October 2023 Market Update for Optometrists: Latest Economic & Financial Trends

KEY POINTS:

-

The economic landscape is characterized by a steady 3.7% inflation and cautious actions from the Federal Reserve, particularly in managing interest rates to avoid potential economic downturns. While some economic indicators like GDP growth appear robust, there's a visible undercurrent of economic stress and mixed expert predictions regarding a potential recession in 2024.

-

September 2023 presented a tumultuous environment for optometrist investors, with notable downturns across various asset classes in both stock and bond markets, despite certain areas like US Growth Stocks and Bitcoin showing robust returns. Amidst the volatility, the emphasis for the ODoF Community is on maintaining a diversified, long-term investment strategy, while managing risk tolerance effectively.

-

The housing market is currently stable with no immediate signs of a crash, even though there are fluctuations in home prices and mortgage rates. Despite some seasonal and economic dips in home prices, a crash isn’t anticipated due to the low housing inventory, though new home buyers, especially optometrists, may face vulnerabilities in an economic downturn.

-

Optometrists managing student loans have several paths, including pursuing Public Service Loan Forgiveness, 20-25 year total federal forgiveness, or aiming for a payoff in 5-10 years through refinancing. The chosen strategy should align with the individual's financial situation and goals, and consulting with a student loan financial planner is advisable to navigate the complexities and evolving nature of student loan management.

Welcome to the October 2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans. Buckle in, this will be a long but very informative newsletter!

First let’s talk about the latest September's CPI inflation report, which showed no progress in headline inflation, maintaining at 3.7%.

The Federal Reserve is focused on achieving a 2% inflation target, with a particular eye on the labor market and services inflation. There's an 87% market expectation that interest rates will NOT be raised in the upcoming November 1st meeting with the two remaining meetings in 2024. Remember that The Federal Reserve aims to manage inflation without triggering a housing market crash or economic depression in the current cycle.

Let's head over to what experts are predicting for the average american. Market live pulse survey predicts the average Americans will run out of money in Q1 2024, with 56% of respondents agreeing, with 21% believing financial exhaustion will occur before the end of the current year.

- Pandemic Savings Distribution:

-

-

- Only the wealthiest 20% of Americans still have excess pandemic savings.

- The bottom 80% depleted their savings quite some time ago.

- 80% of stimulus money went to the wealthiest 20%, and 42% to the top 1%.

-

- Savings and Income Groups:

-

-

- Middle-class savings fell below pre-pandemic levels around March 2023.

- Lower-income group savings dipped below pre-pandemic levels in April 2022.

- Wealthy individuals are better off now compared to pre-pandemic times.

-

- Rising Costs and Inflation:

-

-

- Groceries, utilities, and household expenses have risen by approximately 20% in the past two years.

- Gasoline prices have surged by 44% compared to four years ago, with even higher prices on the west coast.

- Vehicle prices have experienced about 8% inflation per year, with new vehicles potentially averaging $100,000 by 2033.

-

- Credit Card Debt:

-

-

- Credit card debt in America has surpassed $1 trillion for the first time.

- The average credit card balance among unpaid cardholders is $7,271.

- 56% of active credit card holders carry a balance month to month, with interest rates now over 20%.

-

- Struggling Americans and Financial Squeeze:

-

- Everyday Americans are experiencing financial strain due to inflation outpacing income growth.

- The standard of living for middle-class Americans and below is eroding.

- The media and economic experts acknowledge the degrading economic landscape and potential for recession.

Financial Pearl

"Experts predict the average Americans will run out of money in Early 2024 as household expenses have risen by approximately 20% in the past two years."

Let’s head over what the experts are saying for the 2024 Economic Outlook and Recession Concerns.

- Economists are nearly split on recession predictions: 48% foresee one, while 52% do not. But polls indicate a significant portion of consumers (69%) and CEOs (84%) anticipate a recession.

This is contradictory with the Economic Indicators which shows

- Q3 2023 GDP growth is very robust at an estimated 5.1%.

- Unemployment is historically low at 3.8%, but the Federal Reserve projects it to rise to 4.1% by year-end and 4.7% by the end of the next year.

Despite visible consumer spending, there's underlying economic stress with people working multiple jobs and relying on credit cards, especially with student loans payment being due at the end of October, averaging $300 monthly, a payment that many Americans cannot afford.

Let’s address some of the potential future challenges as ODoF Investors:

- The lag effect of interest rate hikes may not fully impact the economy until early 2024.

- There are concerns about stagflation, a scenario of high inflation coupled with a recession. We want to avoid this!

- External factors like worker strikes, potential government shutdowns, oversea wars and inflation, especially in oil and gasoline prices, could further strain the economy.

- Despite economic concerns, some consumers continue to engage in high spending, though financial experts predict a shift towards more frugal habits in Q4 2023. The public's perception and reality of the economic situation might diverge, with some still engaging in what analysts term "YOLO spending." Think $2,000+ Taylor Swift concerts tickets.

The Federal Reserve’s management of the situation, especially regarding interest rates and inflation, remains a crucial factor in economic developments.

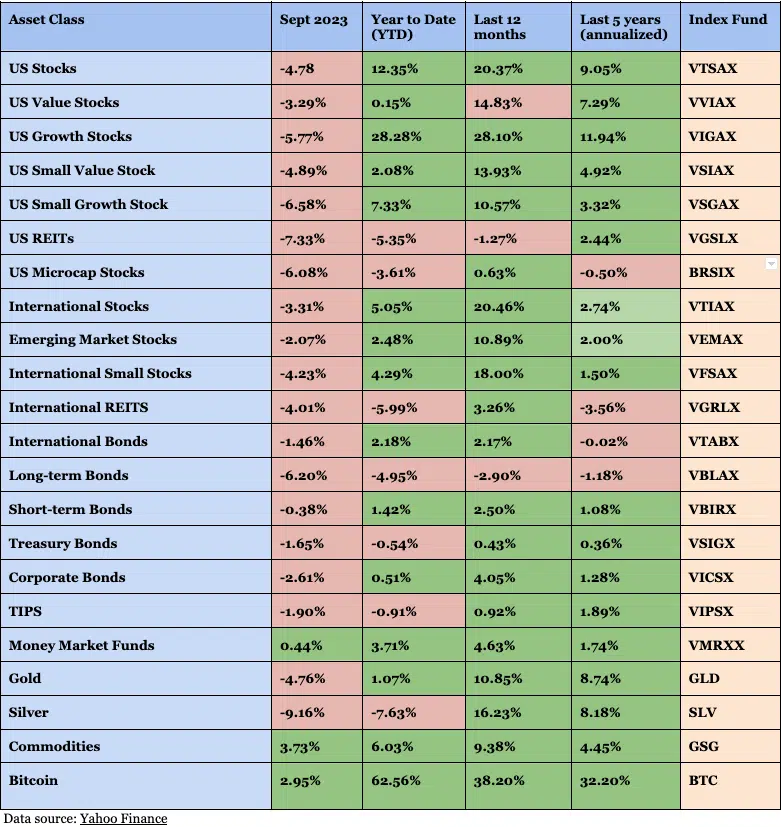

Overview of Stock Market Return

The market data for September 2023 reveals a challenging environment for optometrist investors across various asset classes, with a general downturn observed in both the stock and bond markets. Here's an insightful summary:

- General Downturn: September witnessed a decline across multiple stock asset classes, with US Stocks, Value Stocks, Growth Stocks, Small Value Stocks, Small Growth Stocks, and others all experiencing negative returns.

- Growth vs. Value: The ongoing trend of growth stocks outperforming value stocks persists, with US Growth Stocks showing a robust 28.28% YTD and 28.10% over the last 12 months, despite a -5.77% return in September.

- International and Emerging Markets: International stocks and emerging market stocks also faced a downturn in September but have shown resilience over the last 12 months with returns of 20.46% and 10.89% respectively.

Bond Market

- Negative Returns: Bond markets, particularly long-term bonds, faced a tough month with a -6.20% return in September and -4.95% YTD.

- Short-Term Resilience: Short-term bonds and Corporate Bonds have managed to maintain positive YTD and 12-month returns, providing some stability amidst the volatility.

Alternative Investments

- Real Estate: US REITs and International REITs experienced negative returns in September and have struggled YTD, reflecting a challenging environment for real estate investments.

- Precious Metals: Gold and Silver also experienced a downturn in September, with -4.76% and -9.16% respectively, though they have maintained positive returns over the last 12 months.

- Cryptocurrency: Bitcoin provided a contrasting performance with a 2.95% return in September and a staggering 62.56% YTD, albeit with noted volatility and being down 58% from its peak.

Commodities: Commodities offered a bright spot with a 3.73% return in September and 6.03% YTD, indicating a potential hedge against market downturns.

Financial Pearl

"September saw a lot of red across the board this month, but history has shown us that staying the course and keeping a diversified approach tends to pay off in the long run. So keep dollar-costing averaging (DCA) in your portfolio each month and keep on trucking along! YTD the S&P 500 Index still return 12.35% for 2023!"

In Summary, September was a bit of a roller coaster in the market, wasn’t it? Let’s navigate through these financial waves together as an ODoF Community!

- Diversification Challenges: We saw a lot of red across the board this month, It’s times like these that really test our diversification strategies. Both our traditional and alternative investments took a hit, and it’s a stark reminder that even the best-laid plans can face challenges.

- Long-Term Perspective: But remember, fellow ODoF investors! Investing is a marathon, not a sprint. Despite the hurdles we’re seeing in the short term, it’s crucial to keep our eyes on the prize and stick to our well-thought-out investment plans. History has shown us that staying the course and keeping a diversified approach tends to pay off in the long run. So keep dollar-costing averaging (DCA) in your portfolio each month and keep on trucking along!

- Risk Management: This month also highlighted the absolute importance of managing our risks effectively. It’s vital to ensure our portfolios align with our individual risk tolerance and investment goals. And remember, it’s okay to reassess and make changes as we go along and as our personal situations evolve.

- Potential Opportunities: And hey, let’s not forget, where there are challenges, there are also opportunities. Some sectors or asset classes such as REIT might now be available at a discount, presenting potential buying opportunities for those of us who are looking at the long game.

So what should you do as an OD investor?

The rising interest rate environment is a double-edged sword, presenting its own set of challenges and opportunities in the federal government dealing with inflation.

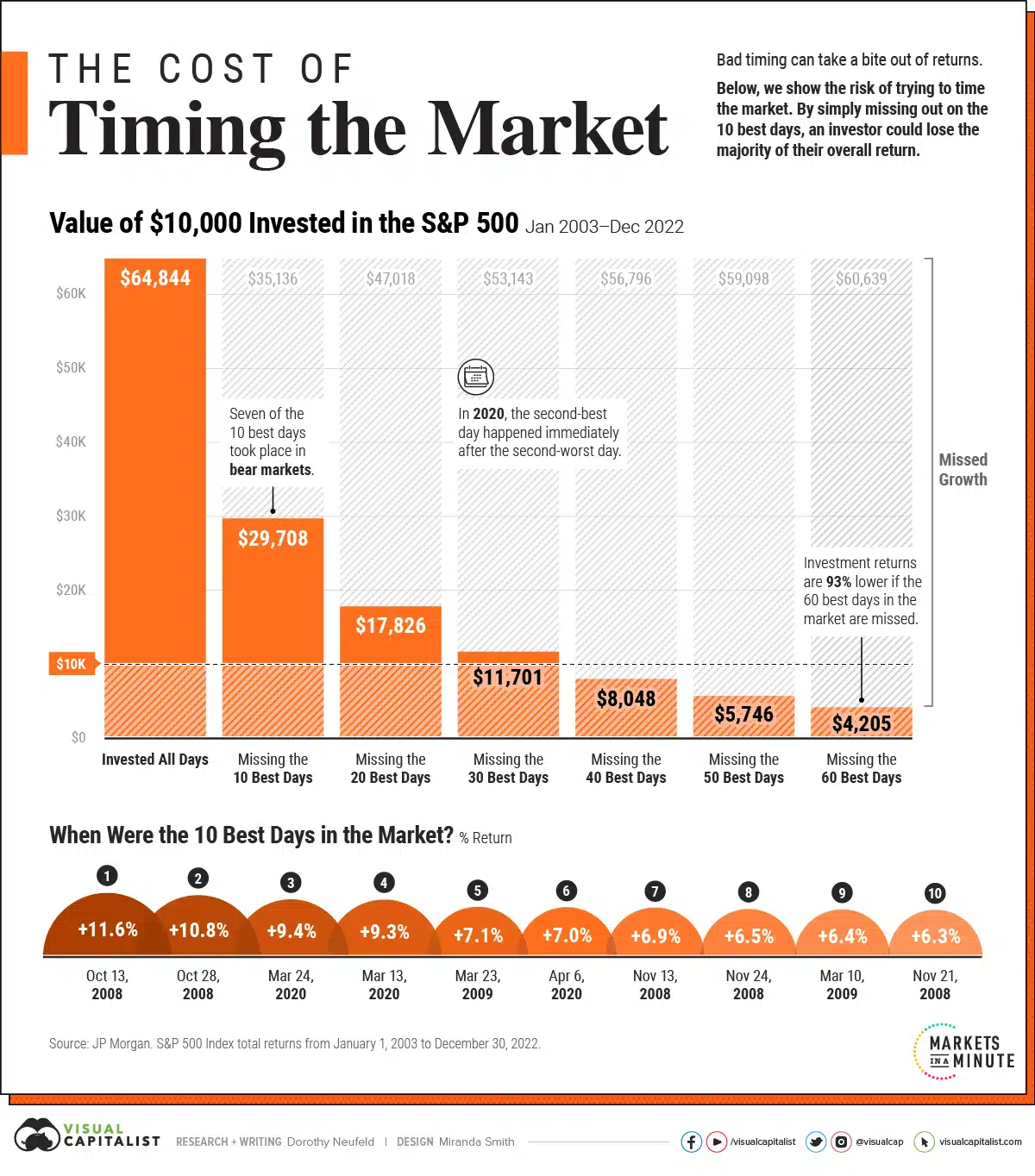

Remember that investing is never a smooth ride, and it’s times like these that test our resolve. But remember, we’re in this together, and the key is to stay steadfast, ensuring our investment decisions are driven by our long-term goals and sound principles, not the short-term market fluctuations. I always like to refer back to the chart to remind me that it is never advisable to time the market!

So Let’s keep our heads up, stay informed, and navigate through these financial seas together.

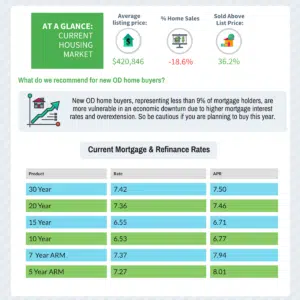

Overview of Real Estate Market

Financial Pearl

"New OD home buyers, representing less than 9% of mortgage holders, are more vulnerable in an economic downturn due to higher mortgage interest rates and extremely low supply. This might forces some home buyers into a home where the higher-interest mortgage payment might exceed their 50% of their paycheck. So be cautious if you are planning to buy this year."

I will start by saying that every housing market is different, your local area might see a massive spike in pricing inventory while other areas like the Bay Area are seeing a decline. I know there is a lot of gloom and doom of the housing market crashing, but the actual data suggests far from that.

Current Housing Market Status:

- No housing market crash observed.

- Median sale price of a home in August was $420,846.

- Home prices fell by $1,291 compared to July but are up 3% YoY.

Housing Inventory:

- 1.51 million homes are listed for sale, slightly up from 1.47 million the prior month.

- YoY, the number of homes for sale is down 18.6%.

Home Selling Trends:

- 36.2% of homes are selling above list price, which is down from 2021/2022 but still above pre-pandemic levels.

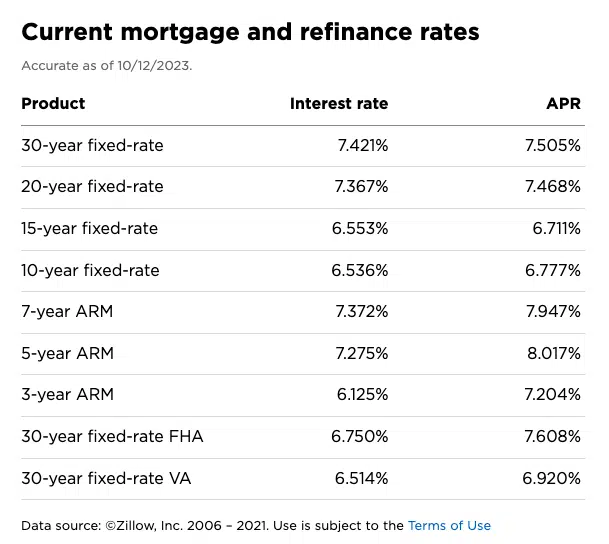

Mortgage Rates:

- 30-year fixed mortgage rates have breached the 7% range, essentially doubling the monthly payment for the same priced home.

- Experts expect a slight decrease by the end of the year, potentially landing in the 6% range.

Expert Predictions on Home Prices:

- Zillow predicts a 4.9% increase in home prices over the next 12 months.

- Morgan Stanley anticipates a slight fall in home prices over the same period.

In summary, it is generally expected that the Federal Reserve will NOT cut interest rates in 2023 but will likely do so in 2024, so Mortgage rates are not expected to go down until 2024. Home prices might dip slightly due to seasonality and economic degradation but a crash is not anticipated due to low housing inventory.

New OD home buyers, representing less than 9% of mortgage holders, are more vulnerable in an economic downturn due to higher mortgage interest rates and extremely low supply. This might forces some home buyers into a home where the higher-interest mortgage payment might exceed their 50% of their paycheck. So be cautious if you are planning to buy this year.

Despite low home affordability, a housing market crash is not necessarily imminent and may be years away.

Overview of Student Loan Market

After 3 long years, it looks like the student loan forbearance ended to an end as borrowers prepare to resume their federal payments Sept 1,2023.

- General Overview:

- 43 million Americans have student loans.

- Payments have been paused since March 2020, but are restarting with interest accruing from September 1st.

- 20% of borrowers are expected to struggle with repayments.

- Current Status:

- Payments are due to restart in October, with billing statements or notices sent at least 21 days before the due date.

- The Consumer Financial Protection Bureau estimates that 1 in 5 borrowers will struggle with repayments.

- Loan Servicer Information:

- Borrowers should check and confirm their loan servicer, especially as some have changed in the past three years.

- Loan and payment details can be checked on studentaid.gov or with the loan servicer.

- Direct payment setups from before the pandemic will NOT automatically resume and need to be re-established.

- Income-driven Repayment Plans:

- Borrowers struggling with repayments should explore available student loan repayment plans.

- Income-driven repayment plans, used by about 30% of borrowers, may be a viable option for many.

- A new plan, the SAVE (Saving on a Valuable Education) plan, has been introduced by President Biden.

- SAVE (Saving on a Valuable Education): This is the newest income-driven repayment (IDR) plan, and all REPAYE borrowers will automatically transition to it. SAVE has several significant benefits for optometrists:

- It offers a 100 percent interest subsidy on any accruing interest, meaning if your payments don’t cover the interest, you won’t be responsible for the interest that accrues. This is particularly beneficial for lower-income borrowers.

- If married, you can exclude your spouse’s income by filing taxes separately.

- The income exclusion for payment calculation increases from 150 percent to 225 percent of the poverty income level.

- Note: Discretionary income is what you earn above 150 percent of the federal poverty level for your family size. If you’re married, your spouse’s income will be counted, which will increase your monthly payment.

- In essence, SAVE only charges 5 percent of your discretionary income for undergraduate loans and 10 percent for graduate loans. If you have both, a weighted average will apply.

- Political Perspectives:

-

- President Biden attempted mass student loan cancellation under the HEROES Act, which was rejected by the Supreme Court.

- A new attempt under the Higher Education Act is underway, but outcomes won’t be known for at least a year.

- Republicans have introduced a Congressional Review Act to overturn the SAVE plan, labeling it as reckless and unfair.

- Criticisms include the $559 billion cost to taxpayers and the shifting of financial burden.

Financial Pearl

"If you are pursuing 20-25 federal forgiveness, set aside any preconceptions about debt payoff. The objective of this program is to make the minimum required payment based on your AGI income throughout its duration. Think of it as a tax bill; aim not to pay the IRS more than what’s due. In other words, avoid leaving a tip."

As an optometrist, here's our advice for you:

(1) Doctors with federal loans, who are enrolled in 10-year Public Service Loan Forgiveness (PSLF):

- Not all non-profit organizations qualify for PSLF; they must also be tax-exempt, so check with your HR department. But as of August 2023, Kaiser optometrists, especially those in Texas and California, now qualify as employees of a non-profit organization and can thus apply for the ten-year PSLF program.

- For the time being, enroll in an income-driven repayment plan like SAVE, work with a student loan CFP to review payment certification and go over vital tax strategies (such as married but filing separately) to reduce your monthly payment requirements.

- If you are one of the lucky optometrists who qualify for the ten-year public service loan forgiveness (PSLF) program, this is usually the most financially prudent option. Just ensure you meet all the requirements and adhere to them for a decade. Be cautious, though, as some non-profit organizations are notorious for limiting associates to part-time hours—under 28 per week—to avoid offering benefits, which could disqualify you from the program, or worse: letting you go unexpectedly prior to the ten years.

(2) Doctors with federal student loans but are pursuing 20-25 Total federal forgiveness

- Although we generally don’t advocate for loan forgiveness, there are few specific situations that we frequently encounter where it might be advisable for optometrists to consider this option for their own financial well-being: such as optometrists with a debt-to-income ratio of 2.0 to 1 or greater. While it’s not impossible for an optometrist earning $100,000 to pay off a staggering $300,000 in student loans, doing so would require an extremely tight budget (think beans and rice) and serious retirement savings, and would likely take much longer than five to ten years to achieve.

- Enroll in SAVE with 25 years of income-driven payment (or 300 qualified payments). We recommend this one since it offers a 100 percent interest subsidy on any accruing interest, meaning if your payments don’t cover the interest, you won’t be responsible for the interest that accrues. This is particularly beneficial in reducing the massive tax bill at the end of 25 years.

- If you are pursuing 20-25 federal forgiveness, set aside any preconceptions about debt payoff. The objective of this program is to make the minimum required payment based on your AGI income throughout its duration. Think of it as a tax bill; aim not to pay the IRS more than what’s due. In other words, avoid leaving a tip.

- That said, it’s advisable to consult with a student loan financial planner. Get a flat-fee consultation and aim to touch base with them every two to three years. This ensures you remain on track, especially given the ever-evolving nature of student loans.

- ⚠️ It’s imperative to be well-informed and mentally ready to commit to this journey, as 20 to 25 years is a significant period. The worst thing would be to change your mind after five years. Begin setting aside funds for the massive tax bill you’ll face at the end of the twenty to twenty-five years in a separate brokerage account.

(3) Doctors with federal student loans but are NOT pursuing forgiveness with the goal to pay it off in 5-10 years.

- Any DT1 that is less than 2.00 to 1 means you DO NOT need to go for 20-25 Total federal loan forgiveness! So I would definitely consider refi your federal 6.8% to a lower rate with the goal to pay it off in 5-10 years, which is totally doable while working toward other financial goals.

- Unfortunately refi rates are high right now with 5 yrs FIXED rates start at 4.25%-4.50% and go up as high as 5.25-5.50% 10 years fixed, depending on your credit score, loan size, financial background, personal debt etc. Sofi with its 1% discount for doctors is the leading lender now

- If you have high interest private private loans or planning to finish off your student loans within 5 years, then refi might be a good option for you!

- I would do 5 years FIXED for the lowest rate (if you are able to handle the monthly payment), but okay for 7 or 10 years if you need more cash flow but higher rate.

- Don’t worry if your rates are not better than your current federal rate, just enroll into SAVE for now, pay extra each month, then we can try refinancing in 1-2 years when rates drop (or your financial profile improves).

- ⚠️ Underwriting Factors: Usually a credit of 775 min and a monthly cash flow (income of expenses vs gross income) of $10,000 will get the lowest rate possible, so keep that in mind.

Summary

In conclusion, as optometrist investors, remember to keep up with the latest news in the financial world and be ready to switch things up as needed. Spread your capital round in different types of investments across different asset classes.

Be careful with cryptocurrency like Bitcoin because it can be super unpredictable. A smart move might be to slowly put money into a low cost index fund that tracks the S&P 500, which can help you avoid the ups and downs of the market in the short term. And don’t worry too much about the real estate market; it might have its issues but a big crash doesn’t seem likely.

For student loan borrowers, the student loan forbearance is officially over, so it's important to prepare for the resumption of loan payments and have a solid game plan to evaluate your options for refinancing or pursuing loan forgiveness based on your individual circumstances. You can always text STUDENT to 55444 if you need free custom guidance.

As always, make informed decisions based on your financial goals and risk tolerance. Cheers to financial freedom!

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get the Lowest Student Refi Rates? Compare & Shop Recommended Student Loans Refi

1

@@BRZ6O