New Targeted $10,000 EIDL Grants: Do You Qualify?

With the initial economic shock of the COVID-19 pandemic back in March 2020, the Emergency Injury Disaster Loan (EIDL) and subsequent grant programs funded by the CARES act received a lot of buzz.

For businesses negatively impacted, these grants were distributed on a first come first serve basis, and the funds were quickly depleted. Fortunately, many of our ODsonFinance members received an EIDL grant, which played an important role in helping them alleviate the financial burdens caused from the mandated shutdown.

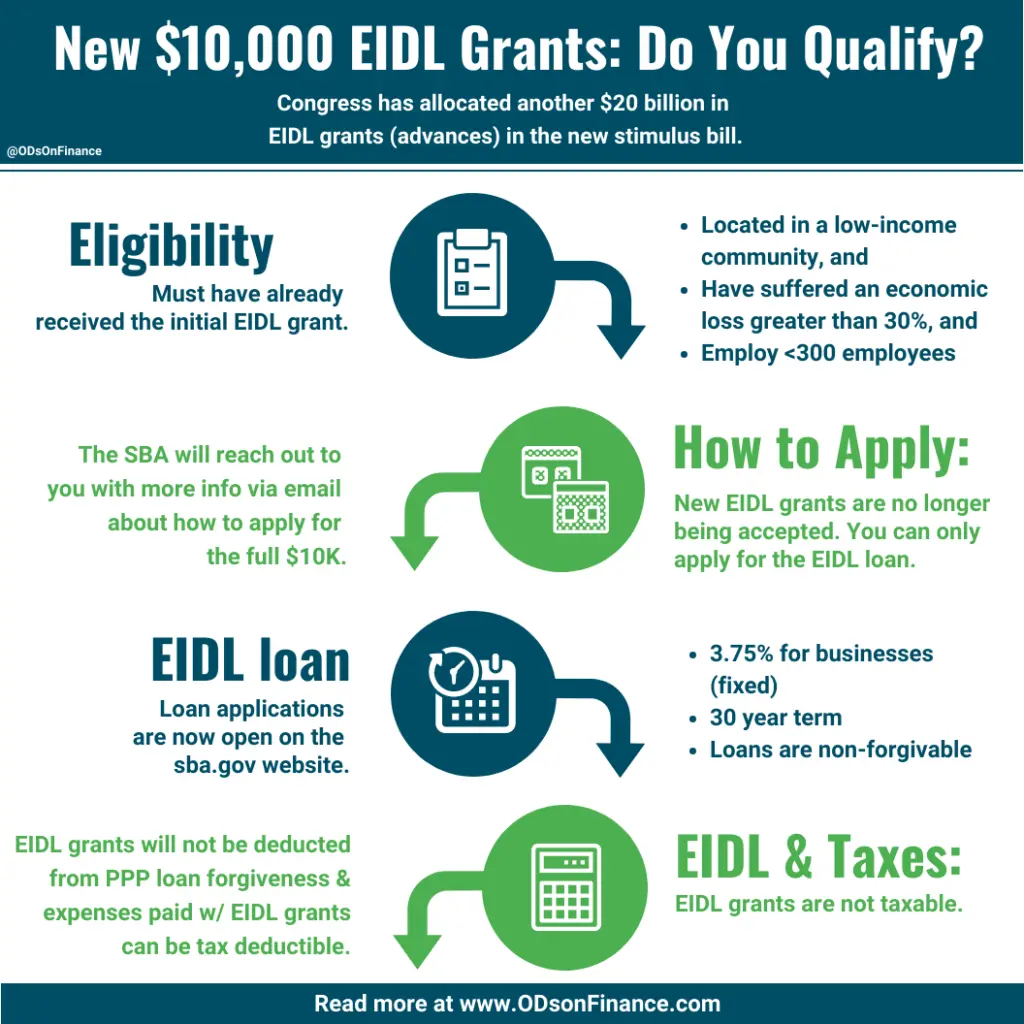

In the first round of the EIDL grant, businesses were granted $1000 per employee of their business, up to a maximum of $10,000. Recently, congress has allocated another $20,000,000,000 in EIDL grants (advances) in the new stimulus to allow businesses who received less than $10,000 to qualify for the full $10,000 grant, minus any amount already received.

Let’s take a look at EIDL grants and common questions regarding them.

First off, what is an EIDL Grant?

The Economic Injury Disaster Loan (EIDL) loans and grants were initially funded with the first COVID-19 stimulus bill in late March. The CARES Act included grants or advances for people who applied for an EIDL loan because of COVID-19.

However, funds for these grants were quickly exhausted, meaning that many businesses were unable to receive them even though they qualified. This is an issue that the recent stimulus (passed near the end of 2020) seeks to address. The new stimulus package provides $20 billion in funding for EIDL grants.

Is EIDL a Loan or a Grant?

Actually, it’s both. Let’s clarify since this can be a bit confusing. The EIDL program allows small businesses (those with 500 or fewer employees) that have been impacted by COVID-19 to apply for a loan. The amount of the loan is determined by the Small Business Administration based on information included in your application. The maximum loan amount is $2 million. The loans have low fixed interest rates (2.75% for non-profits and 3.75% for traditional businesses) and up to 30 years to repay with no penalties for early payment.

However, the EIDL also includes an emergency grant. This grant can be up to $10,000 per business with $1,000 provided for each employee up to ten.

I have received an EIDL grant, can I qualify for the new Targeted EIDL Advance (grant)?

The qualifications are fairly straight forward. First, your business must have qualified and received funding for the first round of the EIDL grant OR applied for the first round but did not receive funding due to depletion.

Secondly, businesses must meet the CARES Act standards to qualify including:

- Be one of the following

- Small business, cooperative, or ESOP Tribal concern with less than 500 employees

- Private non-profit or small agricultural cooperative

- Sole-proprietorship

- Independent contractor

- Incorporated prior to January 31, 2020

- Directly impacted by COVID-19

Additionally, there are three specific criteria for qualification for the additional EIDL grant:

- Located in a low-income community defined by Section 45D(e) of IRS Code

- Experienced an economic loss greater than 30%

- Have no more than 300 employees

A low income community is defined in Section 45D(e) of the Internal Revenue Code of 7 1986 as follows:

“The term ‘low-income community’ means any population census tract if the poverty rate for such tract is at least 20 percent, or in the case of a tract not located within a metropolitan area, the median family income for such tract does not exceed 80 percent of statewide median family income, or in the case of a tract located within a metropolitan area, the median family income for such tract does not exceed 80 percent of the greater of statewide median family income or the metropolitan area median family income.”

You can use this census tool to see if your place of business in classified as a “low income community”

Click here to see if your business location qualify

The SBA states that “additional details on how SBA will identify low-income communities will be available soon on www.sba.gov/coronavirusrelief"

How Do I Apply?

There is nothing that you need to do to apply. Eligibility for this grant includes businesses that previously applied for an EIDL grant and either received less than $10,000 or did not receive a grant due to funds being exhausted.

The SBA will notify you directly if you qualify. It is expected that applicants will be contacted in the next several weeks. It is important to check junk mail and spam filters or to white-list any e-mail address with a “@sba.gov” ending.

If you previously received a grant of less than $10,000, that amount would be subtracted from the $10,000 EIDL grant.

Can I Use the Grant for Any Expenses?

There are limits to what the grants can be used for. Specifically, EIDL grants can be used to provide paid sick leave to employees unable to work due to COVID-19, maintaining payroll to retain employees during business disruptions, meeting increased costs due to supply chain interruptions, making rent or mortgage payments, or repaying debts that cannot be covered due to revenue losses. Thus, while the loans must be used for certain things, there are a wide variety of options.

Are EIDL grants taxable?

Good news! The legislation clarifies that EIDL grants are not taxable. Businesses who receive them will be able to deduct expenses paid with the EIDL grant on their income taxes.

Are EIDL grants subtracted from PPP loan forgiveness?

Recent legislation has confirmed that EIDL grants will not be deducted from PPP for loan forgiveness purposes.

I did not receive the initial EIDL grant, can I apply for a new one?

Unfortunately, only applicants who previously applied for an EIDL advance and received less than $10,000 or did not receive a grant because funds were exhausted will potentially qualify for this grant.

If you did not previously apply for an EIDL loan (3.75% fixed for 30 years), you are able to apply for the low-interest loan through the end of the year. However, you would not be eligible for the $10,000 EIDL grant.

Legislation is constantly changing and evolving to meet the needs of small business owners. Stay up to date with all changes by visiting our Facebook group and Instagram page daily!

Want to learn read more about other CARES Act? Check out Our COVID Resource Center

Want to know how to start a Business Plan? Check out The Optometrist's Guide to Business Plan

Related Articles

- « Previous

- 1

- 2

- 3

- Next »

Facebook Comments