The Optometrist' Guide to Retirement Planning

Chapter 2: How Much Do I Need? And Other Advice/Tips

Now that you have a basic game plan on what financial goals to achieve, we are going to teach you some concepts to help master retirement-planning.

How Much Do I need for Retirement?

Go ahead, think of a number. $50,000? $100,000? $750,000? You are probably way off! As a general guideline, most people need:

[25 x Post-Retirement Expenses] = Total amount Needed in their retirement funds

This Rule-of-thumb assumes a few educated factors:

- Average Market return of 7%

- Retirement age of 65 years old with a 30 years life span longevity

- No debts such as credit card, house mortgage and student loans in retirement

- Doesn’t include social security (~$46,932 per year (as of 2024) mainly because we never want to fully rely on the government because taxes policies change all the time.

- No other side business income

- Assuming a safe 4% withdrawal rule

- Adjusted for inflation

What is the 4% Rule?

The Trinity study states that a person in retirement can safely withdraw 4% of their retirement funds without significantly reducing the total principle amount, thus accounting for yearly inflation of 3% (yes, I know inflation sucks) with an average of 7% market gains.

Example: Dr. Retina is 65 years old and is planning to retire. He is completely debt-free with a paid-off house mortgage. His health is getting worse so his health insurance is significantly higher compared to his 20s. He needs an annual income of $80,000 to maintain his current lifestyle and yearly expenses. He also wants enough to travel and spend time with his grand-kids.

So, following the 25x Rule, he would need a total of:

I know that is quite shocking to believe, but the sad reality is that the average American 401(k) balance among workers 65 and older is $192,877, according to Vanguard's "How America Saves 2019" report.

A savings balance of $192,877 might seem like a lot of money but when we break down that sum on a yearly basis, it actually amounts to very little. If you follow the 4% rule, which states that if you begin by withdrawing 4% of your savings balance your first year of retirement and then adjust subsequent withdrawals for inflation, $192,877 gives you just $7,715 in annual income. That's less than $650 a month

If we break down the math over 35 years of saving, assuming an average market gain of 7%, the average American only saves $105 per month toward retirement. That is less than you spend in a month on coffee!

I know attaining a $2 million retirement nest egg might seem intimidating, especially when you are a new graduate and drowning in student loan debt. But remember that time (the power of compounding interest over decades of investing will allow your investments to grow), tax breaks and a high optometry salary with an increasing saving rate will accelerate your retirement portfolio returns.

"The Average American 401(k) balance among workers 65 and older is $192,877. If you follow the 4% withdrawal rule, this gives you just $7,715 in annual income. That's less than $650 a month to live on"

The Power of Compounding Interest

You have probably heard this term many times before! Basically, if you simply put a small amount away today and let it stay there for 30 years, then it will exponentially grow each year.

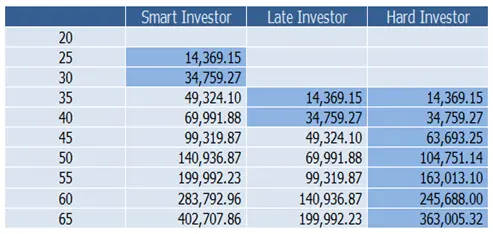

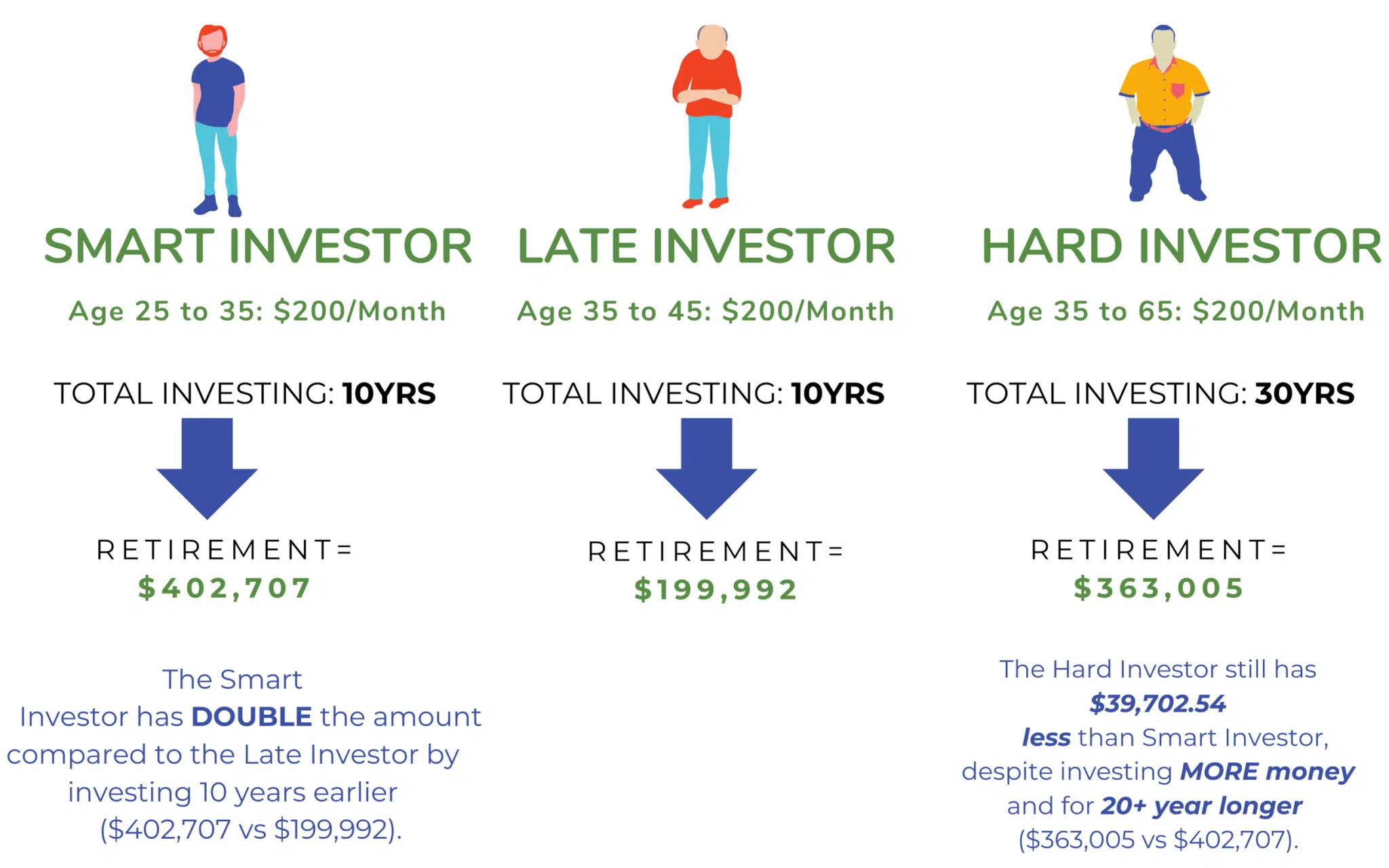

Example: Let’s look at 3 different doctor investors in this example. Doctor A is a Smart investor, Doctor B is the Late Investor and Doctor C is the Hard investor. Lets assume a typical 7% interest Market rate, where the shaded dark area indicates the years in which a $200 a month was saved

Doctor A: Smart Investor, starts saving $200 per month at age 25 until he is 35 years old, then stops all contributions. He invests for a total of 10 years

Doctor B: Late Investor starts saving $200 per month at age 35 until he is 45 years old then stops all contributions. He invests for a total of 10 years

Doctor C: Hard Investor starts saving at $200 per month at age 35 until he retires at 65 (Typical retirement age). He invests for a duration of 30 years while contributing the most money over his lifetime.

At the time of retirement age which is 65 years old for all three investors, we can see a few surprising results:

- By simply investing earlier at Age 25 (10 years before the Late Investor), the Smart Investor has DOUBLE the amount compared to the Late Investor ($402,707 compared to $199,992).

- The Hard investor started saving at Age 35 (10 years behind Smart Investor) and even though he tries to catch up and tried to save an extra $200 per month until he retires at 65 years ago. The Hard Investor still has $39,702.54 less than Smart Investor ($363,0005 vs $402,707).

- In addition, the Hard Investor put in more time and thus more money contributions compared to the shorter investing time by Smart Investor (30 years vs 10 years).

The moral of the story? The sooner you start saving, the quicker you will see power of compound interest.

What is the Latte Factor?

There is a famous theory called the Latte factor. It emphasizes the power of compounding from small daily expenses such as a $4 coffee latte. If we take that $4 coffee per day x 365 days, then comes to a whopping total of $1460 per year. If we were to invest that $1460 from age 30 to 65 years old, using a conservative market return of 7% per year, then that daily cup of coffee will be worth a mammoth $214,770 at 65 years old.

Note: Now, I am not picking on coffee, but I do want to emphasize that tiny expenses add up and it honestly doesn’t take much per month to save up for retirement. if you have all your financial ducks in a row like saving rate + investment, then it is definitely okay to send a little $ on the little joys in life.

"It is estimated that by 2033, the government will only be able to pay 77% of all current Social Security recipients. This means that younger workers will likely end up getting a much lower monthly reimbursement"

What about Social Security?

“Social security was never intended to be a retirement plan. At most, it was designed to provide an income supplement.”

-David Bach

Sorry to break your bubble! But right now, the future of the Social Security program is largely unknown. It is estimated that by 2033, the government will only be able to pay 77% of all current Social Security recipients. This means that younger workers will likely end up getting a much lower monthly reimbursements compared to the older Baby Boomer generations, as time progresses.

With the advancement in healthcare, people are living significantly longer past the average life expectancy of 76 years old (male) and 81 years old (female) and the government is simply not prepared for that.

But even assuming that social security benefits will be paid out in full, don’t expect much! For a typical optometrist making an average $120,000 salary and paying taxes, they should have an expected monthly benefit check of around estimated $3,554 in retirement as of 2023. That is only a yearly income of $42,651, way below the poverty level in USA and it will definitely not account for inflation in retirement age.

So don’t rely on Social Security to support your retirement. If it happens and you get some benefit, then great! Just think of it as extra gravy on top!

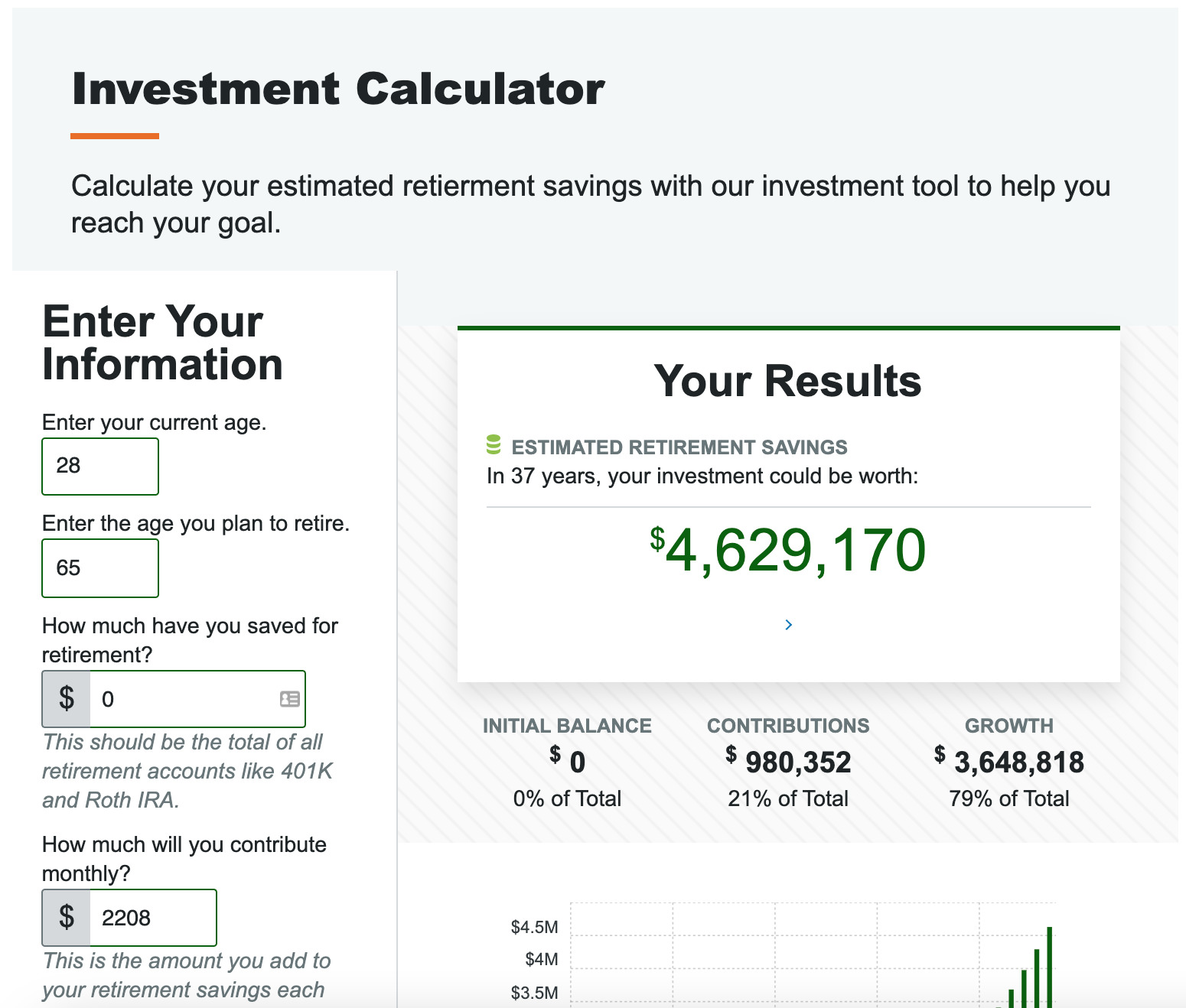

Want to see if you are track for Retirement? Check out our ONLINE RETIREMENT CALCULATOR