The Optometrist's Guide to Roth IRA and How to do a Backdoor Roth

Chapter 2A: How to do a Backdoor Roth with Vanguard | Step by Step Instructions

Updated for 2024 Tax Limits

In this chapter, we will show you a step-by-step guide (with screenshots) on how to do a Backdoor Roth for new investors. We will be using Vanguard as an example, but Fidelity and other major brokerages will have similar steps.

Before we get started, here are 4 requirements before attempting to do a backdoor Roth IRA:

-

(1) You CANNOT have any tax-deferred money in any existing IRAs such as a traditional, SEP or SIMPLE

If you do, you need a strategy to move that money to a Roth-IRA (W2) or solo 401K (1099/S-Corp) via IRA rollover and be aware that there might be a tax bill due on the conversion.

-

(2) Set up 2 Separate Accounts: Trad-IRA | Roth IRA

We will use the same two accounts to do the backdoor Roth conversion each year. So keep both accounts open!

-

(3) Have the full amount $6,500 (for 2023 Limit) to fund for the 2023 Contribution first, then $7,000 for 2024

We recommend doing the full $6,500 in one step for the previous year first (2023) if you haven't done so.

Then If you have another $7,000 to contribute, then you can make a 2024 contribution as well, but again you have until 4/15/2025 the following year to do so.

Note: During 2024, you can do $583 each month into a trad-IRA ($7,000 total) and select the standard "money market" fund BUT DO NOT INVEST ANYTHING until it is fully converted into the backdoor Roth IRA. You might get a few $1-2 in gains but IRS will round down to $7,000 end of the year.

-

(4) Repeat for your spouse (if applicable)

You can contribute another $6,500 & $7,000 for your non-working spouse via Backdoor Roth IRA as well for 2023 and 2024.

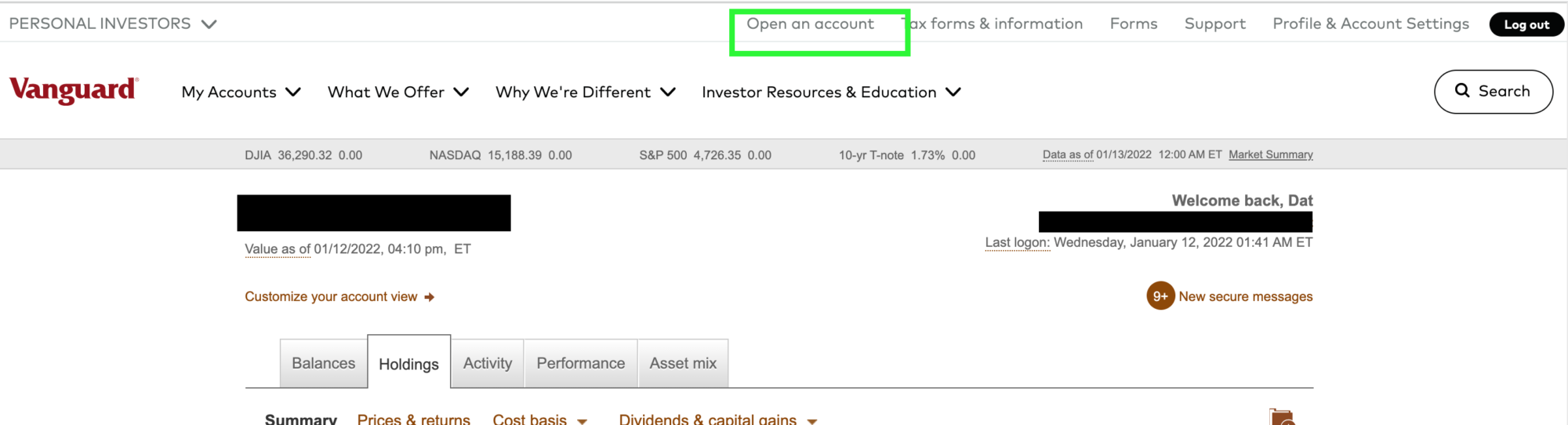

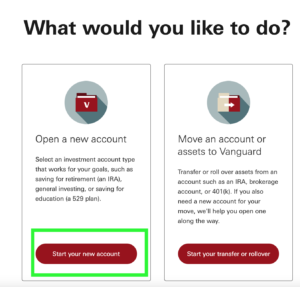

Step 1: Open up an account with Vanguard

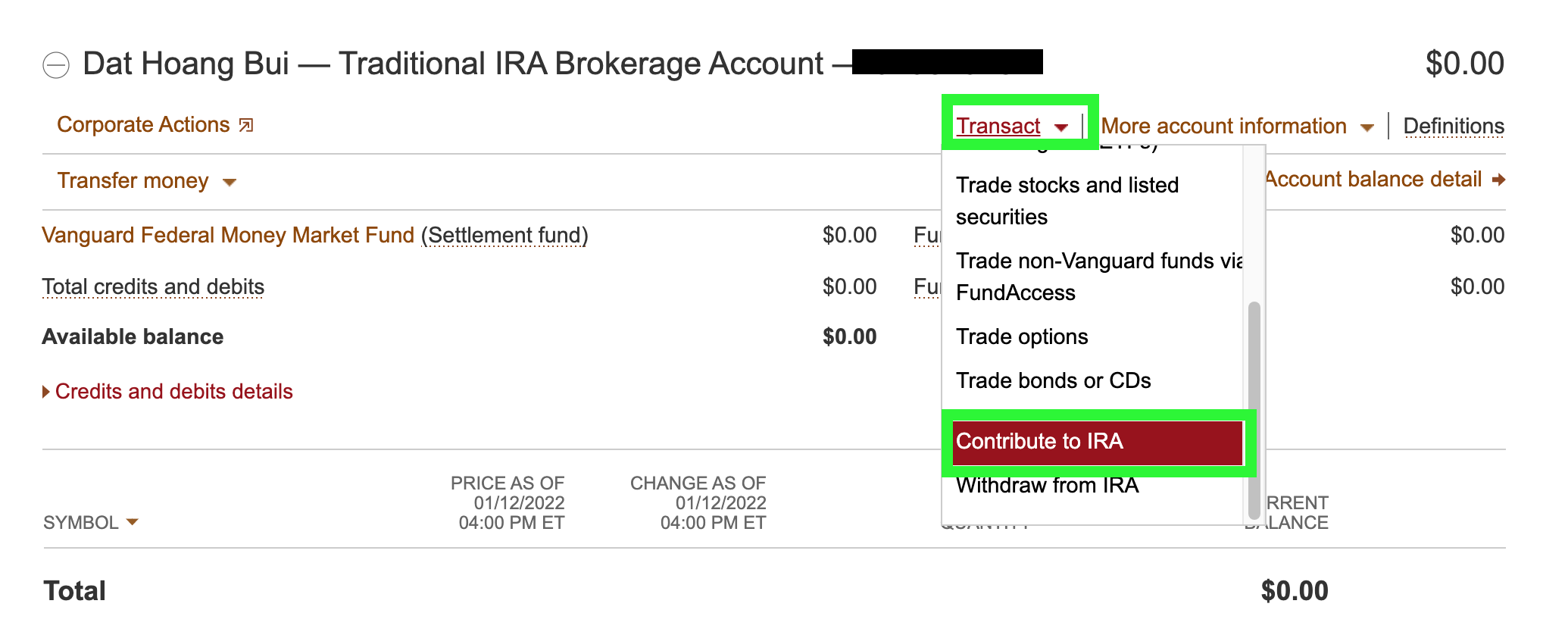

Step 2: Contribute $7,000 to your Traditional IRA First

Once you open both your Trad + Roth IRA accounts, go into your Trad IRA FIRST, you should automatically have a Vanguard Federal Money Market Fund (Settlement Fund). This is basically cash, and where we can use to hold any money for transactions.

Then click Contribute to the Trad-IRA account.

Tell Vanguard where your money is GOING TO for your 2024 Contribution (this amount will be $7,000), and it will automatically be placed in your Federal Money Market.

Note: I already contribute $6,500 & $7,000 for both 2023 & 2024, so that's why my "You can Contribute" is $0.00 but yours should say $6,500 & $7,000 if you have not done so.

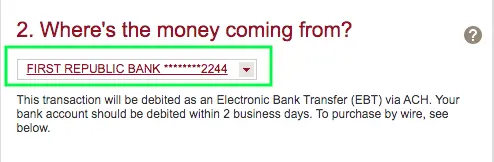

Next, select where the Money is COMING FROM? In this case, we are going to transfer it from a personal checking account at First Republic Bank. You can transfer it from other Vanguard accounts as well.

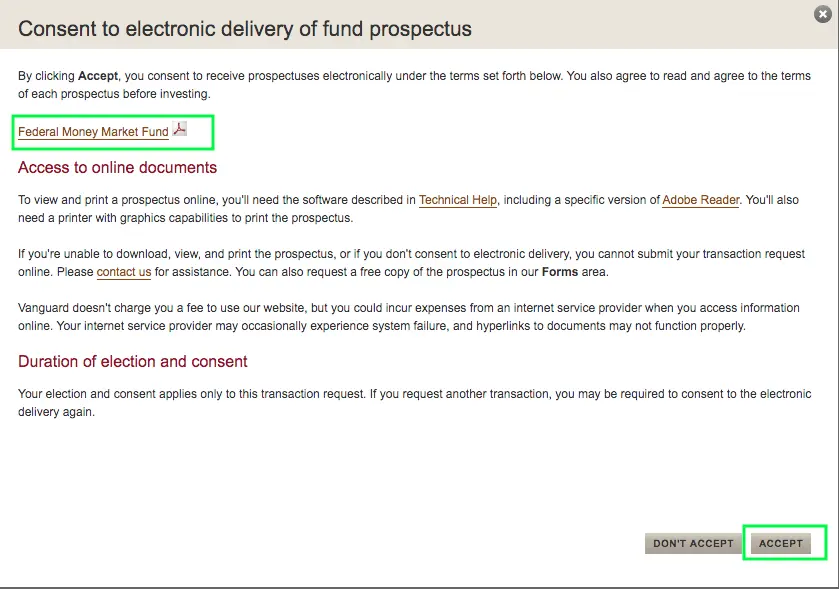

Next, consent to electronic delivery of the prospectus of the “Federal Money Market Fund”. This is basically telling you what the fund actually invests in, which in this case, is all cash.

Step 3: Wait 3-7 days before making the Roth Conversion

It usually takes a day or two for the $7,000 to transfer from your Checking account to your Vanguard Trad IRA. It might take up to 6+ days for your money to settle in your Trad IRA

Then wait another 3-7 days before making the conversation to Roth IRA. Why?

- Step Transaction Doctrine: Some people believe that it is best to wait to do nothing from 1-7 days, this will allow the IRS to “bless” the backdoor Roth convert.

- But In 2018, Congress officially blessed the step of the Backdoor Roth IRA under current law, so many people convert it the next day without any IRS red flags popping up.

Step 4: Convert your $7,000 to a Roth IRA via Backdoor

- Once your $7,000 Settles in your Trad-IRA (usually takes 2-6 days)

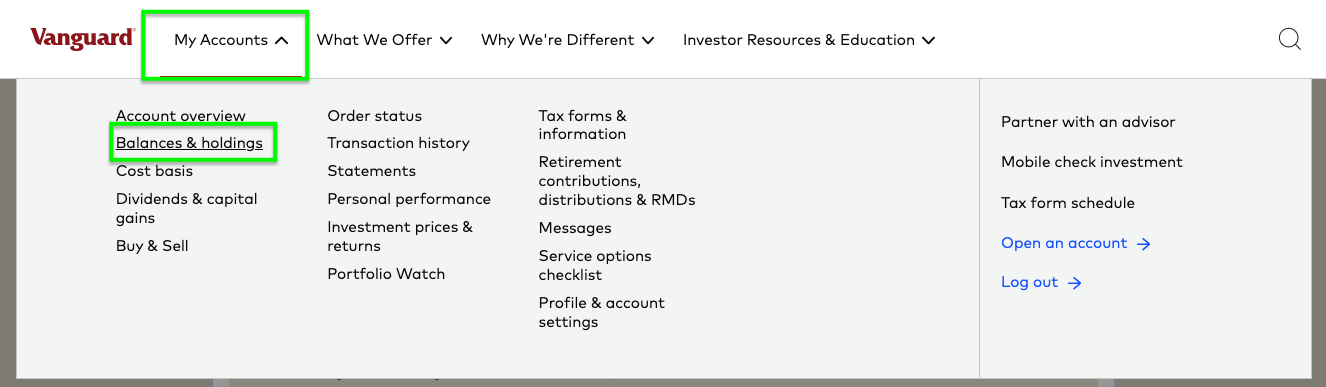

- Go to the top Menu "My Accounts"

- Within your Trad-IRA account, select "Convert to Roth IRA", once your $7,000 has settled in your available balance

NOTE: You can see that I had an extra $4 in my Trad-IRA, this is because the money market fund grew a little during the week that I waited. This is NOT a big deal, the IRS will round down to $7,000 during Tax Season.

Part 1: Choose the account (Trad IRA) to convert. Make sure you convert ALL of the account

Part 2: Select the amount ($7,000) to convert

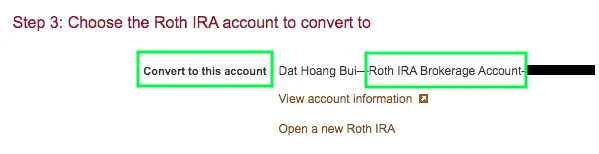

Part 3: Choose the Roth IRA account to convert to. If you open up the Roth IRA during the initial set-up, it will show up here. If you haven't, well you didn't follow instructions very well, so stop and Open a Roth IRA first.

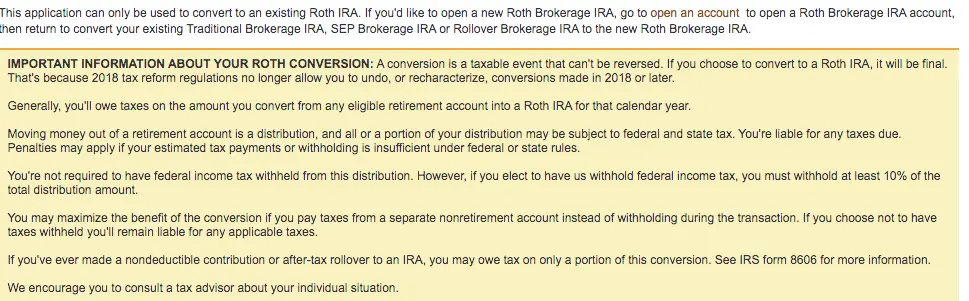

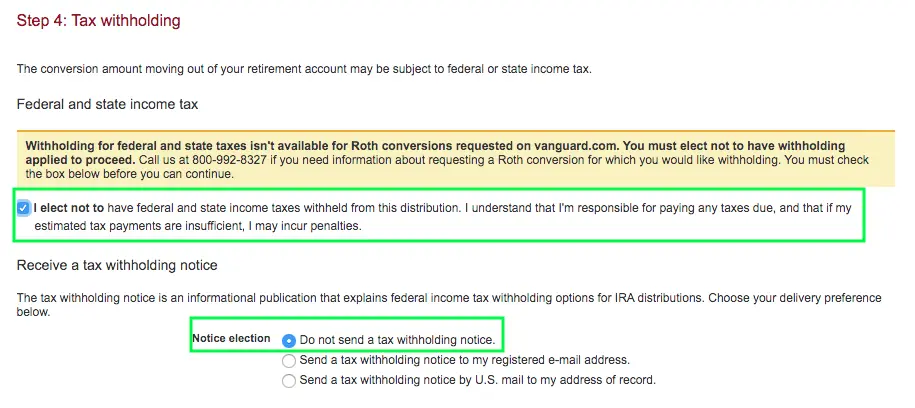

Part 4: Tax Holding

You will be given some information that the conversion is a taxable event that cannot be reversed. Well this isn’t exactly correct, because the final net contribution is a non-deductible $7,000 contribution.

- For 2020, there is a new tax reform that eliminates the ability to re-characterize (or undo) Roth Conversions.

Step 5: Select your investment funds within your Roth IRA

Remember to buy your funds once you have the $7,000 in the money market. BUY YOUR INVESTMENT FUNDS. Think of your Roth IRA as an additional retirement accounts, so choose your investments accordingly.

Financial Reminder

"Please remember that once you convert money market fund (basically cash) from your Trad IRA to Roth IRA, you actually have to chose + BUY the Index Funds like a Vanguard Total Stock Index (VTI) for it to grow. It is surprisingly too commonplace to see many optometrists who are shocked why their Roth IRA return 0% for the last 5 years because they forgot to select the investments"

Step 6: Repeat for your Spouse (if applicable)

If you are married and file jointly, then your spouse can also do a backdoor Roth for an additional $7,000 even if he or she doesn't have an earned income.

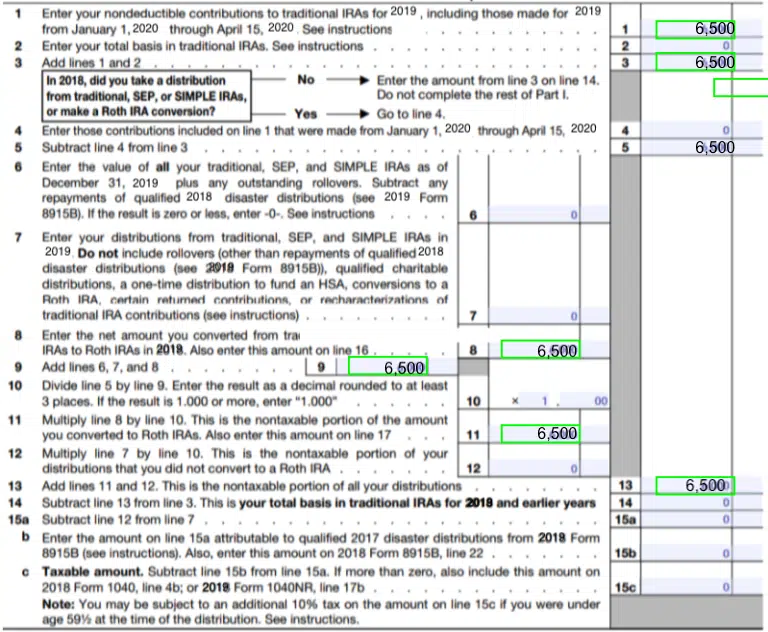

Step 7: Fill out Form 86060 in your 1050 during your tax season

Here is what your IRS form 8606 should look like, but if you want additional instructions from IRS, find out more here.

*Note: This is example of 2023, but your number should be $7,000

TurboTax user: Check out the Finance Buff’s Direction on TurboTax or Check out Youtube Step-by-step direction

Step 8: Repeat every year before April 15 (Tax Deadline)

I usually like to do my Roth IRA backdoor every year around January 2024. I do the full $7,000 amount on the same month of every year. Remember this will go into your Money Market Fund, so you will have plenty of time to choose your investments. If you forgot to do it for 2023, you have until 4/15/2024 to convert $6,500 for 2023

I recommend selecting your investment funds as soon as possible, so your money can start working sooner.