Is the 2020 Real Estate Market Like 2008?

Editor’s Note: This is a guest post written by one of our sponsorship partners. Josh Mettle NMLS #219996 is an industry leading author and ranked in the top 1% of mortgage originators in 2018 by Mortgage Executive Magazine. You can get more great real estate and mortgage advice here or by visiting his book's website. Josh is also a fourth generation real estate investor, and owns a number of rental homes, apartment units and mortgages. Josh is dedicated to helping physicians and other professionals become more financially aware and able - listen to “Physician Financial Success” podcast episodes or download Josh’s latest tips and advice here.

Aaron and Dat are extremely strict about guest requirements in that they must be educational and informative to our readers. Every guest post is vetted, read and upheld to the highest standards of ODsonFinance. Your trust is the most valuable factor to us. We like having experts in their field write on our website, because honestly, Aaron and Dat don't know everything! Enjoy and give us feedback!

I remember the feeling of being one paycheck away from bankruptcy, about to lose it all. Looking back, I don’t think I’ve ever been so scared in my life. I was afraid to fail my family, afraid to not be able to follow through on my word to my creditors, and afraid that everyone would look at me as a fraud and a failure.

The Great Recession was a terribly frightening time in our country for so many that were emotionally and financially impacted by the economic fallout.

It’s human nature to be “once bitten – twice shy”, but making investment decisions on emotion rarely ever works out in anyone’s favor.

This article discusses why today’s real estate market is the exact opposite of what it was in 2008, and examines why buying a home during the COVID-19 pandemic could be one of the greatest long-term investment decisions of your lifetime.

"Many still bear scars from the Great Recession and may expect the housing market to follow a similar trajectory in response to the coronavirus outbreak. But, there are distinct differences that indicate the housing market may follow a much different path. While housing led the recession in 2008-2009, this time it may be poised to bring us out of it."

-Mark Fleming, Chief Economist at First American

The Great Recession and the Dot-Com Bubble

The Great Recession of 2008 was a unique event. The financial collapse that occurred was a direct result of loose lending practices by an industry that had lost sight of the importance of proving a borrower’s ability to repay a mortgage loan. Banks and independent institutions were lending purely on the assumption that home prices would go up forever.

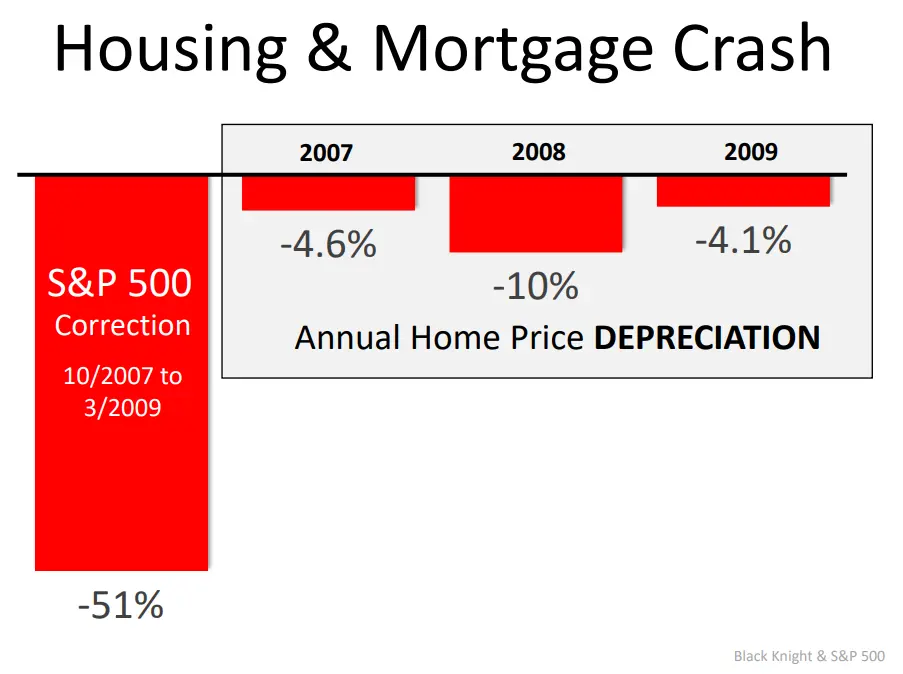

I find it interesting that, even in the dark time between 2007 and 2009, the stock market cratered 51% while the real estate and housing market only fell 18.9%.

"What 9/11 has in common with what is happening today is that this shock has also generated fear, angst and anxiety among the general public. People avoided crowds then as they believed another terrorist attack was coming and are acting the same today to avoid getting sick. The same parts of the economy are under pressure- Airlines, leisure, hospitality, restaurants, entertainment - consumer discretionary services in general."

-David Rosenberg, Chief Economist of Gluskin Sheff + Associates Inc

Granted, nobody wants to buy a home that is going to be worth 18.9% less in three years, but those who held on during that time and waited for the market to come back did very well.

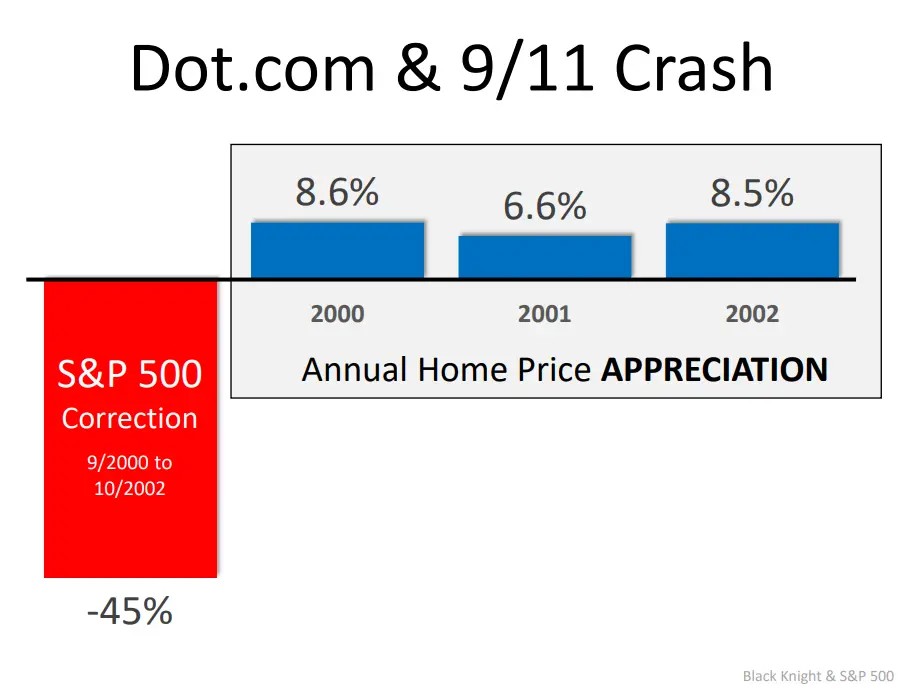

Let’s go back even further and take a look at the previous recession: the Dot-Com & 9/11 crash. From 2000 to 2002, the stock market again cratered 45%. Interestingly enough, home prices continued to appreciate. In fact, during that same time period, housing prices were up 23.7%.

A Historical Pattern of Real Estate Prices

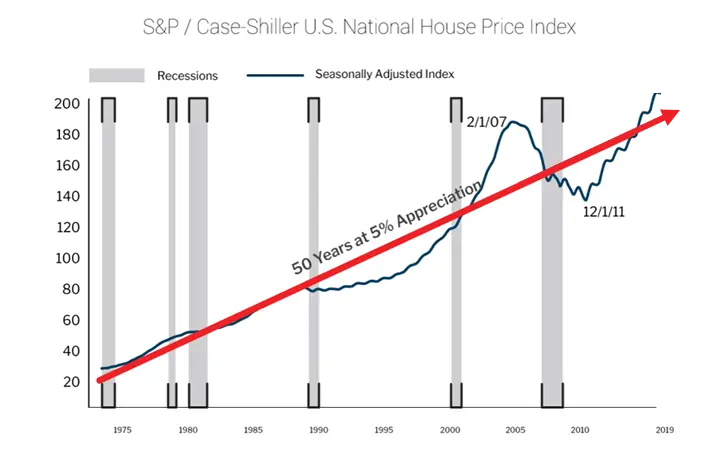

If we continue to look back over a longer period of time, we see real estate prices typically do very well and appreciate at a consistent rate of 5% during most recessions.

The chart above illustrates home prices during every recessionary period since 1975 – the gray bars represent the recessions and times of economic contraction. What most people miss while looking at this data is the fact that real estate tends to do quite well during recessions, largely due to reduced interest rates.

Not surprisingly, we are seeing the same pattern today amid the COVID-19 pandemic.

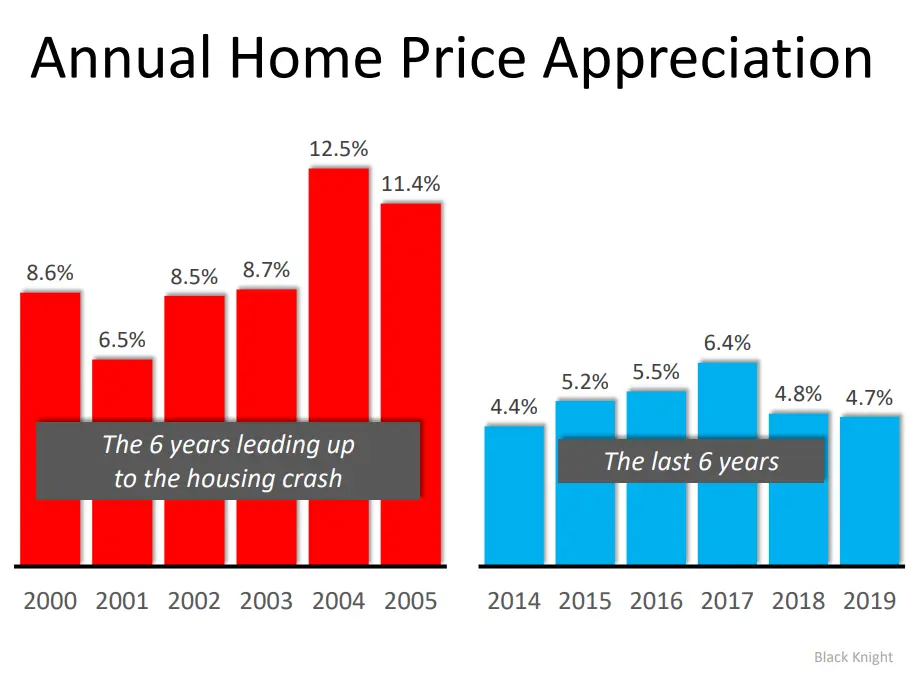

Let’s go back to the comparison of the Great Recession and our current housing market. In the six years leading up to the housing crash of 2008, real estate prices appreciated a total of 56.2% at an annualized rate of 9.36%.

We know the average appreciation rate of residential real estate, going back to 1975, has been around 5% annually. In hindsight, it’s easy to recognize that a market increasing in price at nearly twice the historical average is likely going to require a major reset to get back to historical averages.

Conversely, over the last six years the national real estate market has only appreciated a total of 30.8% at an annualized rate of 5.133%.

In the run up to the COVID-19 pandemic, the real estate market appreciated in line with the 5% annual average we’ve seen over the last 45 years. What’s more, these valuations are not stretched or inflated due to loose lending like they were leading up to the Great Recession.

The Housing and Mortgage Credit Bubble

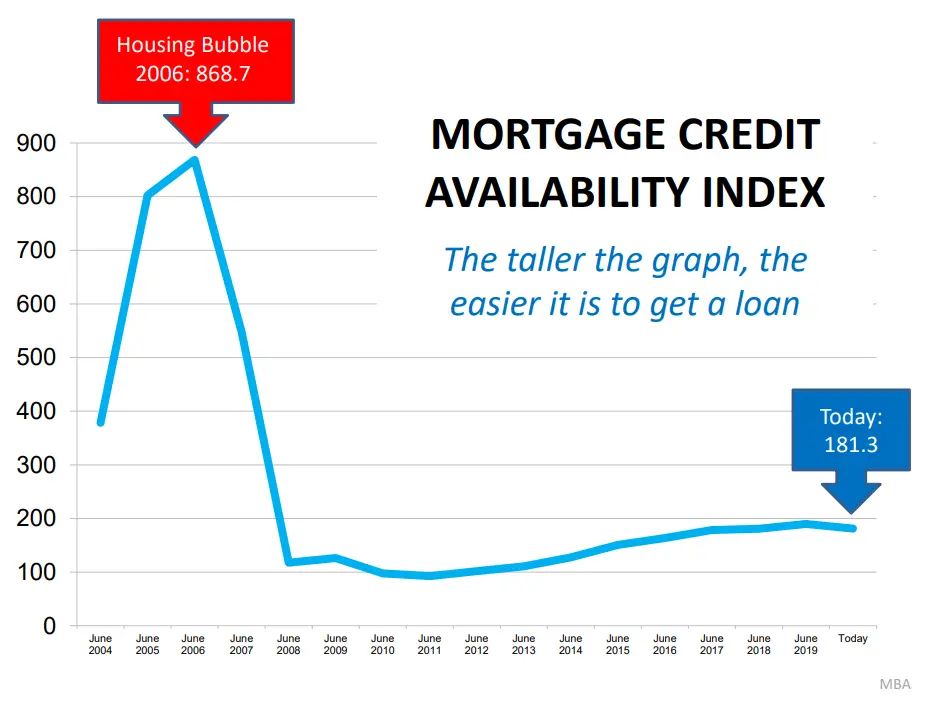

During the Great Recession, the country saw a housing and mortgage credit bubble of epic proportion. As tracked by the Mortgage Credit Availability Index, mortgage credit was more available and easier to obtain than at any other time in history.

Mortgage credit peaked in late 2006; and as cheap, easy credit dried up, so did the number of eligible buyers. You can see that in the twelve years since the housing crash, mortgage credit availability has remained low as buyers continually have to prove their ability to repay their loans.

False Demand for Housing

Before the housing crash, many speculative buyers had entered into purchase contracts with builders who, in response to the high demand, ramped up home construction and bought as much land as they could finance to stay ahead of the seemingly insatiable desire for housing.

Not surprisingly, this led to a massive oversupply of homes for sale; and as the credit dried up, many investors were not able to qualify for financing under the increasingly restrictive underwriting guidelines.

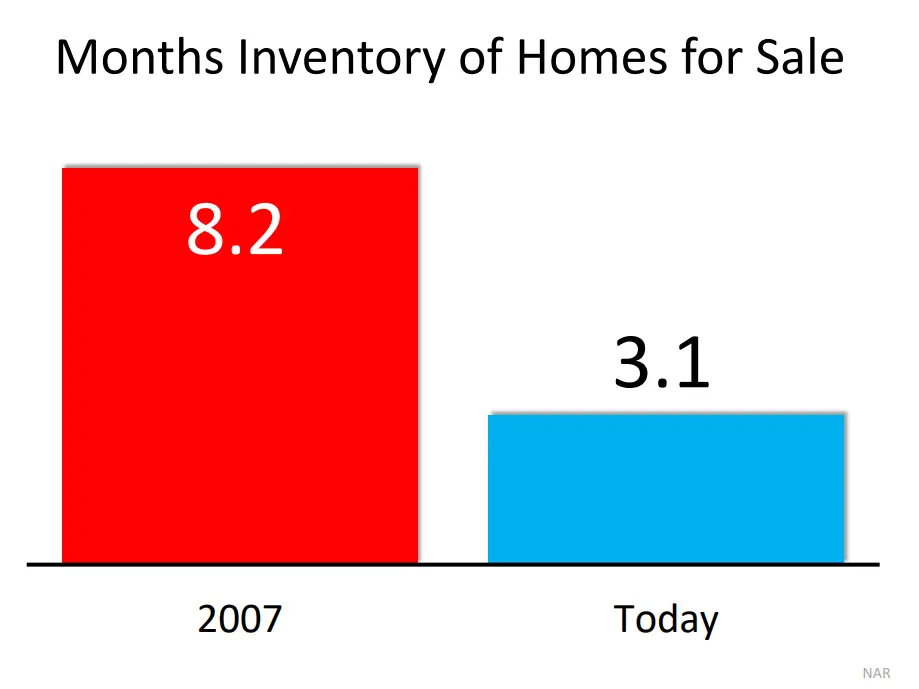

Heading into the Great Recession, there was an 8.2-month inventory of homes available for sale nationally. To put this in perspective, a relatively normal and balanced real estate market has about a 6-month inventory available for sale.

Today, we see almost the exact opposite. Currently in the United States there is only a 3.1-month inventory of homes available for sale. We are sitting at some of the lowest real estate inventory levels we’ve seen in nearly sixty years.

If basic economics teaches us anything, it’s that an oversupply of something typically leads to lower prices, and vice-versa.

This is why 2020 is the polar opposite of the 2008 housing crash.

Using Home Equity Wisely

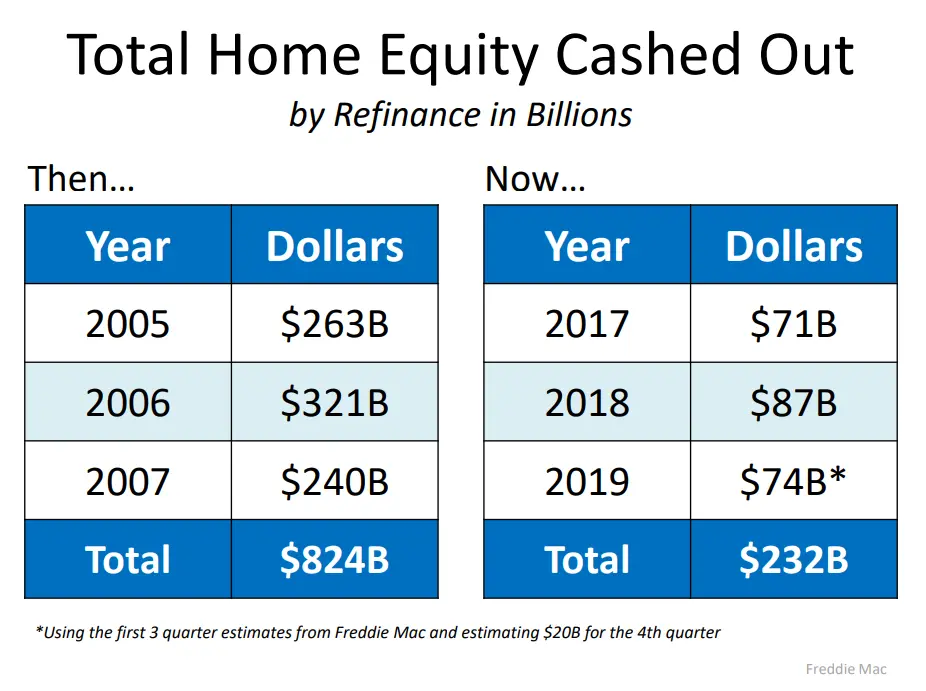

Another stark difference between 2008 and today is how home owners are using the equity in their homes. In the three years leading up to the housing crash, U.S. home owners pulled out nearly one trillion dollars of equity from their homes.

Real estate became the de facto ATM machine for the nation in a big way. As home owners watched their neighbors pull out 125% of their home’s value on home equity lines of credit, many felt they needed to “keep up with the Joneses” and also use their home equity to purchase new motor homes, shiny sports cars, and flashy boats.

Comparing the “ATM machine” mentality leading up to the Great Recession and the mindset of home owners today, we see a much more conservative trend – U.S. homeowners have only accessed $232 billion in home equity over the last three years.

That’s 71.84% less equity being pulled out of housing than in the period before the crash of 2008. It appears many homeowners have learned a valuable lesson from the Great Recession and feel it’s important to build up as much equity in their homes as possible.

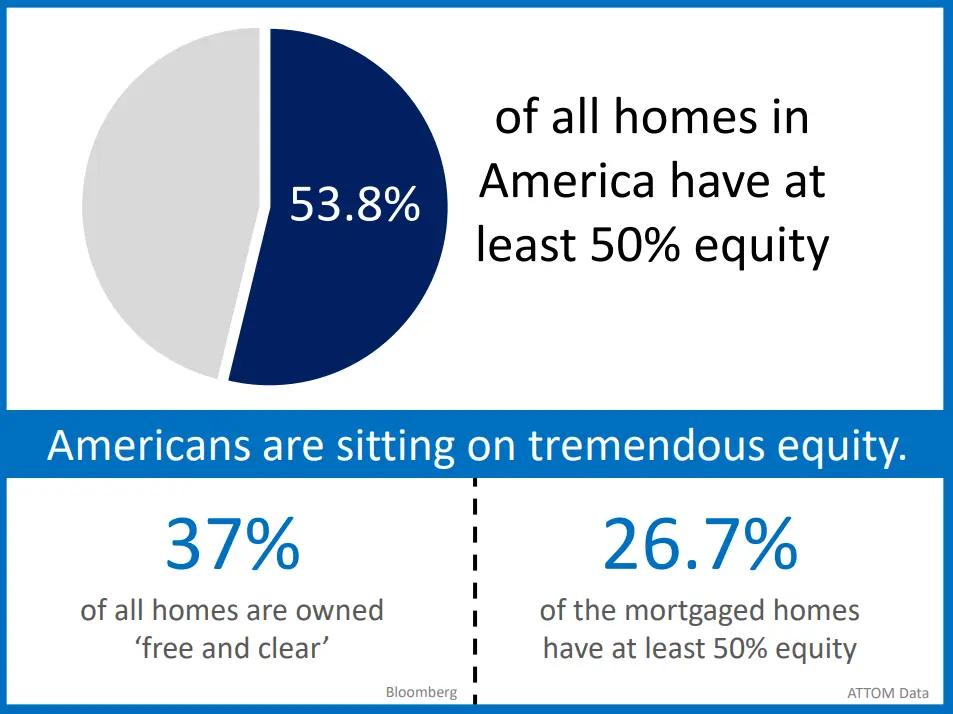

Today, 37% of all homes in America are owned free and clear with no mortgage debt at all. This number is an all-time high, and 53.8% of every home in America has at least 50% equity.

A New Perspective on Housing Expense

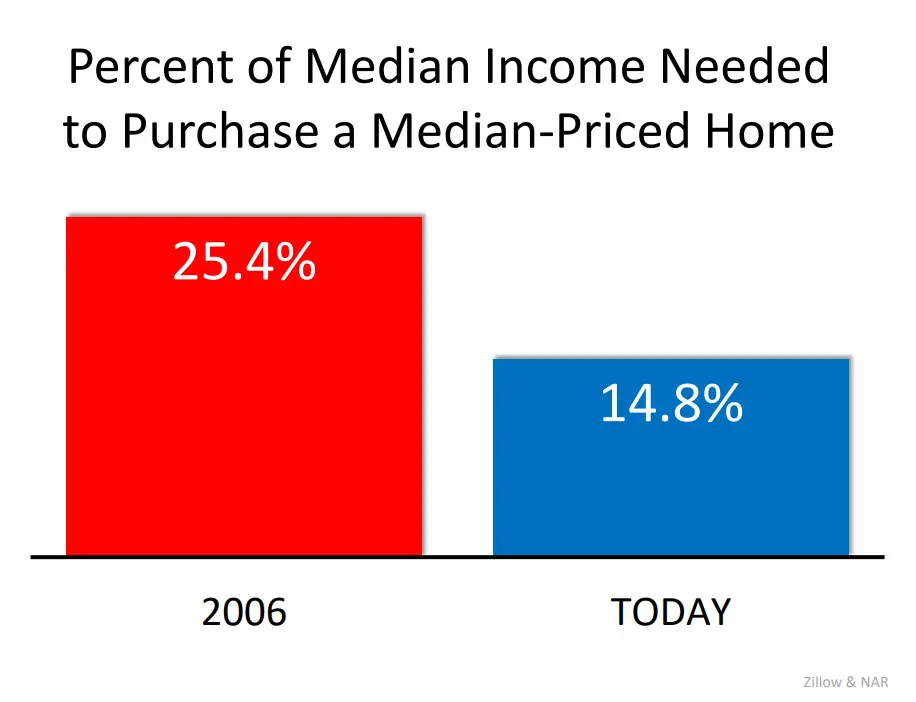

In the period leading up to the Great Recession, homeowners were allocating approximately 25.4% of their monthly income toward their housing expense. After taxes and other payroll deductions, that didn’t leave them with much for savings and other expenses.

As we continue further into the COVID-19 pandemic, we see homeowners who are more conservative with their home equity and pay more attention to the amount they are paying in monthly mortgage payments in relation to their monthly income.

Because of this, and largely due to near historically low interest rates, homeowners are only paying 14.8% of their monthly income toward their housing expense. This leaves them much more liquidity for savings, investments, or recreational use.

Conclusion

“Our goal is more modest: we simply attempt to be fearful when others are greedy and greedy when others are fearful.”

-Warren Buffet

Undoubtedly, housing prices will continue to have their ups and downs. What’s important for us to decide is if the current fear in the market is temporary, and therefore likely an opportunity, or if it is permanent

We find that temporary fear and instability in the market can lead to long term opportunity.

If your job is secure and you have been waiting for the market to cool off a bit, the time to pull the trigger might be right for you. We are seeing sellers paying for buyer’s closing costs, some even coming down in asking prices, and interest rates that are near the lowest they have been in history.

Our goal is to make your home-buying experience simple, low-stress, and fun. Reach out to us if you have any questions or would like to learn about the loan options available for you and get started with the pre-approval process.

Related Articles

- « Previous

- 1

- 2

- 3

Facebook Comments