10 Practical Tips on How to Pay Off $221K+ Optometry Student Loans in 5 years

KEY POINTS:

-

(1) Stop Trying to Live The “Doctor Life” (Year 1)

-

(2) Change Your Mindset and Stop Playing the Victim (Year 2)

-

(3) Refinance Your Student Loans (Year 2)

-

(4) Learn How to Live on a Budget to Keep Your Expenses Low (Year 2)

-

(5) Pay Off Debt via the Snowball Method and Make it a Priority (Year 3)

-

(6) Spend Significantly Less Than That You Make (Year 3-4)

-

(7) Pick up Extra Fill-in Work Whenever Possible (Year 3-4)

-

(8) Learn How to Invest (Year 3-4)

-

(9) Start a Side Hustle and other Passive Incomes (Year 5)

-

(10) Stay Motivated Because It Is A Long Journey (Year 5)

Like many optometrists, I graduated from Southern California College of Optometry (SCCO) with over $221,245 in student loans back in June 2015. It was a combination of both federal loans ($198,303) and high interest private loans ($22,942) that I took out for other living expenses during my 4th year rotations. In early October 2020, during the COVID-19 pandemic, I made my final and last student loan payment, roughly 5 years later.

I was debating for weeks on how to write this article, how to tell my story in a way so it would help my fellow ODs not make some of the mistakes that I made as a new graduate and hopefully fast-track them to financial freedom.

First of all, some background about myself. Unfortunately, I didn’t have any rich parents or a working spouse to help me out financially during this 5-year journey. My family actually grew up quite poor, and as a 1st generation Vietnamese immigrant growing up, I literally had no idea what a 401K even was. And yes, to add salt to the wound, I also moved back home to one of the most expensive places in the US - the “wonderful” Bay Area, CA, where optometrists are a dime-a-dozen and the average pay rate for a new grad back in 2015 was a minuscule $350 per day.

I am not stating all these factors to brag about how “awesome” I was at overcoming obstacles, but rather to show you that I was financially inept - with a lot of factors going against me. Truthfully, anyone, no matter what background or how financially uneducated, can get started and be financially successful.

Here it goes, ten honest, straight-forward and practical tips to help you pay off your student loans in 5 years.

(1) Stop Trying to Live The “Doctor Life” (Year 1)

I was the typical new OD graduate, excited to make my first paycheck and start living the doctor’s life because, well, after 8 long years of schooling, I felt entitled to it and felt that I DESERVED IT! Every single day after work, I would go to happy hours with my buddies and every weekend, I was either at some club or traveling to some far away destination. Like many of my classmates, my student loans were originally on a standard 10-year standard payment plan because during my exit interview, they told me the average new grad salary was $150,000, so I could easily afford to make my monthly payment of $2,841.

Sadly, this was not the case. Practicing in over-saturated CA, while getting low balled by shady practice owners, I quickly found out that my annual salary was around $85,000-90,000 in 2015 as a new graduate. After not being able to make a few payments, I quickly changed it to income-based repayment (IBR) so I could enjoy more of my paycheck.

Instead of trying to negotiate for higher pay or picking up extra work, I literally just stuck my head in the sand and hoped for the best.

It was sad. At the end of my first full year out of school, I realized I accomplished NOTHING. I made $90,000 that first year, only a measly $8,835 went toward my student loans, all of which went straight to interest. Even worse, nothing went into my 401K or Roth IRA while I literally spent over 80% of my income on going out and living expenses. This was the wake-up call for me.

Take-Away: "Don’t try to live the doctor life. You are still a broke doctor with a negative net worth. If you can maintain your lifestyle as a student for a few more years, while making a doctor’s salary, you will be financially more successful than your OD peers"

(2) Change Your Mindset and Stop Playing the Victim (Year 2)

I made a lot of excuses for why I wasn’t paying off my student loans (I was too busy with work to learn), blamed a lot of people (mostly the government for even allowing a dumb 20-something to take out over a quarter million dollars in loans) and tried to find the easiest way out (Hm, should I go for 20/25 total loan forgiveness and hope for the best?)

I simply got tired of being stressed and complaining about money. So once I decided to stop playing the victim, I took action to make a change and took charge of my own financial destiny - it completely changed my mindset toward money. I accomplished this by reading a lot of personal finance books and listened to financial gurus (special shout out to Dave Ramsey). While Ramsey have a lot flawed advice, especially when it comes to investing, I will give credit when credit is due since he was the first one to really motivate me to pay off debt and get my life together.

Take-Away: "You need to have a good attitude toward your finances and actually want to make a change in your life. Once you change your mindset toward money, then you can officially take action"

(3) Refinance Your Student Loans (Year 2)

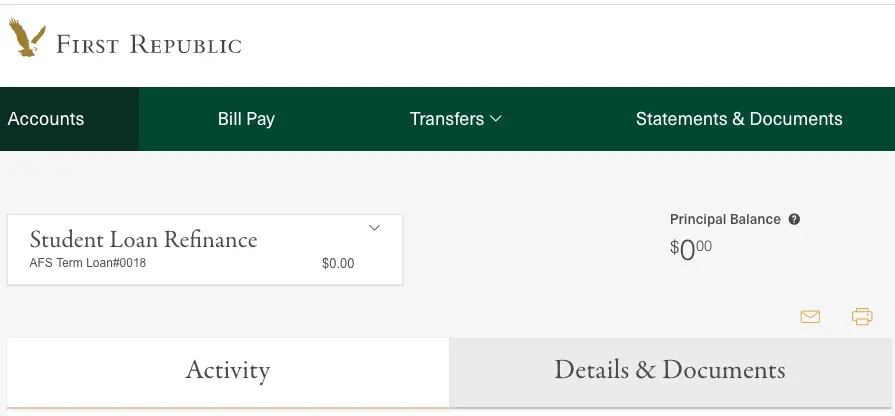

Refinancing your federal student loans was a fairly new and uncommon thing to do back in 2015, since there weren't that many choices in lenders compared to today. I casually refinanced my student loans with First Republic with a term of 10 year fixed 2.9% interest, simply because my friend told me too ( 2.9% is better than 6.8% right?). I didn’t really know all the cons - such as losing all the federal benefits....total Facepalm. But this was an important step in my journey, because for the first time, I was forced and committed to make a monthly minimum required payment of $1852.43 over the course of 10-years.

It was the right direction for me to take and indirectly took away wishful “options” of pursuing 20-25 total loan forgiveness. Basically, I was forced into taking charge of my own financial destiny, rather than being a slave to my debt for 20+ years hoping that the government will forgive my massive student loan debt.

Disclaimer: Please note that with the recent CARES Act, enjoy the 0% interest rate of your federal loans and re-assess in 12/30/2020 if you should refinance or not.

Take-Away: "If you are not pursuing 10-year public service loan forgiveness (PLSF), then refinancing to a lower rate is a smart mathematical move to get a lower interest. The majority of refi lenders will also offer the same competitive benefits as federal loans such as forbearance/deferment during difficult times, cosigner release and/or forgiveness upon death or disability. In addition, it forces you to stick to a more “aggressive” payment schedule, so more of your monthly goes toward principle vs just interest, such as in many federal income-based repayment plans such as IBR or REPAYE"

(4) Learn How to Live on a Budget to Keep Your Expenses Low (Year 2)

During year 2 was when I really got my Sh*t together. I got tired of being stressed out about money and living paycheck to paycheck. I used Mint’s Budgeting App to track my spending for a few months to see where all my money was going. Needless to say, I was SHOCKED.

There was one month when I spent $1200 on restaurants and another month when I dropped $350 in one night for bar drinks. After a few months, I got my budget down to a consistent level where I would usually under or over spend by $5-10. Here was an example of my budget from August 2016 ( Right Side)

I know that budgeting is not fun, but everyone should budget for a minimum of 3 months to know exactly how much they actually NEED for necessary expenses (such as rent/utilities) vs WANTS (such as that Beyonce concert ticket).

I found out a few personal things about myself while living on a strict budget such as what actually brings true joy to my life. In my early 20s, going out to bars/clubs with my buddies was often the highlight of my week, but as I had less money to spend, I realized that just being around my loved ones was the true joy. We didn’t need to drop $200 a night on bottle service to enjoy each other’s company, when a simple board game night was enough.

In addition, because I had a set fund every month, I really had to prioritize goals and/or people that were really important in my life. If it was my little nephew’s birthday for that month, I would say no to a friend’s dinner because I would have to sacrifice some of my restaurant allowance to save up for it.

Take-Away: "You cannot know how much to invest or pay off debt, unless you know what your monthly expenses are and what your budget is. Be conscious with your spending and only spend on things (or people) that really matter to you. If you hate budgeting, do a reverse-budget where you allocate all funds FIRST into your required bills such as rent, student loan debt, retirement and/or short term investing goals, then spend whatever is left over, GUILT-FREE"

(5) Pay Off Debt via Snowball Method and Make it a Priority (Year 3)

To be successful at paying off massive amounts of student loan debt, we must factor in behavioral aspects that help keep us going. This is why I like the Snowball method of paying off debt. Basically, you list the lowest amount of debt at the bottom and go up to the highest amount of debt at the top, regardless of interest rate. Then you start at the bottom where you tackle the lowest amount first and move up.

While mathematically this doesn’t make a lot of sense, I cannot tell you how much of an emotional impact it had on me. Each time I was done with one debt, I felt motivated to tackle the next level of debt and the momentum kept me doing. In addition, for every $20,000 of debt that I paid off, I made sure to have a small celebration such as going out for some beers with some friends or getting myself that new pair of dress shoes that I was eyeing.

Lastly, while I am a big fan of optometrist multi-tasking different financial goals such as saving for retirement, investing, and paying off debts, every OD should stay laser-focused on prioritizing student debt to finish paying it off.

For example, my $200K+ student loan was at a ridiculously low interest rate at 2.9% while a simple low-cost S&P 500 Index fund on average returns 9.8%. So why did I focus so much capital on paying off debt? Simple, because the feeling of being completely debt-free and not being forced to make that required payment of $1,800 each month is worth everything.

Take-Away: "The debt snowball method was a great way to pay off debt from a behavioral aspect and the constant momentum kept me motivated during my journey. Even though I had multiple financial goals such as retirement and investment, I still made paying off debt my #1 priority."

(6) Spend Significantly Less Than That You Make (Year 3-4)

As my OD take-home pay gradually increased each year due to annual pay raises, bonuses or negotiating for a higher salary when I moved to a different company, I still found myself spending the same amount in my living expenses.

My annual living expenses when I was making around $90,000-$120,000 for the first 1-2 years as a new grad was $47,220. But as I progressed in my career, my OD income significantly increased, but I still found myself living on an annual budget of $47,220, thus significantly increasing my post-tax savings rate to close to 50%, to put toward investing or paying off debt each month.

It was extremely easy to pay off my student loans during the last 2 years of my journey, simply because I had more cash left each month to pay off debt.

Take-Away: "I cannot emphasize the importance of not letting the doctor’s lifestyle creep up on you. If you continue to live on the same strict budget each year, despite your rising OD salary, your savings rate will significantly increase and thus will help you make any extra student debt payment."

(7) Pick up Extra OD Fill-in Whenever Possible (Year 3-4)

Optometry is a unique profession where you can work as many days as you want. Aside from your standard 5 day workweek, anyone can pick up a Saturday and/or Sunday at a local Lenscrafters or Costco for additional income.

My friends were always confused about why I was constantly working on weekends when I was already working as a full time optometrist at Apple. It was simple; working those fill-in positions brought in an additional $45,000-$50,000 in income each year. Funds that helped me pay off even more student debt each year.

Look, I get it! Doctor burnout is real, so mental relaxation, health and time spent with your family is more important than money. So make sure you carefully monitor your stress level and take care of yourself both physically and mentally.

The one mantra that I always told myself is that “I definitely don’t want to work 6 or 7 days a week when I have a family and kids, so I might as well do it now when I am young and have the time and energy. Sacrifice now and enjoy the benefits later on in life.”

Take-Away: "Any new optometrist can instantly increase their annual income by 20-30% simply by picking up an extra 1 or 2 days of fill-in. This additional capital can go toward paying off even more student debt. Just remember to be mindful of your stress level and watch out for doctor burnout"

(8) Learn How to Invest (Year 3-4)

Investing is probably one of the most passive ways for any optometrist to earn money, whether it is through a low-cost index fund or a more hands-on method like individual stocks.

While I always have a strong foundation of index funds within my portfolio, I do have an innate passion for individual stocks analysis. I am aware of the inherent risk of stock-picking, and any investors can be wildly successful sticking with a low-cost index fund.

But after consuming almost every single investing book out there and learning from legends such as Warren Buffet and Peter Lynch, I was hooked. I spent any free time reading quarterly financial reports or listening to investing podcasts on my commute to work.

My solid individual stock strategy of “buying good businesses at a fair price for the long term” kept me focused through the high or lows of the market and helped me to ignore the noise. Just after a few years, I was amazed by how well my individual stock brokerage had done. From consistent investment in well-run companies, my profits have skyrocketed to close to $82,340 profit over the course of 3-4 years.

It felt great when I finally sold half of stock profits for a total of $41,200 to pay off the remaining amount of my student loans. Just by learning how to invest in index funds and/or individual stocks, I was able to shave off a whole year of debt payment.

Take-Away: "Any optometrist has the smarts to learn how to invest, whether it is low-cost index funds/ETFs or a more actively managed strategy with individual stocks. It can often be the most passive way for anyone to accumulate wealth to be used toward their student loans"

(9) Start a Side Hustle and other Passive Income (Year 5)

Creating and building ODsonFinance with my fellow co-founder Aaron to the level that it is today probably has been my most successful side hustle to date. ODsonFinance definitely started out as a passion project to help optometrists have a safe community where they could learn to be financially successful. We had no initial intentions of being profitable (or even a company) from the beginning and just simply enjoyed helping our fellow colleagues.

Fast-forward 3 years to today, where ODsonFinance surprisingly produces a small amount of profit. While it is not a significant amount that allows me or Aaron to replace our annual OD salary (Sorry guys! Aaron and I still have to see patients each day), it is a small profit nonetheless.

In addition, my side hustles including doing online optometric surveys which can range from $10 to $200, either during my lunch time or between patients. While this might seem minuscule, usually at the end of the year, it can quickly add up to $1,000-$2,000 per year.

Take-a-Away: "Every optometrist needs to find multiple sources of passive income, either through a side hustle or other profit-generating revenue, no matter how small or large. Find your passion, build a business around it if possible and then learn how to monetize it. If entrepreneurship is not for you, simply learning how to invest, working extra days and/or online surveys can help accelerate your debt pay off. Every little bit helps!"

(10) Stay Motivated Because It Is A Long Journey (Year 5)

I cannot tell you how many times I felt overwhelmed and wanted to give up, just looking at my massive student debt when I was a new graduate. I cannot tell you how many times I resented or hated my optometric profession because it was a “bad” financial decision. I cannot tell you how depressing it was to say no when my friends invited me out to any social event simply because I didn’t have not enough money in my budget. I cannot tell you how lost I felt during my first year because financial education was not taught in school.

But I can tell you that it will be one of the hardest financial journeys that you will undertake during your life. Trust me, it will get better each year as your income increases, your debt shrinks and your financial knowledge vastly grows. I can tell you that your priorities will change; things that you thought made you happy in the past won’t really matter anymore. I can tell you that people who support you emotionally during this journey will be lifelong loved ones in the future.

Summary

So there it is, 10 practical tips to help you succeed in paying off your student debt. People asked how it felt to be done, I told them that it was like having an invisible 50 pound weight finally lifted off my back.

My last piece of advice to any optometrist: Don’t play the victim or try to look for the easy ways out, take charge of your own financial destiny and have a solid financial game plan! Stay motivated and take it one year at a time. Aaron and I are here to help! So please reach out to us anytime.

So what am going to do to celebrate? "I honestly have no idea. My wonderful fiance Tammy who was so supportive during this whole ordeal took me out to my favorite ramen spot (I am not a fancy food type of guy) where we celebrated with some nice cold Sapporo beers. Maybe once COVID-19 is done, I will head back to Las Vegas and rekindle my financially-irresponsible inner 25 year old Dat and splurge on a bottle service at Marquee Nightclub or something like that Haha"

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom or Read this Guide What Should I do First? A Complete Guideline Step-by-Step

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to learn how to Manage your Student Loans? Check out The Optometrist's Guide to Student Loans

Hi Dat, awesome accomplishment – congrats! Where did you find paid surveys that ODs can participate in? Thanks!

Thanks Sarah! Spreading the motivation! I know surveys doesn’t pay much, I think at least I made around $500-1000 a year but it was extremely passive and I usually did between patients or during my lunch time. Here are the ones that won’t spam you and offer legit ones for ODs

Click for online Survey Links: GLG Research/ M3 Global Research/ MNOW Surveys/ InCrowd/ Reckner Healthcare/ ZoomRX/ Inspired Opinions

https://odsonfinance.com/the-optometrists-guide-to-side-hustles/