Posts by DatBuiOD

7 Updates on Managing your Student Loans in Mid-2021

We are halfway through 2021 and close to 1.5 years since the COVID pandemic lockdown; but most importantly, we are approaching the end of the federal 0% student loan interest relief (set to end September 30th). Here are 7 important updates in the world of student loans to help every OD be financially successful!

Read More5 Tips for Avoiding an IRS Audit For Optometrists

While an IRS audit can happen via random selection, in many cases, it’s the actions of the taxpayer that trigger the audit process. And that’s why we put together this helpful guide—outlining five common red flags. Understanding these triggers can save you a lot of potential trouble and anxiety.

Read More8 Financial Mistakes that New Optometrists Make

The average new optometrist graduates at an average age of 28 year old (significantly behind non-OD peers in terms of income generation), with an average student loan debt of over $220,000+, with little or no retirement investments. Often new grad optometrists find themselves practicing in oversaturated cities and most importantly without any formal financial education. This is the perfect storm that often leaves many doctors mentally overwhelmed and prone to devastating financial mistakes. In this article, we will address 8 common financial mistakes that new OD graduates make and how you can avoid them to be financially successful.

Read MoreAmerica Rescue Plan Stimulus Bill: Five Student Loan Updates

On Wednesday March 10, 2021, the House approved President Biden’s $1.9 trillion stimulus bill called the “American Rescue Plan”. The legislation is one of the most sweeping economic recovery plans in the nation’s history. Stemming of the American Rescue Plan, this article will focus on 5 take-aways for student loan borrowers.

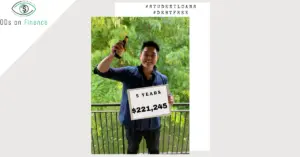

Read More10 Practical Tips on How to Pay Off $221K+ Optometry Student Loans in 5 years

Like many optometrists, I graduated from Southern California College of Optometry (SCCO) with over $221,245 in student loans back in June 2015. It was a combination of both federal loans ($198,303) and high interest private loans ($22,942) that I took out for other living expenses during my 4th year rotations. In early October 2020, during the COVID-19 pandemic, I made my final and last student loan payment, roughly 5 years later.

Read More6 Lessons That Dave Ramsey Get Right, and 6 Lessons That Are Completely Wrong

We have quite a few ODs on Finance members who are big Dave Ramsey fans, and quite a few who are Dave Ramsey Haters. Here are 6 Lessons That Dave Ramsey Get Right, and 6 Lessons That Are Completely Wrong and how each OD can optimize them to be even more successful!

Read More8 Financial Lessons that I Learned during COVID-19

As we approach the end of August, we have experienced the worst market down-spiral in mid-March since the 2008 housing recession, with a -20% stock market crash. Luckily, year to date (YTD), the S&P 500 index has recovered nicely to roughly baseline. While we are not out of the woods yet, I have learned some important financial lessons, both as an investor and as an individual during this once-in-a lifetime catastrophe. Here are 8 things the pandemic has taught me.

Read MoreFederal Student Loan Servicers Get Fired! Chaos Could Extend Student Loan Relief

As we approach September 30, 2020, when the temporary 0% Federal student loan and forbearance period are both expected to end, here are some important updates:

Key Points:

DeVos fires all 4 major loan servicers that handle federal student loans starting December 14, 2020.

What to expect when receiving a welcome letter from your new servicer and what to do?

10 year PSLF Borrowers: Download your payment history before End of 2020

Student Loan servicers chaos could extend student loan relief

Refi Student loans are trending lower

8 Reasons Why Every Optometrist should Invest in Index Funds

KEY POINTS: (1) Better Performance (2) Lower Cost (3) Less Time consuming (4) Less Risky (5) More Tax-Efficient (6) Ease of use in Building your Portfolio (7) Wide Availability (8) Eliminate Behavioral aspect and No Feeling of missing out (FOMO) Due to the recent COVID shelter in place order, many investors (new and experienced) are…

Read MorePPP Flex Act & Forgiveness: Strategies and Highlight for Optometrists (Guest Post)

[Editor’s Note]: This is a guest post written written by Adam Cmejla, CFP®, one of our sponsorship partners. Aaron and Dat are extremely strict about guest requirements in that they must be educational and informative to our readers. Every guest post is vetted, read and upheld to the highest standards of ODsonFinance. Your trust is the most…

Read More