$182K in 2.75 years | Balancing Residency, Future Goals and Aggressive Loan Payoff with Dr. Andreas Zacharopoulos O.D

KEY POINTS:

-

(1) $182,000 finished in 2.75 years with 1 year being in residency

-

(2) Negative mindset toward debt and family experiences motivate me to pay it off quickly

-

(3) 0% Benefits during COVID really super-charged my payments via debt avalanche

-

(4) KMK teaching was the best side hustle. Youtube was fun but very time-consuming and hard to monetize. The best ROI is still doing an extra fill-in

-

(5) Budgeting (living below your means) and tracking your net worth are both vitals

-

(6) Try to fund your retirement accounts along the ways, even if it is a little bit

-

(7) Know your worth and know how to negotiate for a fair wage.

-

(8) Practice Ownership is my next goal after this weight is off my shoulders!

When we think about paying off student loans, it is hard to couple the ideas of finishing a residency and also knocking out student loan debt quickly. Simply put, a residency provides great experience but comes at a cost - a year of well-below average wages. Despite this hurdle, our Student Loan Success Story and active ODs on Finance member Dr. Andreas Zacharopoulos was able to knock out his debt and start setting himself up for financial success.

In this article, Andreas gives us a detailed account of how he paid off his student loans and some helpful strategies for overcoming some common struggles in the quest for financial freedom.

(1) Give us an overview of your background - What year did you graduate and from where? Type of optometry modality? Location? Range of salary?

I graduated in 2019 from Nova Southeastern University, subsequently, I finished my Ocular Disease residency from the Orlando VA Medical Center in 2020

I then joined a private practice in Dunedin, FL (in the Tampa Bay area near Clearwater). This is a one-doctor practice, and the owner was ready to decrease his work load but not fully retire. Thus, he could only add me to the schedule twice a week until we could get more new and established patients to come see me. In the meantime, I’ve had to find fill-in work for the other 2-3 days a week.

Since 2020, I have filled in for 8 other companies in the area. Three of them have been corporate chains (ex. Eyeglass World), three of them have been corporate subleases (ex. Target optical), and two of them have been private practices. As I tested out the waters, I quickly figured out the places I enjoyed working at and was fairly compensated for, and which ones were not worth my time and effort. I also decided early on that seeing more than 2-2.5 patients an hour is just not for me, so I had to cut off the corporate chains a few months in.

My salary has varied depending on where I’m working:

- Private practice is per diem, generally around $500-550 via W2 or $550-600 via 1099.

- Corporate fill-in is usually structured as a “$500-550 daily rate or 60% of production from exam fees, whichever is higher”. So, on a day with a lot of no shows, $500-550 as a 1099. If the day is busy, ~$700-750 or more. I mostly see 2 patients an hour on a typical 9-5pm with 1 hour of lunch.

(2) How much in student loans did you start with and how long did it take to pay them off? What was the average interest rate and were they federal or public?

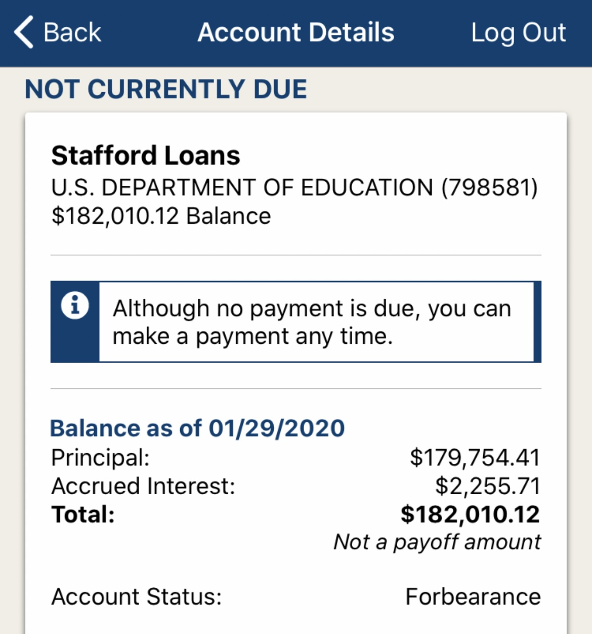

I don’t remember the exact loan amount I took out (about 6 months after I graduated, the student loan interest was added to the principal); however, I know that before my first student loan payment, as of 01/29/2020, I owed $182,010.12 to the federal government.

Since there were 11 semesters in optometry school (fall, spring, summer), I had 11 different student loans. Interest rates were 5.84, 5.84, 5.84, 5.31, 5.31, 5.31, 6.00, 6.00, 6.00, 6.60, and 6.60. Add those up and divide by 11, you could say that my average student loan interest was 5.88%

I paid off my student loans in around 2.75 years, with 1 of those years being residency.

(3) What drove you to pay off your loans so quickly?

I hate the feeling of being in debt, because it is something that limits my personal and financial decisions. I can’t feel comfortable buying something expensive because, well… it’s not my money… because I’m in debt. It is hard to explain, but a feeling of heavy weight and anxiousness had lingered in the back of my head, especially given that interest makes your loan increase.

A sobering moment was when I took my initial loan amount $182k, multiplied it by 5.88% interest, and divided it by 365 days, and got $29…..that means that unless I make a payment, about $29 gets added to my loan every…..Single…Day.

I also have a member in my extended family who is crippled in debt from poor financial decisions in the past. Even though they are past the age of retirement, this debt has forced them to continue slaving away when they should be taking multiple vacations a year.

While I knew that I likely wouldn’t be in that situation, I don’t want anything preventing me from living my life of retirement the way I want to, and I don’t want my future kids to have to worry about large debt either.

(4)What were some strategies that you used to stay focused on paying off loans? Did you utilize the snowball or avalanche method?

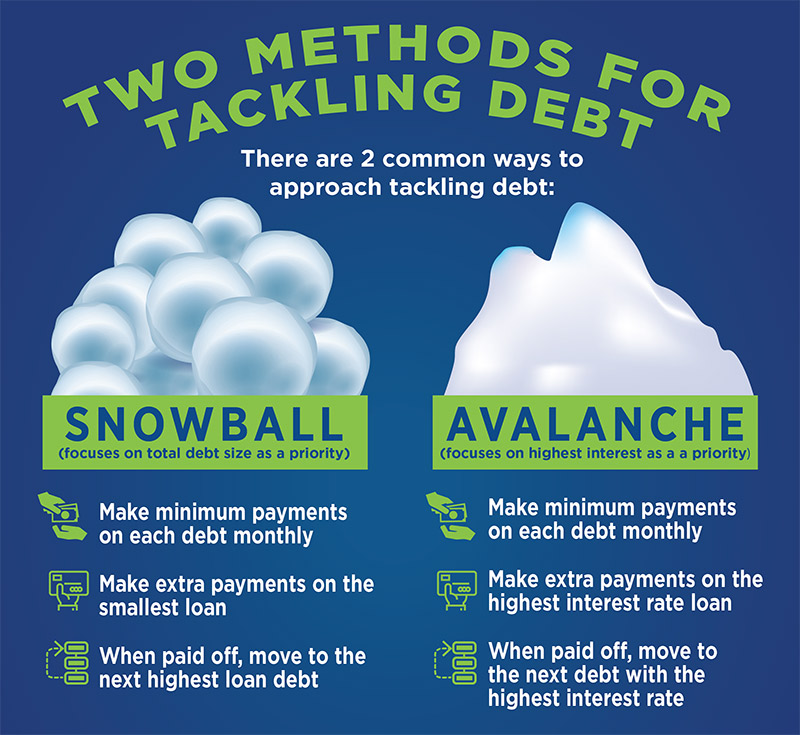

Even though a majority of my time paying back my student loans was during the 0% federal interest period, I feel like the avalanche method was very motivating. Lowering your average interest is key in decreasing that $29 a day that I mentioned earlier, so the best way to do that is by tackling the loans with the highest interest first. Two of my eleven loans had 6.60%, and were each >$15k.

It definitely took me a while to pay off those loans first, but after I did, I felt two massive “mental victories”. The next highest loans were 6% each, and after I got those done, I got another serotonin boost from knowing that all my remaining loans were now under 6%, and also their loan amounts hadn’t grown as much due to having a lower rate. Suddenly, the smaller 5.31% loan didn’t seem to bother me as much, given I had already conquered the 6.6%.

Whether it’s the debt snowball or avalanche, it’s all a mental game in getting you motivated, so choose what makes you want to work harder. For me, it was the avalanche.

(5) Do you have any side hustles for extra ways of earning income?

I have a side hustle with KMK Educational Services. Representing the company, I travel to optometry schools on a few weekends each season to teach a review course for NBEO Part1.

It took me over a year of hard work -studying and preparing to teach at a high level- and many long weeknights and weekends during residency in order to be fully trained. With that said, KMK is now starting to pay off greatly, and I love working for the company and helping students dominate their board exams.

So far, I haven’t made any money from this, but about a year and a half ago I started a YouTube channel, “Andreas Optometry”. I started it because I had a lot of students asking me for advice on prepping for NBEO, specifically Part 3, and also on other topics like residency. So this was a new, fun hobby that I tried to see if I could turn into a side hustle. I enjoyed working on this and got great feedback.

Unfortunately, I took so many days off just to learn how to make these videos, and even then, it took me 10+ hours to get one video made, so 8 months and 10 videos later, I decided to take a break and focus my energy on other things. I was on a decent track to get monetized, but because I stopped, I didn’t quite get there, which is totally fine because it was a fun little project that I may return to in the future.

The point is, if you want to start a side hustle, as long as you treat it as learning a new skill and being prepared for the possibility of not making any money, then totally do it. Because it could possibly pay off immensely.

Working an extra day of clinic a week/month should be thought of as a side hustle, because it is a simple way to make extra money without having to put any extra work on the front end (ex. learning how to sound treat your room for better sounding videos lol). You already put that initial work when you went to optometry school.

(6) Did you learn any important budgeting tips or ways to save money?

Early on, I had made the decision that, aside from my emergency fund, I only need about $2-3k in my checking account (after necessary bills like rent, insurance etc) at one time for daily purchases. So if I log into my bank and have, let’s say $6k in my checking account, then I know that’s too much money and that’s going to IMMEDIATELY go to student loans or investing, otherwise I’ll want to spend it on stuff I don’t need.

This technique helped me because it promoted me to keep attacking my loans, while if I ever had a month of big spending or I wanted to buy something nice for myself, I could still do so as long as I had $2-3k in my bank. This technique basically kept my bank account low enough to get by, which kept me from overspending.

I use the Mint app on a daily basis. It’s free, and I love it because it lists all my financial accounts in one spot (cash in bank, credit card expenses, student loans, investing accounts, etc) so you can easily see an overview of your finances without having to log on to all your accounts. It also calculates your net worth (“cash and investments” minus “expenses and debt”).

I think your net worth is super helpful because it tracks your progress. If your net worth goes up by let’s say $5,000 in one month, then that $5,000 is your total profit after ALL your expenses in that month, and you can use the net worth as a tool to make predictions about where you think you’ll be in a few months in terms of your financial goals.

I’ll admit, it’s a little discouraging to start off with a net worth that is a very high negative number, but that is also good in the sense that there is a ton of progress to be made! It was a wonderful day when my net worth finally became zero!! From then on, every day is a positive!

(7) Did you ever consider loan forgiveness or any other applicable student loan repayment plans?

No, I did not. I can’t say that I wouldn’t consider it if I owed >250-300k, but at the same time, I wanted to be debt free in under 5 years. Also, I didn’t 100% trust that the government was going to wave their magic wand in 10 years and just forgive my debt. I’m sure they would, but I’d rather take the matters into my own hands, pay them off early, and then be debt free earlier.

Want to learn more about Federal Forgiveness? Click here to Read "OD Loan Forgiveness"

(8) Did you refinance your loans and if so, how was that process?

I did not refinance, thankfully due to the 0% federal interest rate from the COVID relief bill, which got delayed until after my last student loan payment. I actually did start an application with Commonbond back in Fall 2021, via ODs on Finance. It was a ~5-minute easy process.

I got offered a much lower rate (I don’t recall what it was) but then I didn't accept. I decided to wait a week before I did, which is when the 0% interest got delayed again, so I had no incentive to refinance.

(9) During loan payoff, did you dedicate any cash flow to investing/retirement?

I contributed the maximum ($6000 per year) to my Roth IRA for 2019, 2020, and 2021. When I switched health insurances, I qualified for an HSA account so I contributed the full $3500 in 2021.

I didn’t have a 401k because I never worked full time for one employer, so no benefits. My boss just offered me a SIMPLE IRA (even though I’m part time) so as of 2022 I currently contribute just the 3% employer’s match, although I’ll probably increase that soon

I also have a brokerage account. I would occasionally invest ~$500 every month or so in stocks. It definitely was sporadic, and the most I ever had in there was ~$4000. I sold most of it in January so I can pay off my student loans early.

(10) Obviously, residency presents a hurdle in loan payoff due to a year of low pay. How did you balance this and would you recommend residency for up and coming new grads?

An easy way to balance this is simply through moonlighting/filling in. It doesn’t have to be often, since residency is demanding enough. But your one week of residency pay gets DOUBLED simply by filling-in on a Saturday. Also, in my case, the private sector is different from working at the VA hospital, so it kept me on my toes. One example is that we didn’t do contacts unless they were medically necessary, so that once a month day working at a corporate location helped me re-familiarize myself with the different contact lens brands and fitting strategies (monovision vs MF etc).

I still recommend residency. It is a year of exceptional experience, especially if your residency is specialized like in contacts or peds. Residency opens doors for you in terms of employment. On the flip side, it is not necessary to thrive, and many OD’s can get similar experiences working at a good peds clinic, OD/MD practice etc. and getting paid more to do so.

This is a long conversation that I made a YouTube video about, but from a financial perspective, I still wouldn’t say no simply because of the lower pay. With that said, if you have circumstances that warrant you maximize your pay ASAP (ex. you owe $300k+ and have 4 kids), then I can understand why you may want to skip that step.

(11) Looking back, is there anything you would have done differently in your loan payoff journey? Any regrets?

Because I could see myself paying my loans off in such a short time, I spent so much money attacking my loans that I do feel like I was under-investing in the stock market. I definitely still invested, but I should have done so more frequently/more automatically.

In other words, I should have had at least $1,000-2,000 a month to automatically go from my bank to my investment account into an SP500 index fund like VOO, instead of just investing random lump sums when I felt like it. Had I done this since I started working, I would have probably made more than a few thousand dollars of passive income (each share is now ~$410 vs $280 in June 2020), which I could have then used to pay off my loans even quicker. While we can never predict what the stock market is going to do in the short term, it is a reasonable assumption to think that the sp500, which has averaged 10% growth a year in every decade since the Great Depression, will probably grow more in 3-5 years than your student loan interest will.

While I would modify my approach if I could go back, I definitely don’t have any regrets. My student loans are gone, which is an emotional weight off my shoulders! I also now have a significantly increased cash flow, as all the money that I normally pay each month on my loans, I could either invest or freely spend it, which is essentially what financial freedom is all about!

(12) What are the 3 pieces of advice you would give someone just starting their journey as a new optometrist with massive student loans?

(1) Live below your means-

- Don’t spend the first few years of being an optometrist by overspending on stuff you don’t need. Use that time to build up your equity, whether it’s paying off loans, investing aggressively, or buying a practice. Don’t buy a new car if your current one works fine. Don’t get Uber Eats every day when you can occasionally cook at home. If you’re able to live with your parents for a few months, you’re saving a ridiculous amount on rent. Definitely don’t go too crazy on the budgeting and be depressed because you feel like you can’t spend any of your money, but know that you will make SO much money over the course of your career that you will be more than well off if you plan things right. Therefore, it benefits you to be responsible for it on the front end, so you set yourself well for the future.

(2) Know your worth-

- Be willing to stand up for yourself and negotiate for a fair wage, whether it’s a full-time job or simply fill-in work. The best way to accelerate your loan payoff is by making more money, even if it’s just an extra $50 a day, $250 per week, or $13,000 a year. Some employers will pay you fairly, some will try not to, which will greatly hinder your progress. Just remember, there are opportunities everywhere, especially for fill-in work. You are an optometrist! You are valuable, and you are needed! So don’t settle for a poor deal because it’s “the only option”, because it’s not.

(3) If you decide to do fill-in work, consult your accountant. They may recommend you open an S Corp if you have enough 1099 income. This could save you thousands in taxes.

(4) Bonus 4th one: Buy the"The Optometrist's Guide to Financial Freedom"

- I knew nothing about investing and my budgeting skills were okay, but that book made my jaw drop multiple times when I read it back in April 2020! At the very least, read some of the juicy content they have on their website, and definitely visit the Facebook page, as the financial advice there is $$$.

(13) What are your future goals both in personal finance and professionally?

There are many routes I can take from here, but I feel like practice ownership, while that is a LOT of work, would provide me the freedom of being my own boss and being in complete control of my own schedule. So that is something that I’m thinking about for the near future.

Five-ten years down the line, I want to have the financial freedom to be in clinic 3-4 days a week so I can make time for my future kids, be more flexible with vacation, and explore other personal goals. Ultimately, I just want to be a good doctor with a healthy work/life balance.

(14) Lastly, what are you going to do to celebrate your accomplishments?

- Buy myself just a few shiny expensive things that I’ve been holding back on…I literally just ordered the new Macbook Pro as I’m typing this.

- Get some beers with my friends!

- Plan my summer vacation

Want to learn how to manage your student Loan? Check out The Optometrist's Guide to Student Loans

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

Facebook Comments