3 Bookkeeping Don’ts + 4 Do’s for Optometrists

Editor’s Note: This is a guest post written by Dr. Wade Weisz OD who is a contributor for ODs on Finance and help ODs with their bookkeeping. Aaron and Dat are extremely strict about guest requirements in that they must be educational and informative to our readers. Every guest post is vetted, read and upheld to the highest standards of ODsonFinance. Your trust is the most valuable factor to us. We like having experts in their field write on our website, enjoy and give us feedback!

KEY POINTS:

-

(1) DON'T... Use Set it and Forget it Tactics

-

(2) DON'T...Give Your CPA a Major Headache at Tax Season

-

(3) DON'T...Rely on Quickbooks to Produce Instant, Perfect Reports

-

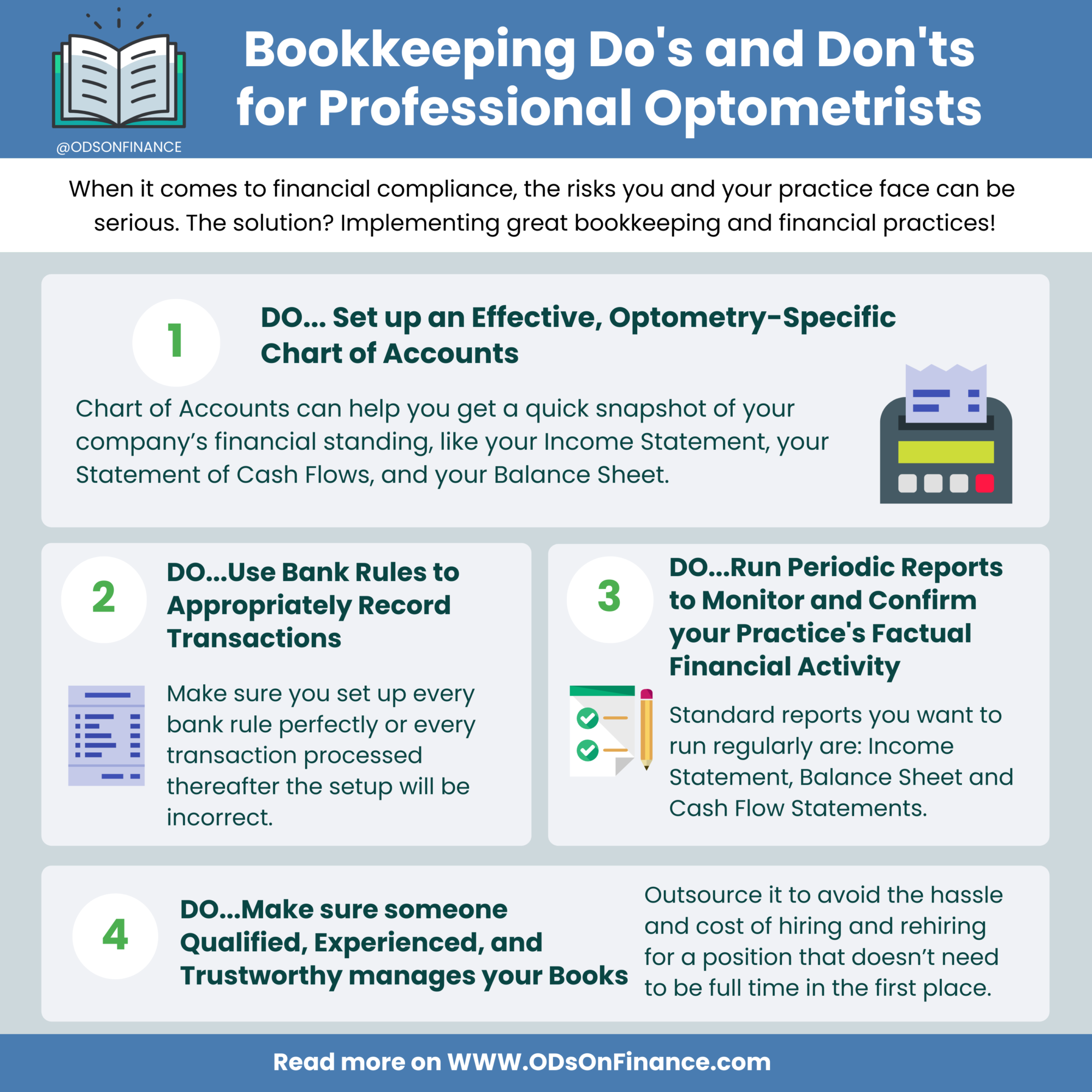

(1) DO... Set up an Effective, Optometry-Specific Chart of Accounts

-

(2) DO...Use Bank Rules to Appropriately Record Transactions

-

(3) DO...Run Periodic Reports to Monitor and Confirm your Practice's Factual Financial Activity

-

(4) DO...Make sure someone Qualified, Experienced, and Trustworthy manages your Books

When I was in your position as an OD just a few years ago, I discovered that a key piece of feeling confident about my practice - and the outcomes for my staff members - was having a strong financial foundation. As most ODs do, I always took the financial well-being of my practice very seriously. But in my early years, the more I learned about bookkeeping, the more I realized how delicate these processes can be and how quickly money can fly out the window if things go awry.

At For Eyes Bookkeeping, we always end things on a positive note. So today, we’ll begin with some of the most common mistakes Optometry practices make when it comes to bookkeeping. Then, we’ll show you some of the key ways to fix these mistakes! Ready to get started? Let's Dive in!

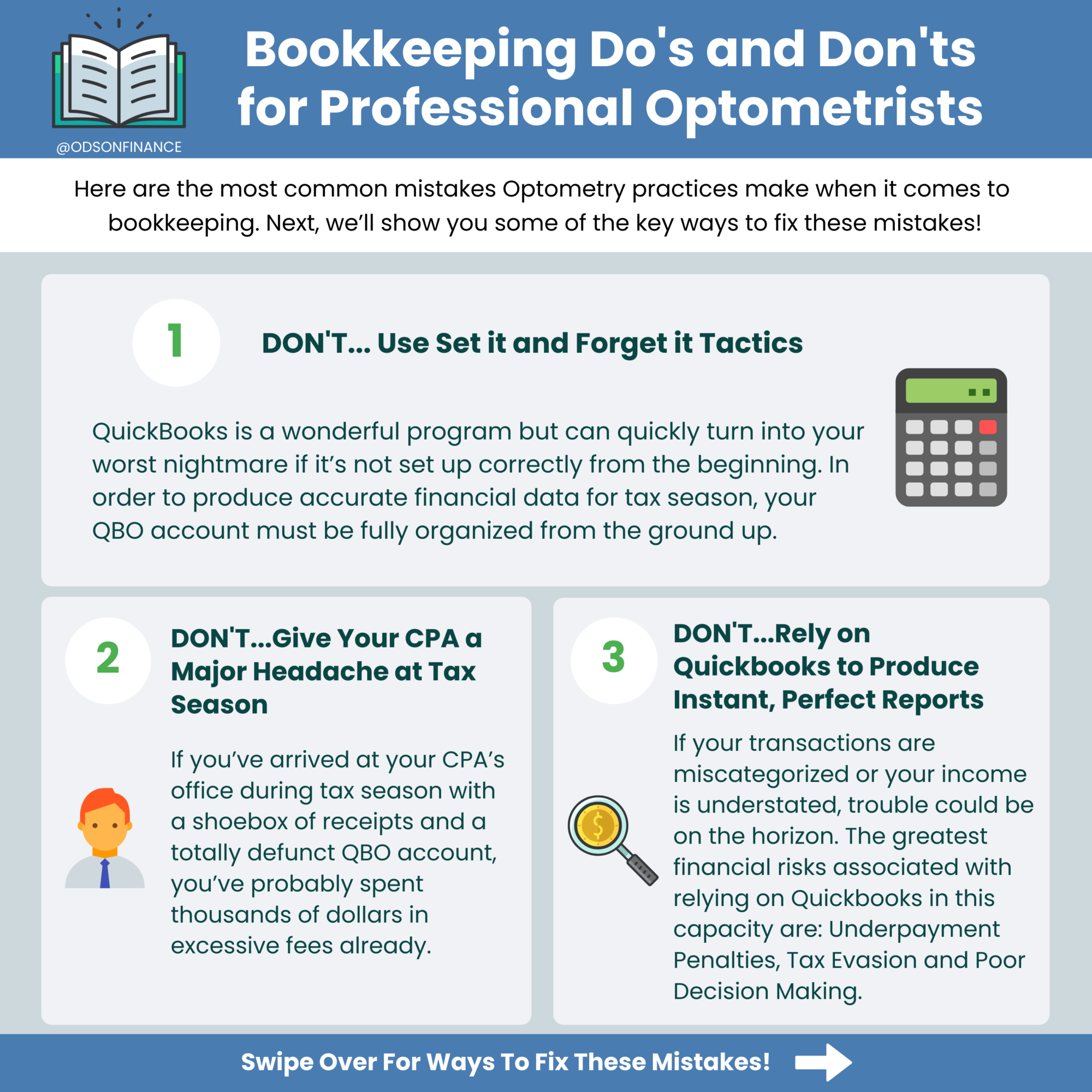

3 Bookkeeping Don'ts for Optometrists

(1) Set it and Forget it Tactics

If you’ve seen any Quickbooks Online (QBO) commercials recently, it’d be easy to believe that it’s a magical solution to all your problems and that manual bookkeeping is a thing of the past. Don’t be fooled, friends! This couldn’t be more untrue.

Though technology has certainly advanced since I began bookkeeping for my business back in the 90s, the same mistakes persist. The most common one I see is a trail of mis-categorized income and expenses, made possible by QBO’s limited ability to categorize transactions without explicit direction on the back end.

Here’s what you need to understand. Just because you write the check through Quickbooks, doesn’t mean it will automatically show up as an expense on your end-of-year financials. The same goes for deposits. QuickBooks is a wonderful program but can quickly turn into your worst nightmare if it’s not set up correctly from the beginning. In order to produce accurate financial data for tax season, your QBO account must be fully organized from the ground up. This starts with setting up a perfect, optometry-specific, Chart of Accounts and continues through the long list of setup options across the entire platform.

Still, the only way to ensure your company data is 100% accurate is to have a qualified bookkeeping professional check to make sure your financials are solid. Even then, poor bookkeeping throughout the tax year can result in a ton of missed opportunities and wasted cash. For better results, you must optimize your processes from start to finish and employ constant attention to your company’s QBO account.

(2) Giving Your CPA a Major Headache at Tax Season

Did you know that CPAs charge much higher fees for cleanups compared to the average bookkeeper? If you’ve arrived at your CPA’s office during tax season with a shoebox of receipts and a totally defunct QBO account, you’ve probably spent thousands of dollars in excessive fees already. The truth is, CPAs specialize in tax preparation and tax projections, not in cleaning up your messes. And because of this, the trouble you cause them during their busiest season will cost you.

Not only does the cleanup cost exceed that of a bookkeeper, extensive cleanups can also lead to the need to file a tax extension. When you file an extension, the IRS waives your failure to file penalty, but failure to pay penalty remains. If your income is understated and you pay the amount you think you owe on the due date but find out you owe more later, you’ll end up with a costly penalty. Just think of where that money could have gone instead! Could you have purchased new equipment? Hired a new staff member? The opportunity cost here can be astounding!

(3) Relying on Quickbooks to Produce Instant, Perfect Reports

Alone, Quickbooks is a far cry from being a hands-off solution for your practice’s bookkeeping needs. If you rely on Quickbooks to provide a clean set of End-Of-Year Financials or even End-of-Month financial statements, you could be burning cash as you go. Or worse, you could be setting yourself up for a painful run-in with the IRS.

You see, Quickbooks is only as accurate as the data you provide it. If your transactions are miscategorized or your income is understated, trouble could be on the horizon. Here some of the greatest financial risks associated with relying on Quickbooks in this capacity:

4 Bookkeeping Do's for Optometrists

Feeling stressed, yet? After writing this, I know I do! Thinking about the most common mistakes takes me back to the days when I felt overwhelmed by my practice finances and experienced the anxieties that come with being responsible for your business and your team. But somewhere along the line, things changed for me. I had to stop these fears from keeping me up at night and take action to protect my practice and put a stop to missed financial opportunities.

The solution? Implementing great bookkeeping and financial practices! This list of Do’s is not exhaustive, but it’s a great start! Let’s dive in.

(1) Set up an Effective, Optometry-Specific Chart of Accounts

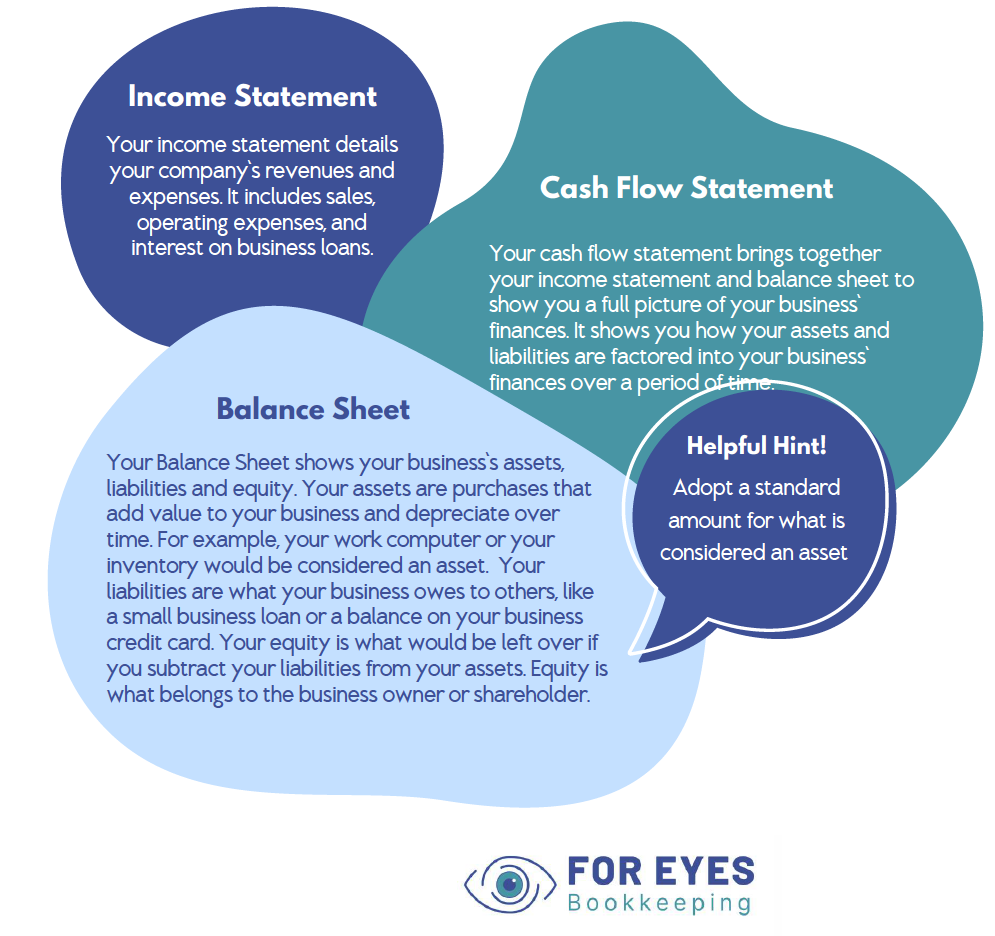

Understanding and utilizing your financial statements is an important step toward growing your practice. But first, you’ll need to set up an optometry-specific Chart of Accounts. Your Chart of Accounts should list your assets, liabilities, and shareholders equity first, followed by revenues and expenses from your income statement.

The trickiest part of setting up your Chart of Accounts is to ensure that your transactions are continually posting to the right categories. This can be a challenge for ODs not only because Quickbooks Online doesn’t always categorize things correctly but also because there can be some grey area about what counts as a deductible expense or what counts as taxable income.

When done correctly, your Chart of Accounts holds a lot of power. Not only can it help you get a quick snapshot of your company’s financial standing, it is also the basis of key financial reports, like your Income Statement (aka Profit and Loss), your Statement of Cash Flows, and your Balance Sheet. That means that when your Chart of Accounts is fully optimized, you gain more knowledge across the entire financial scope of your entire practice!

(2) Use Bank Rules to Appropriately Record Transactions

If you struggle to reconcile your accounts, incorrect categorizations could be the culprit. Luckily, Quickbooks Online has a tool that can help get recurring transactions right every time. Although these rules aren’t effective for more unique transactions, these small steps can help you avoid excessive data corrections on expenses that you pay each month.

How to Set Up Bank Rules in Quickbooks

Method #1

(1) Open up Quickbooks Online and navigate to Banking.

(2) Click the down arrow next to File upload and select Manage rules. Then, click New rule.

(3) Use the fields provided to set guidelines for how Quickbooks should categorize incoming transactions.

Method #1

(1) Open up Quickbooks Online and navigate to Banking.

(2) Click the down arrow next to File upload and select Manage rules. Then, click New rule.

(3) Use the fields provided to set guidelines for how Quickbooks should categorize incoming transactions.

Financial Pearl

IMPORTANT! Make sure you set up every bank rule perfectly or every transaction processed thereafter the setup will be incorrect. If you need help, we’re here to help and can answer your questions.

(3) Run Periodic Reports to Monitor and Confirm your Practice's Factual Financial Activity

Compliance isn’t the only reason bookkeeping is so important for optometric practices. America’s biggest and most successful corporations have entire teams dedicated to analyzing historical financial data and making decisions based on that information. Why? Because when it comes to growing a business, your historical data is golden!

Here are the three main reports you’ll want to be sure you pay attention to: You gain more knowledge across the entire financial scope of your entire practice!

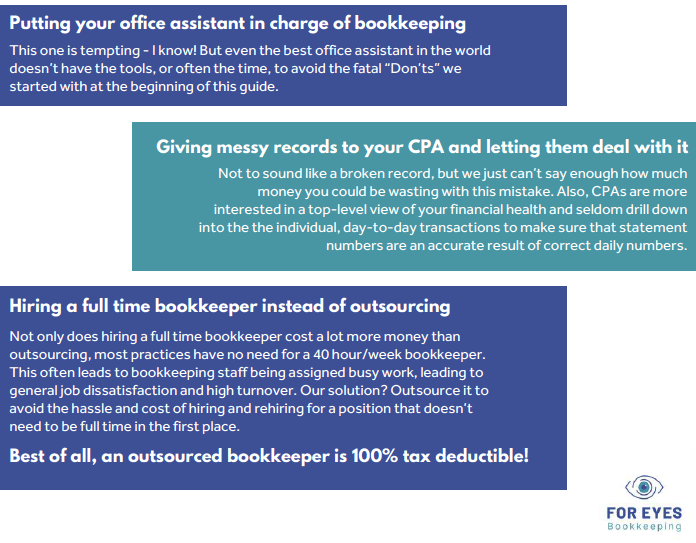

(4) Make sure someone Qualified, Experienced, and Trustworthy manages your Books

When it comes to financial compliance, the risks you and your practice face can be serious. Not only do you risk getting in trouble with the IRS and facing harsh penalties in the case of mistakes, you could also waste tens of thousands of dollars each year simply by deploying sub-optimal bookkeeping strategies. As a former practice owner myself, I know that every dollar is precious and that adding another expense for bookkeeping can seem like a hit to your profits on the surface. After all, I got into this business by being cheap and doing it myself!

But, when I became a real bookkeeper and saw how much money I - and my colleagues - had been wasting, I was stunned! I found that we all make the same mistakes. Mistakes like…

Summary

Think your practice could use some financial TLC? Start with this informative guide! And if you need any help, give me a call! I started this business to support you!

Want Need Help with Tax + Bookkeeping? Check out Recommended Tax + Bookkeeping Experts

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

Bookkeeping is an important factor in any form of business and thanks for sharing your ideas.