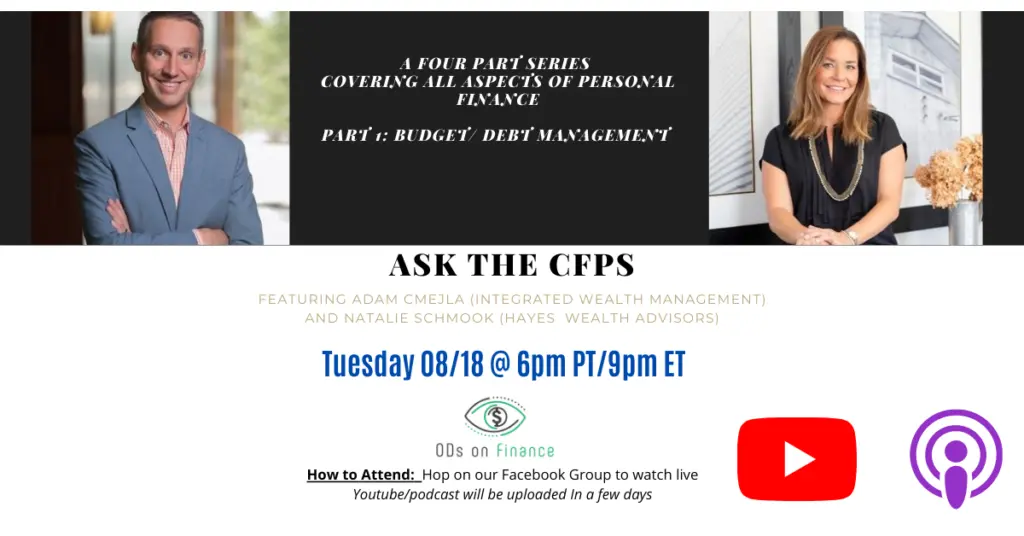

Ask the CFPs Part I – Budgeting and Debt Reduction (FB Live Event)

One aspect of personal finance that is vitally important but not necessarily “sexy” is budgeting and debt reduction. In addition to growing your money, limiting the money owed and devising strategies to keep your debt low will help grow your net worth. Our latest Live event will address ways to get out of debt and budget your way to success.

Our Guests

Adam Cmejla has helped individuals and practice owners make educated and informed personal and professional financial decisions. Being a 3rd generation business owner, the husband of an OD, and a CERTIFIED FINANCIAL PLANNER, gives him a unique perspective that separates him and his firm from other advisory firms. He’s regularly published in optometry publications such as Review of Optometric Business and was named to Investopedia’s Top 100 Financial Advisors in 2019.

Natalie Hayes Schmook is the founder and owner of Hayes Wealth Advisors LLC, a financial planning and investment management service for employed optometrists, practice owners and their families. Natalie started her career in the Private Wealth Management division of SunTrust Bank in 2006 and earned her Certified Financial Planner™ designation in 2009. Natalie graduated with Honors from Rollins College in Winter Park, FL and also received her Masters of Business Administration there.

Summary

1) What methods have you found to be most effective for efficient and effective budgeting? Any tools that you have found useful?

2) How should one allocate their budget based on goals? Do you recommend auto-contributions towards loan debt and investing?

3) What advice do you give ODs who hate to budget? How does one avoid lifestyle creep and spontaneous purchases?

4) Student loan management - let’s go over a quick overview of the various forgiveness plans and whether you are for or against them.

5) Student loan management - let’s go over student loan re-fi and when you advise to re-fi.

6) Strategies for paying off loans quickly? (snowball, avalanche, etc etc)

7) Is there such a thing as good debt or bad debt?

8) When do big purchases (home, car, child [ok, technically not a purchase]) come into play and how do you rebalance your budget and cashflow?

9) Best ways to keep monthly cash flow positive? Do you advocate for multiple bank accounts or other methods of organization?

Facebook Comments