The Optometrist’s Guide to Investing 101

Chapter 6: How to Monitor Your Investment Performance &Other Wealth-Building Tips

How to Monitor Your Investments and Track Your Performances?

The last step of any investing game plan involves monitoring your investments and performance. You don’t need to obsessively check it daily; however, it’s advisable to review it at least once a month. Setting an investment plan in motion, such as selecting a target date for retirement or a passive stock index fund, is straightforward. Still, it’s essential not to neglect it thereafter.

Regularly monitoring your finances can be rewarding, especially when you observe your investments growing and your student debt decreasing each month. Think of every dollar you’ve invested as hundreds of mini-workers, tirelessly working around the clock to earn you passive income.

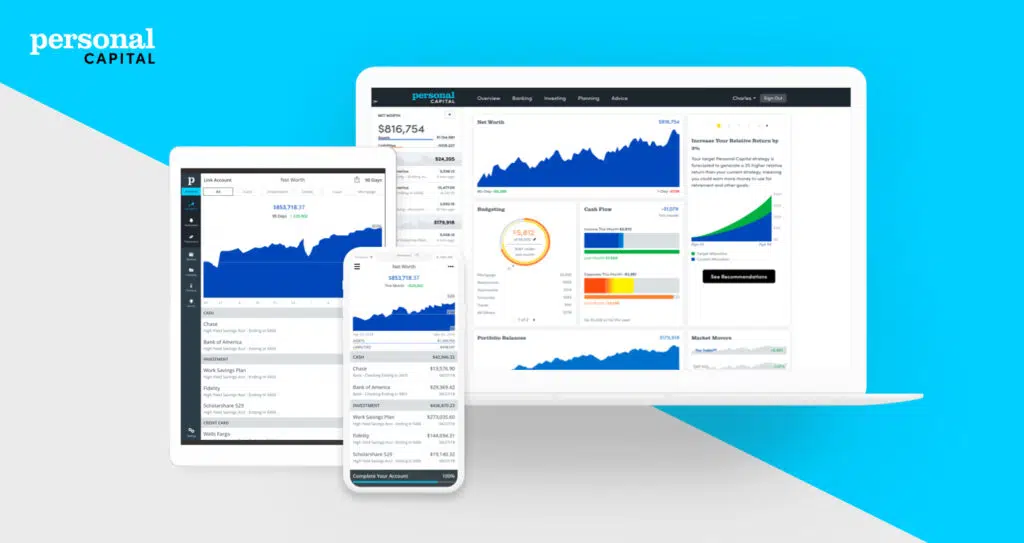

Personal Capital (Free Website + Mobile)

This free app allows you to link all your bank, investment brokerage, retirement, and student loan accounts. It consolidates everything into a comprehensive dashboard, displaying your asset allocations, the ratio of stocks to bonds, total fees paid in funds, and overall net worth (don’t fret if it’s in the negative due to student debt). Additionally, it provides a complimentary retirement planner to guide you on your retirement goals and offers insights about the effectiveness of your financial plan. And, yes, did we mention it’s free?

For those who prefer a more traditional approach, a straightforward Microsoft Excel sheet can effectively track your earnings.

Common Questions About Investing

When should I start investing?

Now is the best time to start investing, irrespective of the market’s state. Warren Buffet, the legendary investor, owes much of his wealth to beginning his investment journey early—purchasing his first stock at eleven. The power of compounding is most effective over extended periods. So start immediately.

What are the best stock market investments?

The best stock investments are low-cost index funds like the S&P 500 Index or Total Stock Market index. By purchasing these funds, instead of individual stocks, you can buy a big chunk of the stock market in one transaction.

This means that you won’t beat the market, but it also means that the market won’t beat you. You are literally betting on the US economy, which is a pretty safe bet. In addition, investors who only trade and pick individual stocks instead of index funds generally under perform the market over the long term.

Is stock trading recommended for beginners?

We caution against beginners dabbling in individual stocks. Moreover, we advise against trading stocks, even for seasoned investors. Regularly buying and selling stocks can lead to tax inefficiencies, particularly if your gains (held for less than a year) are taxed as regular income. Such frequent transactions can also induce erratic decision-making, succumbing to the temptation of market timing.

Instead, we champion a buy-and-hold strategy, focusing on low-cost index funds, and advocate dollar-cost averaging—consistently investing a predetermined sum through market highs and lows.

Financial Tip

"We DO NOT promote trading stocks even for experienced investors. Frequent selling and buying of stocks is not tax-efficient since your gains/profits (less than a year) will be taxed at ordinary income tax. In addition, frequent selling leads to erratic behavior and the innate human nature to try to “time the market”. We highly recommend a buy-and-hold strategy using simple, low cost index fund & dollar cost averaging every month (investing the same set amount each time) through the high and lows."

How do I invest money that I might need in few years? And should I take less risk?

Investing comes down to two things:

- ✅ Time Horizon: When do you need the money?

- ✅ Risk Tolerance: How much risk are you willing to take?

First, let’s delve into the time horizon. If your investment goals stretch into the distant future, like retirement, it’s wise to allocate a significant portion of your investment to stocks, approaching 90 percent. This strategy will likely help your funds grow and stay ahead of inflation. However, as you edge closer to your goal, consider shifting your focus, reducing stock allocation, and incorporating more bonds.

On the other hand, if your investment horizon is relatively short (under five years)—say, for a down payment on a house—it might not be advisable to invest in stocks.

- 👉 Check out: The OD's Guide to Short Term Investing

Next is risk tolerance. This really depends on your own personality and will vary regardless of age. I consider myself a fairly risky investor with a 100% stock allocation in my portfolio. Why do I have so much stock?

What’s the rationale behind this?

- ✅ I’m currently in my thirties, which means I’m looking at an investment horizon that spans over thirty years.

- ✅ When I graduated back in 2015, at twenty-eight, I had no savings to speak of and was burdened with student debt exceeding $230k. As a result, playing it “safe” with a higher bond allocation doesn’t seem feasible for me.

- ✅ Mentally, I’ve braced myself for market fluctuations. A case in point is the 2020 Coronavirus Crisis, which saw the S&P 500 Index plummet nearly 28 percent. While the sea of red numbers was unnerving, I resisted the urge to sell. This episode was a testament to my resilience as an investor. Ultimately, the best investment strategy is one that lets you sleep soundly at night.

It’s crucial to remember that the stock market has its highs and lows. If you find yourself easily spooked by these fluctuations, a more conservative approach, with a pronounced bond allocation, might be more your speed.

Financial Tip

"If you need the money in 5 years or less, then you likely don’t need to be invested in stocks at all. Consider other short-term vehicles. During the worst market crash, it take around 4-5 years for the market to return to baseline"

Summary

Kudos for reaching the conclusion of this comprehensive guide! Inhale deeply. You’ve now mastered the basics of Investing 101. Quite simple when juxtaposed with learning intricate neural pathways, right?

By grasping these rudiments, you’re poised to be a genuine contender in the stock market.

Our intent behind this guide was twofold:

- (1) Render the content engaging and straightforward.

- (2) Highlight potential pitfalls, especially for students and young doctors.

Investing demands patience, consistent effort, and resilience, rather than financial wizardry. Often, young doctors, eager for quick success, can be lured into dubious ventures.

Many doctors falter financially because they either overlook the significance of financial literacy or exhibit overconfidence. This oversight, combined with a lack of structured education on personal finance and investment, is a recipe for disaster.

Many financial representatives, disguised as advisors, might exploit doctors’ trusting demeanor. Remember, financial advisors aren’t bound by an oath to prioritize your interests. Even “fiduciary-certified” advisors can exhibit biases, albeit unconsciously. Your strongest defense? Educate yourself and approach every piece of advice with discernment.

Always be inquisitive, scrutinizing every piece of information, ensuring it aligns with your goals. As with all things, trust but verify.

Financial Tip

"Many doctors ended up broke because they consider themselves too busy or too cocky to learn the basics of finances. This, coupled with no formal education in personal finance and investing, is a perfect storm waiting to happen and often will be preyed on by a shady financial adviser or insurance salesmen"