STUDENT LOAN REFI

Get Up to $1200 & Lowest Rates

FREE CE EVENTS

50hrs Free CE & Financial Events

FINANCIAL RESOURCES

Looking for Insurance, CPA, CFP, Home Mortgage?

JOB | PRACTICE LISTING

Connect With Best Candidates To Your Practice

EYEDOCK

#1 Online Clinical Resource

NEWSLETTER

Get Weekly Financial Updates

FACEBOOK GROUP

Connect With Your ODs Peers

THE BOOK

OD's Guide To Financial Freedom

Latest Announcement | Events

Sunday, May 19, 2024 | 8am PST/11:00am EST (4hrs FREE CEs)

Navigate the intricate world of glaucoma care with a fresh perspective. This unique event bridges the gap between advanced glaucoma management and the financial nuances that drive a successful practice.

✅ AI-enabled glaucoma management (89436-GL) Jessica Steen OD, FAAO | CE Hour 1

✅ Optimizing the Ocular Surface in Glaucoma (85638-GL) Justin Schweitzer, OD, FAAO | CE Hour 2

✅ Billing & Coding Documentation for Glaucoma Evaluations (88896-PM) Kyle D Klute O.D l | CE Hour 3

✅ The Role of Laser in the Treatment of Glaucoma (89296-LP) Nathan Lighthizer, OD, FAAO | CE Hour 4

👉 ODs on Finance Member Rate: FREE | 🎥 Recording AVAL TO REGISTERS ONLY x 4 weeks

Sunday, June 9, 2024 | 8am PST/11:00am EST (4hrs FREE CEs)

Step into the evolving landscape of myopia management. This exclusive event is designed for professionals eager to understand the rising prevalence of myopia and how to harness its potential as a significant revenue stream for their practice.

✅ Upgrading your Myopia Management Practice: Soft Contact Lens Modalities & Fee Structures (82626-CL) Andrew Neukirch, O.D | CE Hour 1

✅ Making a CASE for Advanced Ortho-K (89902-CL ) Anith Pillai, OD, FSLS | CE Hour 2

✅ Breaking Barriers in Myopia Management: Marketing, Pricing, and Parental Involvement (89057-PM) Ariel Cerenzie, OD, FAAO, FSLS l | CE Hour 3

✅ Utilizing Technology for Improved Outcomes: Designing Myopia Management Contact Lenses with Corneal Topography and Tomography (PENDING) Melanie Frogozo, OD | CE Hour 4

👉 ODs on Finance Member Rate: FREE | 🎥 Recording AVAL TO REGISTERS ONLY x 4 weeks

Join the Conversation on Optometry's Largest Finance Focused Forum:

LATEST ARTICLES

June 2023 Market Update for Optometrists: Latest Economic & Financial Trends

Welcome to the June 2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans.

Good vs. Bad Optometry Debt – 4 Ways to Use Good Debt to Your Advantage

That being said, debt can be a useful tool for achieving financial goals, but not all debt is created equal. Some debt can be beneficial, while others can be detrimental to your financial well-being. Let’s explore the difference between good debt and bad debt and how you can use debt to your advantage.

Q1/2023 Market Update for Optometrists: Latest Economic Trends And How To Adjust Your Financial Plan

Welcome to the Q1/2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans… So we hope to provide a comprehensive overview of the latest economic trends and developments, highlighting the challenges and opportunities in today’s market for optometrists.

9 Financial Tips For Optometry Students

As an optometry student preparing to enter the field, it’s important to understand the financial implications that come with this profession. From budgeting for school supplies to managing debt and investing in your future—all these responsibilities add up quickly! With these 9 financial tips, you’ll equip yourself with the knowledge needed to navigate a successful career as an optometrist.

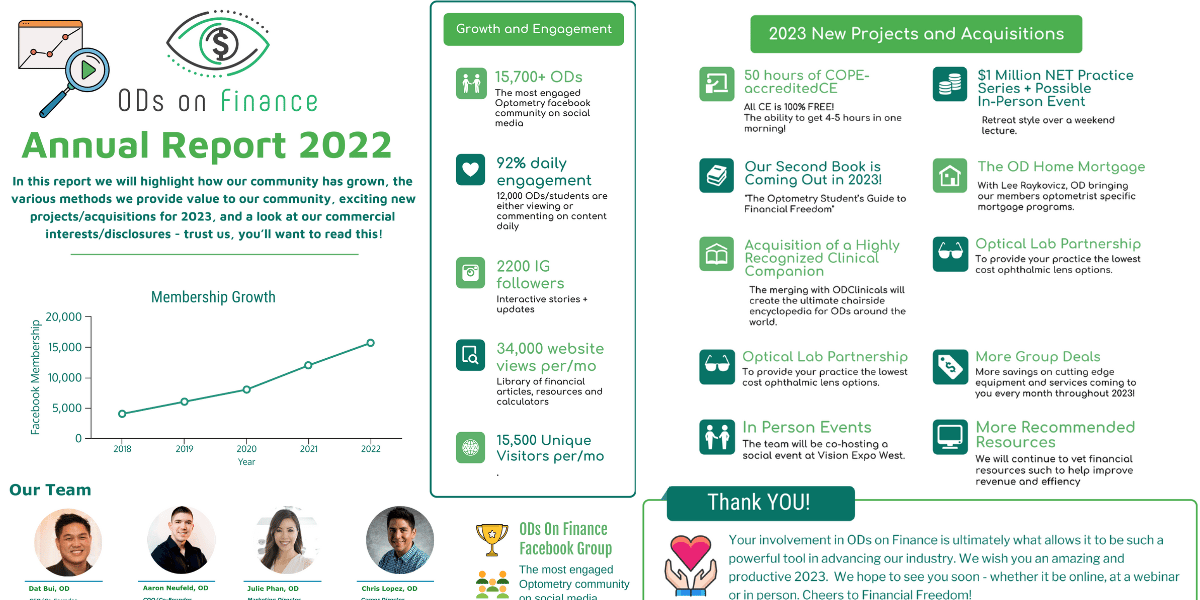

State of ODs on Finance: 2022 in Review, and a Look at 2023!

It’s hard to believe, but the year 2022 has vanished in the blink of an eye. This past year, we’ve had the pleasure of seeing ODs on Finance continue to grow and help ODs on their financial journey, whether they be new grads or seasoned veterans. We are thankful for your attention, your questions and your contributions. Two tenets that hold paramount value to us at ODs on Finance are transparency and productive growth. In this letter, we will highlight how our community has grown, the various methods we provide value to our community, exciting new projects/acquisitions for 2023, and a look at our commercial interests/disclosures – trust us, you’ll want to read this! Here is a quick recap of 2022!

6 Common Tax Mistakes That Optometrists Make

Optometrists are not trained in maximizing their tax benefits. Consequently, doctors who prepare their taxes themselves may miss many deductions they are entitled to take. I don’t know about you, but I want to take advantage of all the tax benefits I am entitled to. Following are six mistakes I see optometrists make that are costing them a lot of money in overpaid tax bills.

10 Things Your Optometry Lawyer Wants You to Know About

Putting yourself in the best position possible to be successful involves getting professional help, and an optometry attorney can be a vital part of your team of professionals.

Action Plan: What To Do with My Optometry Student Loans Before 2023?

Our inbox has been getting slammed with ODs asking for advice on what to do with their federal student loans as we get closer to the 0% forbearance expiration date of 12/31/22. Politics aside, based on the most recent federal news which removes a lot of uncertainty that we had last month, we are going to break it down with some actionable plans that optometrist can take:

The Optometrist’s Guide to Short Term Investing

With the recent volatile market and pending economic recession, many investors are looking to hold their cash in a relatively safe place, especially as our economy faces surging inflation. In this article, we will talk about short term investments and where we can place these funds, aside from just storing cash. What is a short-term investment?

The OD’s Quick Guide into Active & Passive Real Estate Investment

You’ve heard it again and again that real estate is an excellent pathway to accumulate significant wealth. However, you should also know that most real estate investors do not get rich overnight, as it can take years for investment properties to accumulate enough equity and generate significant wealth. The nice thing about real estate is that there are many approaches to make money and to do so either requires a lot of your time, or very little of it. Simply put, real estate investing can typically be classified as either active or passive investing. Let’s take a look at these categories to learn which may be the best fit for you!

Health Insurance Basic 101 That Every Optometrist Should Know

Whether you are a New O.D or Seasoned O.D ….healthcare is changing every year. Working in the medical field, I thought I understood how health insurance worked, until I ended up in the emergency room for two hours earlier this year. We will teach how to understand 6 key terms and how they apply to your health insurance (Premium, Deductible, Co-insurance/Co-pays, Maximum out of pocket, Benefit caps & understand network options (HMO, EPO, POS, PPO).

3 Take-Aways That Optometrists Should Know About Biden’s Student Loan Debt Relief

On Wednesday, Aug 24, 2022, President Biden, along with the US Department of Education announced a three-part plan to help student borrowers with federal loans transition back to regular payments. In addition, we do want to let our members know that it took us a little while to gather our thoughts after the dust settled to address our community.. So let’s begin with the facts first and any questions that optometrists might have. PART 1: Final extension of the student loan repayment + 0% Interest pause forbearance until 12/31/2022

5 Tips for Growing a New Sublease Office

Building a new sublease office inside a retail store brings some unique challenges, but can be even more rewarding when you see your office thrive after years of hard work. Like any new business, attracting new patients may be a struggle at first. However, by engaging in a number of creative practices, I was able to grow this office from a patient base of zero to a thriving optometry office! Below, I will share the five strategies that formed the core of my success plan:

6 Tips for Utilizing Cost Benefit Analysis on a New Piece of Equipment

New equipment is always a temptation for practice owners, and for good reason. A cost-benefit analysis (or CBA for short) is a term derived from Lean theory and is an analysis of the expected balance of benefits and costs, including an account of any alternatives and the status quo. CBA takes into account your overall return on investment (ROI), however the approach is a little less black and white than might be expected. Let’s go through 6 important tips on utilizing CBA to its full extent in order to find whether that new piece of equipment should find its way through your practice doors.

5 Tips to Stand Out in Your Job Search

A commonly noticed trend has been noticed over the last few years – new optometry programs continue to pop up throughout the country. This directly leads to an increase in the number of graduating optometrists. Therefore, it is reasonable to assume that the job market for associate optometrists is becoming more competitive. In a competitive environment, job applicants must seek ways to stand out from their peers as leading candidates. Learn how to make an impact on employers and set yourself apart from colleagues on your way to success.