The Optometrist's Guide to Retirement Planning

Chapter 3: Which Retirement Accounts are Right for You?

We will show you which retirements are best for your own situation and maximize your tax saving by selecting the appropriate accounts.

- ✅ (1) 8 Type of Retirements Accounts

- ✅ (2) Roth vs Traditional: 6 Reasons Why You Should Consider a Roth 401K

- ✅ (3) What the Roth IRA and Backdoor Roth IRA?

- ✅ (4) What is the Health Saving Account (HSA)?

- ✅ (5) Six Retirement Doctor Examples

Okay, let get technical really fast and define all the different types of retirement plans out there first before we dive into which one ideally works best for your financial situation.

8 Basic Types of Retirement Plans Offered (2024)

Employer-Provided 401K/403B/457B

Solo/Individual 401K

-

Who?

Company-provided account for Employees

-

Contributions

Can contribute Pre-Tax Deductible dollar up to $23,000 (Extra $7,500 catch-up for > Age 50. Employer automatically deduct pre-tax contributions on your paycheck.

-

Taxes

All withdrawals are taxed at income rate after age 55, but additional 10% Penalty imposed if withdrawal made before retirement age 55

-

Pros:

- Roth option may be available depending on your employer

- Usually have an employer match (1-10%)

- Able to borrow money as 5-year loan (limited to 50% of 401K fund or $50,000, whichever is less)

- Able to withdraw without penalty due to hardship such as disability and high medical expense

-

Cons:

- Funds selection may be great or very poor. Fund cost can vary in price or have high administration yearly fees depending on company

- Must leave previous company to roll-over to another 401K with new employer or roll-over into personal IRA

-

Who?

Self-employed 1099 individual or Business owner with no employees (other than spouse)

-

Contributions

Can contribute Pre-Tax Deductible dollars - $23,000, toward the employee/employer’s 401K, along with an employer’s match/contribution (profit-sharing) up $69,000 Total (or Max 100% of total income), whichever is less.

-

Taxes

All withdrawals are taxed at income rate after age 55 but additional 10% Penalty imposed if withdrawal made before retirement age

-

Pros:

Able to borrow money as 5-year loan (limited to only 50% of 401K or $50,000, whichever is less).

Able to withdraw without penalty due to hardship such as disability and high medical expense

-

Cons:

Harder to set up and require a plan administer like Vanguard

Traditional Individual Retirement Account (Trad-IRA)

Roth Individual Retirement Account (Roth-IRA)

-

Who?

Any earned-income individual (W2 or 1099)

-

Contributions

Can contribute up to $7,000 Pre-tax Deductible dollars (Extra $1,000 catch-up for >Age 50). Will have Modified Adjusted Gross income (MAGI) limit if Optometrist already have a main employer retirement plan like 401K or SIMPLE IRA

Single: Max MAGI income= $87,000 (start to phase out contribution level at $77,000)

Married filing jointly: Max MAGI income = $146,000 (start to phase out contribution level at $123,000)

-

Taxes

All withdrawals are taxed at income rate after 59 ½ but additional 10% Penalty imposed if withdrawal made prior to retirement age

-

Pros:

Easy to set up with great fund choices

Able to withdraw without penalty due to hardship such as disability and high medical expense

Able to withdraw without penalty for qualified Higher education (You, your spouse or your children or grandchildren)

Able to withdraw without penalty up to $10,000 per spouse for 1st home purchase (You, spouse, grandparents or children/grandchildren)

-

Cons:

- Low contribution Limit

- Most ODs' income will be too high or they will already have a main Employer retirement account

-

Who?

Any earned-income individual (W2 or 1099)

-

Contributions

Can contribute up to $7,000 Post-tax Deductible dollars (Extra $1,000 catch-up for >Age 50), also additional $6,000 Spousal Roth IRA (non-working)

Single: Max MAGI income= $161,000 (start to phase out contribution level at $146,000)

Married filing jointly: Max MAGI income = $240,000 (start to phase out contribution level at $230,000)

-

Taxes

Contributions (what you put in) can be withdrawn at any time, without taxes or penalty. If you withdraw earnings (a.k.a. gains) before age 59 ½ then they will be taxed as income tax rate +10% penalty. Otherwise, withdrawal on gains will be tax-free after 59 ½

-

Pros:

Easy to set up with great fund choices

Tax-free Growth

- Able to withdraw CONTRIBUTIONS Anytime (since it is funded with post-tax already) with tax or 10% Penalty PRIOR TO 59 1/2

Able to withdraw EARNING without penalty due to hardship such as disability and high medical expense (After 5 years)

Able to withdraw EARNING without penalty for qualified Higher education like for you, your spouse or your children or grandchildren (After 5 years)

Able to withdraw EARNING without penalty up to $10,000 per spouse for 1st home purchase for you, spouse, grandparents or children/grandchildren) (After 5 years)

-

Cons:

Low contribution Limit

Max Income limit, but able to do Backdoor Roth IRA

- 5 years Withdrawal Rule:The first Roth IRA five-year rule is used to determine if the earnings (interest) from your Roth IRA are tax-free. To be tax-free, you must withdraw the earnings: (1) On or after the date you turn 59 (2) At least five tax years after the first contribution to any Roth IRA you own

Saving Incentive Match Plan IRA (SIMPLE-IRA)

Self-Employed IRA (SEP-IRA)

-

Who?

Business with <100 employees or self-employed individuals

-

Contributions

Can contribute Pre-Tax Deductible Dollars up to $16,000 (Extra $3,500 catch-up for > Age 50) )

-

Taxes

All withdrawals are taxed at income rate after 59 ½ but Additional 10% Penalty imposed if withdrawal made prior to retirement age

-

Pros:

- Easier and more affordable to set for small business

Able to withdraw without penalty due to hardship such as disability and high medical expense

Able to withdraw without penalty for qualified Higher education (You, your spouse or your children or grandchildren)

Able to withdraw without penalty up to $10,000 per spouse for 1st home purchase (You, spouse, grandparents or children/grandchildren)

-

Cons:

- Lower contribution Limit

No Roth Option

- Cannot do Backdoor Roth IRA due to pro-rata rule if above MAGI income limits

-

Who?

Self-employed 1099 individual or small business owner (including those with employees

-

Contributions

Pre-Tax Deductible dollar for 1099 income. Can contribute up to $68,000 (max is 25% of net income). You simply claim the deduction when you file taxes on your 1099 income or via employer paycheck.

Employer of SEP IRA can offer it to their employees and thus automatically deduct pre-tax contributions on your paycheck or you can deduct it during tax filing.

-

Taxes

All withdrawals are taxed at income rate after 59 ½, but Additional 10% Penalty imposed if withdrawal made prior to retirement age

-

Pros:

Easy to set up with great fund choices

Able to withdraw without penalty due to hardship such as disability and high medical expense

Able to withdraw without penalty for qualified Higher education (You, your spouse or your children or grandchildren)

Able to withdraw without penalty up to $10,000 per spouse for 1st home purchase (You, spouse, grandparents or children/grandchildren)

-

Cons:

No Roth Option

- Cannot do Backdoor Roth IRA due to pro-rata rule if above MAGI income limits

401K with Profit-Sharing Plan (PSP)

Defined Benefit Plan (DBP)

-

Who?

Employer-provided 401K along with a Profit Sharing feature where the employer can make a profit-sharing contribution to employees.

Example: Group of doctor partners

-

Contributions

Can contribute Pre-Tax Deductible dollar $23,000 toward the employee/employer’s 401K, along with an employer’s match/contribution up to $46,000 match, but $69,000 Total (or Max 100% of total income), whichever is less

-

Taxes

All withdrawals are taxed at income rate after age 55, but additional 10% penalty imposed if withdrawal made before retirement age

-

Pros:

- Significant higher Benefits and higher contribution in short period of time, leading to subsidized early retirement

-

Cons:

Extremely expensive and overly Complicated.

Need an administer and cannot discriminate toward higher-paying participants

-

Who?

- Small Business with no employees other than the owners and spouses.

- Basically employer-sponsored that pays out monthly benefits upon retirement based in a set formula

-

Contributions

Employers can only contribute Pre-Tax Deductible dollars up to $275,000 (or max 100% of average income for 3 highest constructive years)

-

Taxes

All withdrawals are taxed at income rate after age 59 ½ but additional 10% Penalty imposed if withdrawal made before retirement age

Upon retirement, can be paid out in 3 ways such as (1) Single life annuity (Fixed monthly benefit until you die, but no further payment to your family survivors upon death), (2) Qualified joint/survivor annuity (your surviving spouse will get benefits until his or her death) or (3) Lump-sum payment.

-

Pros:

- Significant higher Benefits and higher contribution in short period of time, leading to subsidized early retirement

-

Cons:

Extremely expensive and complicated to set up

Need an administer to prevent an Excise Tax if minimum contribution requirement is not satisfied

What is the Difference Between Roth vs. Traditional?

Now that we have a broad understanding of the different retirement plans, let's talk about the differences between Roth and Traditional that can apply to either a 401K or IRA. This is basically how the government can tax our retirement accounts by forcing you to pay money in taxes now (pre-Tax) and later on (post-Tax). Either way, the house, aka the IRS, will get its cut. This can get complicated, so just breathe and read carefully.

Simply put, with a Traditional 401K or Traditional IRA, retirement contributions are made with PRE-TAX INCOME, so you pay taxes later in retirement when you withdraw the money. You are taxed depending on your post-retirement income bracket, which should be fairly low since you are not working anymore (usually 12%). This is often ideal for most high earning doctors because we want to REDUCE OUR TAXABLE INCOME during our peak career.

In a Roth 401K or Roth-IRA, retirement contributions are made with AFTER-TAX INCOME since you already pay taxes on your income when you get your paycheck (usually W2) so this allows the profit gains grow tax-free (which is freaking awesome). This is often ideal for low-earning jobs or optometrists during Residency. This is also good for my "super-saver" optometrist planning to have a large retirement nest egg!

Example: Let’s use a main employer-sponsored 401K account (which has a max employee contribution of $23,000 for 2024). For example, Dr. Ptosis has an annual salary of $115,000 with an employer-sponsored 401K account, and has the choice to go the Traditional or Roth route, which one does he chose?

Since Dr. Ptosis is in a significant high tax bracket now (Federal=24%), he wants as much deduction as possible to lower his taxable income. So, he would want to do Traditional 401K and contribute pre-tax dollars now. This will allow him to pay the taxes later, when he retires.

Assuming that when he retires at 65 years old, he only has to withdraw less than $40,000 from his retirement accounts for living expenses, so essentially, he will only be taxed at 12%! (Thus in one of the lowest tax brackets).

This is the MOST tax-effective way for high-earning doctors.

Trad 401K vs Roth 401K

"For low earners like optometry residents or students, a Roth 401K or Roth IRA is the best route because income will eventually go up in the future; so it is much better to take advantage of their low tax bracket now.

While the typical high-earner doctors should look for the tax deduction, thus traditional 401K is often the route (assuming they have a modest retirement nest egg of ~$2M and only taking out $80K for living expenses)

When in doubt, the tie always goes to Roth"

6 Reasons Why You Should Consider a Roth-401K (EXCEPTION)

A few members of ODsonFinance are what I called SUPER-SAVERS or fairly aggressive investor with a high saving rate (50% or higher); most of them are entrepreneurs who will have lot of side income incoming in during retirement, and thus will tend to have a large retirement nest egg. If you have one or more of these factors, consider a Roth 401K:

-

(1) You max out 401K ($23K) + Roth IRA ($7K) each year

Assuming a typical 7% from 28 to 65 yo, after 37 years, your nest egg will be over~$5.2 M within your retirement accounts. Assuming a safe 4% withdrawal, you are going to take out $209,654 annual living expenses, essentially putting you in a higher tax bracket

-

(2) You are an entrepreneur who will have other side business or rental properties

These side business will continue to passively produce income in retirement, outside of your optometry salary which fill your tax brackets

-

(3) You have a high saving rate (over 50%) and living significantly below your means

Even if you are only making $150K as a typical OD salary, if you are investing $50-75,000 per year by saving 50% of your pay. Assuming a typical 7%, after 37 years, your nest egg will be ~$8.7M within your pre-tax retirement accounts. Assuming a safe 4% withdrawal, you are going to take out $348,000 annually, essentially putting you in the highest tax bracket.

-

(4) You are a very aggressive investor who is focused on stock and don’t have a lot of exposure to bonds even nearing retirement

We have a quite a few investors who are focus heavily on more growth stocks like tech, individual stocks compared to a typical age-recommended conservative stock/bond. They are aware of the higher risk and can tolerate the extreme market volatility, and thus MIGHT have a higher overall return.

-

(5) Required Minimum Distributions RMD (Age 72)

Starting age 72, the IRS require you to withdraw a certain % from all non-Roth Accounts like SIMPLE IRA, trad 401K, etc. While a lot of factors like age, account balance, beneficiaries will impact your yearly RMD, a typical average required withdrawal rate is 3.5%. Otherwise, IRS will impose a 50% Penalty of RMD amount that should have taken out.

So assuming you have a large pre-tax trad 401K account of $4M, you are required to take $208K annually at age 72. Therefore, essentially putting you in the higher tax bracket

-

(6) You will likely be in a higher tax bracket in retirement and/or you think tax rate will goes up with time

The only thing that is certain in life are rain and tax. So if you believe that due to government policies, spending or high inflation, tax rates will be higher by the time you retire (most likely), then it might be best to do Roth.

Why is the Roth IRA so Awesome?

All right, let’s talk about the amazing and hidden powers of this tax-efficient retirement account. The Roth IRA is so complicated in its details that there have been whole books devoted to the topic. We are going to give you the basics of why we love the Roth IRA so much and why it should be a part of every high-earning professional portfolio.

So, as you know, anyone with earned income (regardless of 1099 or W2) can open a Roth IRA via Vanguard or Fidelity and can contribute $7,000 each year for 2024 (and another $7,000 for your non-working spouse if you want). The great thing about a Roth IRA is that you have access to a variety of great and cheap choices of mutual funds, unlike those automatically chosen within your 401K by your employer. Also, it is extremely easy to set up!

The one awesome thing is that since you contribute a Roth-IRA with after-tax money, the contributions can NEVER be taxed ever again (DUH, because you already paid taxes to Uncle Sam). Also, your capital gains (or how much your investment funds grow in profit) will also come out TAX-FREE. This is the principal reason why the Roth IRA is so awesome - because it doesn’t have to pay the typical income tax upon withdrawal, like those in a traditional 401K or even the 15% long-term capital gain tax in a typical Taxable Brokerage investment.

Example: Dr. McLovin is one lazy 30-year-old when it comes to retirement investing and only contributes $7,000 each year to his Roth IRA out of his huge paycheck. If he is planning to retire at 65 years old and assuming an 8% growth each year, his total contribution (how much he put in) will only be $227,000 but his gains will be a WHOPPING $1,33,334

This allows Dr. McLovin to retire a millionaire (Total net worth of $1.3M) by doing the bare minimum (see how little effort it takes to be rich??).

Okay, so lets talk about the tax implications! Since it is in a Roth IRA, that $1.3M is all yours! Uncle Sam can’t touch it.

But if this was in a Traditional 401K, you would have to put taxes BOTH on the contribution and gains. Therefore, assuming you are at the lowest Tax Bracket of 15% in retirement, and you pull out all the money slowly over time, your overall tax bill on the total $1.3M within the traditional 401K, would have an estimated tax bill loss of $200,600 to Uncle Sam.

What About Withdrawals on Contribution or Gains in a Roth IRA?

While you can withdraw the Roth IRA contributions at any time WITHOUT penalty or taxes, there are some strict rules of your GAINS WITHDRAWAL.

5-year Rule: You can only withdraw your gains 5 years after you open your Roth IRA account. For example, if you made a Roth IRA contribution in February 2020 and assign it for 2019 Tax year (Remember you have up until April 2020 Tax Deadline to make any Roth contribution for 2019), you will have to wait until 1/1/2024 to withdraw any Roth IRA earning.

Similar to other retirement account, you still have to wait until they are 59 ½ years old to withdraw any gains to avoid the 10% penalty.

What Are Some Exceptions to Avoid the 10% Penalty For Gain Withdrawal?

- Hardship periods such as disability and high medical expense.

- Higher Education Schooling (can be applied to your spouse, or children/grandchildren).

- Up to $10,000 per spouse, for a first-time home purchase (can be applied to your grandparents or children/grandchildren as long as it is their 1st home purchase).

Also, many doctors want to retire as early as 50 years old but cannot access their Trad-401K or IRAs until 59 ½, so a great strategy is to spend any tax-free Roth IRA contributions to fund their retirement from 50 to 59 ½ year old without the 10% penalty. Then after 59 ½ they can tap the fund in their traditional 401K funds.

Lastly, while we strongly DO NOT recommend this route since the funds in your Roth IRA should be only strictly reserved for retirement, some investors can use their Roth IRA as a source for additional emergency funds in dire financial situation such as a life-saving medical operation.

The Back-Door Roth IRA

You might be asking, “Wait guys! Most doctor salaries are way above the $161,000 limit (2024) and cannot qualify for a Roth IRA! So why are we even talking about this?”

You are absolutely correct!

To qualify for a Roth IRA in 2024, you need to have a modified adjusted gross income of under $161,000 (start to phase out contribution level at $146,000) for single individuals, and for married filing jointly, the max income is $240,000 (start to phase out contribution level at $230,000). So how do many high-earning professionals get around this??

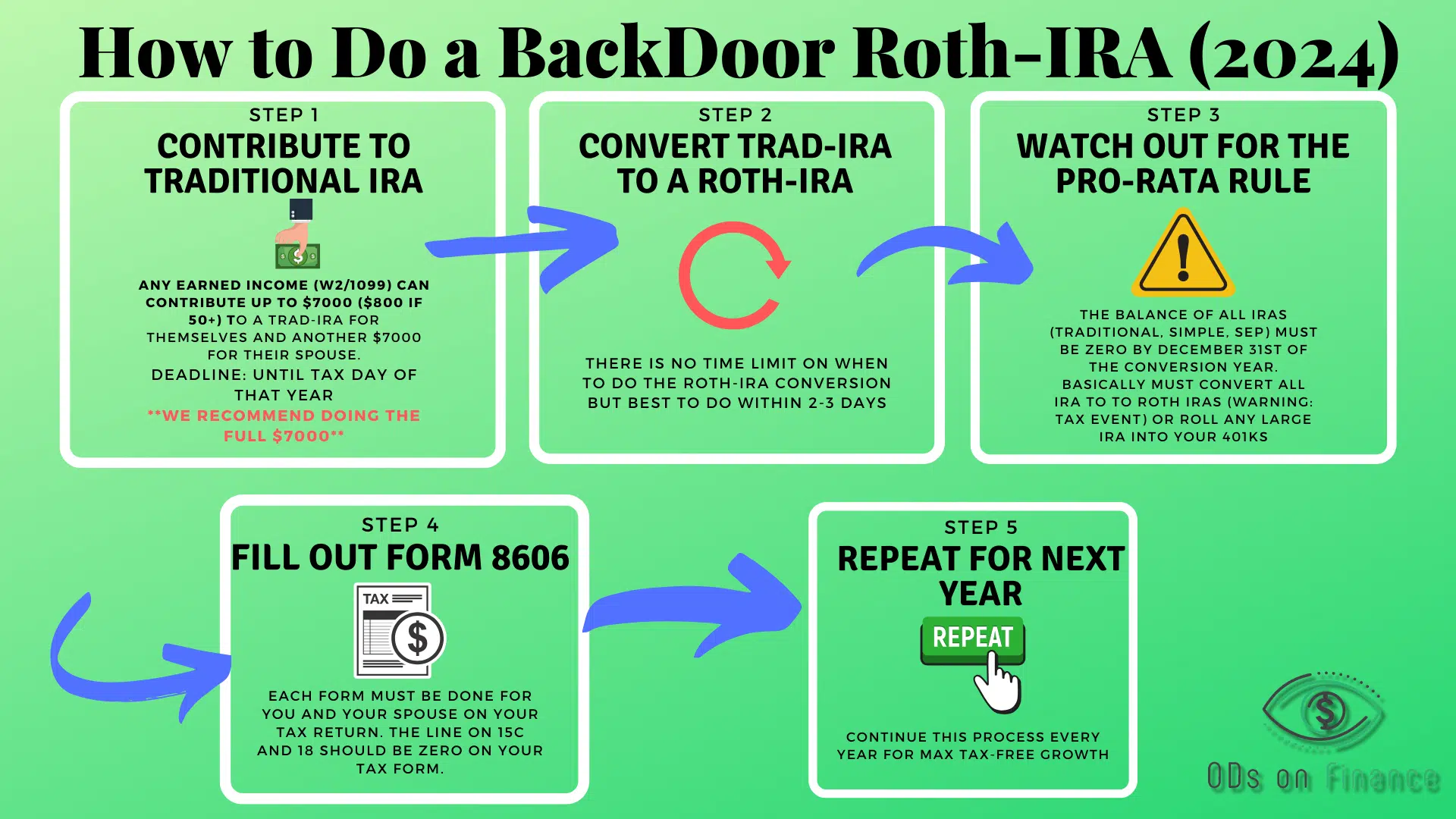

There is a wonderful IRS loophole called the BACKDOOR Roth IRA. It is basically for the high earning professional whose income is above the MAGI Roth IRA Limit and wants to open a Roth IRA. There are many online tutorials on how to do this, but you can basically open a Traditional IRA (ex: via Vanguard) and deposit the full $7,000 max amount. Then, the next day, you convert it to the Roth IRA. You simply repeat this each year.

How does Pro-Rata Rule Affect me if I have any existing IRAs?

We won’t go into much detail, but basically the IRS requires you to perform a calculation end of the year where they will treat all your existing IRAs (such as SEP, SIMPLE, Traditional IRAS) as ONE BIG IRA account. This can complicate things when you try to do a backdoor Roth conversion.

Your Roth IRA will be taxed on the “pro-rata” percentage of all your total pre-tax IRA balances to the total of all your IRA balances. Unless you are willingly to convert ALL IRA accounts to your Roth IRA, and willingly pay the huge tax bill to Uncle Sam (Remember, with Roth, you pay taxes now to avoid the taxes due on any gains in the future). Afterward, you technically only have one Massive Roth-IRA, then you can do the backdoor Roth IRA.

In Summary, it is extremely complicated - so DO NOT attempt the backdoor Roth IRA if you have existing other main IRAs like a SIMPLE or SEP IRA.

If you have any existing IRAs like SIMPLE or SEP IRA, DO NOT attempt the backdoor Roth IRA! This will overcomplicates your tax filing due to the pro rata rule.

If your income starts to creep up and you cannot the Roth IRA, it is always recommended to do the backdoor Roth IRA prior to this! If you make any mistake, just contact your brokerage to "re-characterize" your contributions for you!

Is The BackDoor Roth IRA Legal?

Some financial experts argued that it is just a way for the IRS to track their budget but Congress officially blessed the backdoor Roth IRA for everyone back in 2018. The Roth IRA is a powerhouse when it comes to all these different tools and is a great way to diversify your retirement tax.

Want to learn more about the Backdoor Roth IRA? Check here to Read a Step-by-Step Guide

What is a Health Saving Account (HSA) aka “Stealth IRA”?

Alright, let’s chat about the Ninja in the Room, which is the Health Saving Account (HSA). If you are enrolled in a high-deductible health insurance plan, you can open an HSA either outside or via your employer.

For 2024, the maximum contribution is $4,150 for single individual and $8,300 for Family.

The great thing about the HSA is that it is TRIPLE TAX ADVANTAGED if you use the money for medical expenses, which will be significantly needed, as you get older.

In addition, HSA acts like an additional retirement vehicle to park your money efficiently from taxes, hence the name “Stealth IRA”.

6 Great Things about Health Saving Account (HSA)

-

(1) Funded with Pre-tax dollars, basically a great tax deduction

-

(2) You can use the funds at any time for any health-care expenses, without any tax paid or 10% penalty

-

(3) There are no taxes on growth and you can also withdraw Tax-free for medical expenses

-

(4) After age 65, you can withdraw from your HSA without penalty after age 65 for anything at all, but you just

-

(5) You don't have to use all the funds by end of the year like a Flexible plan (FSA) or Health reimbursement (HRA). Also, the funds carry over after you leave your old job.

-

(6) Able to use money contribution to invests in any mutual funds within the HSA account for maximum return.

6 Retirement Doctor Examples (2024)

Now that you are all educated about the crazy world of retirement accounts, let's run through some real-life cases that will hopefully apply to your own situation. Remember, our goal is to maximize the number of tax-efficient savings that a doctor can put away toward his retirement, depending on his or her tax situation. Please feel free to refer to the Retirement account chart if needed.

Doctor Case A: Full time employed W2 doctor with an income of $120,000 with an employer-sponsored Traditional 401K plan with 5% match.

Doctor Case B: Full time employed W2 doctor with an income of $110,000, but unfortunately her employer doesn’t offer any Employer 401K plans or any other SIMPLE IRA retirement plans. She does some casual fill-in at another optometry office and roughly has $10,000 in 1099 income.

-

(1) Fund the Traditional 401K up to $23,000 with the 5% employer match (Additional $6,000)

-

(2) Open a Traditional or Roth IRA (up to $7,000, max MAGI income limit is $161,000). We recommend Roth IRA route due to tax-free growth.

-

(3) Dump the rest of his post-tax income paycheck into a Non-retirement Taxable brokerage account (No limit) with 15% long-term capital tax on any earnings.

-

This W2 doctor is in great shape and can contribute a significant amount of his income to retirement in a tax-efficient manner.

-

(1) Open a traditional or Roth IRA (up to $7,000, max income limit is $161,000). In this case, either route is okay due to the doctor’s income bracket. But when in doubt, the tie goes to the Roth IRA.

-

(2) Open Solo-401K for her 1099 income (max $22,500). It is harder to set up, but this will allow her to do a backdoor Roth-IRA if her income starts to rise past $153,000 limit in the future.

-

(3) Dump the rest of her post-tax income paycheck into a Non-retirement Taxable brokerage account (No limit) with 15% long-term capital tax on any earnings.

-

This W2 doctor has a significantly more limited max contribution to her retirement fund, compared to our Doctor A. It is great that she has some 1099 income on the side or else, the only thing that she can do is a Roth IRA.

-

Doctor B can technically open a Solo-401K for her small 1099 income, but she can only contribute up to $23,000 Limit. She can deduct the 1099 contribution to Solo 401K when she files her end of year taxes.

Doctor Case C: Full time 1099 doctor with an income of $190,000, working for a private office where there is no employer-sponsored 401K or health benefits. She forms a S-Corp or LLC where she is both the employer/employee.

Doctor Case D: Full time Private Practice Business Owner Incorporated as LLC or S-Corp, and pay himself a W2 salary of $150,000

-

(1) Open a Solo-401K for her 1099 income, but she can contribute $23,000 of her total 1099 income to the Solo-401K. She is also allowed to do an employer’s match up of up to $46,000 but it cannot exceed $69,000 total or Max 100% of her total income, whichever is less.

*She can do a MEGA ROTH Solo 401K via Ubiquity 401K

-

She can deduct the 1099 contribution to Solo-401K when she files her end of year taxes

-

(2) Open a Backdoor Roth IRA (up to $7,000, since max income limit is $161,000)

-

(3) Dump the rest of any post-tax income paycheck into a Non-retirement Taxable brokerage account (No limit) with 15% long-term capital tax on any earnings.

-

Since this Doctor C is all 1099 income with a high income, she should open a solo 401K account even though it takes more work to set up. This will allow her to do a backdoor Roth IRA. Technically, she can do a SEP IRA (similar contribution to Solo 401K) but it will complicate her tax situation when she tries to open her backdoor Roth IRA due to the Pro-Rata rule.

-

(1) Open an Employer-sponsored Traditional 401K for himself but must allow all his staff members to participate (Up to $23,000 contribution max) if desired.

-

(2) Consider a Defined Benefit Plan or Profit-Sharing plan (up to $275,000)

-

(3) Open a Backdoor Roth IRA (up to $7,000, since max income limit is $161,000)

-

(4) Dump the rest of any post-tax income paycheck into a Non-retirement Taxable brokerage account (No limit) with 15% long-term capital tax on any earnings.

-

As private practice owner, you have the option to either pay yourself a salary as a W2 employee of your corporation or pay yourself as 1099 income independent. Being 1099 income allows you to still open a SIMPLE-IRA ($16,000) or SEP-IRA (25% of net, up to $68,000) but again would complicate you opening a backdoor Roth IRA. Also, you have the option to do a 401K with a profit-sharing plan ($23,000 401K with an employer’s match up to $46,000, but $69,000 total (or max 100% of net income, whichever is less), or even a defined benefit plan ($275,000 max).

-

Since taxes get more complicated with owning a business, it is highly recommended that a practice owner works with a CPA to see which retirement account is best for his business.

Doctor Case E: Full time Employed Associates with a W2 salary of $150,000, with a Employer SIMPLE IRA at her office with a 3% Match. She does some 1099 fill-in of $20,000

Doctor Case F: Full time employed W2 doctor with an income of $120,000 with an employer-sponsored Traditional 401K plan with 5% match. Also married with a non-working Spouse and on a high-deductible medical plan (access to HSA)

-

(1) Fully Fund the SIMPLE IRA $16,000 with the 3% Match

-

(2) Open Solo-401K for her 1099 income (max $23,000). It is harder to set up, but this will allow her to do a backdoor Roth-IRA if her income starts to rise past the $161,000 limit in the future but she would need to rollover her SIMPLE IRA once she leave her job

-

(3) Dump the rest of any post-tax income paycheck into a Non-retirement Taxable brokerage account (No limit) with 15% long-term capital tax on any earnings.

-

Doctor E can technically open a SEP-IRA for her 1099 income, but she can only contribute 25% of her total net 1099 income to the SEP IRA (Ex: only $5,000 can be contributed to her SEP IRA). She can deduct the 1099 contribution to SEP IRA when she files her end of year taxes. Again but it will prevent her from doing a backdoor Roth-IRA if her income starts to rise past $161,000 limit in the future. I would go toward Solo-401K route because she would need it eventually anyway.

-

She can also open a Traditional IRA $7,000 but since she is over the MAGI income of $87,000, she won’t be able to deduct it during tax, which defeats the whole purpose. She cannot do the Roth IRA $7,000 via Backdoor due to the pro rata Rule. So unfortunately, this OD is limited to her SIMPLE IRA as her only retirement, unless she has a health spending account (HSA)

-

(1) Fund the Traditional 401K up to $23,000 with the 5% employer match (Additional $7,500)

-

(2) Open a Roth IRA (up to $7,000, max income limit is $161,000, Married $240,000).

-

(3) Open a Spousal Roth IRA (up to $6,500)

-

(4) Fund the HSA (up to $4,150 Single, $8,300 Family). This will add as “triple tax-advantaged stealth IRA” later in life

-

(5) Dump the rest of his post-tax income paycheck into a Non-retirement Taxable brokerage account (No limit) with 15% long-term capital tax on any earnings.

-

This W2 doctor is in great shape and can contribute a significant amount of their income in addition to her non-working spousal to retirement in a tax-efficient manner, especially with that HSA