The Optometrist’s Guide For Health Insurance

Editor’s Note: This is a guest post written by Parita Patel who is health insurance expert. As a licensed insurance broker, she can help optometrists get the best access to all plans for your your own situation. Aaron and Dat are extremely strict about guest requirements in that they must be educational and informative to our readers. Every guest post is vetted, read and upheld to the highest standards of ODsonFinance. Your trust is the most valuable factor to us. We like having experts in their field write on our website, enjoy and give us feedback!

KEY POINTS:

-

(1) Read the fine print on what the 5 big things are for the plan you are considering: Premium, Deductible, Copays/Coinsurance, Max Out of Pocket (MOOP) and Network

-

(2) Your best bet is a PPO plan. It means coverage will be nationwide and not limited to your zip code like most other plans are.

-

(3) If you do get a plan through your employer, they will likely cover you at a great rate but if you add on any family members, it will be full price for them and very high premiums

-

(4) ACA Marketplace and state plans are based on income. They are major-medical so anyone can get on a plan but only during open enrollment or if they have a Qualifying Life Event (QLE).

-

(5) Private Insurance has no mandatory commitment and works across the nation. Lower premiums because you aren’t paying for high expenses with others that have major pre-existing conditions. Not based on income and is tax deductible. Great for small businesses as a benefit to offer employees

Mortgages, car payments, loans - what do these have in common? Well they are all high cost bills on your plate. There are options so your health insurance doesn’t have to be another one. Astonishingly enough, there are people out there still paying $1000’s a month on their coverage. According to experts from eHealth, consumers buying for a family of four pay an average monthly premium of $1,437 for non-subsidized health insurance

When it comes to health insurance, it’s much better to have it and not need it, than need it and not have it.

In an article written by Financial Investment Expert, Mark P. Cussen, the #1 reason for why people go bankrupt in the US is due to medical expenses. As we advance in healthcare capabilities, unfortunately the expenses have advanced as well. It ends up being a double whammy…if you are dealing with a health crisis, not only will you have medical bills, but you are also likely unable to work and your income isn’t flowing to help cover these expenses. On top of that, sometimes when you have health insurance, you may not even know if the insurance is any good! It’s hard to find credible information out there and these 58 page brochures that insurance companies provide make it difficult to navigate through so that you can’t even understand how your benefits work.

Let’s clear a few things up first:

Here are the top 5 things to look for to know whether or not you have a good plan that protects you and your loved ones.

- (1) Premium

- (2) Deductible

- (3) Copays/Coinsurance

- (4) Max Out of Pocket (MOOP)

- (5) Network

Let’s break these down a little further.

-

Premium

What are you paying monthly? Are you sure there isn’t a better option?

-

Deductible

This is typically what you will have to pay yearly BEFORE insurance even starts to cover you.

-

Copays | Coinsurance

On top of your monthly premium do you have to pay co-pays just to say hi to the doctor? What about medications? Co-insurance is what the insurance covers vs. what you cover only AFTER you’ve paid your deductible and UNTIL you reach your Max Out of Pocket. I’d say 80% | 20% is the better option but typically you’ll see 80% | 20%, 70% | 30% and sometimes even 50% | 50% which is not great.

-

Max Out of Pocket (MOOP)

This is your WORST CASE SCENARIO. God forbid something really (and I mean really) bad happens, this is what you need to make sure you have laying around just in case.

-

Network

HMO/EPO/POS vs PPO. Did you know those first 3 options are really only going to cover you in your zip code and county? It means if anything happens to you outside that 5-10 mile radius, you’ll be out-of-network. PPO insurance is going to be the best possible option. It stands for Preferred Provider Organization which in simple terms can basically mean nationwide coverage.

As someone who is likely making an income too high to qualify for government assistance, most optometrists opt for alternative options to the Obamacare/Marketplace/ACA plans. How can you navigate through those when it’s hard to find a solid plan without sacrificing needs or your bank account?

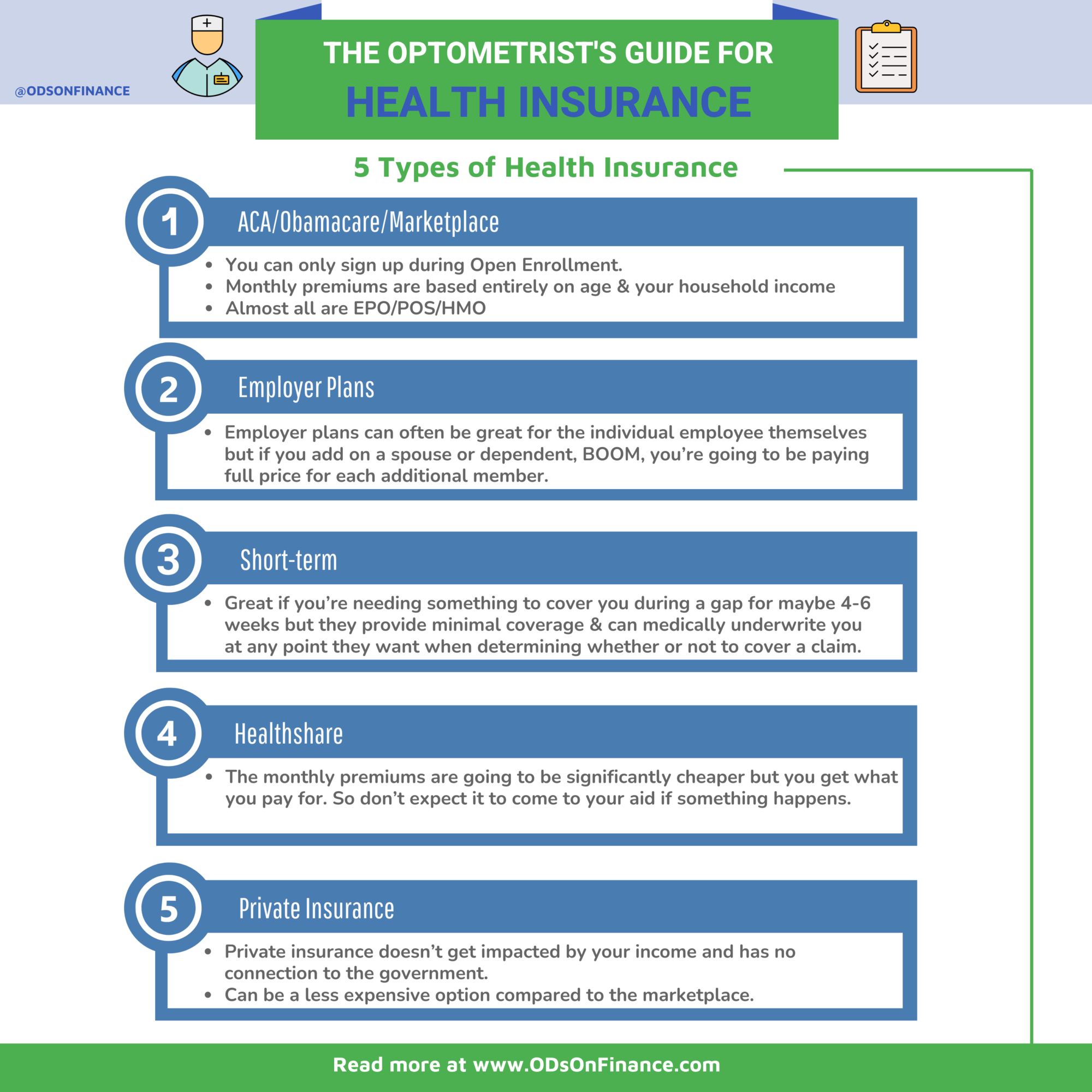

Here is a list of the various types of Insurance that exist and the key points that can help you choose. I’ll break these down further next.

- (1) ACA/Obamacare/Marketplace

- (2) Employer Plans

- (3) Short-Term

- (4) Health-share

- (5) Private Insurance

(1) ACA | Obamacare | Marketplace

You can search in Google for health insurance plans and a few government websites should show up. Some states only want you to get their state insurance option so you may be limited depending where you live. Here are 5 Key plan features:

-

(1) Most plans cover all preventative services so that’s good!

-

(2) Almost all are EPO | POS | HMO but you can find some PPO plans depending on what state you’re in.

-

(3) Monthly premiums are based entirely on age & your household income.

- If you’re exceeding certain income brackets like many optometrists, the government won’t give you discounts

- If your income is not as high, they will give you a discount BUT if by the next year’s tax season, you end up doing better than you originally thought when setting up a plan, you’ll be paying all those discounts back. No fun. Who wants the IRS to be involved in their healthcare right?

- If you’re exceeding certain income brackets like many optometrists, the government won’t give you discounts

-

(4) You can only sign up during Open Enrollment (usually November 15th - December 1st for most states). Otherwise you will need a Qualifying Life Event (QLE) in order to sign up outside of open enrollment.

-

(5) Below is a list with Qualify Life Event (QLE) examples as stated in www.Healthcare.gov (not the full list)

- Loss of health coverage

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

- Turning 26 and losing coverage through a parent’s plan

- Changes in household

- Getting married or divorced

- Having a baby or adopting a child

- Death in the family

- Changes in residence

- Moving to a different ZIP code or county

- A student moving to or from the place they attend school

- A seasonal worker moving to or from the place they both live and work

- Moving to or from a shelter or other transitional housing

- Other qualifying events

- Changes in your income that affect the coverage you qualify for

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. citizen

- Leaving incarceration (jail or prison)

PLEASE read the fine print. You will almost always be paying full price for every service until you hit that huge deductible that comes with the plan.

- Loss of health coverage

(2) Employer Offered Plan

Employer plans can often be great for the individual employee themselves but if you add on a spouse or dependent, BOOM, you’re going to be paying full price for each additional member. This is how some families end up spending the cost of a mortgage on their health insurance.

Financial Pearl

"According to ehealth.com, a family of four pay an average monthly premium of $1,437 for non-subsidized health insurance, and the #1 reason for why people go bankrupt in the US is due to medical expenses"

(3) Short-Term Plans

Meant for exactly how they sound, short-term. These plans are great if you’re needing something to cover you during a gap for maybe 4-6 weeks but they provide minimal coverage AND can medically underwrite you at any point they want when determining whether or not to cover a claim. That means if you fall and break your leg and need surgery and let’s say 18 months ago you bumped your knee and went to urgent care and they gave you a steroid shot for it…well I have seen instances where the short term insurance pulls medical records and if they see that urgent care visit, they will say that the knee bump was a pre-existing condition and not cover your surgery claim.

They do also cap your coverage to some dollar value (usually $2M) rather than give you a maximum out of pocket.

(4) Health Share | Christian Ministries

The monthly premiums are going to be significantly cheaper but you get what you pay for. So don’t expect it to come to your aid if something happens. Majority of my experiences with these have left my clients both medically and financially exposed so if you’d like to understand how these operate further, please feel free to reach out to me.

Financial Pearl

"Many optometrists are drawn to the low monthly premiums. But there are many disadvantages of healthcare sharing ministries such as lack of legal protection if a claim is not paid, coverage is denied, or the ministry goes bankrupt. In addition, there are certain restrictions and payment caps relating to pre-existing conditions such as diabetes, may require a member to pay an additional monthly amount along with standard membership fees"

(5) Private Insurance

People hear “private” and they automatically think it means it will be expensive. Not true! Private insurance doesn’t get impacted by your income and has no connection to the government. The coverage itself is great because in most cases they provide benefits up front, rather than having to deal with co-pays or paying full-price for everything until you’ve met a deductible first.

So what’s the catch? Well, not everyone can qualify for it. Private insurance is based on your health. It does require some medical underwriting where they review your health history to determine if you can get approval. For example, if there are big things you are needing for your health on a regular basis, private insurance may not provide enough for your pre-existing conditions, so you wouldn’t get approved because the insurance company knows it cannot cover your expenses.

However, there are private options that are guaranteed-issued which means they won’t do any medical underwriting so at that point just make sure your agent is walking you through exactly how the plans work so that you have full transparency and can see the fine print. Whatever your situation, it’s worth learning about all the options available to you.

-

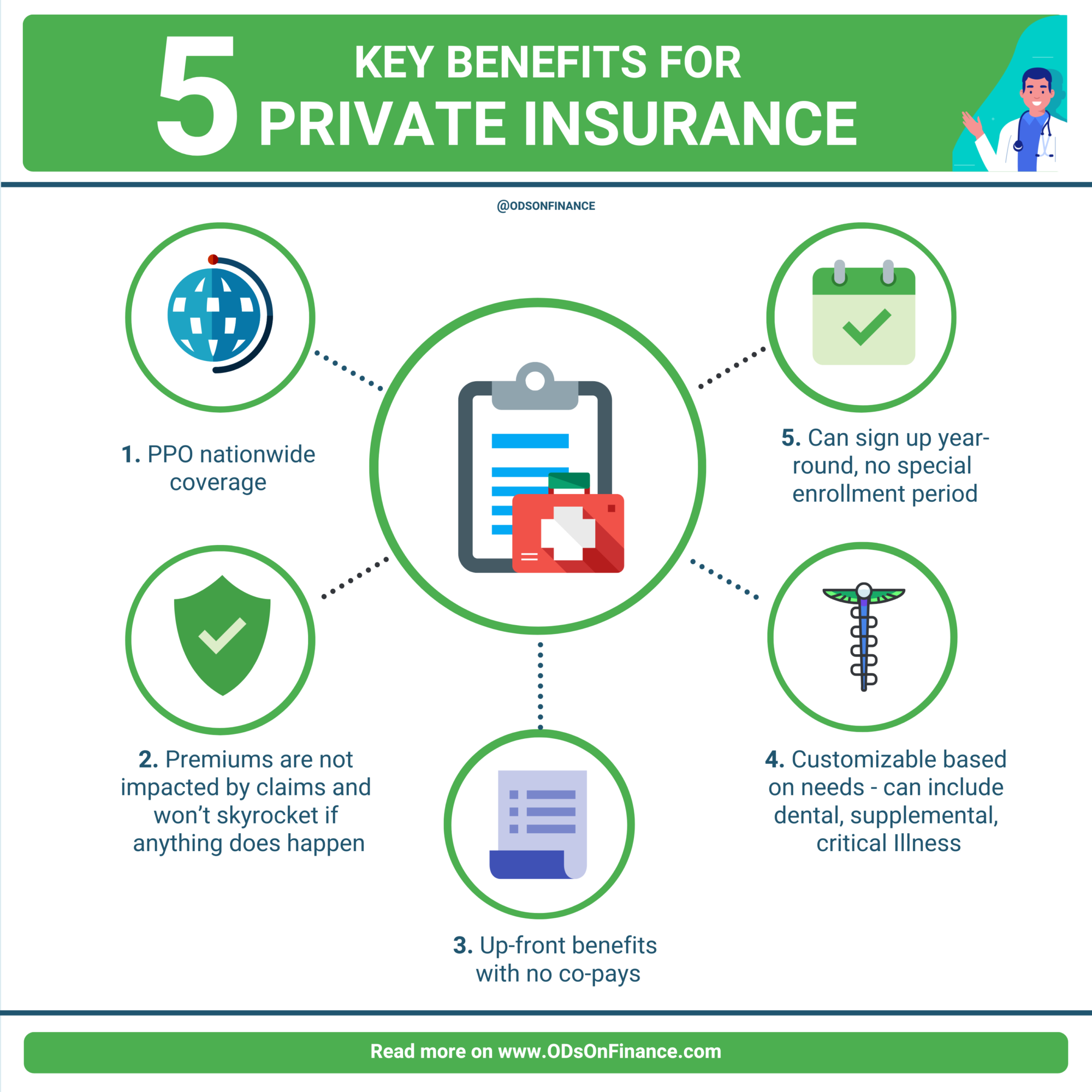

5 Key Benefits for Private Insurance

(1) PPO nationwide coverage with some of the largest networks in the world

-

(2) Premiums are not impacted by claims and won’t skyrocket if anything does happen

-

(3) Up-front benefits with no co-pays

-

(4) Customizable based on needs - can include dental, supplemental, critical Illness

-

(5) Can sign up year-round, no special enrollment period

Summary | How much should I be spending and what’s a “fair” price?

All insurance takes your age into account. The older you are, the riskier you become to insure. As mentioned earlier, your income impacts the Obamacare rates. Your health impacts whether you can qualify for private. So it pays to be healthy.

In my experience, my husband and I did not qualify for government assistance so we were paying full price which was over $675 for us monthly. This was way more than what we are now paying with private money! The biggest thing to look out for is whether that plan gives you good coverage or not because even if the monthly costs are the same in two different plans, the coverage is almost not even close.

Oh and don’t forget that year-over-year, Obamacare plans get more expensive while simultaneously often decreasing your benefits. I literally saw my benefits cut in HALF and my premium INCREASE. Pay attention if you’re going with that option! Private insurance doesn’t do that at least, I’ve seen benefits go up year over year and premiums only slightly increase to account for age increase!

In summary, the world of health insurance is complicated and filled with tiny little nuances that can overwhelm a medical provider like an optometrists. So it is always great to touch base with an health insurance expert to shop around for the best medical plans for you and your family.

Need help comparing health plans? Connect with Recommended Health Insurance

Need Life or Disability Insurance? Get help at Recommended Insurance Agents

Facebook Comments