The Optometrist’s Guide to Investing 101

Chapter 2: How to Create The Ideal Portfolio of Stocks and Bonds

How to Do a Proper Asset Allocation

Determining the right asset allocation can be the most crucial, and often the most stressful, decision an investor makes for their retirement or other taxable investment accounts. Many investors spend a lot of unnecessary time on this step, resulting in stress. However, whether your asset allocation is simple or complex, it can still serve you well.

Our recommendation? Keep it simple. Believe it or not, even the most successful investor might have a portfolio comprising just three to five funds.

Follow these 3 basic steps to devise an ideal asset allocation strategy:

- ✅ STEP 1) Decide on the Percentage of Stocks vs. Bonds:

- ✅ STEP 2) Within the Stock Portfolio, Which Types of Stocks Should I Invest In?

- ✅ Step 3) Rebalance Your Asset Allocation Each Year

STEP 1) Decide on the Percentage of Stocks vs. Bonds:

Each investor’s choice varies, influenced by individual personality and risk tolerance. The higher your risk tolerance, the more stocks should dominate your portfolio

Here’s a scenario: If you have $500,000 invested entirely in stocks and the market plummets by 50 percent (resembling the 2008-09 crash), could you bear a $250,000 loss, waiting four to five years for recovery? If this gives you pause, consider a heavier bond allocation.

Also, reflect on when you’ll actually need the funds—likely around retirement. Most investments are considered long term (beyond five years), as this duration allows the market ample time for recovery. Remember, for many, it wasn’t until 2012 that they recouped their losses from the 2008 debacle.

Financial Tip

A good rule of thumb for long-term investing: as retirement nears, incrementally shift your portfolio toward bonds. Imagine the repercussions of a significant market crash when you’re a year shy of retirement with a fully stock-weighted portfolio. Such an event could necessitate additional working years for financial recovery.

Once you are completely aware of all these factors, then you can choose an asset allocation that is right for you and allows you to sleep at night. Just make sure you STICK with it, through market crashes and gains!

As more Americans are living longer in retirement, a simple rule to determine how many stocks vs bonds to have in your portfolio is:

Example: A 30-year-old investor should have 90% stock + 10% bond mixture, while a 60-year-old investor should have 60% stock + 40% bond mixture since he is approaching retirement age.

Recommended Stock to Bond Ratio (Age Range)

| Age | Amount of Bonds % | Amount of Stocks % |

|---|---|---|

| 20-30 | 0 % | 100% |

| 30-40 | 10% | 90% |

| 40-50 | 20% | 80% |

| 50-60 | 30% | 70% |

| > 60 | 40% | 60% |

To be honest, if you are a young investor in your 20s or early 30s, and you want to do a 100% stock portfolio, that is perfectly okay! I know plenty of young investors who have all stock portfolios because they want the highest return yield

- Example: the Vanguard Total Stock Market Index Fund has a return of 10.5% over a 15-year course

As long as they understand the risk and can emotionally stick with the game plan even through a crash, then yes, the overall return will be significantly higher. It is acceptable for younger long-term investors to take more risk with stocks because they have a longer investing period to recoup any losses.

Which Bond Fund Should I Choose?

You guess it! A simple, low-cost passive Total Bond index fund such as the Vanguard Total Bond Market Index Fund

This great bond index has a ridiculously low expense ratio (annual cost of the fund) of 0.15%.

What is the annual gain of this bond over an average of 10 years?

- Barely 3.5%! Just enough to beat the inflation rate increase of 3-4% each year. As we told you, bonds are not meant to create significant wealth, but they are simply there to create stability in one’s portfolio.

There are other types of bonds out there ranging from TIPPS (Treasury Inflation Protected Securities), high-yield corporate bonds or municipal bonds. As you become a more experienced investor, you might want to dabble more into the intricacies of bond allocation. For now, keep it simple and easy and chose a Total Bond Index Fund that has all types of bonds within it.

Financial Tip

If you are a young investor in your twenties or early thirties and you want to do a 100 percent stock portfolio, that is perfectly okay! I know plenty of young investors who have all stock portfolios because they want the highest return yield. Overall, the Vanguard Total Stock Market Index Fund has a return of 10.5 percent over a fifteen-year course.

STEP 2) Within the Stock Portfolio, Which Types of Stocks Should I Invest In?

Domestic US stocks should be the cornerstone, making up roughly 75 percent of your allocation. Given the robustness of the US economy, this is where significant returns are anticipated.

The US economy is the strongest market in the world compared to other countries. So, this is going to be your moneymaker right here! The US Total Stock Index has had some years that have seen as high as a 33% gain (2013) but also, some years as low as -37% loss (2008 crash). Typically, US stocks over the course of 15 years have an average return of 10.5%, which isn’t too shabby!

There are many different types of stocks out there. Below are summaries of each class for you to get a general idea.

US Domestic Stocks vs. International Stocks

US domestic stock funds invest only in US-based companies like Amazon or General Electric, while international stock funds invest in international companies from Chinese Alibaba (“The Amazon of China”) to European Volkswagen.

The whole idea of having a small 25% portion of your stock portfolio in International stocks is to diversify your portfolio. So, if the US economy isn’t doing so hot, then you stabilize your returns with other international markets.

The question is do you really need international stocks in your portfolio? ABSOLUTELY NOT! While some investment experts recommend 25% of your stock portfolio to consist of international stock, many financial analysts argue that a lot of US-based companies do business in the international market (ex: Apple sells iPhones in China) thus giving you indirect international exposure.

So basically, you do not need a 25% portion devoted to international stock unless you want to.

Financial Tip

"The US economy is the strongest market in the world compared to other international countries. So, this is going to be your moneymaker right here! Returning close to 10.5% on average.... While some investment experts recommend 25% of your stock portfolio to consist of international stock, many argue that a lot of US-based companies do business in the international market (ex: Apple sells iPhones in China) thus giving you indirect international exposure"

Large-Cap vs. Mid-Cap vs. Small-Cap Stocks:

The capitalization size of a fund tells you if they are investing in a large or small company. Large-cap funds invest in $10-100 billion or greater giant businesses like Apple and Chevron, while mid-cap funds invest in $2-10 billion companies like Guess and Urban outfitters. Lastly, small-cap funds invest in $250 million to 2 billion companies such as Spectrum pharmaceuticals or Lithia Motors. Many of these smaller companies are unknown to the general public.

As a general rule, large-cap mutual funds will focus on the largest US companies and thus, will be the safest and most stable returns, but they might not be the largest returns.

Small-cap mutual funds focus on the smaller but faster-growing companies, which result in higher risk but can have the highest returns. Mid-cap is the blend of both worlds.

Now, with a clearer grasp of stock types, you’re better positioned to make informed asset allocation decisions.

Building the Perfect Portfolio: A Mix of Stocks and Bonds

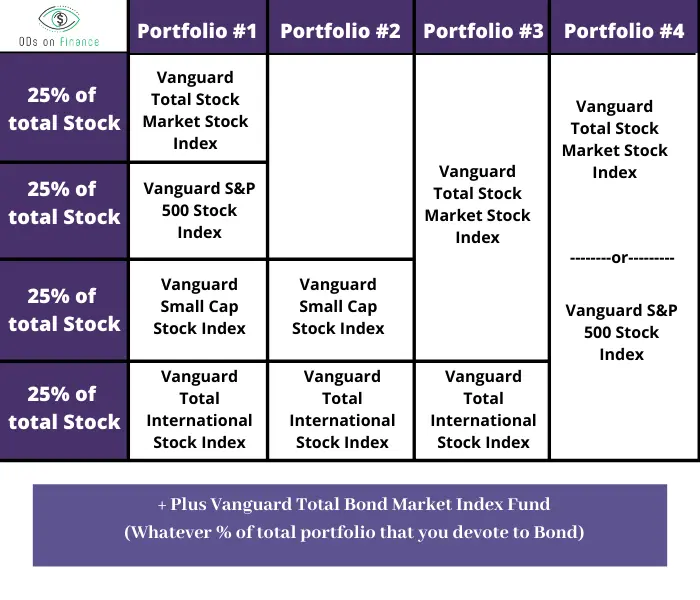

4 Portfolio Asset Allocation Examples:

Now that you have a handle on the basic types of stocks, let’s explore stock allocation.

Example: Assuming that a young 30-year-old doctor investor wants to go for a 100% stock portfolio (ignoring the bond portion for now), what would the reasonable stock fund profile be?

We will Vanguard index ETF funds for examples. Remember that the ETF version of an index fund is the same exact same but we can buy smaller amount, great for new investors who might have not have enough funds.

These four passive-index and low-cost stock fund types that should be the CORE of your portfolio:

- ✅ (1) Vanguard Total Stock Market Index Fund ETF (VTI)

- Tracks the performance of ALL company stocks in the USA.

- Tracks the performance of ALL company stocks in the USA.

- ✅(2) Vanguard S&P 500 ETF (VOO):

- Reflects the performance of the top five hundred stocks in the USA, mainly large-cap with a smattering of mid-cap companies.

- Reflects the performance of the top five hundred stocks in the USA, mainly large-cap with a smattering of mid-cap companies.

- ✅ (3) Vanguard Small-Cap Index Fund ETF (VB):

-

- Monitors the performance of all small-cap company stocks in the USA.

- ✅ (4) Vanguard Total International Stock Index Fund ETF (VXUS):

- Tracks the performance of international stocks outside the USA.

- Tracks the performance of international stocks outside the USA.

For our Bond fund, again, we will use a simple low cost index bond fund ETF version

Here are four simple yet effective portfolio examples, suitable for investors ranging from beginners to experts. Remember that the objective behind each portfolio is to diversify your assets and ensure exposure across different segments.

The goal of each portfolio is to diversify your asset allocation and have exposure in each field.

Portfolio #1:

- Has a straight strategy of allocating 25% to each major fund, thus giving us equal exposure. Both the Total Stock Market and the S&P 500 funds’ returns are similar to each other but each or both funds should be the main core of any portfolio.

Portfolio #2:

- Has half of its allocation in S&P 500 funds, which is mainly large-cap, and some mid-cap companies, thus it is wise to have exposure to a small-cap stock fund, basically tilting your portfolio to smaller companies.

Portfolio #3

- Essentially combines S&P 500 and Small-Cap Index into one single Total Stock Market fund, basically giving us exposure to all three tiers of stock (Large, mid, small).

Portfolio #4

- So, you might ask why the heck does Portfolio #4 exist when there is no international exposure? Once again, remember that a majority of US companies do business overseas, this will give us indirect exposure to international markets. So if an investor wants to do all USA stocks, that’s completely acceptable as well.

In essence, similar to refraction, asset allocation is both an art and a science. Each of these portfolios possesses unique merits and strengths, ensuring ample diversification. Many investors prefer simplicity and a minimalistic approach, making Portfolio #3 or #4 particularly appealing. Whichever allocation you choose, you’re poised for success. And as you broaden your financial understanding, you can always embrace a more intricate portfolio structure.

Step 3) Rebalance Your Asset Allocation Each Year

Let’s assume you've chosen to invest 70% of your portfolio in stock mutual funds and 30% in bonds at the beginning of 2019. Then, as the prices of stocks and bonds change with the market toward the end of the year, your portfolio might result in 75% stocks and 25% bonds. Therefore, re-balancing is simply correcting the imbalance by returning to the original 70% to 30% allocation.

A lot of investors re-balance more frequently (like every month, which is extremely excessive) or when their portfolio reaches a certain threshold (like 40% stock). We recommend keeping it simple, so re-balancing ONCE A YEAR is good enough.

Many 401K or IRA accounts will have options to allow investors to set the % of their mutual funds to the desired stock/bond asset allocation, thus making re-balancing easy and done within 5 minutes.

Obviously, the more asset classes you have (like commodities, REITS) or multiple IRA accounts, then the more difficult it will be.

Financial Pearl

Rebalancing your portfolio simply means correcting any imbalances, restoring your original stock-to-bond ratio. It’s advisable to keep it uncomplicated: rebalance ONCE A YEAR.