How Dr. Kala Brown Eliminated $180K While Dealing with Husband’s Leukemia in 7 years #InspirationalStudentLoansSuccess

Editor’s Note: This is a guest post/Interview written by Dr. Kala Brown OD who an optometrist working in North Carolina as an associate OD. We want to thank you for sharing her inspirational student loan story! Every guest post is vetted, read and upheld to the highest standards of ODsonFinance. Your trust is the most valuable factor to us. We like having experts in their field write on our website, enjoy and give us feedback!

One of the most rewarding parts of running ODs on Finance is seeing all of the inspiring posts coming from optometrists that have eliminated their student loans. Although there are many ways to approach debt elimination and the timeline that one eliminates, it is hard to parallel the emotions that come with getting rid of massive student loan debt.

When it comes to loan debt elimination, Dr. Kala Brown Brewer’s story of eliminating $180,000 in student loan debt over 8 years is especially inspiring and heart wrenching. As a newly minted SCO grad in 2013, Kala first did a residency and then embarked on a career at an ophthalmology practice in North Carolina. Upon arriving at her new job, Kala found out that her husband had a relapse of leukemia. Here is the account of events, in Kala’s words:

-Aaron, COO/Cofounder

How did it all start by Kala....

Right after we got to Charlotte we discovered that my husband had a relapse of leukemia (had been in remission for years). I delayed my work start date by a few weeks, he had to withdraw from school, and go into the hospital for chemo. We flew his mother out to help and I started working so we’d have health insurance and a source of income. The chemo didn’t put him into remission so we enrolled him in a clinical trial at Duke. At the end of the trial we found out the new treatment didn’t work either. So then we enrolled him into a clinical trial at University of Pennsylvania. Before he could receive the Car-T cell immunotherapy, the FDA shut down the trial due to the number of deaths.

We had some help from friends and family along the way, but were in a desperate situation and I was supporting my husband and mother in law while she lived with us for over a year. A few months went by and the FDA decided to reopen the trial so he went through the immunotherapy treatment in 2015. It put him in remission! Then his doctor advised him to have a stem cell transplant. His brother was the donor and was a ½ match. It seemed crazy at the time but I decided it was best for us to buy an affordable new build house instead of continuing to live in an apartment. I found a loan option with only 3% down and no PMI. A year later my husband relapsed again and went through the same UPenn study a 2nd time in summer 2016. It put him back into remission!

What was the one thing that drove you to become debt free?

It’s hard to pick just one! Mainly the desire to put that large portion of my paycheck towards other things that I needed and wanted instead of towards student loans

What was your initial plan of action in order to become debt free? How did you structure your debt reduction strategy?

I increased my monthly payments beyond the minimum and tried to be frugal in spending. Each time I got a bonus, tax return, or profit from the sale of our houses, I paid extra on my student loans. In the beginning I tackled the loans with the highest interest rates first (avalanche method). When I paid those off, I put that monthly payment towards other loans. I decided to consolidate and refinance in 2018. I made sure to write a letter to my refinancing company (Laurel Road) specifying that I wanted any extra payments to go to the principal balance instead of to interest.

Could you walk us through numbers? How much per month were you paying? Was this solely from your income? How much came from real estate profits? (if you don’t want to give exact numbers, no worries!)

I deferred my loans during residency then started paying a minimum amount for about the next 2-3 years while we were navigating through my husband’s major health problems. After things settled down some, I started paying about $300/month above the minimum, then increased it to $600/month above. From 2018-2019 I was paying $1738/month. When the pandemic hit I decreased my payments to $1,600/mo since my paycheck was cut. I was the sole source of income for the majority of the last 8 years.

When we sold out first house in 2019, we paid $37,500 in profits towards my loans. When we sold our second house in 2021, we paid the remaining $22,100 on my loans and $16,141 on my husband’s.

As an associate OD, what were some ways that you increased your cash flow (ex: negotiating higher pay, moonlighting, etc.)?

During residency I did moonlighting at a few different practices on my days off and Saturdays. At my first job position I started out with a base salary and production bonus, then went to straight production. The bonuses and production amounts were not paid on a regular schedule so I felt less financially secure. When I decided to change jobs, I negotiated a much higher base salary but traded for a low bonus. My husband occasionally worked a part time job for at least 3 years.

Any psychological pay off reward strategies that you used? (ex: snowball, avalanche, or some other system)

Financial Pearl

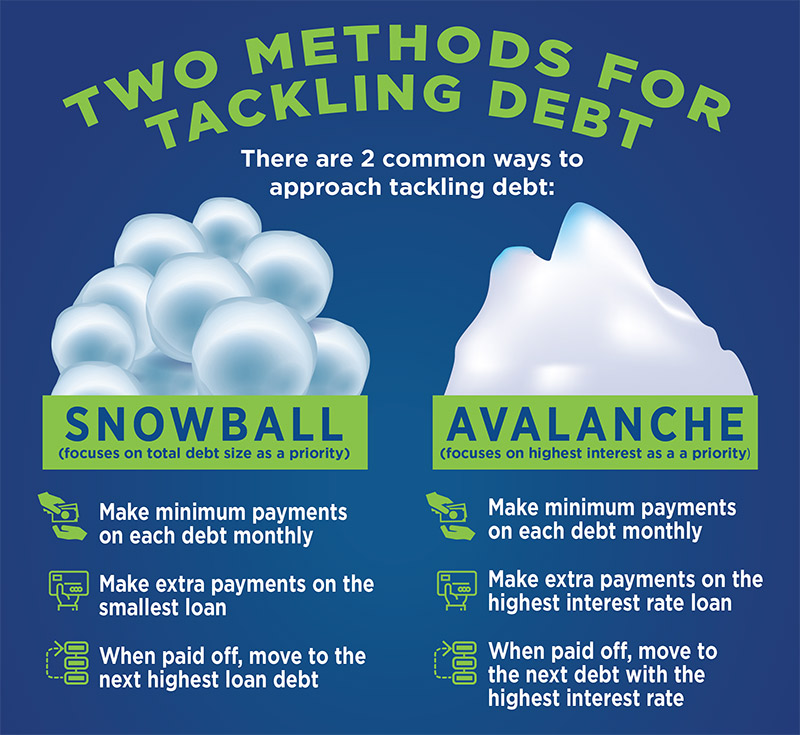

I used the avalanche strategy, which is involves making minimum payments on all debt, then using any extra funds to pay off the debt with the highest interest rate. The debt snowball method involves making minimum payments on all debt, then paying off the smallest debts first before moving on to bigger ones.

Did you have help, such as a financial advisor or CFP?

No. I did read articles, listen to some podcasts, etc such as from Dave Ramsey.

Want more recommended Podcasts/Book? Check out Dat & Aaron's favorites

Did you invest at all while paying off your loans?

I invested in retirement. I put 3% of my earnings into a Roth account and 3% into a 401k. My employers matched a portion of the 401k contributions also

What are your goals now that those pesky loans are a thing of the past?

To remodel our bathroom, prepare for the baby we’re going to have in March, and invest more money!

Throughout your story, I’m sure of the thought of health care expenses that were looming. Did you budget out for unforeseen healthcare costs, uncovered services, etc? And if so, how did that budget look?

Yes, I made sure to set aside $13,000+ for the out of pocket max that we would inevitably meet every year. We had a high deductible insurance plan. We also tried to set aside emergency funds that could cover 3 months in the beginning and 6 months later on. There were still unexpected bills that came in beyond our max insurance amount paid. We successfully fought most of them, but had to pay a few. The highest amount we can remember paying outside of our deductible/OOP max was about $4,000.

Any advice to those that are struggling with their student loan debt?

Don’t give up! If you are struggling, look for resources to help you out in your journey. Read articles from ODs on Finance. Don’t sacrifice what you want the most for what you want right now.

Want to learn how to Manage your Student Loans? Check out The Optometrist's Guide to Student Loans

Want to get $1000 Bonus + Lowest Rate? Compare Recommended Student Refi Lenders

Related Articles

- « Previous

- 1

- 2

- 3

- 4

- Next »

Facebook Comments