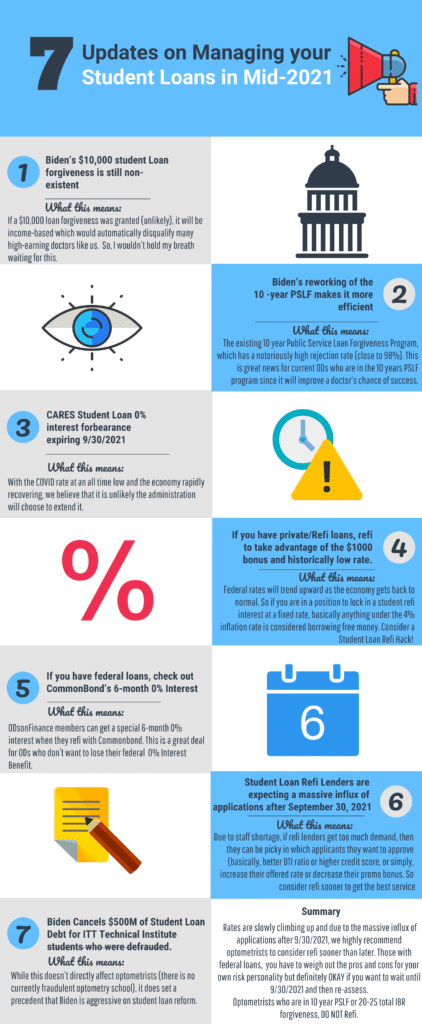

7 Updates on Managing your Student Loans in Mid-2021

KEY POINTS:

-

(1) Biden’s $10,000 student Loan forgiveness is still non-existent

-

(2) Biden’s reworking of the 10 year PSLF makes it more efficient

-

(3) CARES Student Loan 0% interest forbearance expiring 9/30/2021

-

(4) If you have private/Refi loans, refi to take advantage of the $1000 bonus and historically low rate.

-

(5) If you have federal loans, check out CommonBond’s 6-months 0% Interest

-

(6) Student Loan Refi Lenders are expecting a massive influx of applications after September 30, 2021

-

(7) Biden Cancels $500M of Student Loan Debt for ITT Technical Institute students who were defrauded.

We are halfway through 2021 and close to 1.5 years since the COVID pandemic lockdown; but most importantly, we are approaching the end of the federal 0% student loan interest relief (set to end September 30th). Here are 7 important updates in the world of student loans to help every OD be financially successful!

(1) Biden’s $10,000 student Loan forgiveness is still non-existent

While there was a wide range of political promises starting with Democrat Elizabeth Warren’s $50,000 forgiveness promise, Biden’s recent official stance (during a May 20 interview with the New York Times) suggested that he still supported the move to write off $10,000 of student debt, but not $50,000. The president told columnist David Brooks, “The idea that you go to Penn and you’re paying a total of $70,000 bucks a year and the public should pay for that? I don’t agree with that.”

Opinion: Honestly, $10,000 forgiveness doesn’t move the financial needle for most optometrists with an average student loan debt of over $200,000+. The likelihood of any student loan forgiveness outside of 10 year Public Service Loan Forgiveness (PSLF) and/or 20-25 years IBR/REPAYE total forgiveness is extremely low. If a $10,000 loan forgiveness was granted (unlikely), it will be income-based which would automatically disqualify many high-earning doctors like us. So, I wouldn’t hold my breath waiting for this.

(2) Biden’s reworking of the 10 year PSLF makes it more efficient

While no specific plan has been introduced yet to change the existing 10 year Public Service Loan Forgiveness Program, which has a notoriously high rejection rate (close to 98%), Biden did propose qualifying additional federal loans and repayment options for PSLF, such as half your balance being forgiven after five years plus an easier application process.

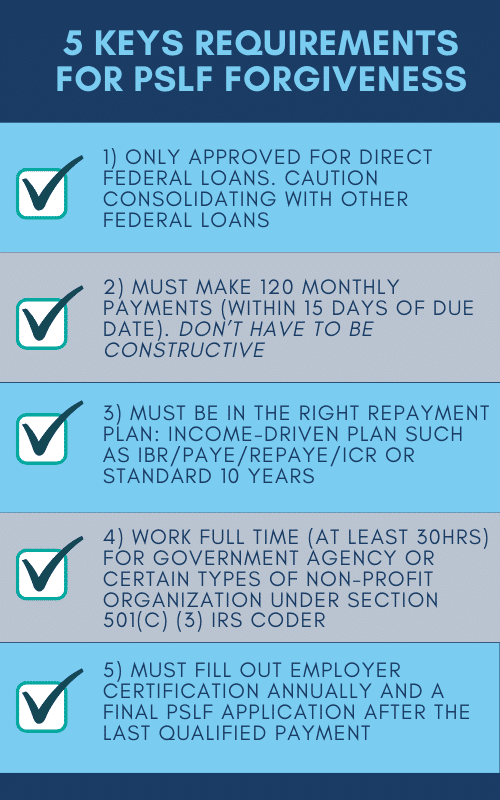

Opinion: This is great news for current ODs who are in the 10 years PSLF program since it will improve a doctor’s chance of success. Since the inception of the 10-year PSLF back in 2007, we can count on one hand the number of doctors that got their student loans forgiven. But our advice is still the same, if you are going for PSLF, make sure you take strict note of the 5 key requirements!

Financial Pearl

"For Kaiser Optometrists, especially in CA or Texas, you are NOT going to qualify for 10 years PSLF. State laws prevent hospitals from employing doctors and nurses directly. So many doctors are actually hired through a FOR-PROFIT medical group, which employs doctors at NON-PROFIT hospitals like Kaiser. That's why you see the majority of optometrists in 10-year PSLF working for university hospitals like UCLA/USC, or at the VA. When in doubt, check with HR and your federal lender"

(3) CARES 0% student loan interest forbearance expiring 9/30/2021

When Biden took office, he extended the student loan CARES benefit until the end of 9/30/2021, which automatically pauses payments on most federal student loans and waives new interest on the loan balance. It also halts all collection activities on loans in default for all federal student loans.

Opinion: With the COVID rate at an all time low and the economy rapidly recovering, we believe that it is unlikely the administration will choose to extend it. In addition, looking at the recent legislation budget agenda, there is no mention on either side of the aisle of extending it.

(4) If you have private/Refi loans, refi now to take advantage of the $1000 bonus and historically lowest rate.

While no one can predict federal rates, current student loan refi rates are historically low at the moment (lowest rate offered for 5 years fixed is 2.13%) - well below the recent consumer inflation of 4%.

Federal Reserve officials signaled that they expected to raise interest rates from rock bottom sooner than they had previously forecasted due to increasing confidence that the economy would rebound robustly from the pandemic. Fed policy makers are expected to make 2 interest rate increases by 2023.

Opinion: Without getting into the political weeds, we do believe that federal rates will trend upward as the economy gets back to normal. So if you are in a position to lock in a student refi interest at a fixed rate, basically anything under the 4% inflation rate is considered borrowing free money.

Financial Pearl

“With the ease of online application and soft credit pulls, a lot of our ODsonFinance members are doing a kind of ‘Student Refi Hack’, in which they hop from refi lender to refi lender, to capture the sign-on bonus, which can range up to $1000.

The most refi applications done by one OD that we have seen? A WHOOPING FOUR applications over a course of 1.5 years. When we asked if it was difficult or tedious, the optometrist replied, 'Everything was online, so it was really easy to submit all my financial documents, it was the easiest $3,250 that I made sitting at my computer' "

(5) If you have federal loans, check out CommonBond’s newest Introductory Rate of 6-months at 0% Interest

After weeks of negotiation, Aaron and Dat are happy to announce that ODsonFinance members can get a special 6-month 0% interest when they refi with Commonbond. This is a great deal for ODs who don’t want to lose their federal 0% Interest Benefit. Actually this is a MUCH BETTER deal than what the government is offering.

Why? Considering that it is almost July 2021 and the Fed benefit expires September 30, 2021. This means you get a whooping 3 extra months of 0% interest if you refi now (Up to 6 months perk past September 2021 expiration deadline)

Opinion: This is a pretty great deal. If you currently have an existing federal loan and not going for 10 year PSLF, this is a great way to get introductory 0% for 6 months and future FIXED lower interest rate, and lastly $400 cash-back!

(6) Student Loan Refi Lenders are expecting a massive influx of applications after September 30, 2021

It is no secret that student refinancing companies have been hit the hardest economically this past year and some have even been laying off their staff due to low volumes of refi application. This means during this time, Refi lenders will offer the best top-notch service and lowest rate to attract your business! This is a win-win situation for you!

Opinion: After talking to a lot of our partners, lenders are gearing up to handle the massive influx of refi applications, but due to labor staff shortage, they are concerned about processing delays and inability to handle the traffic (Remember the mortgage low rate in 3/202 0 when banks were turning away applicants for a few months).

We predict that it is a simple supply and demand, if lenders get too much demand, then they can be picky in which applicants they want to approve (basically, better DTI ratio or higher credit score) and might turn away less desirable applications, or simply, increase their offered rate or decrease their promo bonus.

(7) Biden Cancels $500M of Student Loan Debt for ITT Technical Institute students who were defrauded.

While this was a long time coming, under the direction of President Joe Biden, recently announced that the 18,000 students who were defrauded by ITT Technical Institute will have their student loans forgiven. In total, over $500 million worth of student debt was forgiven, amounting to an average of nearly $28,000 per borrower.

Opinion: While this doesn’t directly affect optometrists (there is no currently fraudulent optometry school, even though the high tuition might feel like high school robbery haha, JK), it does set a precedent that Biden is aggressive on student loan reform. This might open a lot of doors for future student loan policies in addressing the $1.57T student loan crisis that are plaguing our country.

Summary

Overall, our advice to optometrists hasn't changed much. Rates are slowly climbing up and due to the massive influx of applications after 9/30/2021, we highly recommend optometrists to consider refi sooner than later. Those with federal loans, you have to weigh out the pros and cons for your own risk personality but definitely OKAY if you want to wait until 9/30/2021 and then re-assess.

Optometrists who are in 10 year PSLF or 20-25 total IBR forgiveness, DO NOT Refinance your student loans!

As always, Aaron and Dat will always keep you updated on the latest student loan refi and negotiate for our little OD community, the lowest refi rate + best bonus!

Want to learn how to manage your student loans? Check out The Optometrist's Guide to Student Loans

Want to Compare the best Refi Rates and the highest Cash-Back? Check out Our Vetted Student Loans Refi Partners

Facebook Comments