Four Major Benefits of Investing in Out of State Rentals

KEY POINTS:

-

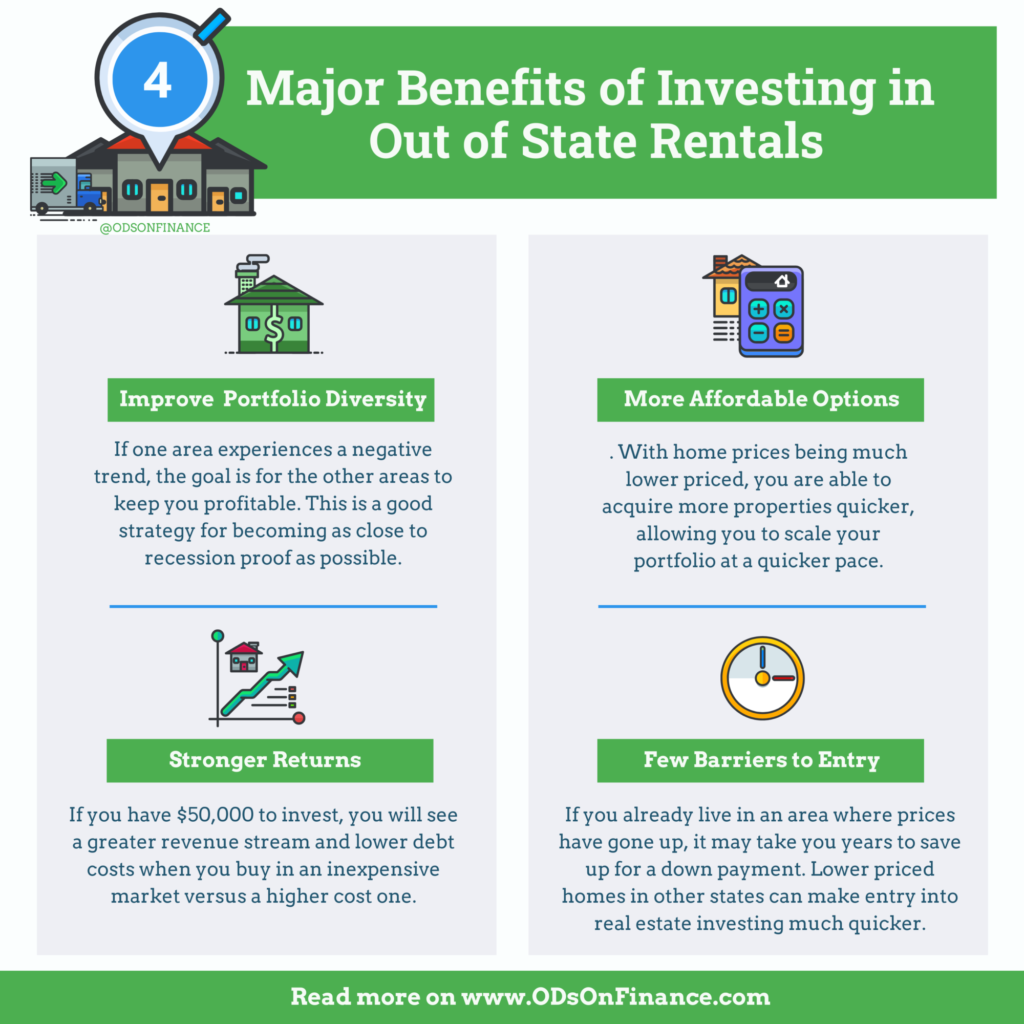

(1) Improve RE Portfolio Diversity due to Different Markets

-

(2) More Affordable Options for Properties

-

(3) Stronger Returns Especially When it Comes to Cash Flow

-

(4) Few Barriers to Entry

If you’re reading this article, you most likely live in a state that has a high cost of living and home prices are skyrocketing at a pace that makes little sense in investing for cash flow. You’ve wondered how you can also own rental properties and enjoy the sweet success of passive positive cash flow that isn't possible where you’re at. Well, you’re not alone in this desire to own positive cash flow rentals. Rather than try to force an investment that won’t yield a positive return, a potential solution for many is to invest outside your backyard, or in other words, out of state. While there are some disadvantages of investing away from home, the benefits often outweigh the disadvantages. This is especially true if you have the right local team in place to help you. We’ll talk more about the disadvantages in a follow up article, but for now, we will dive into four major benefits of investing in rental properties out of state.

(1) Improve Portfolio Diversity

Diversifying is very important. After all, this is why many investors purchase indexes of hundreds of stocks rather than investing in individual companies. Spreading investments between different areas is generally beneficial.

In real estate, each area has specific trends within their markets. Thus, investing in a variety of areas outside your home state can keep your portfolio more diverse. If one area experiences a negative trend, the goal is for the other areas to keep you profitable. This is a good strategy for becoming as close to recession proof as possible.

Investing in rental properties in other states helps to provide you with geographic diversity. For example, if a major company leaves a town you’ve invested in, people will typically go with it as jobs go away, leaving you struggling to find tenants. Furthermore, exposure to natural disasters, or changes to rental regulations that make an area less landlord-friendly will not affect you as much if all of your properties are spread out. Thus, having a diverse rental portfolio will help to mitigate the effect of these risks!

Financial Pearl

"Investing in rental properties in other states helps to provide you with geographic diversity. For example, if a major company leaves a town you’ve invested in, people will typically go with it as jobs go away, leaving you struggling to find tenants. Furthermore, exposure to natural disasters, or changes to rental regulations that make an area less landlord-friendly will not affect you as much if all of your properties are spread out. Thus, having a diverse rental portfolio will help to mitigate the effect of these risks!"

(2) More Affordable Options

One of the major reasons that people choose to invest in out of state rentals is due to the pursuit of better return on their investments. After all, if the rental options in your area are particularly expensive, looking elsewhere can enable you to get into the rental game more easily, especially if properties elsewhere are less expensive.

- Here is an example: in a state like California, a single family home would cost an average of $600,000 to own. Lenders usually require a minimum down payment of 20% to finance the property, which equates to $120,000 plus closing costs. This is a large sum of money! Let’s say you manage to save up $120,000, it would likely take you another 3-5 years to accumulate the same amount of money to acquire another rental property.

However, if you look at other markets where properties are less expensive, such as Jacksonville, FL or Memphis, TN, where the average price of a 3-bedroom single family home can cost $100,000, you may only need to invest about $20,000 plus closing costs (assuming a 20% down payment), in order to acquire the property. With such a small cash investment, you may find yourself possibly acquiring 2 rentals a year, vs. 1 rental every 3-5 years if investing in more expensive markets like California. With home prices being much lower priced, you are able to acquire more properties quicker, allowing you to scale your portfolio at a quicker pace.

Keep in mind, if you are looking at an area where housing prices have increased greatly for quite a while, you are likely going to experience a more significant downturn in the future. Markets that have much larger appreciation and expensive home values are more at risk of being affected during a housing downturn vs. smaller markets where home prices are already substantially less. Either way, remember that real estate is a long-term investment, looking at history as well as projections going forward is important.

(3) Stronger Returns

When investing in out of state real estate where home prices are much lower, you can see two major financial benefits: positive cash flow and attractive cash on cash returns.

Cash flow is the amount of money left over after all expenses, including mortgage debt, have been accounted for. When you invest in a market where the rental amount is at or near 1% of the home price, your chances of positively cash flowing are much greater.

- Let’s use an example to help paint this picture: If you invest in a market like Memphis, TN, as mentioned early, you can find properties worth $100,000 that can be rented for $1000/month. Following the 1% rule (where the rent is 1% of the home’s purchase price), you will be able to have positive cash flow after accounting for expenses and debt services. However, in more expensive markets such as California, where home prices are much higher than rental rates, being cash flow positive is nearly impossible.

The second indicator of investment success is cash on cash return.

- Cash on cash return refers to the amount of net cash flow a property is generating as a percentage of the total amount of cash invested. In less expensive markets, your dollar goes much further. A $20,000 investment for a down payment for a $100,000 roperty will likely yield you at least a 8% return while a $120,000 investment for a downpayment for a $600,000 house will likely yield you far less than half of that. In that case, your money is better spent in index funds where returns have historically averaged 7-8% annual returns.

Thus, if you have $50,000 to invest, you will see a greater revenue stream and lower debt costs when you buy in an inexpensive market versus a higher cost one.

Additionally, out of state markets also enjoy great appreciation just like expensive markets.

- An example would be purchasing property in undervalued markets that are seeing strong population growth and job growth tend to generate strong appreciation over time. As a result, your property will likely go up greatly in value over the long-term. This means you benefit not only from a strong cash flow and return on investment, but also from increased equity due to the appreciation.

Financial Pearl

"Cash flow is the amount of money left over after all expenses, including mortgage debt, have been accounted for. When you invest in a market where the rental amount is at or near 1% of the home price, your chances of positively cash flowing are much greater. If you invest in a market like Memphis, TN, you can find properties worth $100,000 that can be rented for $1000/month. Following the 1% rule (where the rent is 1% of the home’s purchase price), you will be able to have positive cash flow after accounting for expenses and debt services. However, in more expensive markets such as California, where home prices are much higher than rental rates, being cash flow positive is nearly impossible"

(4) Few Barriers to Entry

If you are hoping to become a property investor for the first time, it may feel impossible if you already live in an area where prices have gone up - it may take you years to save up for a down payment. Lower priced homes in other states can make entry into real estate investing much quicker.

However, out of state markets that are up-and-coming can be more affordable while also benefiting from the long term gain of appreciation. Another benefit of beginning in a lower cost market is that you will get experience in a lower stakes environment. Investing in real estate is definitely a learning experience. Having greater experience before investing in an expensive market can be a good thing.

5 Tips for Owning Out of State Properties

-

If you do go ahead and invest in out of state property, there are some important tips for succeeding:

-

(1) Research and identify markets that are growing, with a strong rental demand.

-

(2) If you have a large portfolio of properties or a busy schedule, consider finding a reliable property manager.

-

(3) Build relationships with trustworthy realtors, contractors and a reliable maintenance team as they can help you find, rehab and maintain your property.

-

(5) Invest in an area where a friend or family member can help conduct inspections or walk through vacant units.

Final Thoughts

Investing in out of state rental properties can be a good investment, particularly for those who live in areas that are already established as strong markets with high prices. While out of state investing has its share of challenges, it is also a good opportunity for diversifying your portfolio, increasing return on investment, optimizing cash flow, and allowing for easier entry into the market. While this can be a very lucrative opportunity, there are certainly some risks involved that must be considered. Remember, clearly evaluating the market is key when investing out of state. Once you’ve determined a market that fits your investing needs and located a potential property, be sure to perform proper due diligence and you will be on your way to success!

Want to learn how to follow Julie for more REI Tips? Follow her on IG@house_hustle

Want to take a passive approach toward REI? Check out our Recommended Syndications Recommend RE Investments

Facebook Comments