8 Reasons Why Every Optometrist should Invest in Index Funds

KEY POINTS:

-

(1) Better Performance

-

(2) Lower Cost

-

(3) Less Time consuming

-

(4) Less Risky

-

(5) More Tax-Efficient

-

(6) Ease of use in Building your Portfolio

-

(7) Wide Availability

-

(8) Eliminate Behavioral aspect and No Feeling of missing out (FOMO)

Due to the recent COVID shelter in place order, many investors (new and experienced) are finding themselves with a significant amount of free time. This has led many readers to pick up the dangerous side hobbies of “speculative investing,” day trading or swing-trading - often exposing them to significant risk and losses.

In addition, many inexperienced and younger investors are buying random individual stocks simply because they were mentioned in our Facebook Community without doing their own due diligence or due to the fear of missing out on a hot stock pick.

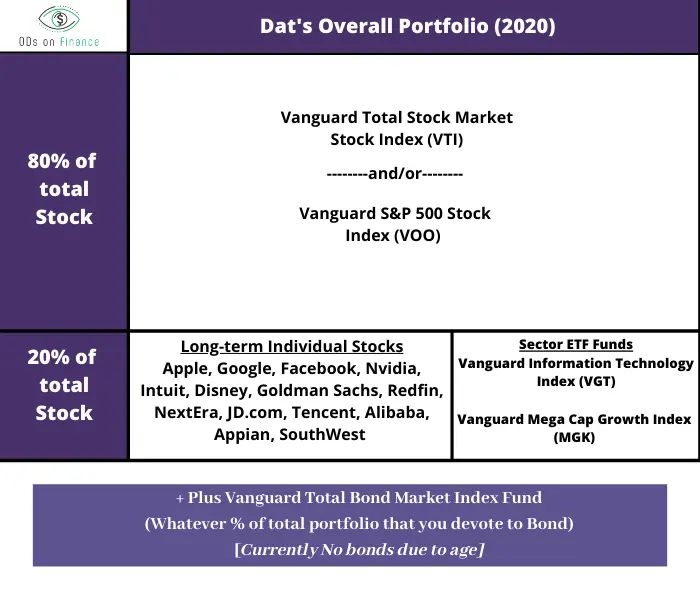

While I don’t talk much about passive index funds enough (Maybe that is my fault as an administrator) and maybe a bit too much about individual technology stocks (a completely different strategy of long-term investing), I do advocate for readers to know that the vast majority of both my portfolio and co-founder Aaron’s portfolio (over 80%) is still invested in traditional, low-cost, passive, broadly-diversified index funds (or their exchange traded fund ETF equivalents).

Here is my Entire Stock Exposure (YTD 2020)

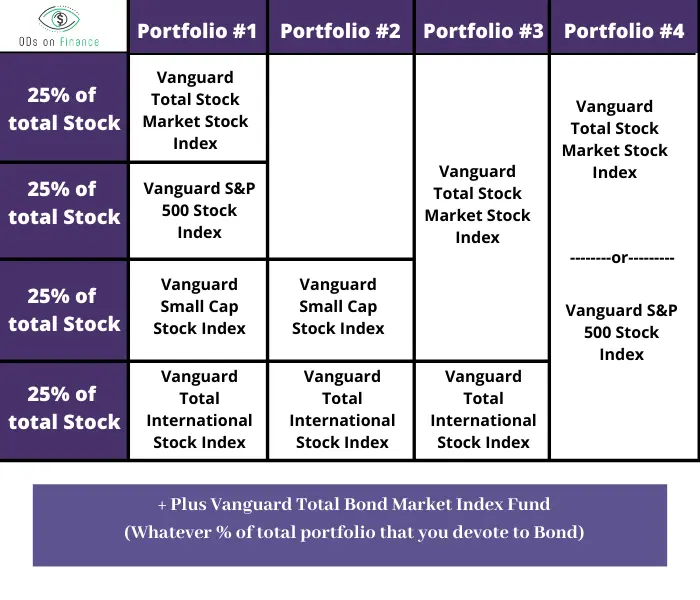

But for a typical investor (new or experienced), anyone can be extremely successful by having a simple 2-5 Index fund Portfolio from either one of these four recommended portfolios:

As the billionaire Warren Buffet wisely say, “By periodically investing in an index fund, the know-nothing investor can actually outperform most investments professionals”

(1) Better Performance with Guaranteed Market Return (10% Average)

Study after study shows that over a 10-year period, index funds will outperform 80% of actively-managed funds, after accounting for fees. If you hold a fund for longer than 10+ years, then it will outperform close to 90% of all actively-managed funds!

So if the market is up 28%, great! If it is down 10%, no worries since everyone is down as well. The great thing about index funds is that you will always get the market return since you are betting on the whole market or in essence, the US Economy which is the most powerful and most stable economy in the world.

(2) Low Cost Fee ~0.09% (Compared to Active Fund Fee ~0.78%)

Fees matter a lot! And especially over the long run, they can be a significant drain on your overall returns. Statistics show that investors pay nearly 9X more in fees for actively managed mutual funds which charged an average of 0.78% per year, while the average index fund’s cost is 0.09%

Index funds are essentially run by computer algorithms which are programmed to automatically track the market’s up and down peaks within an index. Computer robots don’t require the same high salary or end of the year bonus as wall-street hedge managers, so they are significantly cheaper; even costing 0% like the Fidelity ZERO Total Market Index Fund (FZROX). These savings are passed along to you.

Meanwhile, many actively-managed funds have hidden commissions and higher rates of trading frequency, which results in higher fees that eventually will be charged to you.

(3) Less Time Consuming

I personally love investing in individual stocks for the long term, but this takes a ridiculous amount of my free time each day to keep up with the latest research. I have a portfolio of roughly 14 individual stocks containing large companies such as Apple, Google, Disney, Facebook to smaller companies like Redfin and Appian. I spend my morning reading the latest Wall Street Journal to keep up with current events, reading quarterly earning & financial reports and lastly following each CEO’s twitter account for up-to-date news.

If I had to estimate the amount of time spent per day? Roughly 30mins a day or 182 hours per year. That’s roughly 7 days worth of research in a year, or a total optometrist’s wage loss of $3150 (if we assume a humble average of $450 per day) .

Now, let’s compare that to the amount of time I spent managing my parents, siblings, in-laws and fiance’s investing portfolio which consists of all index funds. I probably spend at most an hour per year to set it up, rebalance it and make sure they are on track for retirement.

That is the beauty of index fund investing! You basically set it up and let it run its course for the rest of the year. There is no need to market-time or sell if a company has a poor earning report for the quarter.

For any high-earning professionals whose time is limited, it might be more valuable to spend your personal time on other personal and professional goals like time with your loved ones or starting another business, rather than researching individual stocks. Heck! Simply picking up an extra fill-in day might be more profitable.

(4) Less Risky

When you invest in a passive index fund like an S&P 500 Index that mirrors the market, you also avoid all the unnecessary risk as well. Here are some risks with individual stocks or actively-managed funds:

Company Fraud/bankruptcy

- While you might pick the next Apple, you can also pick the next Enron as well. In more recent news, there were two hot and much-beloved start-ups: Luckin Coffee (“The Starbucks of China”) and WireCard (“The PayPal of Germany”) that are expected to go bankrupt due to fraud. Wirecard’s financial audit revealed that $2 Billions went missing while Luckin Coffee falsified $300 Million in sales. Luckin stock plunged 90% while Wirecard spiraled down 95%, leaving many investors broke.

Avoid Manager risk

- Remember that every fund manager is human, and they are prone to the same human errors. So when you invest in an actively-managed fund, you are always left wondering whether the cause of your underperformance for the year is due to the natural cyclical market or simply because your manager is unskilled, unlucky, stupid, corrupt or simply quit to start another fund.

(5) More Tax-Efficient

Index funds are extremely tax-efficient compared to actively-managed funds due to low stock turnover & frequency of trading, which results in long term capital gain taxes (instead of short term capital gain taxes in actively-managed funds)

Let me explain this more in detail. Actively-managed funds tend to chase “the next hot stock” which results in constant short-term trading. This in turn produces short-term gains (held less than a year) that are taxed at ordinary income tax of 24% federal tax (for most high-earning doctors).

Since index funds simply replicate the holdings of an index like the S&P 500 (500 largest US companies which rarely change in and out of the index), they don’t trade in and out of stocks often. Therefore, they can hold onto stocks within an index much longer. So when an index fund has to sell a stock, they usually have that stock longer than a year, and thus will be taxed at the long-term capital gains rate (for most high-earning ODs, it will be 15%).

In addition, ETF versions of an index mutual fund have an additional benefit of being slightly tax-efficient compared to a mutual index fund. Without going into the complex nuances of how ETFs are set up, when an investor sells an ETF Index fund (similar to a stock), it is sold to another investor directly (rather than to the mutual index fund to hold temporarily), so it is a straight transaction and thus no capital gain taxes.

(6) Ease of use in Building your Portfolio

I cannot emphasize how easy it is to construct your portfolio using a variety of index funds. Want some exposure to real estate? BOOM there is Vanguard Real Estate Index ETF (VNQ) Want to tilt toward some Tech sector? Piece of cake! There is the Vanguard Information Technology Index ETF (VGT). Confused on how different types of bonds work? No worries! Just invest in the Vanguard Total Bond Market Index Fund.

You get my point! Once an investor has a solid foundation of S&P 500 stock Index, they can easily customize or tilt their portfolio to a sector of interest.

(7) Wide Availability

What I really love about index funds is that every single brokerage (Vanguard, Fidelity, etc) or even your own employer 401K will have their own version of similar index funds. In addition, almost every single investing vehicle out there from your Roth IRA, Health Saving Account (HSA) to your children’s college 529s will have some kind of index fund choices.

So if my employer 401K doesn’t have my favorite low cost Vanguard S&P 500 Index fund, they will likely have a similar SP 500 index fund with similar cost and return. This makes it extremely easy to choose similar index funds across different accounts.

(8) Eliminate Behavioral aspects and Fear of Missing out (FOMO)

An investor's success is greatly measured by his or her ability to control their own emotion and behavior during a volatile market rather than choosing the right fund or stocks.

Owning individual stocks can sometimes be extremely emotional. You might put in hours of research convincing yourself to finally buy a hot tech IPO. But when it starts to tank after a few years, your ego might make excuses to hold it just a bit longer…. until it finally comes crashing down. Personally speaking, I have a large position in Apple, but I am such a big Apple fanboy that it will be extremely difficult for me to sell any shares when the time finally comes. This is the worst mistake, to mix emotions with investing. I have to remind myself to be aware of this.

What is so great about an Index fund is that I literally have no emotional attachment to the fund at all. If I need to sell some index funds for a future home purchase? No problem at all. It is just a simple mathematical transaction in my brokerage account.

Lastly, there is no fear of missing out on the next hot stock! Your buddy purchased some Amazon stock before the COVID Pandemic and now it’s skyrocketing due to increased demand for E-commerce? No worries, you can also brag that you own a big chunk of Amazon in your S&P 500 index fund as well.

Summary

For any new or experienced investors, we strongly advocate building a solid foundation of index funds first, dollar-cost average it by funding it consistently, avoid market-timing or trying to chase the next hype stock/investment. While index funds might not be the most exciting thing to talk to your friends about at parties, that is what successful investing looks like… Boring as heck!

As you get more experienced and want to dabble in other avenues of investing, do your due diligence, don’t invest more than 10% of your portfolio and don’t take unnecessary risk. Will you be more successful than the average index investor? Statistically, probably not. However, there are many roads to wealth, so take the one that is catered to you.

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

Facebook Comments