6 Tips for Utilizing Cost Benefit Analysis on a New Piece of Equipment

KEY POINTS:

-

(1) Better Performance

-

(2) Lower Cost

-

(3) Less Time consuming

-

(4) Less Risky

New equipment is always a temptation for practice owners, and for good reason. Innovative technologies allow practitioners to give better care to their patients, enhance exam room efficiency, and provide more services which in turn can render more revenue. While new equipment is often thought of as an investment into the business in hopes of yielding profits down the line, especially as ODs on Finance brings you some of the best equipment deals ever seen (yes, even better than those conventions that you pay an arm and a leg to go to), it is important to understand whether that equipment actually makes sense in an office.

This is where the idea of cost benefit analysis comes into play. A cost-benefit analysis (or CBA for short) is a term derived from Lean theory and is an analysis of the expected balance of benefits and costs, including an account of any alternatives and the status quo. CBA takes into account your overall return on investment (ROI), however the approach is a little less black and white than might be expected.

Let’s go through 6 important tips on utilizing CBA to its full extent in order to find whether that new piece of equipment should find its way through your practice doors.

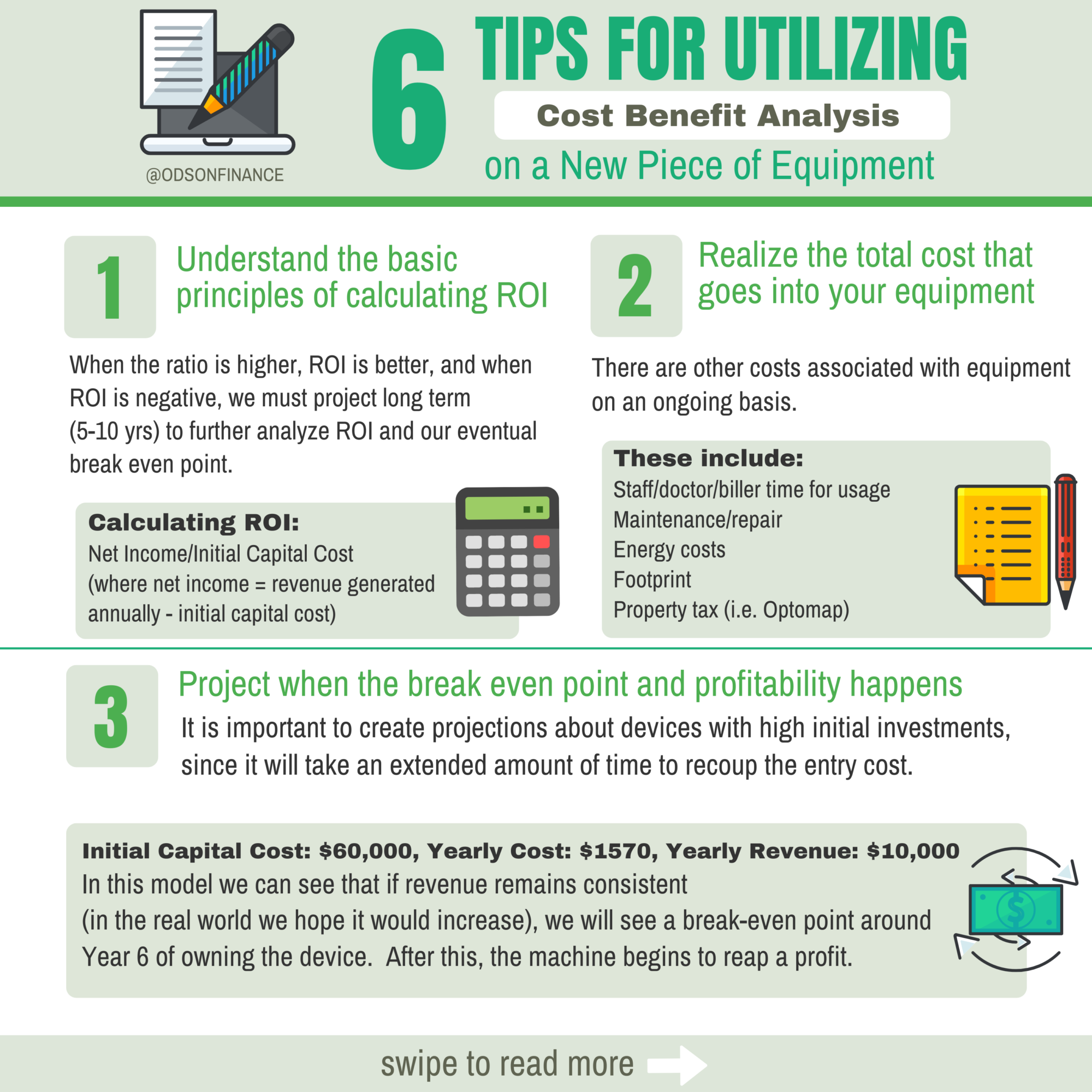

Tip #1: Understand the basic principles of calculating ROI

We tend to think of ROI as a blanket term that describes if something is a worthwhile monetary investment, however ROI is actually a formula that gives us a ratio:

ROI = Net Income/Initial Capital Cost

(where net income = revenue generated annually - initial capital cost)

There are two things we can gather from this equation. #1 - when the ratio is higher, ROI is better, and #2 - when ROI is negative, due to net income being negative due to a higher initial capital cost, we must project long term (5-10 years) to further analyze ROI and our eventual break even point.

Let’s look at two examples:

Example 1: Purchasing a Lens Edger

Initial Capital Cost: $20,000

Projected revenue Generated Annually: $50,000

Annual net income: $50,000-$20,000= $30,000

ROI = $30,000/$20,000 = +1.5

This lens edger presents a positive ROI ratio greater than 1, thus representing “good” ROI.

Example 2: Purchasing an OCT

Initial Capital Cost: $60,000

Projected revenue Generated Annually: $10,000 (200 patients* $50/medical reimbursement)

Annual net income: $10,000-$60,000=-$50,000

ROI = -$50,000/60,000 = -0.83

The OCT presents a negative ROI ratio that is less than 1, thus representing a “bad” ROI. However it is important to note, this is just the beginning. In our next few tips, we will view this investment with a more educated mind, to find if this initially “bad” ROI really represents a “bad” investment.

Tip #2: Realize the total cost that goes into your equipment

When we look at equipment and inherent ROI, we tend to only factor in the cost of the equipment and compare it to the subsequent revenue generated through associated fees. However it is important to note that there are other costs associated with equipment on an ongoing basis. These include:

- Staff/doctor/biller time for usage

- Maintenance/repair

- Energy costs

- Footprint

- Property tax (applies to certain pieces of equipment such as Optomap)

When running a cost benefit analysis, an approximate ROI should be determined from Tip #1, then these factors should be added on to get a truer sense of revenue generation from our proposed investment.

Let’s apply these factors to our OCT example, once again assuming 100 patients:

Initial Capital Cost: $60,000

Projected revenue Generated Annually: $10,000 (200 patients at $50 each)

- Staff time per usage (@ $20/hr) - 15 min = $5/patient - $500/100 patients

- Doctor time per usage (@ $60/hr) - 5 min = $5/patient - $500/100 patients

- Biller time per usage (@ $15/hr) - 3 hrs/100 patients - $45/100 patients

- Avg. Maintenance cost per year - $200

- Energy cost per usage - $0.25 - $0.25 x 100 patients - $25

- Footprint - 10 sq ft @ $30 sq ft/yr lease = $300/yr

- Property tax - not applicable in this instance

So if we add all of these up, our total cost per year to run the OCT on 100 patients comes up to:

$500 + $500 + $45 + $200 + $25 + $300 = $1570/year. Certainly not a huge amount, but enough to be seen as significant!

Tip #3: Project when the break even point and profitability happens

Now that we have a fuller picture of the total cost of our OCT, we can now project our long term revenue outlook which will allow us to quantify when our break even point happens, and subsequently when profitability occurs.

- Initial Capital Cost: $60,000

- Yearly Cost: $1570

- Yearly Revenue: $10,000

In this model we can see that if revenue remains consistent (in the real world we hope it would increase - but we are keeping it stagnant for simplicity’s sake), we will see a break-even point around Year 6 of owning the device. After this, the machine begins to reap a profit.

It is important to create projections about devices with high initial investments, since it will take an extended amount of time to recoup the entry cost. Keep in mind that many offices do offer OCT wellness exams, which will accelerate the break even point due to the increased number of paid OCT scans.

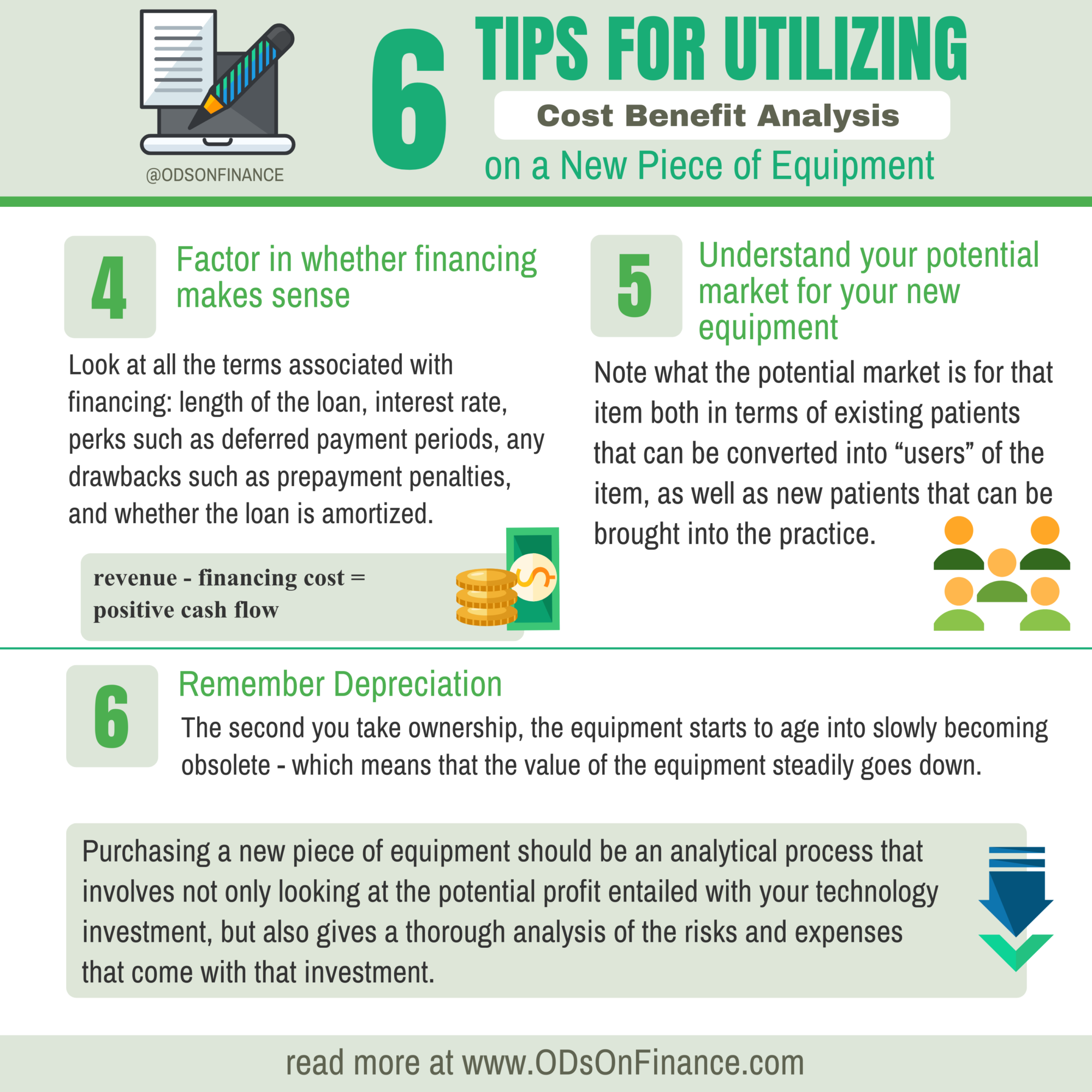

Tip #4: Factor in whether financing makes sense

Up until this point, we have assumed that we paid cash for our new equipment. However, in many instances a practice can either not afford to pay up front for equipment or chooses not to due to favoring liquidity over incurring more debt. Thus financing comes into the equation.

When financing equipment, it is important to look at all the terms associated with financing. This includes the length of time that the loan covers, the interest rate of the loan, any perks such as deferred payment periods, any drawbacks such as prepayment penalties, and whether the loan is amortized.

Remember: if your monthly financing cost is more than the revenue that the equipment is producing, then the piece of equipment is producing negative cash flow for your practice.

Tip #5: Understand your potential market for your new equipment

While the allure of higher revenue and reimbursement gives the purchase of new equipment emotional validity, it is important to know if that validity will transfer realistically into your practice’s bottom line.

What if I told you that a practice that I refer to frequently grosses over $3 million annually, and does NOT have an OCT. Are you shocked? Are you amazed?

Well, you shouldn’t be. That’s because this is a VT only practice. While they easily could afford an OCT, and could possibly convert some patients to medical in order to utilize it, it would make no sense to own one since their potential market does not support one.

When looking at big ticket items, it is important to note what the potential market is for that item both in terms of existing patients that can be converted into “users” of the item, as well as new patients that can be brought into the practice. A business plan of sorts should be written up, especially if this new item will be fueled by cash pay rather than insurance reimbursement.

Financial Pearl

"When looking at big ticket items, it is important to note what the potential market is for that item both in terms of existing patients that can be converted into “users” of the item, as well as new patients that can be brought into the practice"

Tip #6: Remember Depreciation

Despite how shiny and innovative a new piece of equipment is, remember that at the end of the day it is just like a car. The second you take ownership, the equipment starts to age into slowly becoming obsolete - which means that the value of the equipment steadily goes down. One mistake often made when conducting a CBA is the assumption that the value of equipment remains stagnant, when in reality it always decreases.

Especially of note when modeling CBAs that turn profits on a long term trajectory (5-10+ years out) is to take note of how often equipment “turns over” in terms of new tech and add-ons. It is also important to research reliability of possible future investments and the customer support reputation that the brand behind the equipment has.

Summary:

In conclusion, purchasing a new piece of equipment should be an analytical process that involves not only looking at the potential profit entailed with your technology investment, but also gives a thorough analysis of the risks and expenses that come with that investment. It is important to think of the long term value of equipment, so that when that too-good-to-be-true deal comes from us at ODs on Finance, you can make an informed, educated decision that will build your practice.

Need Equipment Financing? Check out ODoF Business Financing | Merchant Services

Want to get a full blueprint on How to get Business Financing? Check out The Optometrist's Guide to Business Financing

Facebook Comments