The New Coronavirus Stimulus Package – FAQs for Small Business Owners

KEY POINTS:

-

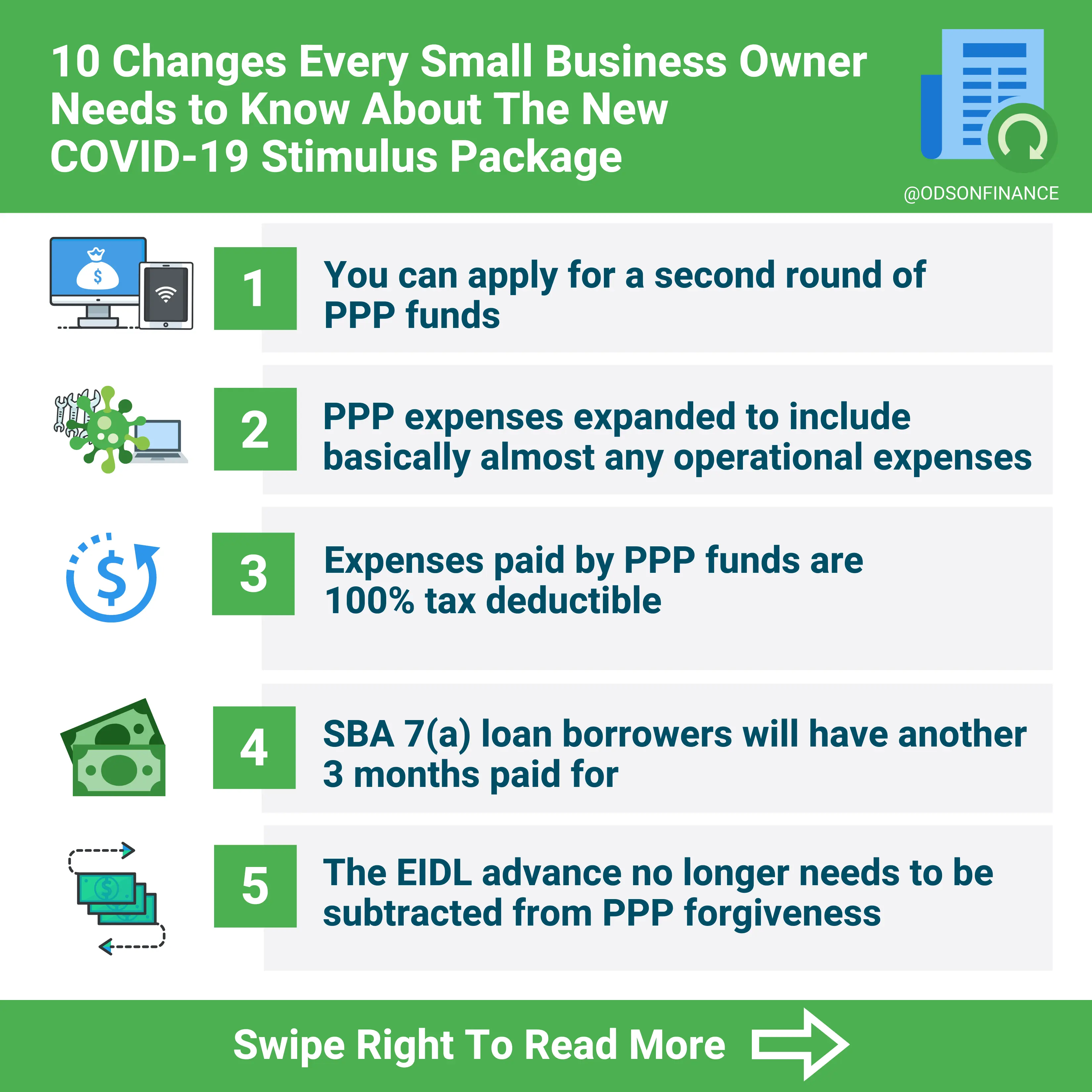

(1) You can apply for a second round of PPP funds

-

(2) PPP expenses expanded to include almost any operational expenses

-

(3) Expenses paid by PPP funds are 100% tax deductible

-

(4) SBA 7(a) loan borrowers will have another 3 months paid for.

-

(5) The EIDL advance no longer needs to be subtracted from PPP forgiveness!

-

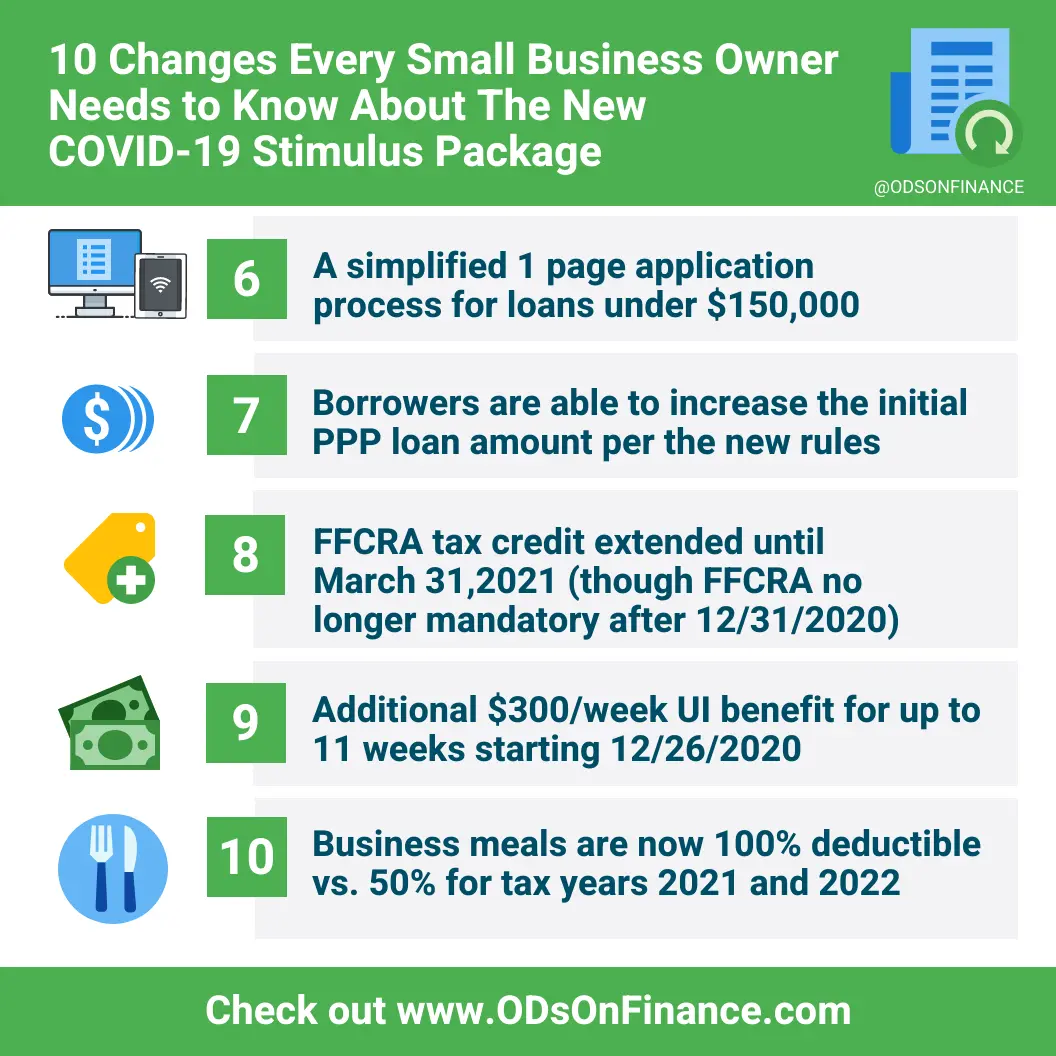

(6) A simplified 1 page application process is available for loans under $150,000

-

(7) Borrowers are able to modify/increase the initial PPP loan amount per the new rules

-

(8) FFCRA tax credit extended until March 31,2021 (though FFCRA no longer mandatory after 12/31/2020)

-

(9) Additional $300/week over and above the state’s benefit for up to 11 weeks for new PUA UI claims starting December 26, 2020

-

(10) Business meals are now 100% deductible vs. 50% for tax years 2021 and 2022

Here we go again! In case you missed it, President Trump recently signed a new COVID-19 stimulus package on December 27th, 2020, that provides over $900 billion in aid to individuals and businesses.

The text of the new bill is thousands of pages long, however our amazing CFP partner Adam Cmejla did a superb job digesting the bill and writing a very detailed article on how the bill directly affects small business owners, specifically optometrists. Please see Adam’s article here:

COVID-19 Stimulus bill and how it affects optometrists and private practice owners

Notable parts of the new bill include changes to PPP (Paycheck Protection Program), EIDL, clarification of tax treatments of relief funds, and an extension to the Families First Coronavirus Response Act tax credit.

To help you further understand the bill, here is a quick rundown of everything you may need to know in an easy to read FAQ format.

Paycheck Protection Program

The stimulus package also makes significant changes to PPP loans available to small businesses. The bill

- (1) Expands how PPP loan funds can be used;

- (2) Provides for a second round of PPP loans; and

- (3) Allows borrowers to request an increase to their initial PPP loan amounts.

I have already received a PPP loan can I still qualify for the second round of PPP funding?

Yes, you can qualify! Whether you have received the PPP loan or not, you can still apply for the 2nd round of PPP. Eligibility is based on the last 12 months or full 2019 year. The calculation methodology is the same as the first round (2.5 months of payroll).

What are the eligibility requirements for the second PPP loan?

Businesses that employ less than 300 employees per location, have used or will use the full amount of its first PPP loan; and demonstrate at least a 25% reduction in gross receipts in the first, second, or third quarter of 2020 relative to the respective 2019 quarter.

Applications submitted on or after January 1, 2021 are eligible to utilize the gross receipts from the fourth quarter of 2020.

- Your covered period still begins when you receive the loan, however the end of the period can be anywhere between 8 and 24 weeks from receiving it (previously you had to choose EITHER an 8 week period or 24 week period. Now you can choose 15 weeks, for example, if that's how long it takes you to spend the funds). It is recommended to choose the 24 week period as it produces the highest probability of 100% forgiveness.

What can PPP funds be used for?

This bill expands what you can use PPP funds for - such as: personal protection equipment, sanitizing stations, retrofitting for Covid-related protection like front desk glass shields, also business software and cloud services and payroll/HR services. Keep in mind that the 60% minimum to be spent on payroll is still required for full forgiveness.

Can expenses paid by my PPP loan(s) be tax deductible?

Yes! This is the major win for this bill. Please make sure to keep track of all expenses with proper record keeping.

What is the forgiveness requirement for the second PPP draw?

Borrowers of a PPP second draw loan are eligible for loan forgiveness equal to the sum of their payroll costs, as well as mortgage, rent, utility payments, covered operations expenses, covered property damage costs not covered by insurance (i.e. vandalism, looting from riots), covered supplier costs, and covered worker PPE incurred during the covered period. Full forgiveness will still require that 60% of the loan amount to be used towards payroll costs.

I received an EIDL grant/advance along with my PPP loan, will the advance amount be reduced from my PPP loan forgiveness?

Another big victory in this bill. The EIDL advance no longer needs to be reduced from PPP forgiveness!

I already applied for PPP forgiveness and have had my EIDL advances deducted, what should I do?

Your lender may still be waiting on guidance from the treasurer on how to proceed with the new revision. After a week or so, please reach out to your lender if you currently have an unforgiven part of your PPP loan related to your EIDL advance.

I am ready to apply for PPP forgiveness, what do I do?

If you have a PPP loan of under $150K, there is a simplified forgiveness form. We recommend that you wait a couple of weeks until the treasury releases the form to see what it looks like. This forgiveness form is expected to be short and requires much less documentation. Though the forgiveness is easier, it is not automatic, you will still need to apply.

A simplified application process for loans under $150,000 will look something like this:

- No more than 1 page

- A description of the number of employees the borrower was able to retain because of the covered loan

- The estimated total amount of the loan spent on payroll costs

- The total loan amount

- The borrower must also attest that the borrower accurately provided the required certification and complied with PPP loan requirements and retained relevant records related to employment for four years and other records for three years.

The SBA must provide this certification form within 24 days of enactment and may not require additional materials unless necessary to substantiate revenue loss requirements; or satisfy relevant statutory or regulatory requirements.

If your loan is less than then $50,000, the SBA already has a simplified one-page PPP forgiveness application for borrowers of $50,000 or less. Please contact your lender for it. It is likely that the SBA will utilize a similar application for borrowers with loans of less than $150,000. Stay tuned.

Can I request for more PPP funds from the first round?

If you didn't receive as much of the first PPP loan as you should have (bank error, omission of wages), please contact your bank and request for an increase.

Per Section 312 “The stimulus package requires that the SBA issue guidance to lenders within 17 days of enactment of the law that would allow borrowers who returned all or part of their PPP loan to reapply for the maximum amount applicable, so long as they have not yet received forgiveness.”

We advise that you work with your lender to modify the value of your loan if your initial loan calculations would have increased due to changes in the PPP’s final rules.

Families First Coronavirus Response Act: Employee Paid Leave Rights

My staff is currently quarantined due to COVID-19, will I need to pay for their time off?

The Families First Coronavirus Response Act (FFCRA) requires certain employers to provide employees with paid sick leave or expanded family and medical leave for specified reasons related to COVID-19.

Please see here for more details on the Department of Labor

Keep in mind that after December 31, 2020, the FFCRA is no longer mandatory. Which means, under the new bill, if employers voluntarily decide to provide paid leave to employees, they can receive a tax credit for the employee’s pay up to March 31,2021.

Summary

The PPP and FFCRA are just a few small pieces of the much larger stimulus bill. Other important changes that pertain to small business owners is the extension of the Pandemic Unemployment Assistance, which provides an additional $300/week over and above the state’s benefit for up to 11 weeks starting December 26, 2020. Secondly, business meals are now 100% deductible vs. 50% for tax years 2021 and 2022. Yay to more GrubHub dinners for all your zoom calls!

Lastly, for those SBA borrowers that have 7(a) loans, SBA will pay another 3 months payments for payments due on or after February 1, 2021. Please reach out to your SBA lenders for more information.

This is a summary only and a brief overview of the most popular questions pertaining to the new stimulus bill. Please keep checking in our Facebook community for updated coverage!

Facebook Comments