The Optometrist’s Guide to Business Financing

An Introduction to Business Financing

By: Dr. Aaron Neufeld (last updated: Sept 8, 2020)

“You have to spend money to make money.” You may have heard the old adage, and for good reason! In order for a business to thrive, it must have money to support staffing and operations in order to subsequently generate a profit. However in many scenarios, especially cold starts, the cash needed to run is simply not available and must be obtained from outside sources.

This is where financing comes into the picture. At the simplest level, financing involves a loan process. A financier gives you a sum of money which you pay back with interest. This money loaned provides you with the means necessary to conduct business. In essence, you are renting money to establish liquidity.

In 3 short chapters, we will teach you:

KEY POINTS:

-

(1) Six Types of Financing

-

(2) Five Types of Financiers and Fixed vs Variable Interest Rates

-

(3) When to Finance and Other Finance Terms

What are 6 Types of Financing?

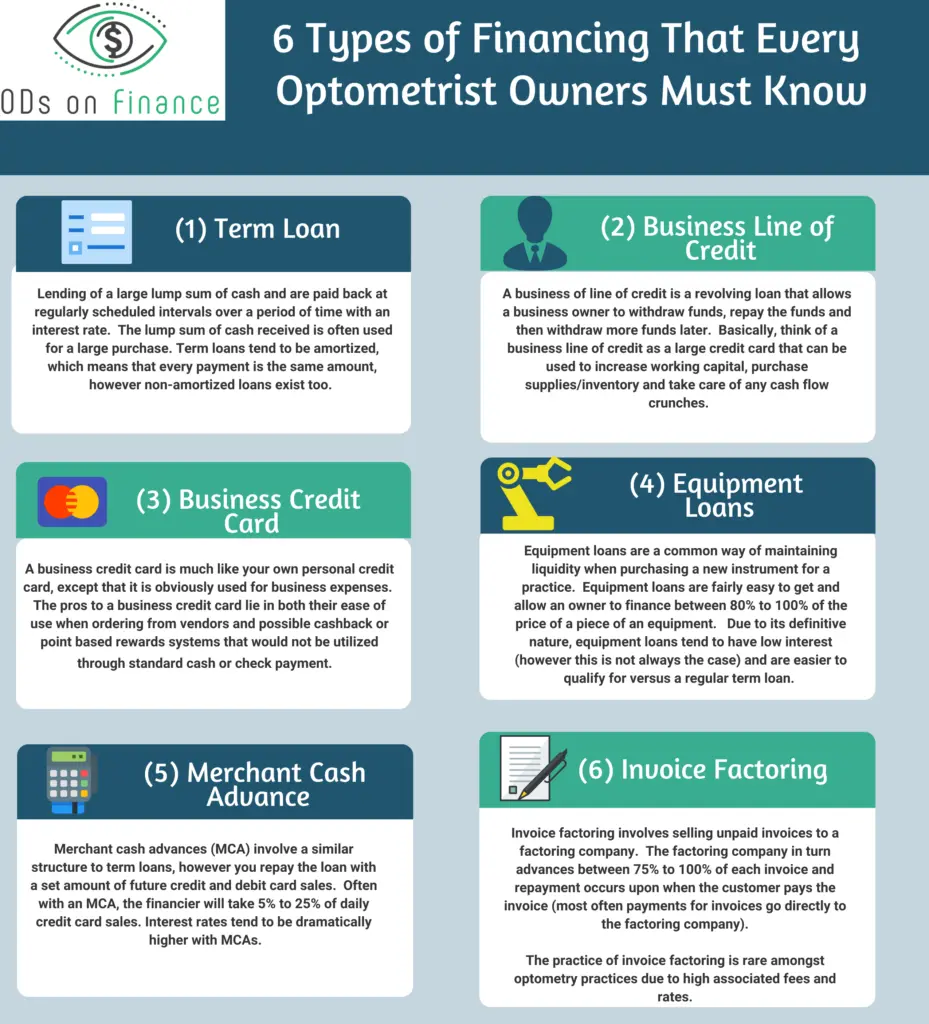

When it comes to running a small business there are 6 different types of financing you can obtain to help inject cash into your business machine.

(1) Term Loan

Term loans are the most common type of business loan and most likely the type of loan that comes to mind when one thinks of a business loan. Term loans involve the lending of a large lump sum of cash and are paid back at regularly scheduled intervals over a period of time with an interest rate. The lump sum of cash received is often used for a large purchase, but can also be used for smaller purchases.

Term loans tend to be amortized, which means that every payment is the same amount, however non-amortized loans exist too. The length of repayment for a term loan can range from short term loan repayments in 1-2 years, medium term repayments in 2-5 years and long term repayments in 2-25 years.

(2) Business Line of Credit

A business of line of credit is a revolving loan that allows a business owner to withdraw funds, repay the funds and then withdraw more funds later. Basically, think of a business line of credit as a large credit card that can be used to increase working capital, purchase supplies/inventory and take care of any cash flow crunches.

The biggest advantage of a business line of credit is that you only have to take out and pay interest on what you need, rather than being stuck with a huge lump sum of money with accruing interest.

(3) Business Credit Card

A business credit card is much like your own personal credit card, except that it is obviously used for business expenses. The pros to a business credit card lie in both their ease of use when ordering from vendors and possible cash-back or point based rewards systems that would not be utilized through standard cash or check payment.

The downside to a business credit card is much like that of a personal credit card - the psychological potential of spending more than one actually needs, due to a high credit limit.

(4) Equipment Loans

Equipment loans are a common way of maintaining liquidity when purchasing a new instrument for a practice. Equipment loans are fairly easy to get and allow an owner to finance between 80% to 100% of the price of a piece of an equipment.

Due to its definitive nature, equipment loans tend to have low interest (however this is not always the case) and are easier to qualify for versus a regular term loan. The piece of equipment is taken as collateral for securing the loan.

(5) Merchant Cash Advance

Merchant cash advances (MCA) involve a similar structure to term loans, however you repay the loan with a set amount of future credit and debit card sales. Often with an MCA, the financier will take 5% to 25% of daily credit card sales.

The downsides to MCAs are that amounts are smaller than term loans and have shorter terms. Additionally, interest rates tend to be dramatically higher with MCAs.

(6) Invoice Factoring

Invoice factoring involves selling unpaid invoices to a factoring company. The factoring company in turn advances between 75% to 100% of each invoice and repayment occurs upon when the customer pays the invoice (most often payments for invoices go directly to the factoring company).

The practice of invoice factoring is rare amongst optometry practices due to high associated fees and rates. Often this is used as a last resort if more standard types of financing cannot be obtained.

Want to Learn more about Practice Management Tools? Check out Recommended PM Resources