Q1/2023 Market Update for Optometrists: Latest Economic Trends And How To Adjust Your Financial Plan

KEY POINTS:

-

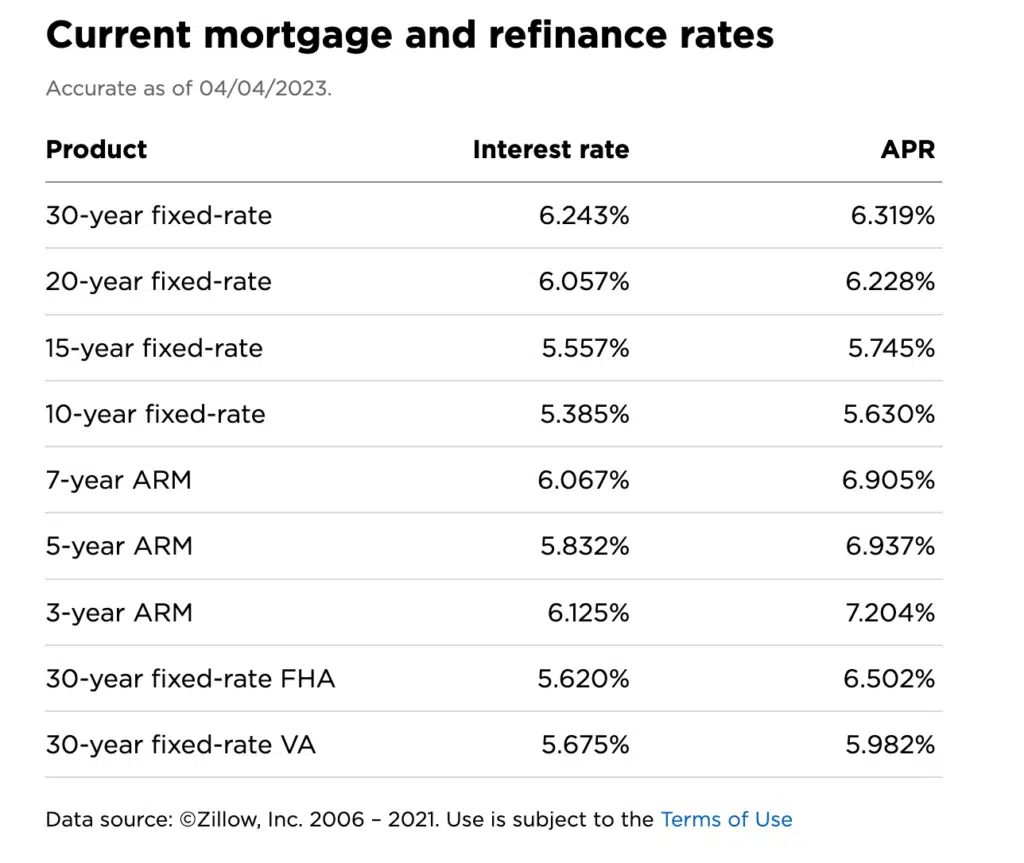

Q1/2023 marks fluctuations in federal rates, the collapse of major banks, and changes in housing mortgage rates.

-

US total stocks have rebounded and are up by 7.16% YTD, but there are concerns about a deeper recession and more layoffs especially in the tech sector.

-

Inflation is still high at 6%, and although the Federal Reserve raised the prime interest rate by 0.25%, it is still below the goal of keeping inflation at 2.5%.

-

Advice to ODs: Continue dollar-cost averaging into S&P 500 index funds for long-term investments, but keep cash reserves since there will be buying opportunities in late 2024

-

According to Yale economist Robert Shiller, if you have the opportunity to delay your purchase, it may be a good time to do so as home prices may drop after 6 months.

-

There are two scenarios related to the student loan debt cancellation plan proposed by President Biden. If the Supreme Court rules on the lawsuit before June 30, 2023, borrowers with remaining balances will need to start repaying loans 60 days after the court decision. If the Supreme Court does NOT rule before June 30, 2023, forbearance will automatically end, and borrowers will need to start repaying loans 60 days after June 30. Latest possible extension would September 30, 2023

Welcome to the Q1/2023 market update, where Aaron and myself will provide you with an overview of the latest economic trends and developments, including what we as optometrists should watch out for and how we should adjust our investing plans.

This quarter has seen significant changes in the market, with fluctuations in federal rates, the collapse of several major banks, and changes in housing mortgage rates.

The Federal Reserve has been closely monitoring the economy and has made several adjustments to the federal rates to ensure economic stability. However, despite their efforts, the market has seen some volatility, with fluctuations in stock prices.

One of the biggest shocks this quarter has been the collapse of several major banks like Silicon Valley Bank & Signature Bank , which have sent shockwaves throughout the financial sector. This has led to increased uncertainty and concerns about the stability of the banking system.

Additionally, there have been changes in housing mortgage rates, which have impacted the real estate market. This has led to both opportunities and challenges for investors and homeowners.

So we hope to provide a comprehensive overview of the latest economic trends and developments, highlighting the challenges and opportunities in today's market for optometrists.

Overview of Stock Market Return

So what should you do as an OD investor?

It was a pretty interesting year to date, with US total stocks finally in the positive +7.16% after being in the negative for 2022. Be a little weary of this spike since we are still heading into a deeper recession with more layoffs, especially in the tech sector.

Long term bonds are making a comeback with the rising federal interest rate. This means your high-interest saving accounts like Ally Bank, Marcus, etc are returning close to 3-4%!

With inflation recently coming down to 6% (essentially a -0.50% decrease), it is nowhere near where the inflation goal is at 2.5%. Hence why at the last federal meeting, the market expected a 0.50% increase to slow down inflation, but Jerome Powell only increased it by 0.25%, bringing the prime interest rate to 4.83%.

Why? With the collapse of multiple banks like Silicon Valley Bank, many experts predict that increasing it by 0.50% might be too big of a shock to the market, causing a domino effect resulting in more bank failures similar to 2008-2009.

Overall, inflation is still at all-time high with the feds planning to increase another 0.25% more, then holding steady at a potential bench-mark goal of 5-6%. Remember that the highest fed rate was 20% back in 1979-1980 to combat the inflationary spiral brought on by rising oil prices, government overspending and rising wages.

We are still heading into a deeper recession as we get into 2024, and I don’t see any expected federal pivots until late 2024, but who can predict anything right?

So what are we doing?

For any long-term investments such as retirement (401K/Roth IRA), dollar-cost averaging into S&P 500 index funds through the low & highs is the way to go. As studies show time and time again, over the course of 10 years, the market will return an annual average of 10%.

With that being said, I am taking a break from individual stocks and I am NOT putting any money into the stock market that I plan to use for the next 5 years. Essentially, I am hoarding cash as reserves because I do believe there are massive buying opportunities around late 2024 after this market cycle. The lesson that we took from 2008-2009 is that real wealth was created but only for investors who had the cash reserve to take advantage of it.

Financial Pearl

"I'm hoarding cash reserves and taking a break from investing in individual stocks, with plans to invest in late 2024 when I believe there will be significant buying opportunities. The lesson from 2008-2009 is that investors who had cash reserves were able to create real wealth. Aside that, continue DCA into index funds for your long-term investments"

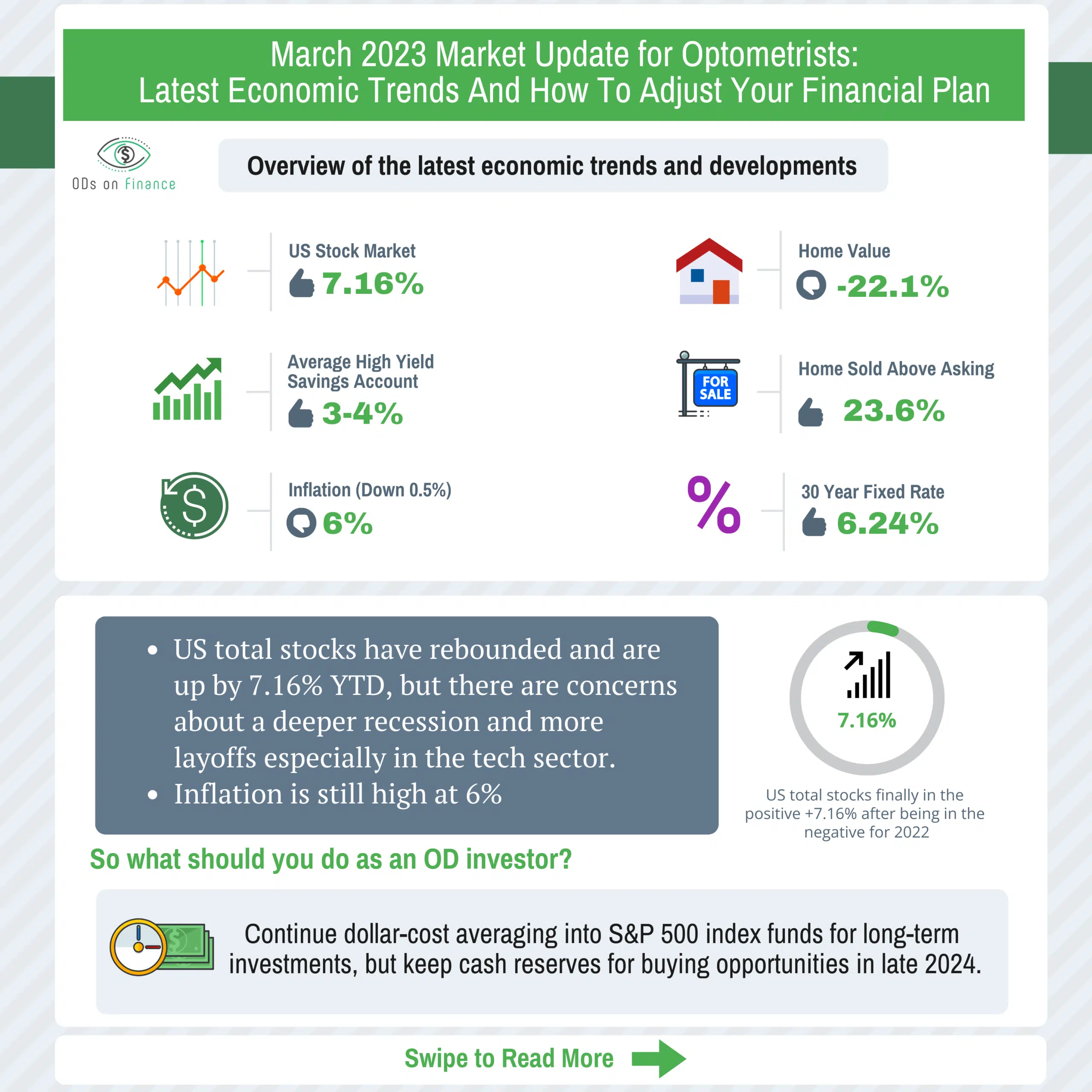

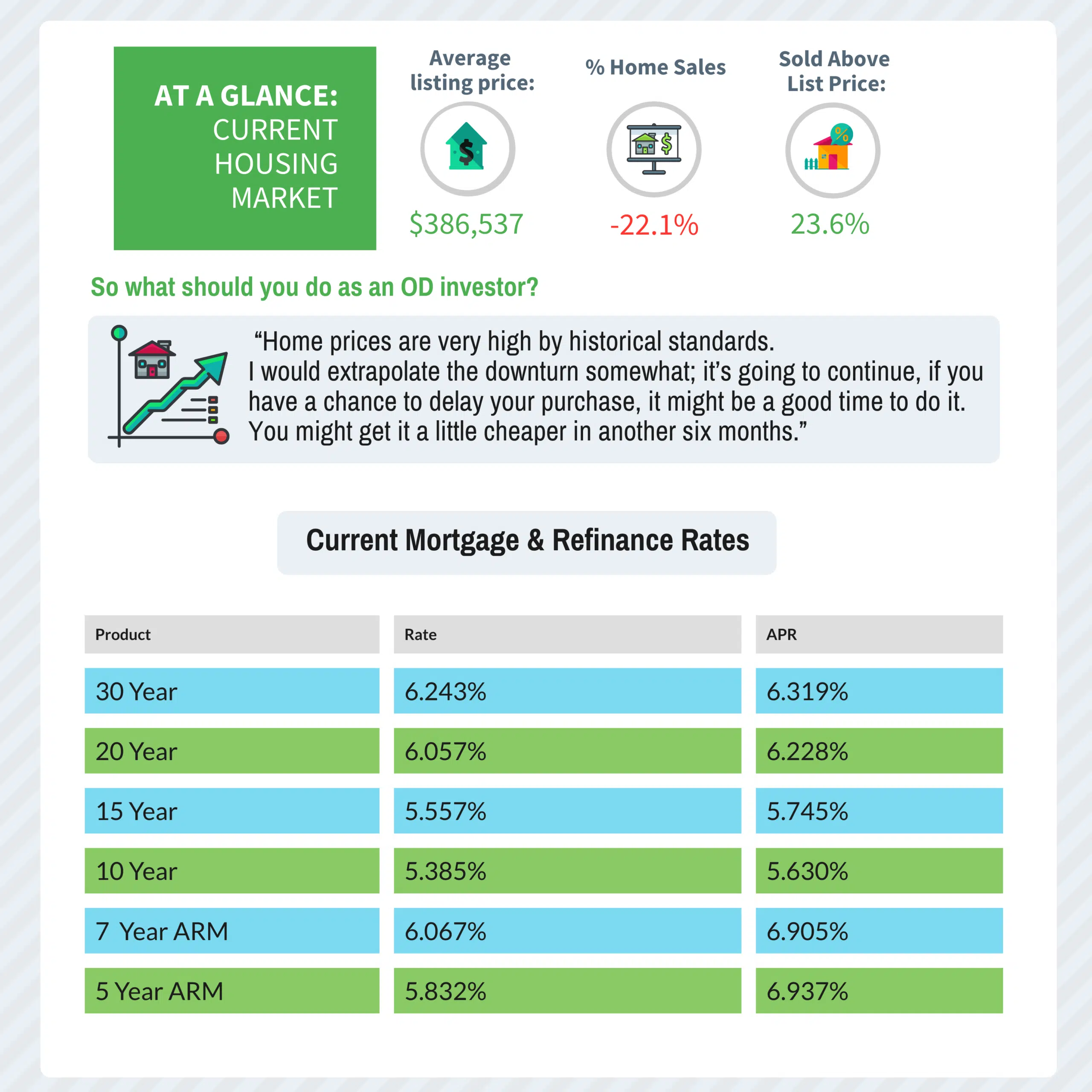

Overview of Real Estate Market:

So what should you do as an OD investor?

I will start by saying that every housing market is different, your local area might see a massive spike in pricing inventory while other areas like the Bay Area are seeing a decline.

But overall, compared to March 2022 year over year, the median sale price is $386,537 (1.1% increase), with a -22.1% decline in overall home sales. As you can see, the national average 30-year fixed rate is 2.5% higher compared to March of 2022. Remember that we have to take seasonality into consideration.

As of now, home pricing is not crashing because there is a little supply coming into the market, so the number of houses for sale is still extremely low. Most importantly, the higher interest rates are pricing out a lot of potential buyers, thus there is still consistent demand in the real estate market.

The good news is that only 23.6% of homes are being sold above list price (-23.7% less compared to last year), so no more crazy bidding wars like we saw back in 2020-2021.

So if you are selling your house, lower your expectations and don’t expect buyers to cater to your demands.

For home buyers, according to Yale economist Robert Shiller, “Home prices are very high by historical standards. I would extrapolate the downturn somewhat; it’s going to continue, if you have a chance to delay your purchase, it might be a good time to do it. You might get it a little cheaper in another six months.” This makes sense as the economy weakens, unemployment goes up, thus, less people will be able to afford a home purchase. Remember to ask for contingencies and negotiate for credits to lower the price!

For renters, your annual rent pricing increase is slowly down to 2% annual compared to March 2022, so it might actually make financial sense to be a renter, especially when inflation is 6% and with the high mortgage interest rate.

In summary, I think we are heading into a real estate depression, but not a crash.

Financial Pearl

"Yale economist Robert Shiller advises home buyers to delay their purchase 6 months from now as home prices are historically high and the downturn is likely to continue. With a weakening economy and rising unemployment, fewer people will be able to afford a home purchase. Buyers should negotiate for credits and contingencies to lower the price."

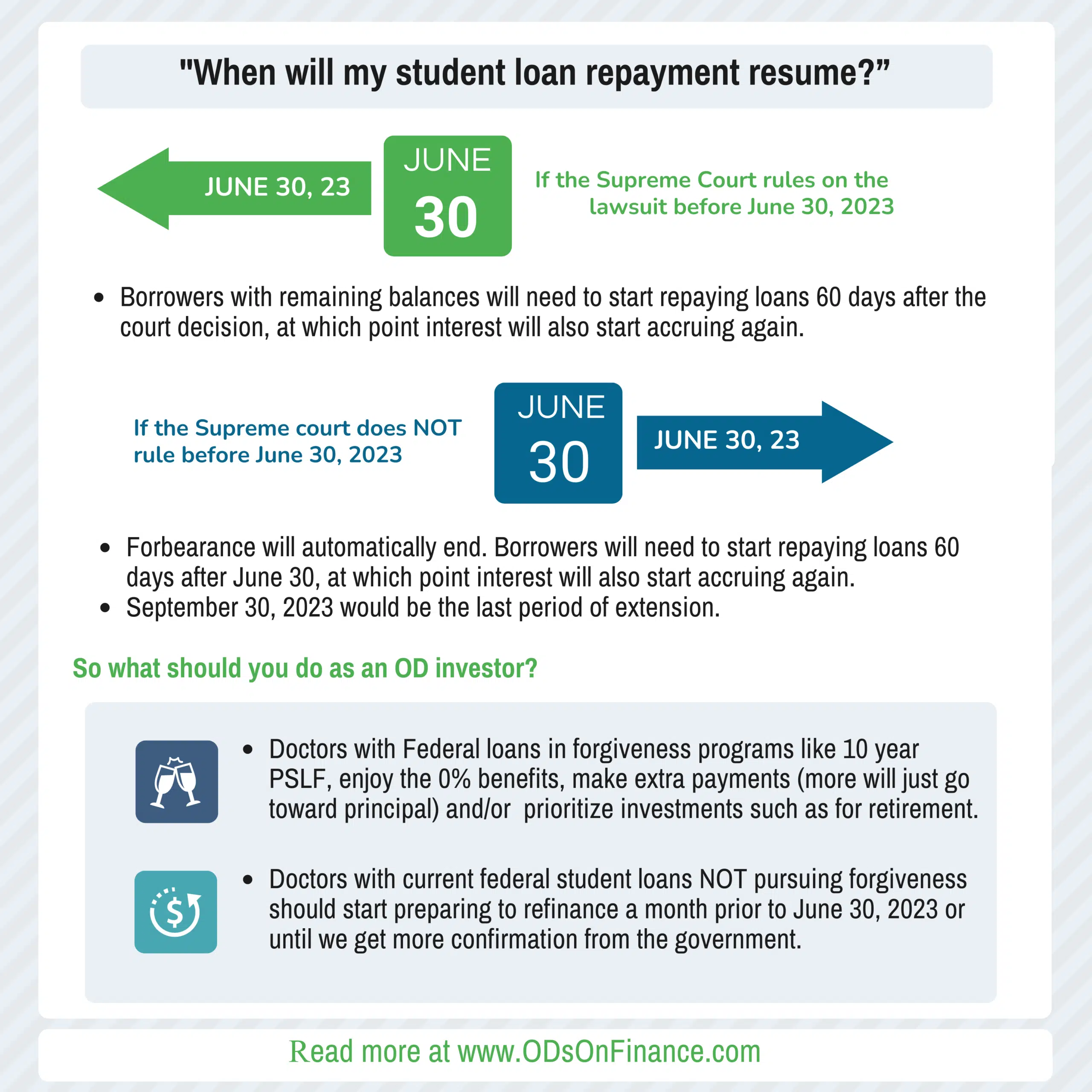

Overview of Student Loan Market:

The common question that I get a lot from optometrists is “when will my student loan repayment resume?”

As you probably know, on Feb. 28, the Supreme Court heard oral arguments from two cases challenging Biden's student debt relief plan. While the court has promised an expedited final decision, a resolution will likely take months.

But forbearance could end sooner if the Supreme Court decides the fate of President Biden’s plan to cancel up to $20,000 in student debt per borrower before then.

Here are two scenarios that I can see happening:

So what should you do as an OD investor?

Our advice is still the same:

- (1) Doctors with Federal loans in forgiveness programs like 10 year PSLF, enjoy the 0% benefits, make extra payments (more will just go toward principal) and/or prioritize investments such as for retirement.

- (2) Doctors with current federal student loans NOT pursuing forgiveness should start preparing to refinance a month prior to June 30, 2023 or until we get more confirmation from the government.

There is a general consensus among our refi lenders that after the extension pause is over, there is a mad rush of demand, bank lenders can choose to be more selective in their underwriting approval process (lower DTI, higher credit score, work experience, etc) and increase their overall rates.

If you are still on the fence, no worries, wait to reassess when more news is closer to June 30, 2023.

Summary:

As the saying goes, tough times don't last, but tough people do. It's true that we may be facing some challenges, especially a deeper recession ahead, but that doesn't mean we can't rise to the occasion and come out stronger on the other side. By sticking to the financial advice that Aaron and I have given, you're taking proactive steps to protect yourself and your future.

And let's not forget, even in the midst of economic uncertainty, you as an optometrist still have the power to make a positive impact on your patients and your community. As a doctor, you have the unique privilege of being able to help people in a tangible way and provide a steady income to your loved ones.

So let's stay motivated and focused on the things we can control. Let's continue to build our optometric practices, invest in our futures, and take care of ourselves and our loved ones. Remember, we're all in this together, and together we can weather any recession storm.

Want to learn how to build your own portfolio? Check out The Optometrist's Guide to Investing 101

Want to get a full blueprint on How to start? Buy our Book The Optometrist's Guide to Financial Freedom

Related Articles

- « Previous

- 1

- …

- 4

- 5

- 6

Facebook Comments