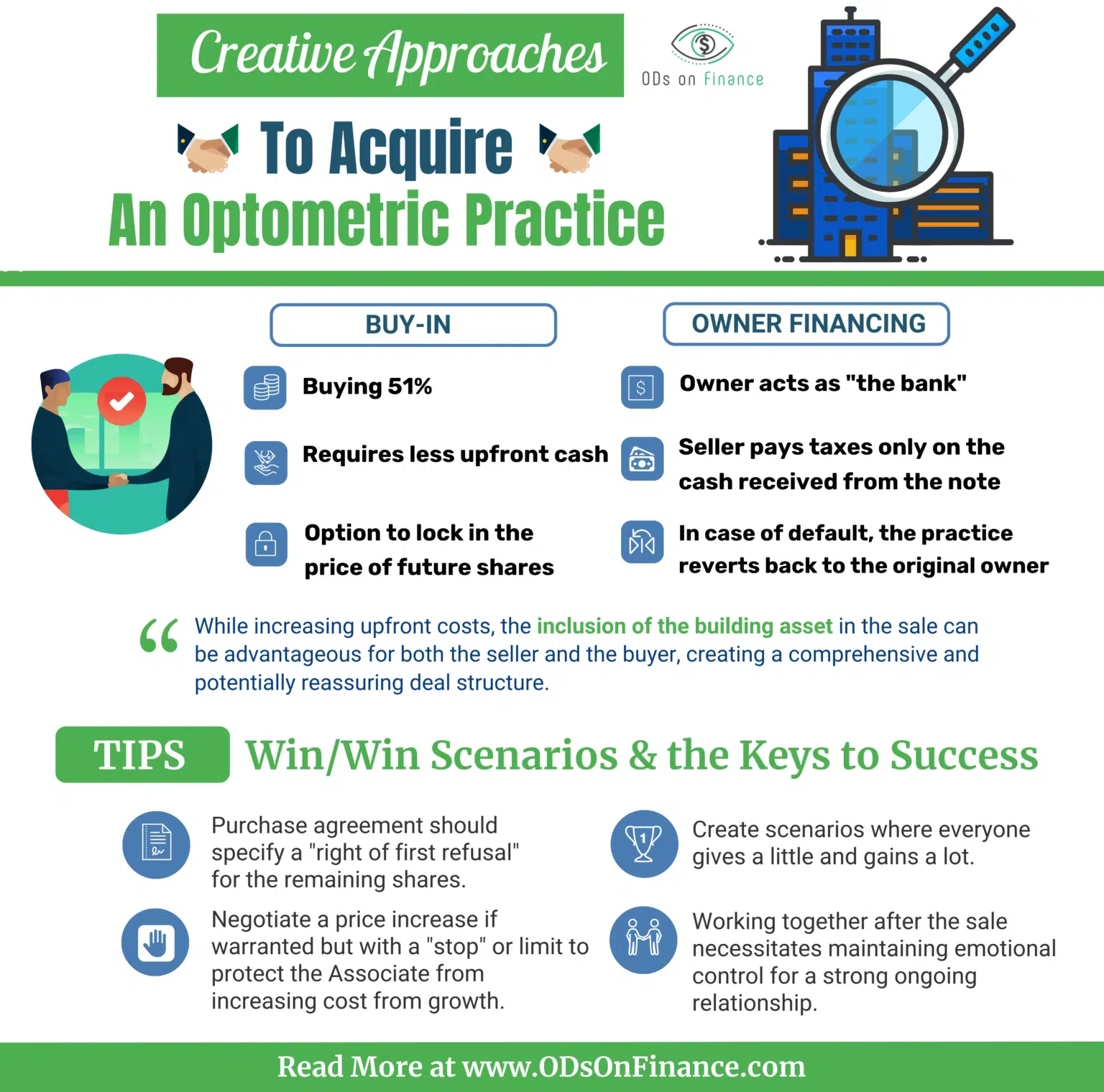

Creative Approaches To Acquire An Optometric Practice

Editor’s Note: This is a guest post written by Michael Pote, CEO/Recommended practice Broker of the Growth Co-op, with over 200 practice sales and consolidations, The Growth Cooperative is one of the leaders in assisting doctors make the most of their practice assets.

Despite recent reports of young OD disinterest in owning their own practices, practice ownership is NOT dead. To the contrary, there is a definite surge in interest in developing one’s own practice as a career asset and cornerstone to a larger financial portfolio.

However, it can be expensive to acquire a practice, especially with the presence of Private Equity firms setting sale price expectations at an all-time high. With the recent spike in interest rates, borrowing money for your acquisition can make the process even more expensive. Approaching the acquisition of your first practice with a little creativity may open up additional opportunities for acquisition at a more reasonable cost of investment.

We are all used to the approach of identifying a practice for sale and buying it. Gone are the days when banks easily lent money, that borrowed cash was affordable, and the price of practices for sale was attainable to a new solo practice optometrist. In addition, towards the end of their optometric careers, many optometrist owners step back, letting their practices diminish further before putting them on the market for sale. This usually results in poor profit and loss statements (and purchase offers) while sale price expectations remain high (i.e. “This practice once did $800,000 per year and it can do it again.”) Taking these diminished profit and loss statements to the bank for your business loan can lead to being declined.

The Growth Cooperative is having great success with a few different practice sale approaches in addition to the traditional practice acquisition path. Three ideas are articulated below, but many combinations of these general approaches can be deployed for a successful acquisition.

(1) Buy-In

Today’s practices, if healthy, are expensive. As a new owner, you do not want to spend the first half of the month seeing patients just to service your debt (loan interest). Instead of buying the entire practice, you might offer to buy 51%, or controlling interest, in the practice from the current owner. This will require significantly less cash from you upfront (you may still need a loan) and yet provide the current owner with a head start on the cash payment they deserve from selling their asset. Your purchase agreement should clearly articulate a ‘right of first refusal’ to purchase the remaining percentage of the practice and may include a timeline for such. Sometimes, parties can even agree to lock in the price of those future shares. In the end, you will be the sole owner and the current owner will receive 100% of their sale price.

Financial Pearl

"If you are purchasing a partial majority of the practice, the Purchase agreement should specify a "right of first refusal" for the remaining shares along with a specific timeline & specific future pricing"

(2) Current Owner to ‘Bank Roll’ the Sale

Another approach we have used successfully is for the office owner to act as “the bank" in order for you to purchase the practice. There are, of course, a variety of permutations to this. Essentially, you agree to buy the practice for a specified amount and you give the owner a note for the amount owed and a schedule by which you will pay this note.

Often, a downpayment is required as earnest money. The practice is used as collateral so that if there is a default on the loan note, the practice reverts back to being the original owner. The owner may carry some risk in this sense, but we have seen success with it when the price is right and there are few other options available to the owner. The other good news for the seller is that they only pay taxes on the cash they receive from the note and not on the total sale price. The seller also receives an interest payment on top of their principal just like the bank would. When the note is paid off, the practice is yours.

(3) The Role of Real Estate

Many optometric practice owners are also the owners of the buildings the practices occupy and often, the building asset is worth more than the practice itself. Include the role of this large asset when considering purchasing a practice. While it makes the entire deal more expensive, it also packages up all of the owner’s assets in one sale (although that sale may take place over a period of years). This can create peace of mind for the seller and a very healthy future financial plan for you.

Financial Pearl

"While increasing upfront costs, the inclusion of the building asset in the sale can be advantageous for both the seller and the buyer, creating a comprehensive and potentially reassuring deal structure."

Case Study

A young optometrist five years out of school in Iowa was seeking to acquire a practice in a nice suburb within a few miles of their home. This was a tall order as suburban areas offer a fewer overall number of practices to start with, never mind practices that might be for sale.

We found an opportunity, but the practice had revenues of $2.2 million per year. This put the purchase price for that practice significantly out of reach for the buyer. Also, the current owner was NOT ready to leave and preferred the idea of adding an Associate to the very busy practice and continuing to grow.

We needed to create a win/win scenario where everyone got most of what they wanted. We drew up a plan for the Associate to acquire 49% of the stock of the practice with the right of first refusal to purchase the remaining 51% at a later date.

But what about the price for the remaining 51%? The Associate was concerned that she would grow the practice, only increasing the cost of the second half of the practice to her. The owner, of course, felt that she should be paid a higher price if the practice was worth more. In the end, we negotiated some growth in price (if warranted) but added a “stop” or limit on the rise in the value of the practice to protect the Associate. This resulted in a win-win scenario for all parties.

The third and final step in the plan is for the Associate to eventually acquire the current owner’s building. They agreed on the right of first refusal for the Associate and on a market-rate price at the time of purchase of the building. In the end, this eight-year plan will provide this Associate the opportunity to own what will likely be a $3 million practice and a beautiful building.

Financial Pearl

"If you are a potential buyer located in the Iowa & the Midwest, reach out to Chris Lopez OD of ODoF Recruiting or TEXT RECRUIT to 55444 for practice opportunities"

Summary

The key to these arrangements is creating scenarios where everyone gives a little and gets a lot. While this case study story is very straightforward, you might imagine the many conversations required to get everyone to arrive in the same place and the myriad of emotions that can interfere with a successful outcome on both the buyer and seller side.

These doctors also agreed to work together after the sale, so maintaining appropriate emotional control was crucial to having a strong continued working relationship that would allow for the successful execution of the rest of the plan.

If you have questions about acquiring an optometric practice, please contact Michael Pote at 415-481-9008 or michael@growthco-op.com.

Want to get the lowest practice financing from COLD START to practice buy-in? Check out Recommended Practice Lending

Want to get a full blueprint on How to start? Check out The Optometrist's Guide To Business Financing

Facebook Comments