We are likely going to head into a Recession; here is how you can Prepare

Hey ODsonFinance Community,

Look like today is going to be another unpleasant day in the stock market with the recent announcement by the President to restrict air travel to Europe. As of this writing on Thursday March 12, 2020, the market have drop more than 20% from its recent highs in February and officially we are in a bear market.

We have not seen this rapid falling pace since 2008 during the housing recession and as the pandemic spreads, it is starting to feel a bit closer to home as NBA season, major concerts & conventions are getting cancelled but more importantly, being there for our loved one to celebrate major milestone like weddings and upcoming graduations.

I will not go into much of the medical explanations of the COVID-19 virus but as healthcare providers, it is our responsibility to promote and practice good hygiene for our patients and family, and to promote social distance when it comes to large gathering. In addition, now than ever, it is vital to keep our immune system healthy by monitoring our own selves and taking necessary breaks (I am talking to all you workaholics out there, myself included). Lastly, people in our social and professional circles relies on us as medical providers to instill a sense of calmness during this crisis.

From an economical and financial side of thing, while no one can predict what is going to happen, we can do a lot of things right now to protect ourselves and our family, in order to secure our long-term financial future

1) We are probably heading toward a Recession so let's just Start preparing for it

While no one can predict when a recession is going to happen, based on what is going on with the markets such as COVID-19 virus affecting multiple business sectors, oil prices diving as OPEC and Russia failing to reach a deal and lastly the end of a great 11-years overvalued bull market, many experts think are likely to head there.

Technically, a recession is not declared until two successive quarters of negative GDP growth happen but certain government policies might be implemented prior to prevent that, now it is a great time to increase our emergency savings and plan for the worst.

Luckily for us as optometrists, our job security is likely very safe. Although patient traffic for eye exams might be reduced, people are still going to need their ocular health and glasses/contact lens prescription to function.

I would advise employed optometrist associates to increase their emergency fund to a minimum of 6 months expenses in liquid cash. For practice owners, make sure there is enough cash flow for a minimum of 6 months to keep the business running and cover any overhead.

If your spouse have an economically sensitive job such as within the travel sector, I would increase that emergency fund to 1-2 years of expenses right now.

If you are planning to start up a side business, I would be cautious and make sure there is enough capital. Maybe wait until the dust settle.

Then keep on cost-dollar averaging your retirement investing and paying down debt like you normally have done in the past, though the high and lows of the markets.

"Technically, a recession is NOT declared until two successive quarters of negative GDP growth happen but certain government policies might be implemented prior to prevent that, now it is a great time to increase our emergency savings and plan for the worst"

2) Consider Reducing your Extra Student Payments for a short period

For the last few years, I been advocating being debt-free and paying extra student loan payments each month to aggressively pay off your student debts, but now it might be a good time to re-assess and shift your priorities a bit.

While some experts will tell you it is better to pay off all debts now since investing will likely result in a lower or even negative return, I have to disagree with that. In a severe recession, you want to prioritize having more liquid assets like cash for emergencies.

So What are some Tips that you can do to Manage Student Loans for a possible Recession?

a) For those who are currently refinancing their student loan, I would advise signing up for fixed rate (vs variable), then consider a longer duration such as 10 or even 15 years. Even though this will result a higher interest rate, it will lower your required monthly loan payment to a more manageable level and lock in that fixed rate.

Know your monthly budget so you know you can manage your own personal cash flow. Remember that we can always refinance to a short term for a better rate in the near future. If you are financially stable, then you can consider a more aggressive term like 5 or 7 years.

b) For those who already refinanced their student loans to a variable rate just have a larger emergency fund (9 months instead of 6 months) to cover the required monthly payment, just in case the rate spike up temporary.

c) For those doing 10-years public service loan (PSLF) or 20/25 Total forgiveness programs with an income-based payment plan, if your salary income significantly drop (unlikely for an optometrist), then you can call your loan service to get your monthly payment recalculated based on your new lower salary.

d) Remember that in extreme cases, you can get up to 3 years of forbearance protection for federal loans and nowadays, the mass majority of refinanced private loans like Sofi, Earnest, Brazos, Commonbond offer forbearance options during time of hardship, usually up to 3 months at a time. Credible, Lendkey and Splash will vary on lenders selected but First Republic currently do not offer any forbearance assistance.

E) Keep on making your required monthly student payments with a financial goal to pay it off within a certain period. Just because we are in a mild economic crisis does not give you an excuse to defer all student loans payment. Do not be an idiot. Once the economy stabilizes, go back to your original game plan of aggressively paying off your student loans within 5-10 years.

"I would advise signing up for fixed rate (vs variable), then consider a longer duration such as 10 or even 15 years. Even though this will result a higher interest rate, it will lower your required monthly loan payment to a more manageable level and lock in that fixed rate"

3) Stick with your Investing Plan, Stay Calm and Carry on

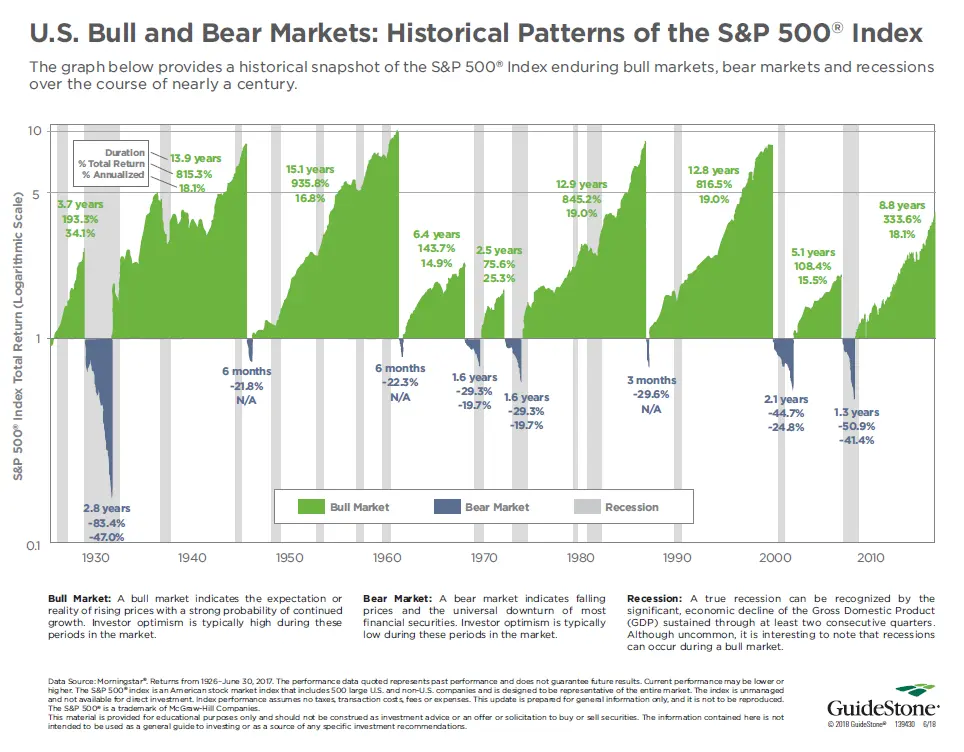

If you ever talk to any older and seasoned investors who been to multiple recessions in their lifetime such as the Dot.com tech crash in late 1990/early 2000s where the S&P 500 index drop 44% or the housing crisis in 2008/2009 (S&P index drop 50%), they are surprisingly very calm. They know the economy will rebound eventually.

Morbidly speaking, the worst-case scenario is that you die from the Coronavirus, then who cares if your 401K dipped (again, very low probability). The next worst-case scenario, you do not die (Yay!), then it is likely the market will recover in the long term and this is just a small blip in your investing career.

I want to validate your fears and concerns. I completely get it! I personally had a small mini freak-out myself last night after reading all new articles and comments on Facebook. With the multiple cases happening, I don’t know why Tom Hank getting affected with Coronavirus really hit me hard. Forest Gump is one of my favorite movie though!

Remember that we live in an age of Facebook where social media allows for information to be transmitted quickly but it also allows fear and mob mentality to run rampant.

Let put things in perspective, the Spanish Flu of 1918 killed over 100 million people, and the market only fell 15%. There is almost no chance that the Coronavirus will cause that many fatalities. I bet you if Facebook was around, the market probably have drop 90%.

As you can see from the graphic below, Markets have recovered from much worse events (Great depression Drop=83%, World War II Drop=21%).

This is why it is important to have automatic contributions to your 401K and Roth IRA so the decision is made for you. Remember that successful investing is 10% calculative strategy and 90% behavioral.

So stay optimistic and continue your long-term investing plan!

"Let put things in perspective, the Spanish Flu of 1918 killed over 100 million people, and the market only fell 15%. There is almost no chance that the Coronavirus will cause that many fatalities. I bet you if Facebook was around, the market probably have drop 90%"

So Many Readers have asked me? What am I doing personally?

I am an unmarried with no kids, early 30 year-old optometrist working in Silicon Valley CA. I have an appropriate investing game plan that is specifically tailored to my investing style, risk tolerance and age range.

For someone in their 30s, I usually recommend a split of 10% Bond & 90% Stocks asset allocation. However, I am pretty aggressive when it comes to investing so I have close to 100% Stock portfolio, well technically 90% Stock overall if I count my emergency fund of 6 months in liquid cash.

Within my retirement Accounts such 401K and Roth IRA, I am 100% low cost S&P 500 Index and I will continue to dollar average contribution every month. I am not going to touch this fund for close to 30+ years. It is boring and consistent, just how the majority of investing should be.

For my taxable brokerage account, this is my “play money” (roughly 10% of my investing portfolio) where I can invest in sector ETF and individuals stocks. This is money I can afford to lose and thus I can have more flexibility for buying opportunity with my cash reserve.

Yes, yes before people judge at me for trying to “time the market”; you have to understand that individual stocks is a completely different strategy compared to long-term index fund investing.

"Within my retirement Accounts such 401K and Roth IRA, I am 100% low cost S&P 500 Index and I will continue to dollar average contribution every month. I am not going to touch this fund for close to 30+ years. It is boring and consistent, just how the majority of investing should be"

How do I Invest my 10% Play Money?

I have an updated watch-list of individual stocks for me to potentially buy when the opportunity allows such as a dip or have enough cash to invest.

All potential buys are companies that I have researched greatly, knows their financials (yes I love reading earning reports all the time) and knows its growth potential. My individual stock investing style is that:

“ For individual stocks, I buy great businesses with good financials that I want to own for at least 5-10 years+, and preferably at a discounted price if possible”

For the last few weeks, I added more to my current positions such as Apple and Vanguard Information Tech Index VGT (a low cost fund that track all the tech companies). I wanted to buy Google and Disney for almost a year now, so now was the perfect time to buy them at a heavily discounted prices.

Will families stop going to Disneyland or watch Disney/Marvel movies? Or stop using Google after this whole crisis is over? Heck no.

Do I buy oil, airlines and/or cruise line stocks just because the frugal Asian in me see it as being 50% Sale off? Heck no.

I did not have any interest in investing in commodity stocks like oil and airlines prior to the Coronavirus, so I am not going to have any interest now.

Do I think that we hit the bottom? Probably not, so I just been buying it in small chunks at a time.

Do you need to buy any stocks during the crash to be a successful investor? NOPE. Do not feel the pressure to do anything at all.

Remember that sometime in investing; doing nothing is often the greatest action of all.

I get so many messages from doctors who never invest in individual stocks before, then tell me that they are going to “buy Exxon Mobile on sale” because someone post it on Facebook. I simply asked them what Exxon Mobile’s financials was and why it is a good business to invest in. They usually go silent. Don’t invest in something that you don’t understand.

"Do you need to buy any stocks during the crash to be a successful investor? Nope! Do not feel the pressure to do anything at all. Remember that sometime in investing; doing nothing is often the greatest action of all"

Remember that this is my 10% Play Money, which means I can afford to lose 100% of that money and I will still be financially fine. Otherwise I wouldn’t be doing this.

I also increase my emergency reserves from 3 months to 6 months, not because I am planning to use it but just in case if I do need it.

I also do not really watch the news much nowadays and try to enjoy more time outdoors by going on hikes, just in case if we do need to self-quarantine for a few weeks. I still need to stop by Costco to buy some more rice and toilet paper though.

My biggest takeaway especially for new investors is; do not panic and sell low, continue to invest as usually, and remember that investing is a long-term mindset.

Aaron and I will always be here to educate and support you guys during these unknown times.

Sincerely,

Dat, Cofounder

Facebook Comments