The Optometrist’s Guide to Business Financing

Chapter 2: 5 Types of Financiers and Fixed vs Variable Interest Rates

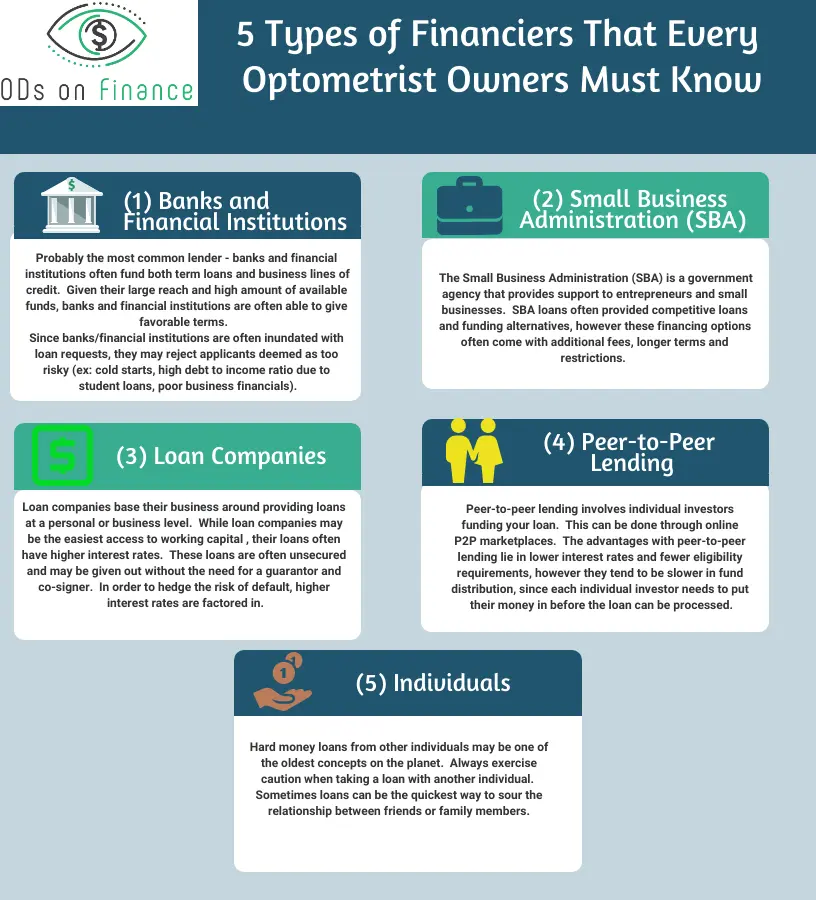

There are different types of entities that can provide financing to a business. The business model that each of these entities follows plays a factor in how terms, length and size of a loan are decided.

(1) Banks and Financial Institutions

Probably the most common lender - banks and financial institutions often fund both term loans and business lines of credit. Given their large reach and high amount of available funds, banks and financial institutions are often able to give favorable terms.

So why wouldn’t every practice owner just get a loan with favorable terms from a bank/financial institution? Well, often these loans are only available to well qualified individuals. This blanket term takes into account how much risk the financier will take in terms of a loan possibly defaulting. Business history, business financials, debt to income ratio, assets as well as the possibility of a co-signer or guarantor - all factor into a financial institution’s decision to give out a loan. The more risk, the higher the interest.

Since banks/financial institutions are often inundated with loan requests, they may reject applicants deemed as too risky (Ex: cold starts, high debt to income ratio due to student loans, poor business financials).

(2) Small Business Administration (SBA)

The Small Business Administration (SBA) is a government agency that provides support to entrepreneurs and small businesses. SBA loans often provided competitive loans and funding alternatives, however these financing options often come with additional fees, longer terms and restrictions.

If a practice owner chooses to finance with the SBA, they will most likely enter the SBA 7(a) loan program. There are five common loans the SBA 7(a) program provides if you choose to go this route:

- Standard 7(a)

- 7(a) Small Loan

- SBA Express

- Veterans Advantage

- CAPLines

Due to changing guidelines for the US government, utilize the sba.gov website to check on current terms and limits for each of these loans.

(3) Loan Companies

Loan companies base their business around providing loans at a personal or business level. While loan companies may be the easiest access to working capital , their loans often have higher interest rates. This is because they are more willing to take a chance on riskier applicants. These loans are often unsecured and may be given out without the need for a guarantor and co-signer. Often, these loans may still be obtained without a stellar credit score of debt to income ratio. In order to hedge the risk of default, higher interest rates are factored in.

When bank loans and SBA loans are not in the cards, which often happens with newer business owners, loan companies can be a great resource for business loans.

(4) Peer-to-Peer Lending

Peer-to-peer lending involves individual investors funding your loan. This can be done through online P2P marketplaces such LendingTree.com The advantages with peer-to-peer lending lie in lower interest rates and fewer eligibility requirements, however they tend to be slower in fund distribution, since each individual investor needs to put their money in before the loan can be processed.

(5) Individuals

Hard money loans from other individuals may be one of the oldest concepts on the planet. Always exercise caution when taking a loan with another individual. Sometimes loans can be the quickest way to sour the relationship between friends or family members. Also, avoid those shady loan shark characters down at the local watering hole. You’ll thank us later.

What are 2 Types of Interest?

Two types of interest rates exist on business loans, much like student loans - fixed and variable interest.

(1) Fixed interest

Fixed interest describes a scenario in which the interest rate is always the same for a loan. Due to their definitive nature, fixed interest loans tend to have a higher stated interest rate and longer term lengths.

(2) Variable interest

Variable interest describes a scenario in which the interest rate for a loan can fluctuate throughout its term. Often the interval of fluctuation will be defined. Due to the less certain nature of variable interest, they may often be found to have lucrative starting rates and shorter term lengths, however customers should be wary of fluctuation and timing of this fluctuation.

Want to Learn more about Practice Management Tools? Check out Recommended PM Resources